Australia Specialty Chemicals Market Size, Share, Trends and Forecast by Type and Region, 2025-2033

Australia Specialty Chemicals Market Overview:

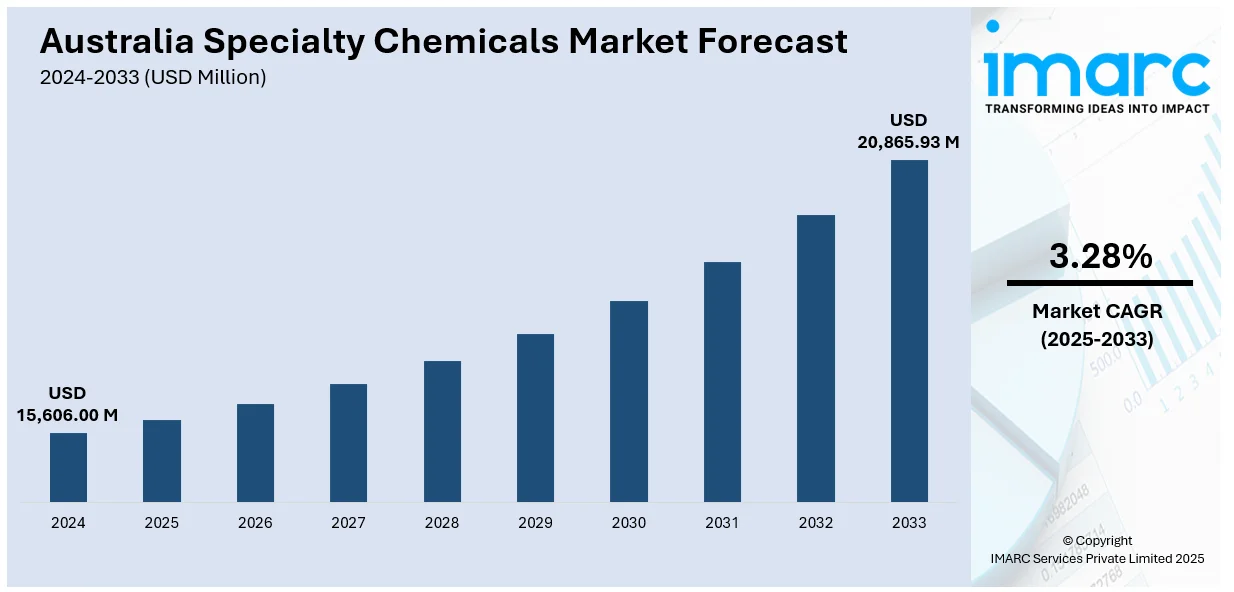

The Australia specialty chemicals market size reached USD 15,606.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 20,865.93 Million by 2033, exhibiting a growth rate (CAGR) of 3.28% during 2025-2033. The market is expanding due to rising demand in construction and agriculture. In the building sector, the focus is on enhancing material strength, durability, and sustainability through additives and coatings. In agriculture, the push for higher yields, resistance management, and eco-friendly practices is leading to the adoption of advanced agrochemicals. Both sectors are increasingly reliant on tailored chemical solutions that align with regulatory standards and performance expectations, supporting continued rise in the Australia specialty chemicals market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 15,606.00 Million |

| Market Forecast in 2033 | USD 20,865.93 Million |

| Market Growth Rate 2025-2033 | 3.28% |

Australia Specialty Chemicals Market Trends:

Growth of Construction and Infrastructure Sectors

The continuous growth of Australia’s construction and infrastructure industries is driving the demand for specialty chemicals that improve material performance and meet sustainability objectives. As cities grow and infrastructure upgrades accelerate, there is greater reliance on specialized formulations that improve the strength, efficiency, and longevity of construction materials. Concrete additives, protective finishes, and performance boosters are being widely incorporated into modern construction solutions to align with changing structural and environmental requirements. A clear illustration of this transition is CRDC Global’s opening of its inaugural Australian RESIN8 facility in Melbourne in 2024. The facility processed one ton of mixed plastic waste each hour, converting it into concrete additives suitable for construction. By transforming plastic into functional building materials, the facility promoted sustainable construction methods and tackled waste management issues. RESIN8 enhanced bond strength in concrete and met ASTM standards, making it a suitable additive for residential and commercial use. Its introduction reflects a broader industry move toward chemical solutions that offer technical benefits without compromising environmental performance. As builders and developers focus on resource-efficient and long-lasting materials, the importance of specialty chemicals in insulation, waterproofing, admixtures, and structural reinforcement is consistently growing. These materials are crucial not only for adhering to contemporary regulations but also for fulfilling the demands of investors and stakeholders emphasizing lifecycle value and sustainability standards. As these projects expand across the country, the specialty chemicals industry keeps gaining traction in Australia's construction scene.

To get more information on this market, Request Sample

Rising Use of Agrochemicals

The agricultural sector continues to fuel the Australia specialty chemicals market growth, particularly through the increasing adoption of innovative agrochemical products aimed at boosting crop protection and sustainability. As farmers face mounting pressure to increase yields while managing resistance and reducing environmental impact, the demand for targeted, efficient, and adaptable chemical solutions is rising. Specialty chemicals, such as insecticides, herbicides, and biostimulants, are central to this evolution, especially in precision and integrated pest management systems. A key development highlighting this trend was the 2024 launch of Cimegra insecticide by BASF in Australia. Designed for use in Brassica vegetable crops, Cimegra features Broflanilide®, which was a novel active ingredient classified under IRAC Group 30, that provided long-lasting control of pests like the Diamondback moth without known resistance issues. It supported sustainable farming practices through its low application rates and compatibility with a wide range of tank mixes, making it suitable for integrated pest management strategies. This innovation reflects how the market is shifting toward advanced formulations that meet the dual needs of efficacy and environmental responsibility. As more producers embrace data-driven farming and look for inputs that align with regulatory and ecological priorities, specialty agrochemicals are playing a growing role in shaping the future of Australian agriculture. This momentum ensures continued expansion of the specialty chemicals market, driven by both demand for technical performance and alignment with modern agricultural standards.

Australia Specialty Chemicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type.

Type Insights:

- Agrochemicals

- Polymer Additives

- Construction Chemicals

- Water Treatment Chemicals

- Oil Field Chemicals

- Food Additives

- Surfactants

- Electronic Chemicals

- Specialty Polymers

- Others

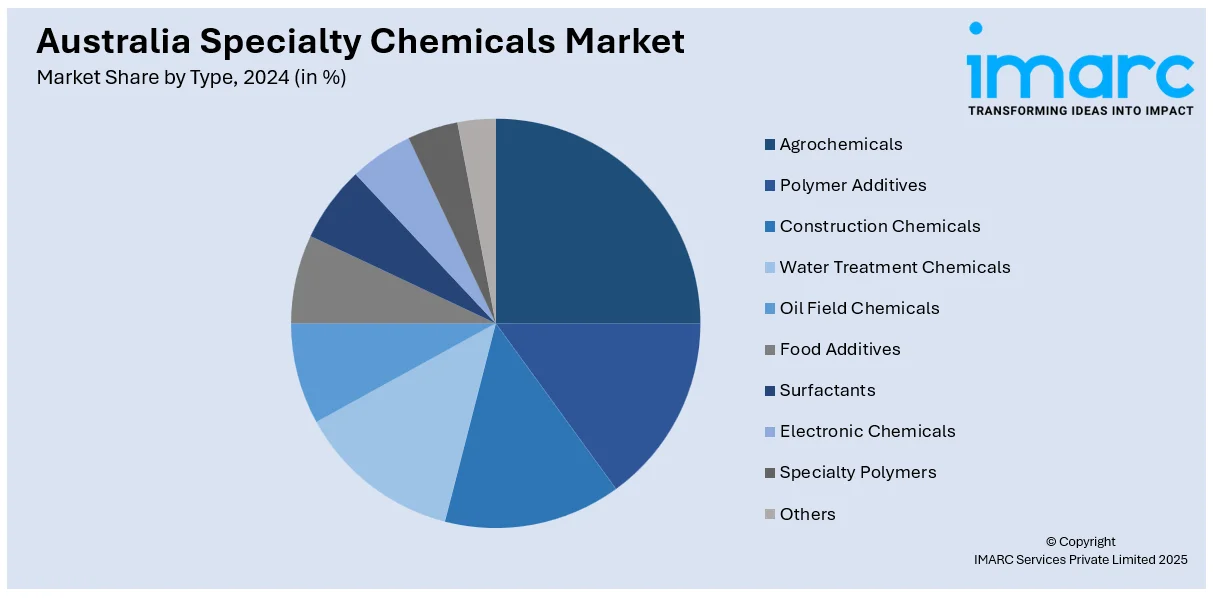

The report has provided a detailed breakup and analysis of the market based on the type. This includes agrochemicals, polymer additives, construction chemicals, water treatment chemicals, oil field chemicals, food additives, surfactants, electronic chemicals, specialty polymers, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Specialty Chemicals Market News:

- In March 2025, Mapei launched Mapecube, a new range of concrete admixtures designed to reduce CO2 emissions and improve strength using supplementary cementitious materials. The Australian-developed variant, Mapecube 70, was formulated at Mapei’s Brisbane plant. The range supports the construction industry's shift toward climate neutrality by enabling lower-carbon concrete production.

- In September 2024, Albaugh announced the registration of its SPIROMAX 240 SC Insecticide in Australia, featuring Spirotetramat as the active ingredient. This systemic insecticide provided effective protection against pests like aphids and whiteflies in cotton and fruit/vegetable crops. Albaugh’s innovation included a patented crystalline form of Spirotetramat for enhanced efficacy and stability.

Australia Specialty Chemicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Agrochemicals, Polymer Additives, Construction Chemicals, Water Treatment Chemicals, Oil Field Chemicals, Food Additives, Surfactants, Electronic Chemicals, Specialty Polymers, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia specialty chemicals market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia specialty chemicals market on the basis of type?

- What is the breakup of the Australia specialty chemicals market on the basis of region?

- What are the various stages in the value chain of the Australia specialty chemicals market?

- What are the key driving factors and challenges in the Australia specialty chemicals market?

- What is the structure of the Australia specialty chemicals market and who are the key players?

- What is the degree of competition in the Australia specialty chemicals market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia specialty chemicals market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia specialty chemicals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia specialty chemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)