Australia Spectrometry Market Size, Share, Trends and Forecast by Type, Product, Application, End User, and Region, 2025-2033

Australia Spectrometry Market Overview:

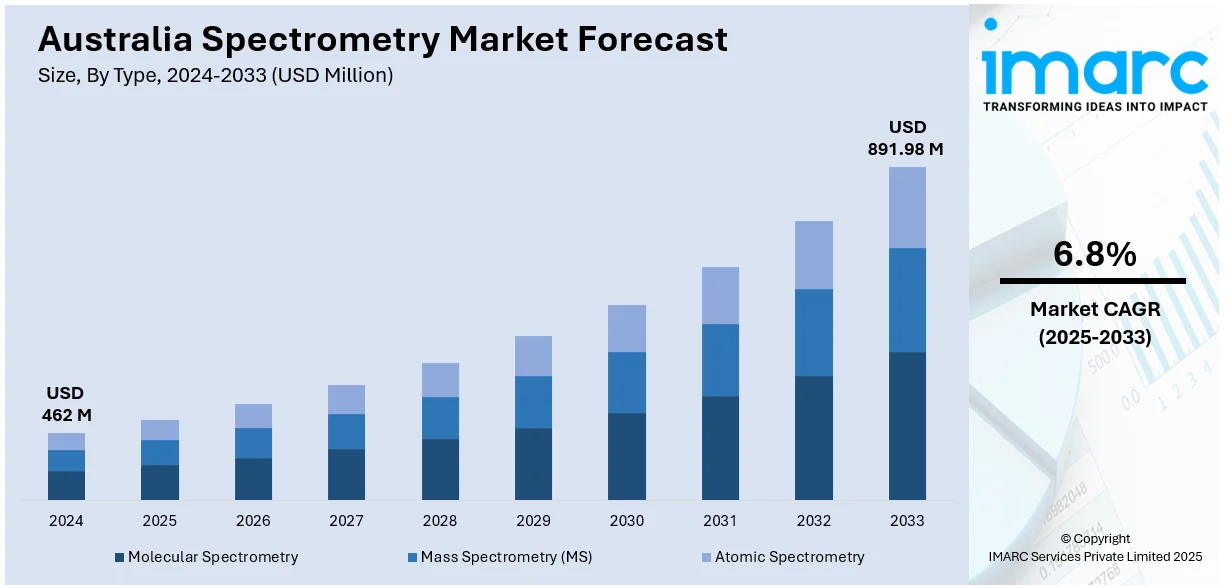

The Australia spectrometry market size reached USD 462 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 891.98 Million by 2033, exhibiting a growth rate (CAGR) of 6.8% during 2025-2033. Increasing demand for advanced analytical techniques in pharmaceuticals, environmental monitoring, and food safety is one of the factors contributing to Australia spectrometry market share. Additionally, rising research activities, technological advancements in spectrometry instruments, and stringent regulatory standards drive market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 462 Million |

| Market Forecast in 2033 | USD 891.98 Million |

| Market Growth Rate 2025-2033 | 6.8% |

Australia Spectrometry Market Trends:

Advances in RNA Mass Spectrometry for Therapeutic Development

Australia is seeing a growing focus on RNA mass spectrometry platforms, particularly in the biomedical sector. These innovations enhance the detection and analysis of RNA biomarkers, crucial for advancing drug development and personalized medicine. By improving the accuracy and sensitivity of RNA analysis, these platforms are enabling more precise therapeutic interventions. As a result, Australia is strengthening its capabilities in mass spectrometry, positioning itself as a leader in cutting-edge technologies that support therapeutic research and precision healthcare. This growth in specialized applications is expected to drive further investment and development, benefiting the healthcare ecosystem through more targeted treatments and improved patient outcomes. These factors are intensifying the Australia spectrometry market growth. For example, in July 2024, Monash University secured funding from the MRFF to develop a new RNA mass spectrometry platform aimed at advancing therapeutics. This platform would enhance the detection and analysis of RNA biomarkers, enabling improved drug development and personalized medicine. It strengthens Australia’s mass spectrometry capabilities, with a focus on biomedical applications, offering significant potential for advancing therapeutic research and precision healthcare within the country.

To get more information on this market, Request Sample

Growth in Advanced Mass Spectrometry Imaging for Biological Research

The Australia mass spectrometry market is seeing developments in ion mobility mass spectrometry imaging systems, which improve the precision and sensitivity of organic molecule analysis. This method offers comprehensive spatial mapping and imaging of molecules within complex biological tissues, hence enhancing research capacities. These sophisticated systems strengthen Australia's position in worldwide scientific discovery by supporting both established and future research fields. The increasing availability of such cutting-edge instruments is projected to expedite discoveries in sectors like as molecular biology, illness diagnostics, and medication development, putting the country at the forefront of biomedical research and innovation. This initiative greatly adds to Australia's developing research infrastructure and growing influence in the worldwide scientific community. For instance, in November 2023, the University of Tasmania introduced the new ion mobility mass spectrometry imaging system, which became available for research at its Central Science Laboratory. This advanced technology allows for precise spatial mapping, visualization, and quantification of organic molecules in complex biological tissues, providing enhanced sensitivity and accuracy. It supports both current and emerging research in Tasmania, strengthening the region’s position in international research fields.

Australia Spectrometry Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, product, application, and end user.

Type Insights:

- Molecular Spectrometry

- Visible and Ultraviolet Spectroscopy

- Infrared Spectroscopy

- Nuclear Magnetic Resonance (NMR) Spectroscopy

- Others

- Mass Spectrometry (MS)

- MALDI-TOF

- Triple Quadrupole

- Quadrupole-Trap

- Hybrid Linear Ion Trap Orbitrap

- Quadrupole-Orbitrap

- Atomic Spectrometry

- Atomic Absorption Spectroscopy (AAS)

- Atomic Emission Spectroscopy (AES)

- Atomic Fluorescence Spectroscopy (AFS)

- X-ray Fluorescence (XRF)

- Inorganic Mass Spectroscopy

The report has provided a detailed breakup and analysis of the market based on the type. This includes molecular spectrometry (visible and ultraviolet spectroscopy, infrared spectroscopy, nuclear magnetic resonance (NMR) spectroscopy, and others), mass spectrometry (MS) (MALDI-TOF, triple quadrupole, quadrupole-trap, hybrid linear ion trap orbitrap, and quadrupole-orbitrap), and atomic spectrometry (atomic absorption spectroscopy (AAS), atomic emission spectroscopy (AES), atomic fluorescence spectroscopy (AFS), x-ray fluorescence (XRF), and inorganic mass spectroscopy).

Product Insights:

- Instrument

- Consumables

- Services

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes instrument, consumables, and services.

Application Insights:

- Proteomics

- Metabolomics

- Pharmaceutical Analysis

- Forensic Analysis

- Others

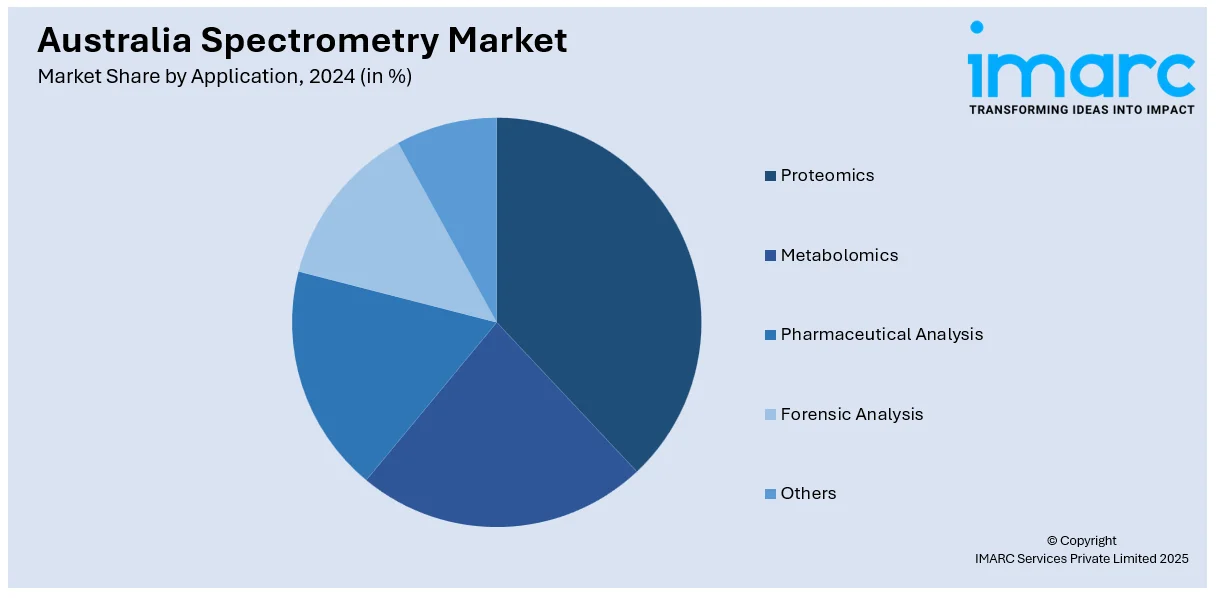

The report has provided a detailed breakup and analysis of the market based on the application. This includes proteomics, metabolomics, pharmaceutical analysis, forensic analysis, and others.

End User Insights:

- Government and Academic Institutions

- Pharmaceutical and Biotechnology Companies

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes government and academic institutions, pharmaceutical and biotechnology companies, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Spectrometry Market News:

- In November 2024, Thermo Fisher’s EXENT System got approval for clinical use in Australia, offering advanced mass spectrometry for detecting monoclonal gammopathies, including multiple myeloma. The system provides highly sensitive M-protein detection, surpassing traditional methods, and supports better patient management by identifying stable disease and early relapses.

Australia Spectrometry Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Products Covered | Instrument, Consumables, Services |

| Applications Covered | Proteomics, Metabolomics, Pharmaceutical Analysis, Forensic Analysis, Others |

| End Users Covered | Government and Academic Institutions, Pharmaceutical and Biotechnology Companies, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia spectrometry market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia spectrometry market on the basis of type?

- What is the breakup of the Australia spectrometry market on the basis of product?

- What is the breakup of the Australia spectrometry market on the basis of application?

- What is the breakup of the Australia spectrometry market on the basis of end user?

- What is the breakup of the Australia spectrometry market on the basis of region?

- What are the various stages in the value chain of the Australia spectrometry market?

- What are the key driving factors and challenges in the Australia spectrometry market?

- What is the structure of the Australia spectrometry market and who are the key players?

- What is the degree of competition in the Australia spectrometry market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia spectrometry market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia spectrometry market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia spectrometry industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)