Australia Sports Utility Vehicle Market Size, Share, Trends and Forecast by Type, Fuel Type, Seating Capacity, and Region, 2025-2033

Australia Sports Utility Vehicle Market Overview:

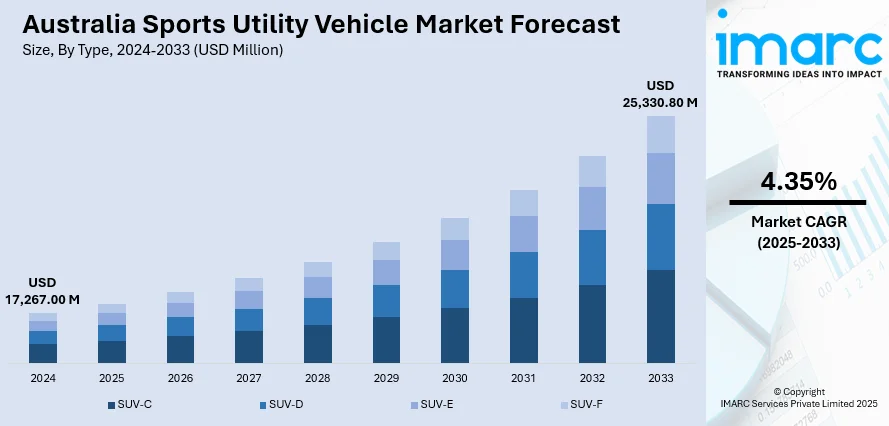

The Australia sports utility vehicle market size reached USD 17,267.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 25,330.80 Million by 2033, exhibiting a growth rate (CAGR) of 4.35% during 2025-2033. The market is being driven by rapid advancements in vehicle technology and improvements in fuel efficiency. Individuals are drawn to models that offer seamless digital integration, safety features, and smart connectivity, making technology a key differentiator. In addition, the rise of hybrid and electric powertrains is addressing concerns over fuel usage, expanding the appeal of SUVs to eco-conscious and cost-aware buyers. Together, these trends are shaping a more innovative and sustainable SUV landscape, thereby influencing the Australia sports utility vehicle market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 17,267.00 Million |

| Market Forecast in 2033 | USD 25,330.80 Million |

| Market Growth Rate 2025-2033 | 4.35% |

Australia Sports Utility Vehicle Market Trends:

Technological Integration and Innovation

There is a rise in the integration of advanced technologies in SUVs as individuals are increasingly prioritizing innovation, connectivity, and intelligent design in their vehicle choices. Modern SUVs include state-of-the-art infotainment systems, digital screens, smartphone connectivity, voice commands, and sophisticated driver assistance technologies that improve both comfort and safety. Users are particularly attracted to cars that provide a smooth digital experience, whether via wireless charging, live navigation, or semi-autonomous driving features. These advanced technological features are not just exclusive to luxury models but are becoming commonplace across various SUV ranges. For instance, in 2024, Zeekr unveiled its new 7X electric SUV at the Chengdu Auto Show, with an Australian launch in 2025. The 7X featured ultra-fast 10-minute charging (10–80%), up to 780 km CLTC range, and dual-motor variants producing 470 kW. Aimed at tech-savvy families, it featured a roomy interior and high-end attributes suited for contemporary living. The vehicle establishes itself not merely as a mode of transport but as a cutting-edge center on wheels, emphasizing the importance of innovation in this sector. As digital expectations rise among buyers in Australia, especially in the EV space, the SUV remains at the forefront of automotive technology, making it a compelling choice for those seeking futuristic, high-performance vehicles in a connected world.

To get more information on this market, Request Sample

Fuel Efficiency Improvements and Powertrain Options

Historically, SUVs had high fuel utilization, making them less attractive to cost-conscious or environmentally aware individuals. However, this viewpoint is changing quickly because of improvements in powertrain technologies and a wider selection of fuel-efficient choices. Modern SUV models are equipped with advanced petrol and diesel engines, hybrids, plug-in hybrids, and entirely electric drivetrains. These advancements are considerably reducing the efficiency difference between SUVs and smaller vehicle categories. Enhancements in aerodynamics, lowered engine sizes, and intelligent energy management systems are making SUVs more practical for everyday use while maintaining performance and comfort. A prime illustration is the introduction of the Polestar 3 in September 2024, which is the brand’s inaugural electric SUV in Australia. Equipped with a significant 111 kWh battery, a dual-motor setup, and an outstanding 628 km WLTP range, the Polestar 3 showcased how high-end electric SUVs can harmoniously blend performance and eco-friendliness. It additionally included cutting-edge technology like vehicle-to-grid (V2G) functionality, attracting environmentally aware individuals looking for energy stability and lasting efficiency. In a nation such as Australia, where extensive travel is frequent, the accessibility of long-range electric SUVs offers an appealing answer. This transformation in SUV design and powertrain variety continues to enhance the segment's attractiveness and promote ongoing market expansion. As a result, the Australia sports utility vehicle market growth is being strongly driven by user demand for more sustainable, high-performance, and technologically advanced mobility solutions.

Australia Sports Utility Vehicle Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, fuel type, and seating capacity.

Type Insights:

- SUV-C

- SUV-D

- SUV-E

- SUV-F

The report has provided a detailed breakup and analysis of the market based on the type. This includes SUV-C, SUV-D, SUV-E, and SUV-F.

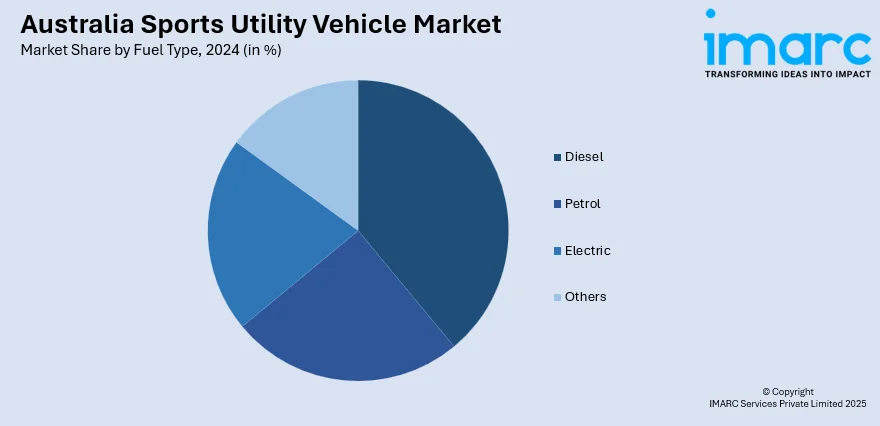

Fuel Type Insights:

- Diesel

- Petrol

- Electric

- Others

A detailed breakup and analysis of the market based on the fuel type have also been provided in the report. This includes diesel, petrol, electric, and others.

Seating Capacity Insights:

- 5-Seater

- 7-Seater

- 8-Seater and Above

The report has provided a detailed breakup and analysis of the market based on the seating capacity. This includes 5-seater, 7-seater, and 8-seater and above.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Sports Utility Vehicle Market News:

- In May 2025, JAECOO announced its official entry into the Australian market with a launch event scheduled for May 6 in Sydney, in partnership with Nine. The event will unveil the premium J7 and J8 SUV models, including a hybrid version offering 1200 km range. A media campaign developed by UM and M+C Saatchi will roll out from May 7 across Nine’s platforms.

- In March 2025, Geely launched its all-electric EX5 SUV in Australia and New Zealand at an event in Sydney, expanding its presence into Oceania. The EX5 is built on Geely’s GEA architecture and features the Geely Short Blade Battery and CTB structure.

Australia Sports Utility Vehicle Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | SUV-C, SUV-D, SUV-E, SUV-F |

| Fuel Types Covered | Diesel, Petrol, Electric, Others |

| Seating Capacities Covered | 5-Seater, 7-Seater, 8-Seater and Above |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia sports utility vehicle market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia sports utility vehicle market on the basis of type?

- What is the breakup of the Australia sports utility vehicle market on the basis of fuel type?

- What is the breakup of the Australia sports utility vehicle market on the basis of seating capacity?

- What is the breakup of the Australia sports utility vehicle market on the basis of region?

- What are the various stages in the value chain of the Australia sports utility vehicle market?

- What are the key driving factors and challenges in the Australia sports utility vehicle?

- What is the structure of the Australia sports utility vehicle market and who are the key players?

- What is the degree of competition in the Australia sports utility vehicle market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia sports utility vehicle market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia sports utility vehicle market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia sports utility vehicle industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)