Australia Statin Market Size, Share, Trends and Forecast by Type, Therapeutic Area, Drug Class, Application, Distribution, and Region, 2025-2033

Australia Statin Market Overview:

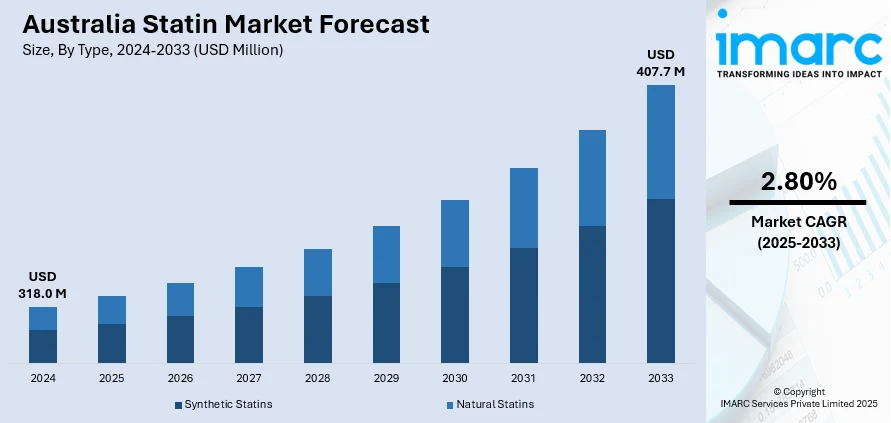

The Australia statin market size reached USD 318.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 407.7 Million by 2033, exhibiting a growth rate (CAGR) of 2.80% during 2025-2033. The market is primarily driven by increasing prevalence of cardiovascular disorders, rising incidence of hypercholesterolemia, widespread clinical adoption of statins, government-backed healthcare policies, national screening initiatives, standardized clinical guidelines, consistent prescription practices, and expanding access to generic and branded statin formulations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 318.0 Million |

| Market Forecast in 2033 | USD 407.7 Million |

| Market Growth Rate 2025-2033 | 2.80% |

Australia Statin Market Trends:

Increasing Prevalence of Cardiovascular Disorders and Hypercholesterolemia

The steady increase in the burden of cardiovascular disease (CVD) across Australia continues to reinforce the demand for statin medications. Elevated cholesterol is a well-established risk factor associated with atherosclerosis and coronary artery disease. As per the latest 2024 industry reports, an estimated 1.3 million Australian adults (6.7%) reported having heart, stroke, or vascular conditions, including 600,000 (3.0%) with coronary heart disease in 2022. Cardiovascular disease was more common in men (7.6%) than women (5.8%) and affected 28% of those aged 75 and over. With an ageing demographic and high incidence of sedentary lifestyles, the healthcare sector is witnessing consistent demand for lipid-lowering agents. In this context, statins have become the preferred pharmacological intervention, given their clinically validated efficacy in lowering low-density lipoprotein (LDL) cholesterol levels and reducing the risk of cardiac events. Furthermore, statins have demonstrated benefits beyond lipid control, including anti-inflammatory effects and improved endothelial function. The widespread use of electronic medical records and clinical decision support systems in Australian general practices has further enhanced the early detection and consistent management of at-risk population, thereby contributing to the expansion of the Australia statin market share across therapeutic segments. Parallel to clinical adoption, public health strategies and screening campaigns have played a considerable role in broadening statin usage. National guidelines from organizations such as the National Heart Foundation of Australia encourage cholesterol screening as part of routine health assessments. This proactive approach leads to earlier interventions, particularly in asymptomatic individuals. With sustained efforts from both public and private healthcare stakeholders, the treatment pool continues to expand, particularly across urban and regional settings. The pharmaceutical landscape, featuring multiple generic and branded statin formulations, ensures widespread access and affordability. These factors are critical in supporting the long-term Australia statin market growth, particularly in light of healthcare reforms that emphasize chronic disease prevention and medication adherence.

To get more information on this market, Request Sample

Government-Backed Healthcare Policies and Pharmaceutical Benefits Scheme (PBS)

Australia’s healthcare infrastructure, underpinned by universal access and centrally managed drug reimbursement schemes, significantly influences pharmaceutical market dynamics, including the statin segment. The country’s Pharmaceutical Benefits Scheme (PBS), administered by the Department of Health and Aged Care, subsidizes the cost of essential medications, including statins, to ensure affordability across socioeconomic groups. The Australian Government has announced that, starting January 1, 2026, the maximum cost for Pharmaceutical Benefits Scheme (PBS) medicines will be reduced to $ 25 per script for general patients. This measure is projected to save Australians over $ 200 Million annually. Pensioners and concession cardholders will continue to benefit from a freeze on their PBS medicine costs, maintaining the current rate of $ 7.70 until 2030. This scheme covers widely prescribed statins such as atorvastatin, rosuvastatin, simvastatin, and pravastatin, making them financially accessible through community pharmacies nationwide. The structure of PBS ensures minimal out-of-pocket expenditure for patients, while encouraging long-term adherence to prescribed regimens. By removing cost as a barrier to access, the PBS framework has helped normalize statin use among large segments of the population, particularly among pensioners and low-income households. Another dimension reinforcing statin consumption is the alignment of reimbursement policies with clinical guidelines. The continuity of government support across successive policy cycles reflects the strategic value placed on preventive pharmacotherapy. Additionally, Australia’s data-driven health administration enables policymakers to identify high-risk cohorts and ensure focused interventions. These administrative efficiencies reduce the incidence of cardiovascular hospitalizations and long-term treatment costs for the public health system. Furthermore, the standardization of clinical care across Australia’s public and private health sectors supports consistent prescription behaviors. Most general practitioners adhere closely to the Australian Clinical Guidelines, which recommend statins for patients with elevated cardiovascular risk scores or confirmed hyperlipidemia. Pharmacies and healthcare providers benefit from predictable demand patterns, allowing efficient inventory planning and pricing negotiations with suppliers. These institutional mechanisms, combined with an integrated healthcare delivery model, underpin the stable expansion of the Australia statin market outlook.

Australia Statin Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, therapeutic area, drug class, application, and distribution.

Type Insights

- Synthetic Statins

- Natural Statins

The report has provided a detailed breakup and analysis of the market based on the type. This includes synthetic statins and natural statins.

Therapeutic Area Insights

- Cardiovascular Disorders

- Obesity

- Inflammatory Disorders

- Others

The report has provided a detailed breakup and analysis of the market based on the therapeutic area. This includes cardiovascular disorders, obesity, inflammatory disorders, and others.

Drug Class Insights

- Atorvastatin

- Fluvastatin

- Lovastatin

- Pravastatin

- Simvastatin

- Others

The report has provided a detailed breakup and analysis of the market based on the drug class. This includes atorvastatin, fluvastatin, lovastatin, pravastatin, simvastatin, and others.

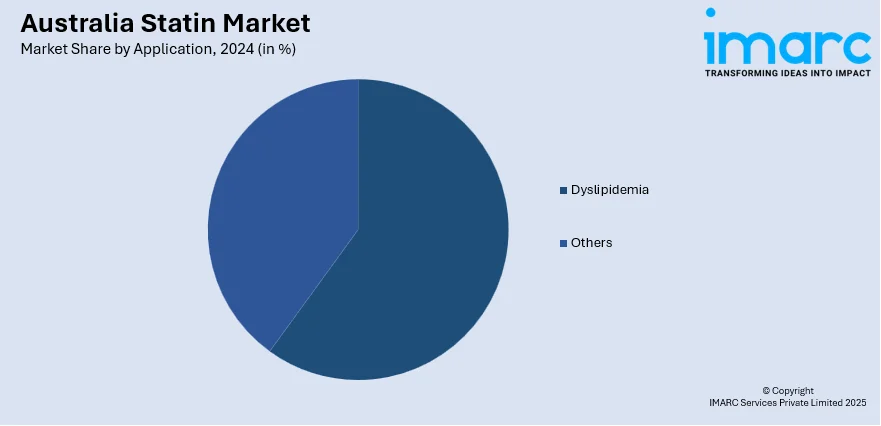

Application Insights

- Dyslipidemia

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes dyslipidemia and others.

Distribution Insights

- Hospitals

- Clinics

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution. This includes hospitals, clinics, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has provided a detailed breakup and analysis of the market based on the region. This includes Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Statin Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Synthetic Statins, Natural Statins |

| Therapeutic Areas Covered | Cardiovascular Disorders, Obesity, Inflammatory Disorders, Others |

| Drug Classes Covered | Atorvastatin, Fluvastatin, Lovastatin, Pravastatin, Simvastatin, Others |

| Applications Covered | Dyslipidemia, Others |

| Distributions Covered | Hospitals, Clinics, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia statin market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia statin market on the basis of type?

- What is the breakup of the Australia statin market on the basis of therapeutic area?

- What is the breakup of the Australia statin market on the basis of drug class?

- What is the breakup of the Australia statin market on the basis of application?

- What is the breakup of the Australia statin market on the basis of distribution?

- What is the breakup of the Australia statin market on the basis of region?

- What are the various stages in the value chain of the Australia statin market?

- What are the key driving factors and challenges in the Australia statin market?

- What is the structure of the Australia statin market and who are the key players?

- What is the degree of competition in the Australia statin market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia statin market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia statin market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia statin industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)