Australia Specialty Food Ingredients Market Size, Share, Trends and Forecast by Product Type, Source, Application, Distribution Channel, and Region, 2025-2033

Australia Specialty Food Ingredients Market Overview:

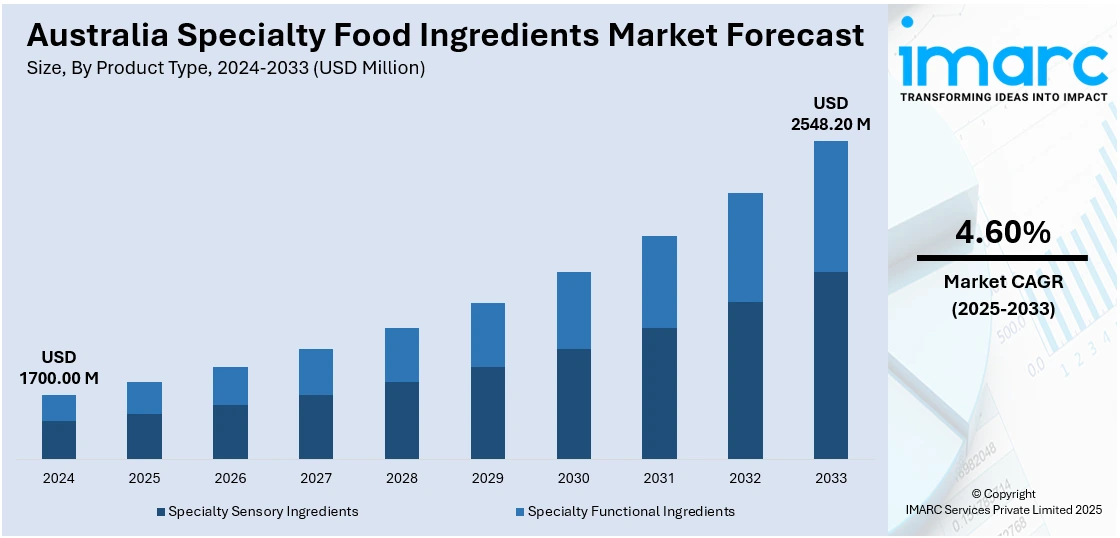

The Australia specialty food ingredients market size reached USD 1700.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2548.20 Million by 2033, exhibiting a growth rate (CAGR) of 4.60% during 2025-2033. The market is driven by increasing demand for functional and clean-label products, rising health consciousness, advancements in food processing technologies, and the growing influence of plant-based and fortified diets. Urbanization and premiumization trends, coupled with regulatory support for innovation, further accelerate Australia specialty food ingredients market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1700.00 Million |

| Market Forecast in 2033 | USD 2548.20 Million |

| Market Growth Rate 2025-2033 | 4.60% |

Australia Specialty Food Ingredients Market Trends:

Rise of Personalized Nutrition and Fortified Ingredients

An increasing focus on personalized nutrition is influencing the formulation of specialty food ingredients in Australia. Consumers are seeking tailored food solutions that meet specific health objectives such as improved gut health, enhanced immunity, or optimized energy levels. This demand is encouraging manufacturers to incorporate targeted micronutrients, adaptogenic botanicals, probiotics, and amino acid blends into a broader range of everyday products. The use of data from wearable technologies and health diagnostics is also facilitating more precise ingredient development. Local brands are investing in proprietary blends and partnering with clinical researchers to substantiate health claims. This trend reflects a broader shift from general wellness to precision nutrition, positioning fortified specialty ingredients as a core strategy for both consumer satisfaction and brand differentiation in Australia’s evolving food landscape. For instance, in November 2024, Samyang Corporation become the first company globally to receive Novel Food approval from Food Standards Australia New Zealand (FSANZ) for allulose, a low-calorie sugar alternative. This approval allows its use in sugar-reduced and sugar-free products across Australia and New Zealand. Samyang plans to expand its market presence through exclusive regional supply and local partnerships.

To get more information on this market, Request Sample

Functional Plant-Based Alternatives in Dairy and Bakery

The move toward plant-based diets is reshaping the use of specialty food ingredients in Australia, particularly in dairy and bakery sectors. Consumers are increasingly seeking plant-based alternatives that deliver on both nutrition and sensory appeal, driving demand for ingredients like plant proteins, modified starches, and natural emulsifiers. Local companies are responding with innovations using lupin, chickpea, and oat-derived components. This trend is a key factor in the Australia specialty food ingredients market growth. MasterFoods™, a key influencer in Australia’s food landscape, is also aligning with this shift. Known for its flavour-forward and convenience-driven products, the brand has evolved to offer health-conscious, plant-based options that reflect changing dietary preferences. It continues to lead by introducing functional ingredients that support modern cooking styles and wellness goals. With regulatory backing for clean-label foods and consumer focus on allergen-free formulations, multifunctional plant-based ingredients are emerging as crucial differentiators. MasterFoods™ stands as a notable example of how heritage brands can adapt to the health-forward, label-aware direction of today’s food market.

Australia Specialty Food Ingredients Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, source, application, and distribution channel.

Product Type Insights:

- Specialty Sensory Ingredients

- Enzymes

- Emulsifiers

- Flavors

- Colorants

- Others

- Specialty Functional Ingredients

- Vitamins

- Minerals

- Antioxidants

- Preservatives

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes specialty sensory ingredients (enzymes, emulsifiers, flavors, colorants, and others) and specialty functional ingredients (vitamins, minerals, antioxidants, preservatives, and others).

Source Insights:

- Natural

- Synthetic

The report has provided a detailed breakup and analysis of the market based on the source. This includes natural and synthetic.

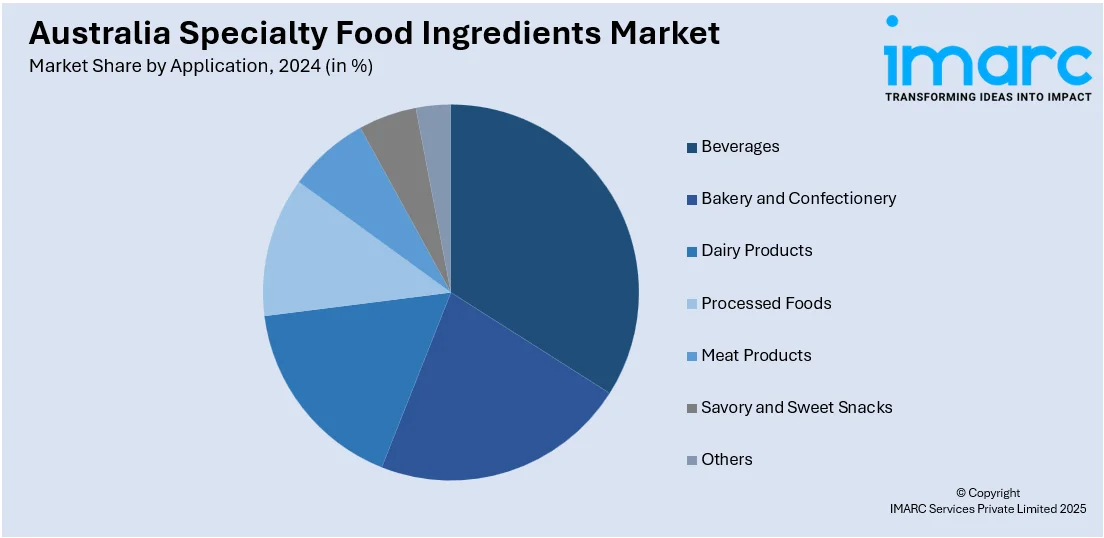

Application Insights:

- Beverages

- Bakery and Confectionery

- Dairy Products

- Processed Foods

- Meat Products

- Savory and Sweet Snacks

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes beverages, bakery and confectionery, dairy products, processed foods, meat products, savory and sweet snacks, and others.

Distribution Channel Insights:

- Distributors

- Manufacturers

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes distributors and manufacturers.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Specialty Food Ingredients Market News:

- In October 2024, Ingredion launched VITESSENCE Pea 200 D, a next-generation pea protein isolate designed for nutritional beverages. This new ingredient offers enhanced solubility, quick dispersion, and a smooth, creamy texture with a neutral taste, reducing the need for masking agents. Containing 80% protein on a dry basis, it is ideal for ready-to-mix plant-based drinks.

- In March 2024, Australian Oilseeds Holdings Limited completed its business combination with EDOC Acquisition Corp. The company, a leader in cold-pressed, non-GMO, and organic vegetable oil production, is expanding its processing capacity in Queensland to meet rising global demand for chemical-free food ingredients. With a newly built specialty plant and increased production capabilities, Australian Oilseeds is positioning itself as the largest cold-pressed oil producer in the APAC region, targeting sustainable, health-conscious markets worldwide.

Australia Specialty Food Ingredients Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Sources Covered | Natural, Synthetic |

| Applications Covered | Beverages, Bakery and Confectionery, Dairy Products, Processed Foods, Meat Products, Savory and Sweet Snacks, Others |

| Distribution Channels Covered | Distributors, Manufacturers |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia specialty food ingredients market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia specialty food ingredients market on the basis of product type?

- What is the breakup of the Australia specialty food ingredients market on the basis of source?

- What is the breakup of the Australia specialty food ingredients market on the basis of application?

- What is the breakup of the Australia specialty food ingredients market on the basis of distribution channel?

- What is the breakup of the Australia specialty food ingredients market on the basis of region?

- What are the various stages in the value chain of the Australia specialty food ingredients market?

- What are the key driving factors and challenges in the Australia specialty food ingredients market?

- What is the structure of the Australia specialty food ingredients market and who are the key players?

- What is the degree of competition in the Australia specialty food ingredients market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia specialty food ingredients market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia specialty food ingredients market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia specialty food ingredients industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)