Australia Surgical Sutures Market Size, Share, Trends and Forecast by Type, Material, Application, End User, and Region, 2025-2033

Australia Surgical Sutures Market Overview:

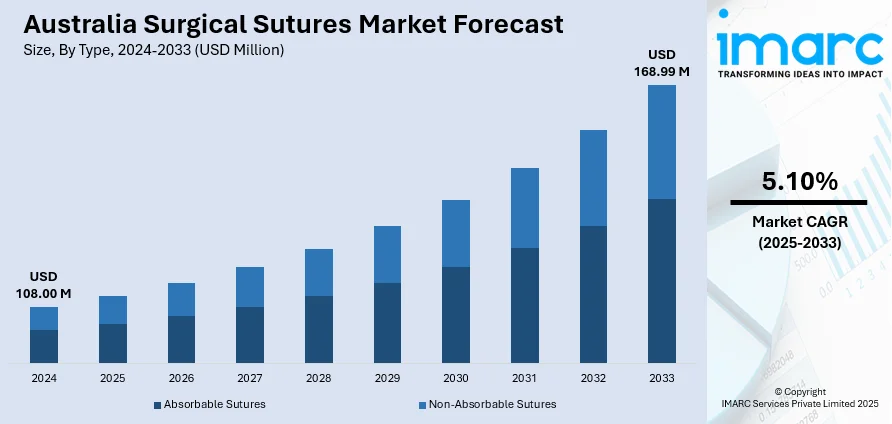

The Australia surgical sutures market size reached USD 108.00 Million in 2024. Looking forward, the market is projected to reach USD 168.99 Million by 2033, exhibiting a growth rate (CAGR) of 5.10% during 2025-2033. The market share in Australia is growing owing to the rising medical tourism, expanding healthcare infrastructure, and high healthcare expenditure, all of which are increasing surgical volumes, enhancing facility capabilities, and reinforcing demand for high-quality sutures across both urban and regional healthcare systems.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 108.00 Million |

| Market Forecast in 2033 | USD 168.99 Million |

| Market Growth Rate 2025-2033 | 5.10% |

Key Trends of Australia Surgical Sutures Market:

Increasing Medical Tourism and International Patient Inflow

Australia's exceptional healthcare system and cutting-edge surgical expertise are establishing the nation as a top choice for medical tourism, directly increasing the need for surgical sutures. Individuals from the Asia-Pacific area are progressively making their way to Australia for superior treatment in fields like orthopedics, oncology, cardiology, and cosmetic surgery, most of which require complex suturing methods. The consistent influx of international patients is increasing the quantity and intricacy of surgical operations, especially in urban hospitals and private medical facilities. The IMARC Group states that the medical tourism market in Australia was worth USD 350 million in 2024 and is expected to rise to USD 3,251 million by 2033, featuring a strong CAGR of 27.2% from 2025 to 2033. This rapid expansion indicates an increasing need for high-quality healthcare services, which is driving the demand for sophisticated surgical materials such as sutures, strengthening the industry’s role in Australia’s medical economy. The Australia surgical sutures market forecast reflects this upward trend, anticipating sustained demand driven by rising surgical volumes and international patient inflow.

To get more information on this market, Request Sample

Expanding Healthcare Infrastructure

The growth of hospitals, improvements to surgical departments, and the inclusion of operating rooms are boosting the nation’s ability to manage an increasing number of surgical operations. This is especially significant in rural and remote regions, where access to surgical treatment is being enhanced via new facilities and support systems such as telehealth. For instance, in 2025, the Western Australian government awarded ADCO Constructions the tender for the new Laverton Hospital project. Construction will begin in March 2025, aiming to enhance regional healthcare with modern emergency, outpatient, and specialist services. The project includes a $16.8 million federal contribution and will use modular construction to suit the remote location. These infrastructure initiatives directly enhance local surgical capacity and necessitate a consistent provision of vital surgical supplies, such as sutures. With the enhancement and modernization of regional capabilities, the need for premium sutures simultaneously increases, supporting the Australia surgical sutures market growth.

Rising Healthcare Expenditure and Investment

Investments from both the government and the private sector are improving hospital facilities, expanding surgical capabilities, and facilitating the acquisition of sophisticated medical supplies, such as high-quality sutures. These investments guarantee that surgical teams obtain high-quality sutures that promote improved healing, minimize complications, and correspond with contemporary surgical methodologies. For example, in 2024, the Australian Government announced that it would prevent the removal of essential surgical items from the list of medical products that private health insurers must cover. This decision aimed to prevent higher costs for patients and private hospitals. The move followed concerns raised about potential financial pressures on the healthcare system. By guaranteeing ongoing financial support and insurance for essential surgical supplies, like sutures, the government bolstered its commitment to upholding quality care and market stability. These developments support a positive Australia surgical sutures market outlook, driven by policy support, infrastructure upgrades, and sustained clinical demand.

Growth Drivers of Australia Surgical Sutures Market:

Rising Surgical Procedures

The increasing demand for surgical sutures in Australia is closely linked to the rising number of surgical interventions taking place nationwide. Factors such as the growing incidence of lifestyle-related health issues, including obesity and cardiovascular diseases, as well as accidental injuries, have led to a greater need for both elective and emergency surgeries. Furthermore, the aging population is more susceptible to chronic diseases and orthopedic problems, which further drives the frequency of surgical procedures. This ongoing growth in surgeries continues to boost the need for dependable suturing solutions, significantly affecting the Australia surgical sutures market share.

Advancements in Suture Materials

Technological advancements in suture materials have become a key factor in the market's expansion. The introduction of absorbable sutures eliminates the need for removal, enhancing patient convenience and reducing the risk of complications. Antimicrobial sutures help decrease the likelihood of surgical site infections, while biodegradable options support sustainability and patient safety objectives. These innovations enhance surgical results and encourage acceptance among healthcare providers and patients across various medical specialties. As healthcare practitioners focus on quality and innovation, the market is expected to continue its growth, bolstered by the increasing preference for sophisticated suture materials in surgical settings.

Minimally Invasive Surgeries

Minimally invasive surgical techniques are becoming more popular in Australia, thanks to advantages such as quicker recovery periods, shorter hospital stays, and fewer complications. These types of procedures necessitate specialized suturing techniques and materials that ensure precise and secure closure of small incisions. The increase in laparoscopic and robotic-assisted surgeries across a range of specialties, including gynecology and orthopedics, further drives the demand for advanced sutures. This trend is transforming the market landscape by promoting innovation in product design and usage. According to Australia surgical sutures market analysis, minimally invasive surgeries will remain a vital contributor to long-term market growth.

Australia Surgical Sutures Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, material, application, and end user.

Type Insights:

- Absorbable Sutures

- Non-Absorbable Sutures

The report has provided a detailed breakup and analysis of the market based on the type. This includes absorbable sutures and non-absorbable sutures.

Material Insights:

- Monofilament

- Multifilament

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes monofilament and multifilament.

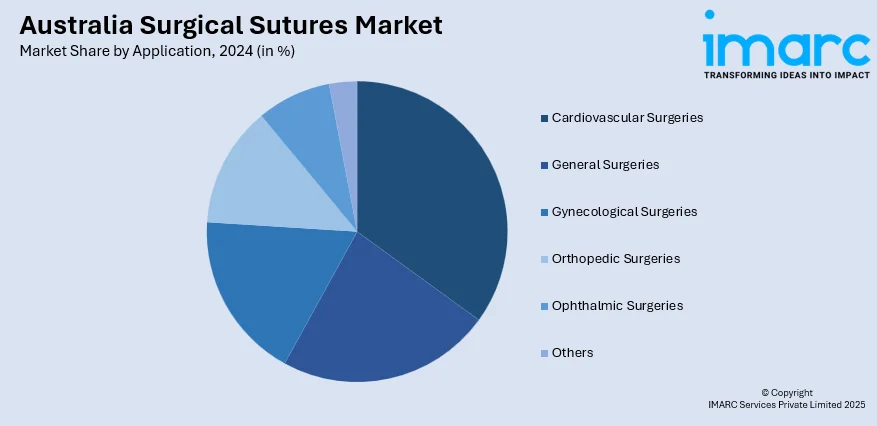

Application Insights:

- Cardiovascular Surgeries

- General Surgeries

- Gynecological Surgeries

- Orthopedic Surgeries

- Ophthalmic Surgeries

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes cardiovascular surgeries, general surgeries, gynecological surgeries, orthopedic surgeries, ophthalmic surgeries, and others.

End User Insights:

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals and clinics, ambulatory surgical centers, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Arthrex, GmbH

- B. Braun Australia Pty Ltd

- Dynek Pty Ltd

- Johnson & Johnson Medical Pty Ltd.

- Revolution Surgical Pty Ltd

Australia Surgical Sutures Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Absorbable Sutures, Non-Absorbable Sutures |

| Materials Covered | Monofilament, Multifilament |

| Applications Covered | Cardiovascular Surgeries, General Surgeries, Gynecological Surgeries, Orthopedic Surgeries, Ophthalmic Surgeries, Others |

| End Users Covered | Hospitals and Clinics, Ambulatory Surgical Centers, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Arthrex, GmbH, B. Braun Australia Pty Ltd, Dynek Pty Ltd, Johnson & Johnson Medical Pty Ltd., Revolution Surgical Pty Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia surgical sutures market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia surgical sutures market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia surgical sutures industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The surgical sutures market in Australia was valued at USD 108.00 Million in 2024.

The Australia surgical sutures market is projected to exhibit a compound annual growth rate (CAGR) of 5.10% during 2025-2033.

The Australia surgical sutures market is expected to reach a value of USD 168.99 Million by 2033.

The Australia surgical sutures market is witnessing trends such as growing adoption of advanced absorbable sutures, rising preference for minimally invasive surgical procedures, and innovation in antimicrobial materials. Increasing focus on patient safety, faster recovery, and sustainability in medical products is also shaping market evolution.

Market growth is driven by a surge in surgical volumes due to accidents, chronic illnesses, and an aging population. Expanding healthcare infrastructure, rising medical tourism, and supportive government initiatives are also boosting demand. Enhanced insurance coverage and growing accessibility to advanced healthcare services are further accelerating market adoption across Australia.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)