Australia Stearic Acid Market Size, Share, Trends and Forecast by Type, End User, and Region, 2025-2033

Australia Stearic Acid Market Overview:

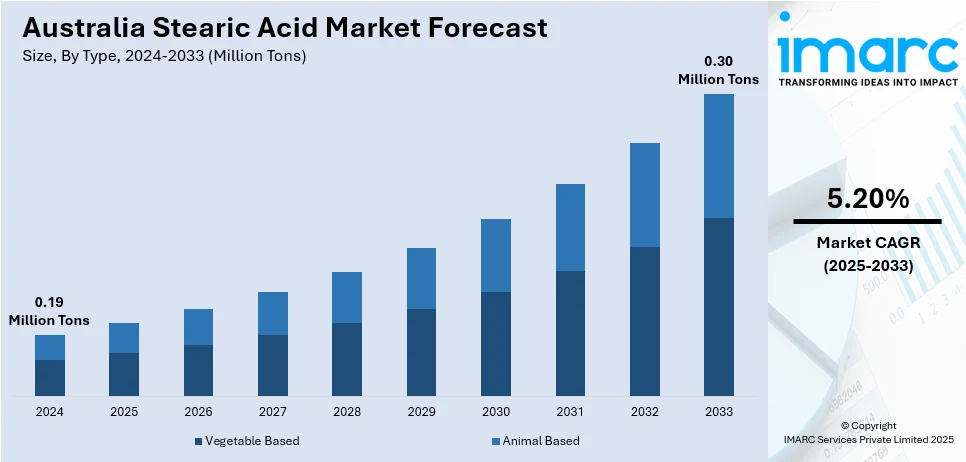

The Australia stearic acid market size reached 0.19 Million Tons in 2024. Looking forward, IMARC Group expects the market to reach 0.30 Million Tons by 2033, exhibiting a growth rate (CAGR) of 5.20% during 2025-2033. The market is experiencing significant growth due to its wide application in industries such as cosmetics, pharmaceuticals, rubber, and food processing. The increasing demand for personal care products, along with the rising industrial applications, and growing focus on sustainable and high-quality products represent some of the other factors contributing to the Australia stearic acid market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 0.19 Million Tons |

| Market Forecast in 2033 | 0.30 Million Tons |

| Market Growth Rate 2025-2033 | 5.20% |

Australia Stearic Acid Market Trends:

Rising Demand for Personal Care Products

The application of stearic acid in cosmetic products is on the rise because it serves a basic function as an emulsifier, thickener, and stabilizer. Stearic acid enhances skin feel, texture, and product consistency in creams, lotions, and soaps. Its ability to emulsify oil and water-based ingredients makes it possible for them to blend without problems hence becoming a fundamental component in most formulas. In addition, stearic acid also provides moisturization and helps in the long-term performance of personal care products. With growing awareness among consumers regarding skincare and grooming, there is a growing demand for high-quality personal care products, further driving the demand for stearic acid. With growing demand for natural and sustainable ingredients plant-source-derived stearic acid is gaining popularity in line with the trend towards cleaner and greener formulations. This shift is propelling the increasing application of stearic acid in the personal care industry.

To get more information on this market, Request Sample

Increasing Use in Food Processing

Stearic acid is increasingly being used in the food market as an emulsifier and stabilizer and plays a part in the uniformity, texture, and food shelf life of foods. Stearic acid prevents the breakdown of ingredients of foods like margarine, chocolate and spreads. Creating stability and softness of food stearic acid ensures enhanced overall customer experience. Also, it serves to maintain the desired consistency of dressings, sauces, and bakery items. As demand grows for convenience and processed foods, so does demand for reliable emulsifiers like stearic acid. Also, with growing interest in clean-label ingredients the application of natural and plant-based stearic acid is driving market growth. This shift to plant-based emulsifiers is adhering to the need of the consumers for healthier and sustainable food sources, hence increasingly boosting Australia stearic acid market growth.

Growth in the Rubber Industry

The rubber industry is the leading driver of stearic acid consumption as it is a wide-ranging additive used as an aid in the process of the rubber product manufacturing industry. Stearic acid acts as an efficient processor of rubber, which boosts the efficiency of the process as well as being easy to control when manufacturing the product. Stearic acid is a lubricant that helps reduce friction, allowing rubber flow during molding activities. Second, stearic acid is also an activator in the process of vulcanization, whose role is to optimize the curing of the rubber and render the rubber better in quality in general. As the number of cars and manufacturing units grows, the demand for rubber products such as tires, seals, and gaskets will rise, further triggering the demand for stearic acid. With the increased expansion of the rubber industry being driven by increasing infrastructure development and automobile production, the use of stearic acid in the rubber production process is likely to rise, supporting the overall market growth.

Australia Stearic Acid Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end user.

Type Insights:

- Vegetable Based

- Animal Based

The report has provided a detailed breakup and analysis of the market based on the type. This includes vegetable based and animal based.

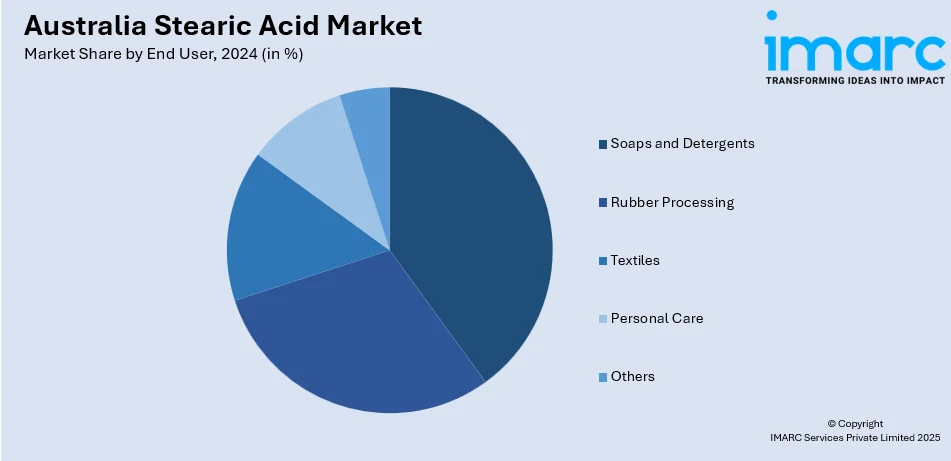

End User Insights:

- Soaps and Detergents

- Rubber Processing

- Textiles

- Personal Care

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes soaps and detergents, rubber processing, textiles, personal care, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Stearic Acid Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Vegetable Based, Animal Based |

| End Users Covered | Soaps and Detergents, Rubber Processing, Textiles, Personal Care, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia stearic acid market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia stearic acid market on the basis of type?

- What is the breakup of the Australia stearic acid market on the basis of end user?

- What is the breakup of the Australia stearic acid market on the basis of region?

- What are the various stages in the value chain of the Australia stearic acid market?

- What are the key driving factors and challenges in the Australia stearic acid?

- What is the structure of the Australia stearic acid market and who are the key players?

- What is the degree of competition in the Australia stearic acid market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia stearic acid market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia stearic acid market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia stearic acid industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)