Australia Sports Betting Market Size, Share, Trends and Forecast by Platform, Betting Type, Sports Type, and Region, 2025-2033

Australia Sports Betting Market Overview:

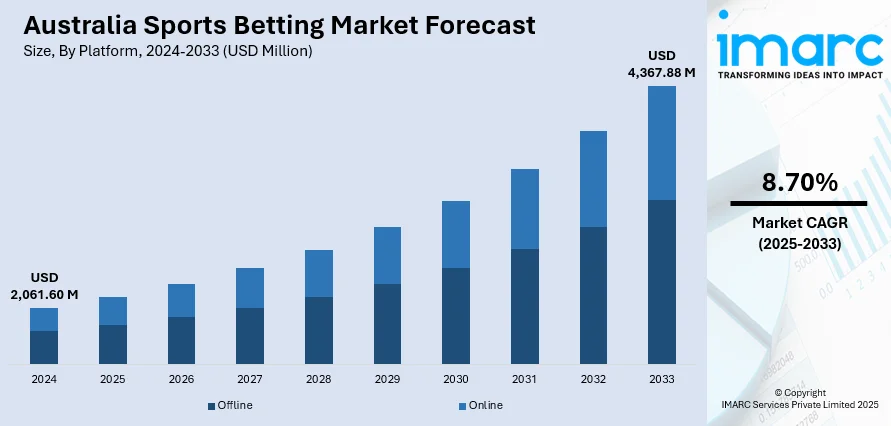

The Australia sports betting market size reached USD 2,061.60 Million in 2024. Looking forward, the market is expected to reach USD 4,367.88 Million by 2033, exhibiting a growth rate (CAGR) of 8.70% during 2025-2033. Key factors driving Australia's sports betting market include a robust regulatory framework, widespread smartphone and internet penetration, high consumer interest in sports, technological advancements in betting platforms, and strategic partnerships between domestic operators and global tech providers that enhance user experience, product innovation, and market reach across both digital and retail channels.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,061.60 Million |

| Market Forecast in 2033 | USD 4,367.88 Million |

| Market Growth Rate 2025-2033 | 8.70% |

Key Trends of Australia Sports Betting Market:

Legal and Regulatory Framework Advancements

One of the most distinctive drivers of the Australia sports betting market share is the country’s conducive legal and regulatory environment, which has established a coherent framework that accommodates both consumers and operators. In contrast to most jurisdictions where sports betting is heavily constrained or prohibited, Australia has adopted a regulated gambling framework, predominantly regulated by the Interactive Gambling Act 2001 (IGA) and supporting state-based laws. These regulations permit sports betting by licensed domestic operators while banning unlicensed or offshore organizations, providing market security and adherence. This structure promotes consumer trust since players are assured of protection by local law and regulation, minimizing exposure to fraud and immoral conduct. Furthermore, the existence of licensing authorities like the Northern Territory Racing Commission promotes high standards of operation and compliance. Regulatory clarity has attracted considerable investment from local and international betting companies, further improving service quality and competitiveness. Additionally, recent consultations and amendments, for example, on advertising prohibitions and harm minimization, suggest that the government is taking an active role in honing policy to find a balance between market development and public health.

To get more information on this market, Request Sample

Technological Penetration and Mobile Betting Culture

Another factor driving the Australia sports betting market growth is the widespread technology adoption, particularly via mobile and digital means, is another key but significantly different driver of the Australian sports betting market. Australia is one of the world's leading countries by smartphone and internet access, providing digital engagement ease for broad appeal. Mobile betting apps, live odds, live streaming, and in-play features have dramatically altered the way Australians interact with sports betting. Present-day consumers are digitally empowered and hence crave immediate access to betting websites, personalized odds, and safety guarantees in payments, all made standard because of Australia's mature digital ecosystem. All such organizations have made huge investments in customer-optimized app experiences, algorithmic odds customization, and secure and seamless payments. Such facilities propel not just acquisition of customers but also retention based on optimized bettor experiences. In addition, integration of technology with live sporting events such as real-time information, interactive elements, and social interaction enhances user engagement. The capacity to make micro-bets during a match, utilize voice commands, or even utilize predictive analytics based on player statistics, all enhance user empowerment and invite repeat usage.

Growth Drivers of Australia Sports Betting Market:

Legal Framework and Market Liberalization

One of the major growth drivers of the Australian sports betting industry is its sound legal framework and relatively liberalized status. Australia has had a long-standing legal environment that allows and controls sports betting, thus being one of the few nations where gambling is both accepted on a widespread scale and closely regulated. This balance has provided a secure basis for operators to expand and develop within defined legal parameters. The state-based system of licensing found only in Australia enables multiple territories to host and license betting operators with the ability to operate nationwide. For instance, the Northern Territory licenses most of the nation's large betting operators, providing an attractive regulatory environment that invites business investment while allowing regulation. This decentralized model has also encouraged competition and service variety between platforms. The legality and social acceptance of gambling in Australia have facilitated local operator growth and have encouraged international firms to enter the market as well, further fueling growth.

Cultural Love of Sports and Domestic Leagues

Australia's strong sports culture substantially contributes to the growth of its sports betting market. In contrast with other parts of the world where global sports such as soccer feature prominently on betting slips, Australians are deeply invested in local sports including the AFL, NRL, and BBL. These leagues command enormous audiences and interest, which directly translates into betting. A primary mover here is the regional identity and sense of community that comes with supporting local teams, which is further magnified when league seasons and finals are underway. Additionally, the format of these leagues—with games played often, fluid play, and unusual scoring regimes, repeatedly presents chances for a wide variety of bets. Anomalies such as the State of Origin series and the Melbourne Cup likewise heighten betting activity, serving as part of the national culture that combines entertainment and betting. This convergence of sports interest and betting interest produces a market environment where betting is viewed as an extension of playing sport, driving sustained expansion along with the Australia sports betting market demand.

Operator Competition and Marketing Strategies

Intense competition between licensed betting operators and aggressive marketing approaches have also been instrumental in stimulating growth in the Australian market. The extremely competitive environment has led brands to differentiate based on inviting promotions, rewards for loyalty, and association with leading sports bodies. Betting firms traditionally sponsor top Australian sides and sports broadcasts, literally instilling their presence in the sporting experience. A regional trend is incorporating betting coverage within pre- and post-match discussion on sports channels, gradually mainstreaming the betting discourse among supporters. Furthermore, operators are also increasingly investing in personal marketing—leveraging user data to personalize odds boosts, free bets, and targeted communications that resonate with unique betting patterns. Personalization has been a success factor that has improved user engagement and retention. As regulatory scrutiny of advertising increases, existing promotional strategies have already established robust brand awareness and user loyalty, which makes marketing innovation a steady growth driver in Australia's distinctive regulatory and cultural environment.

Opportunities of Australia Sports Betting Market:

Growth into Niche and Emerging Sports Markets

Expansion into niche and emerging sports is one of the key opportunities in the Australian sports betting market. Although mainstream sports like AFL, NRL, and horse racing take center stage, there is also increasing popularity in alternative competitions like esports, MMA, and foreign leagues like the NBA and Premier League. This transition offers an opportunity for operators to expand their services and appeal to a wider audience. Notably, esports gambling has begun to gain traction among Australian millennials and Gen Z markets, with domestic esports competitions gaining more visibility. Another exclusively Australian opportunity lies in the growing popularity of women's sporting competitions, such as the AFLW and WBBL, which are building hard-core fan bases and media attention. Accessing such growing markets enables bookmakers to establish new customer bases and lead the way in evolving consumer interests, therefore expanding earnings streams outside of conventional sporting events.

Innovations in Technology Integration and In-Play

According to the Australia sports betting market analysis, the region’s strong digital economy and high mobile phone penetration offer rich soil for ground-breaking betting technology, particularly around in-play and interactive betting. While Australian regulation now limits online in-play wagering, customers can make live bets over the phone, establishing a regional hybrid model that is available. This limitation has not dissuaded interest; rather, it has compelled operators to create transparent platforms blending pre-match betting with live data and user-initiated call-ins. Moreover, augmented reality (AR) integrations, predictive analytics, and AI-based bet suggestions can provide highly personalized and engaging betting experiences. With Australian customers already demonstrating a significant inclination towards mobile betting, sites that adopt the latest features have the potential to gain considerable competitive edge. Building these technologies alongside the regulatory constructs can open new heights of engagement and user satisfaction.

Localized Content and Regional Market Penetration

One special opportunity in the Australian market is increasing regional penetration by providing extremely localized content and betting opportunities specific to individual states and territories. With such a large geography and sports loyalties based on state, operators who can tailor their products to local tastes are most likely to achieve higher levels of engagement. Queensland and New South Wales, for example, have rugby league followings, and Victoria has a stronger AFL supporter base. Refinements in promotions, type of bets, and user interface to mirror such local tastes can make the user experience more resonant. There is also scope in localizing advertising campaigns, in entering partnerships with community clubs, and in using local slang and sports commentary in platform content. Additionally, Australia's vibrant country and regional sporting cultures—such as local footy and cricket competitions, may represent underdeveloped betting markets. By attuning themselves more to regional identities and interests, bookmakers can extend their reach and build stronger customer loyalty throughout the nation.

Challenges of Australia Sports Betting Market:

Emerging Regulatory Pressures and Advertising Restrictions

One of the biggest challenges to the Australian market for sports betting is the increasing regulatory environment, especially regarding advertising and consumer protection. The government, in recent years, has introduced measures to limit the prominence of betting advertisements during live coverage of sports and in timeslots in reach of children. These restrictions stem from growing public concern about the normalization of gambling and its potential influence on young viewers. Additionally, calls for further reforms—such as blanket bans on inducement offers and increased scrutiny on betting apps—signal a shifting landscape where operators must adapt quickly or risk penalties. The fragmented regulatory model, where each state or territory has its own licensing and compliance requirements, further complicates operations. For instance, the Northern Territory is a favorite destination for betting license bases due to its comparatively relaxed regime, yet new developments at the federal level could affect the picture. Managing these shifting regulations while staying in the market is a constant challenge for local and foreign operators alike.

Public Sentiment and Social Responsibility Pressures

Another increasing issue for the industry is the evolving public attitude toward gambling and the need for betting firms to be more socially responsible. In Australia, gambling has been socially established for many years, but recent times have witnessed a clear change of heart because of worries regarding gambling addiction, financial injury, and mental illness. Regional media, activists, and politicians have served to heighten the debate, with demands for increased regulation and more open practices. The region is characterized by a high level of pressure from the state governments to introduce consumer protection measures in the form of obligatory account limits and readily available self-exclusion programs. Betting operators are now expected to adhere to rules in order to actively show that they are committed to safe gambling. Failing to achieve this can result in reputational loss and consumer distrust. Balancing profitability with ethical accountability has thus become a complicated but necessary component of doing business in the Australian sports betting environment.

Market Saturation and Intense Operator Competition

The Australian sports betting industry, while mature and profitable, is challenged by saturation and intense operator competition. Given many licensed betting agencies competing for the same consumer base, services need to be differentiated increasingly. All platforms provide similar odds, promotions, and sports coverage, resulting in churn and a price war and bonus war. A distinguishing feature of the Australian market is the dominance by a handful of established brands that have developed extensive loyalty based on sporting sponsorships and mainstream media. This makes it more challenging for new players or small operators to cut a meaningful share without huge amounts of marketing spend. Additionally, with regulatory oversight gathering pace, operators have limited room to aggressively market services, further inhibiting differentiation efforts. In a crowded market, innovation becomes crucial but even then, user acquisition and retention continue to be challenges in the face of increasing operational costs and regulatory compliance pressures.

Australia Sports Betting Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on platform, betting type, and sports type.

Platform Insights:

- Offline

- Online

The report has provided a detailed breakup and analysis of the market based on the platform. This includes offline and online.

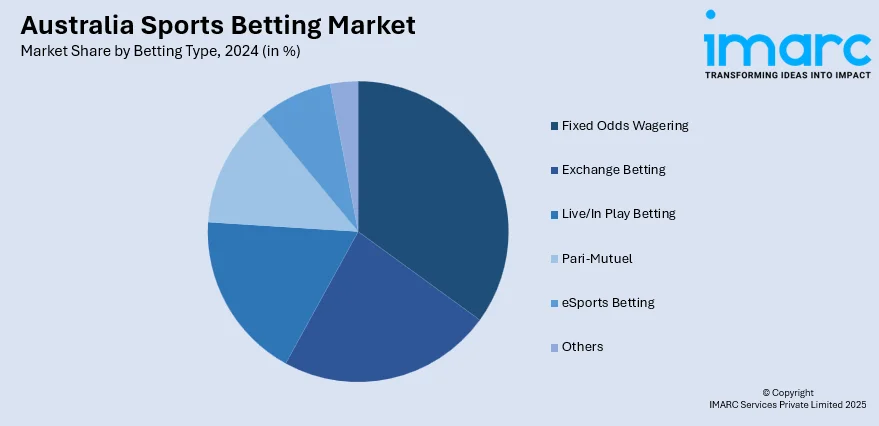

Betting Type Insights:

- Fixed Odds Wagering

- Exchange Betting

- Live/In Play Betting

- Pari-Mutuel

- eSports Betting

- Others

A detailed breakup and analysis of the market based on the betting type have also been provided in the report. This includes fixed odds wagering, exchange betting, live/in play betting, pari-mutuel, eSports betting, and others.

Sports Type Insights:

- Football

- Basketball

- Baseball

- Horse Racing

- Cricket

- Hockey

- Others

The report has provided a detailed breakup and analysis of the market based on the sports type. This includes football, basketball, baseball, horse racing, cricket, hockey, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Sports Betting Market News:

- April 2024: Tabcorp partnered with OpenBet to enhance its sports betting platform. OpenBet will provide its scalable betting engine and advanced trading system to Tabcorp's flagship brand, TAB, aiming to improve user experience and operational efficiency. This collaboration aims to redefine the sports betting landscape in Australia by delivering innovative and agile solutions.

- November 2023: Picklebet raised AUD 15 million in a Series A funding round. The round was led by Discerning Capital, with additional participation from notable investors including Drive by DraftKings, Manifest Investment Partners, and Jeff Sagansky. This company aims to use the funding to fuel technological advancements, expand its media footprint, and support its strategic plans for international market entry.

Australia Sports Betting Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Platform Covered | Offline, Online |

| Betting Types Covered | Fixed Odds Wagering, Exchange Betting, Live/In Play Betting, Pari-Mutuel, eSports Betting, Others |

| Sports Types Covered | Football, Basketball, Baseball, Horse Racing, Cricket, Hockey, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia sports betting market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia sports betting market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia sports betting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia sports betting market was valued at USD 2,061.60 Million in 2024.

The Australia sports betting market is projected to exhibit a CAGR of 8.70% during 2025-2033.

The Australia sports betting market is expected to reach a value of USD 4,367.88 Million by 2033.

The Australia sports betting market trends show a strong shift toward mobile and online platforms, with growing interest in live betting and niche sports. Operators focusing on user experience, while regulatory changes continue to shape advertising practices and responsible gambling measures are also accelerating market growth.

Key drivers of the Australia sports betting market include a well-established legal framework, strong cultural ties to domestic sports like AFL and NRL and increasing digital adoption. Mobile technology, competitive operator strategies, and personalized betting experiences continue to fuel growth, despite regulatory constraints and rising demands for responsible gambling practices.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)