Australia Surgical Navigation Systems Market Size, Share, Trends and Forecast by Technology, Application, End User, and Region, 2025-2033

Australia Surgical Navigation Systems Market Overview:

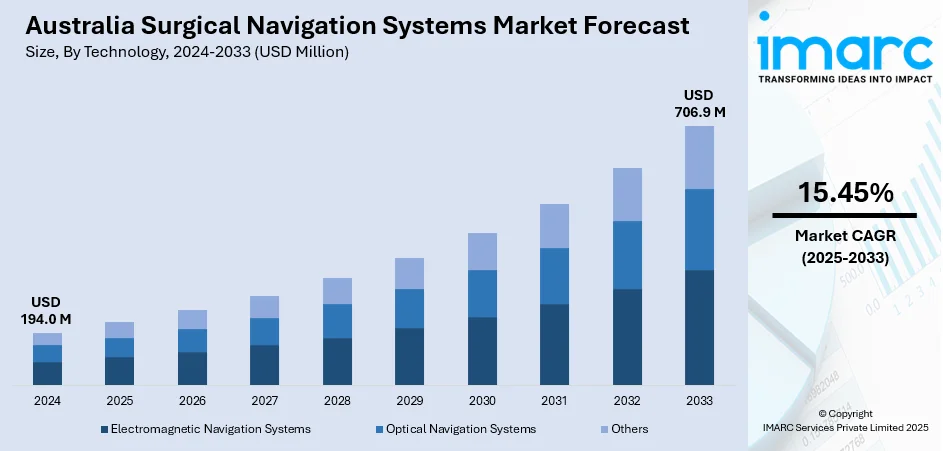

The Australia surgical navigation systems market size reached USD 194.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 706.9 Million by 2033, exhibiting a growth rate (CAGR) of 15.45% during 2025-2033. Government initiatives and investment in healthcare infrastructure are driving the market. Policies and public funding are incentivizing hospitals to adopt advanced technologies, ensuring improved healthcare services. Additionally, the increasing use of robotic-assisted surgeries is catalyzing the demand for integrated navigation systems, enhancing precision and surgical outcomes. The synergy between robotic systems and navigation technology is particularly significant in complex procedures, increasing the Australia surgical navigation systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 194.0 Million |

| Market Forecast in 2033 | USD 706.9 Million |

| Market Growth Rate 2025-2033 | 15.45% |

Australia Surgical Navigation Systems Market Trends:

Government Support and Healthcare Infrastructure Development

Government programs and investments in healthcare facilities are vital for fostering the expansion of the surgical navigation systems market in Australia. Initiatives designed to improve healthcare access and quality are encouraging hospitals to implement advanced medical technologies, including surgical navigation systems. Public financing like the Victorian Budget of 2024 has delivered considerable support for this change. In this budget, the government revealed a $1.7 billion investment in health infrastructure, covering enhancements to major hospitals such as Austin Hospital, Northern Hospital, and Monash Medical Centre. These improvements aimed at enlarging emergency departments and establishing new surgical facilities, thus directly increasing healthcare capacity and services. Additionally, the financial plan designated resources for purchasing state-of-the-art medical devices, such as surgical navigation tools, and enhancing mental health facilities. Such funding guarantees that hospitals possess the means to adopt advanced technologies that enhance surgical accuracy and patient safety. Regulatory backing is also simplifying the introduction of new medical technologies into the market, promoting innovation and encouraging healthy competition among providers. Given Australia’s growing elderly population and the rise in chronic illnesses that necessitate surgical procedures, lawmakers are focusing on ensuring surgeries are both efficient and safe. These various elements, such as enhancements to infrastructure and financial motivations, are hastening the uptake of surgical navigation systems in healthcare facilities both in urban and regional areas throughout Australia.

To get more information on this market, Request Sample

Rising Popularity of Robotic-Assisted Surgeries

The increasing use of robotic-assisted surgeries is propelling the Australia surgical navigation systems market growth. Robotic surgery offers unmatched precision, flexibility, and control, which, when integrated with advanced navigation systems, leads to enhanced surgical outcomes. Surgeons are able to carry out intricate procedures with enhanced precision, fewer complications, and reduced surgical mistakes, which ultimately shortens recovery durations. As robotic surgery systems become easily available and advance, the demand for integrated navigation technologies is growing. Robotic systems rely significantly on navigation to deliver real-time direction, enhance positioning, and increase overall surgical accuracy. The collaboration between robotic technology and surgical navigation is driving the need for advanced navigation systems, especially in precision-intensive areas like orthopedics, neurosurgery, and urology, encouraging their use in hospitals and surgical facilities. In September 2024, Victoria's Department of Health launched an innovative policy regarding Robotic-Assisted Surgery (RAS), showcasing its vast potential while stressing the need for ongoing research to completely grasp its advantages. The policy urged health services to consider self-funding methods for obtaining RAS platforms, providing assistance to enable them to make informed and significant investment choices. Such initiative enhances the incorporation of robotic surgery with navigation systems in Australian healthcare, strengthening the need for advanced technologies that guarantee superior patient care in intricate procedures.

Australia Surgical Navigation Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on technology, application, and end user.

Technology Insights:

- Electromagnetic Navigation Systems

- Optical Navigation Systems

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes electromagnetic navigation systems, optical navigation systems, and others.

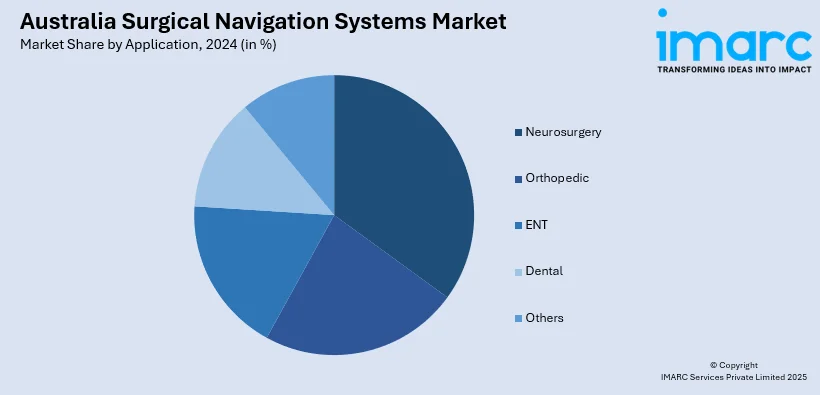

Application Insights:

- Neurosurgery

- Orthopedic

- ENT

- Dental

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes neurosurgery, orthopedic, ENT, dental, and others.

End User Insights:

- Hospitals

- Ambulatory Surgical Centers

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals and ambulatory surgical centers.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Surgical Navigation Systems Market News:

- In January 2025, Proprio announced a partnership with LifeHealthcare to distribute its AI-powered surgical guidance system, Paradigm, in Australia and New Zealand. This collaboration aims to improve surgical outcomes by offering real-time, AI-guided insights.

Australia Surgical Navigation Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Electromagnetic Navigation Systems, Optical Navigation Systems, Others |

| Applications Covered | Neurosurgery, Orthopedic, ENT, Dental, Others |

| End Users Covered | Hospitals, Ambulatory Surgical Centers |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia surgical navigation systems market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia surgical navigation systems market on the basis of technology?

- What is the breakup of the Australia surgical navigation systems market on the basis of application?

- What is the breakup of the Australia surgical navigation systems market on the basis of end user?

- What is the breakup of the Australia surgical navigation systems market on the basis of region?

- What are the various stages in the value chain of the Australia surgical navigation systems market?

- What are the key driving factors and challenges in the Australia surgical navigation systems market?

- What is the structure of the Australia surgical navigation systems market and who are the key players?

- What is the degree of competition in the Australia surgical navigation systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia surgical navigation systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia surgical navigation systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia surgical navigation systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)