Australia Structured Cabling Market Size, Share, Trends and Forecast by Product Type, Wire Category, Application, Vertical, and Region, 2026-2034

Australia Structured Cabling Market Overview:

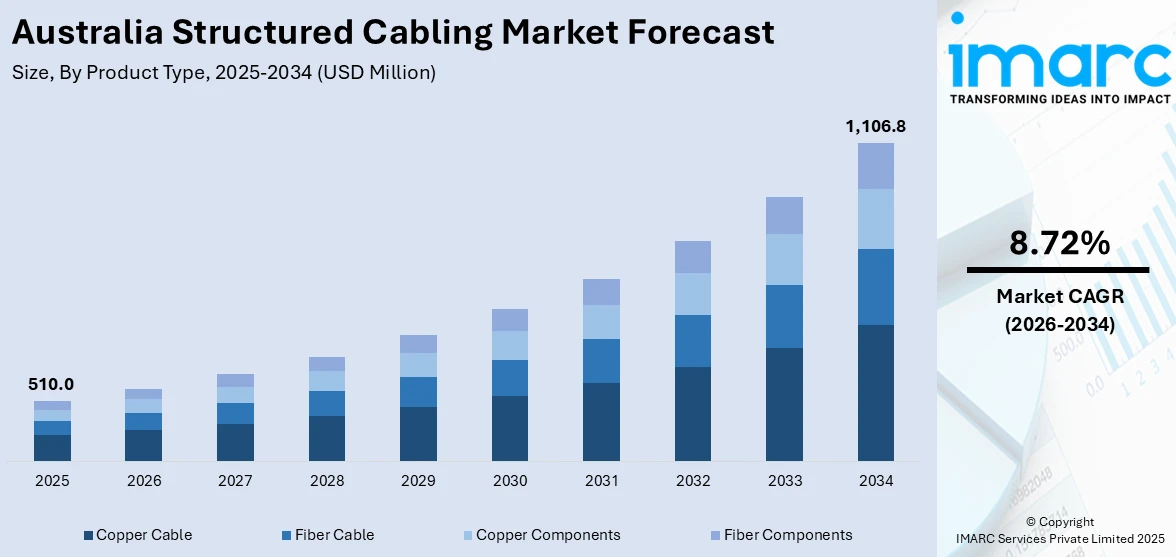

The Australia structured cabling market size reached USD 510.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,106.8 Million by 2034, exhibiting a growth rate (CAGR) of 8.72% during 2026-2034. The growing reliance on cloud computing, expanding data center infrastructure, and the rapid digital transformation of Australia’s education sector are catalyzing the demand for advanced structured cabling systems to ensure reliable, high-speed connectivity and support scalable, future-ready digital environments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 510.0 Million |

| Market Forecast in 2034 | USD 1,106.8 Million |

| Market Growth Rate 2026-2034 | 8.72% |

Australia Structured Cabling Market Trends:

Increasing Focus on Data Center Expansion and Cloud Adoption

The rising use of cloud computing, combined with the swift growth in data usage, is driving the need for more sophisticated and high-capacity data centers throughout Australia. These facilities need strong structured cabling systems to handle the growing data demands and guarantee smooth, high-speed connectivity for both business and public sector uses. Structured cabling establishes the framework for expandable, resilient network infrastructure, crucial for sustaining the performance and dependability of mission-critical services. As companies keep transitioning to cloud-based solutions for storage, teamwork, and operational functions, the demand for dependable, future-ready cabling systems is becoming more critical. Additionally, the emphasis of the governing body on digital transformation and updating public services is further speeding up investment in data center facilities. In 2024, DCI launched its second data center in Adelaide, South Australia, named Adelaide 02 (ADL02). The 4MW facility, built with an AU$70 million investment, expanded the campus capacity to 5.4MW. This launch reinforced DCI’s commitment to strengthening South Australia's digital infrastructure. The launch emphasizes how both public and private sectors acknowledge the strategic significance of robust digital infrastructures. With the launch of additional data centers, the need for advanced structured cabling systems capable of managing extensive data traffic, guaranteeing operational effectiveness, and facilitating future technological advancements is increasing, solidifying structured cabling as an essential element of Australia's digital framework.

To get more information on this market Request Sample

Expansion of Education Sector and E-Learning Initiatives

The swift growth of the education sector in Australia, particularly the increasing dependence on digital learning platforms and e-learning programs, is catalyzing the demand for sophisticated structured cabling systems. With the growing adoption of online platforms, virtual classrooms, and cloud-driven educational resources by schools, universities, and training institutions, the demand for dependable, high-speed network infrastructure is becoming critical. Structured cabling serves as the foundation for these digital learning settings, facilitating smooth connectivity among various devices and applications, ranging from live-streamed classes and interactive modules to collaborative online workspaces. In the absence of a strong cabling infrastructure, educational institutions may face service interruptions, subpar video quality, and restricted access to learning materials. The increase in e-learning use further highlights this necessity. In 2024, the Australian e-learning sector was assessed at USD 6.8 billion, and as per the IMARC Group, it is expected to grow to USD 18.6 billion by 2033, with a CAGR of 11.70% from 2025 to 2033. This rapid expansion indicates a significant change in the methods of providing and engaging with education, highlighting the need for dependable digital infrastructure. As more institutions scale up their digital capabilities to meet the demands of modern learners, the structured cabling market in Australia is poised for significant growth, driven by the imperative to support uninterrupted connectivity and data transfer across increasingly complex educational ecosystems.

Australia Structured Cabling Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on product type, wire category, application, and vertical.

Product Type Insights:

- Copper Cable

- Fiber Cable

- Copper Components

- Fiber Components

The report has provided a detailed breakup and analysis of the market based on the product type. This includes copper cable, fiber cable, copper components, and fiber components.

Wire Category Insights:

- Category 5e

- Category 6

- Category 6A

- Category 7

A detailed breakup and analysis of the market based on the wire category have also been provided in the report. This includes category 5e, category 6, category 6A, and category 7.

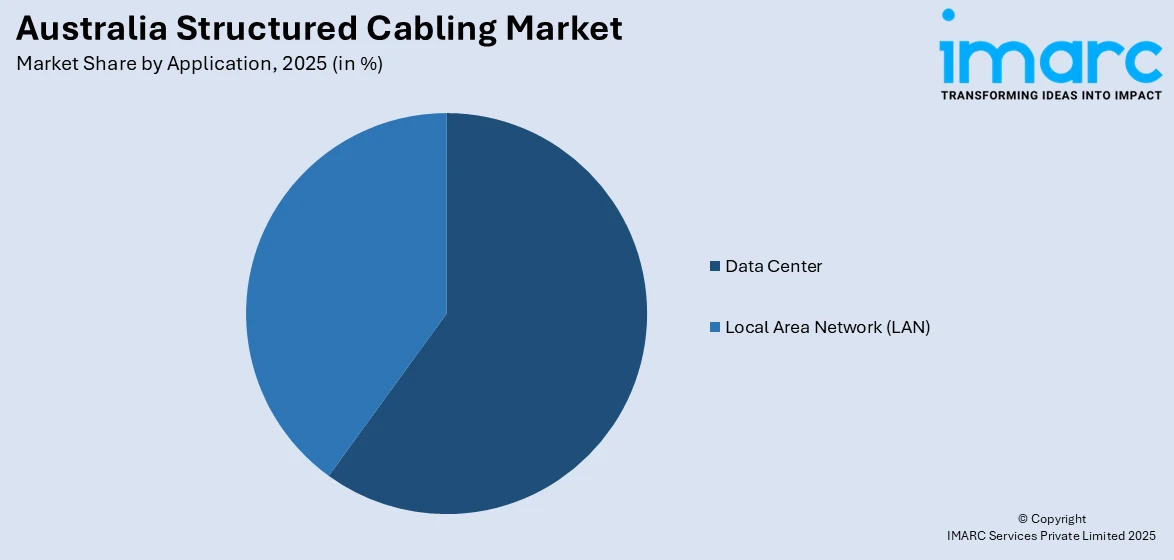

Application Insights:

Access the comprehensive market breakdown Request Sample

- Data Center

- Local Area Network (LAN)

The report has provided a detailed breakup and analysis of the market based on the application. This includes data center and local area network (LAN).

Vertical Insights:

- Government

- Industrial

- IT and Telecommunications

- Residential and Commercial

- Others

A detailed breakup and analysis of the market based on the vertical have also been provided in the report. This includes government, industrial, IT and telecommunications, residential and commercial, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Structured Cabling Market News:

- In July 2024, 4Cabling Australia announced its partnership with Leviton Network Solutions as an authorized distributor of their structured cabling systems. This collaboration enabled 4Cabling to offer premium end-to-end copper and fiber cabling solutions across enterprise and data center markets. The move aligned with both companies' strategic growth and commitment to high-quality network infrastructure.

Australia Structured Cabling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Copper Cable, Fiber Cable, Copper Components, Fiber Components |

| Wire Categories Covered | Category 5e, Category 6, Category 6A, Category 7 |

| Applications Covered | Data Center, Local Area Network (LAN) |

| Verticals Covered | Government, Industrial, IT and Telecommunications, Residential and Commercial, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia structured cabling market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia structured cabling market on the basis of product type?

- What is the breakup of the Australia structured cabling market on the basis of wire capacity?

- What is the breakup of the Australia structured cabling market on the basis of application?

- What is the breakup of the Australia structured cabling market on the basis of vertical?

- What is the breakup of the Australia structured cabling market on the basis of region?

- What are the various stages in the value chain of the Australia structured cabling market?

- What are the key driving factors and challenges in the Australia structured cabling market?

- What is the structure of the Australia structured cabling market and who are the key players?

- What is the degree of competition in the Australia structured cabling market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia structured cabling market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia structured cabling market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia structured cabling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)