Australia Team Collaboration Software Market Size, Share, Trends and Forecast by Component, Software Type, Deployment Mode, Industry Vertical, and Region, 2025-2033

Australia Team Collaboration Software Market Overview:

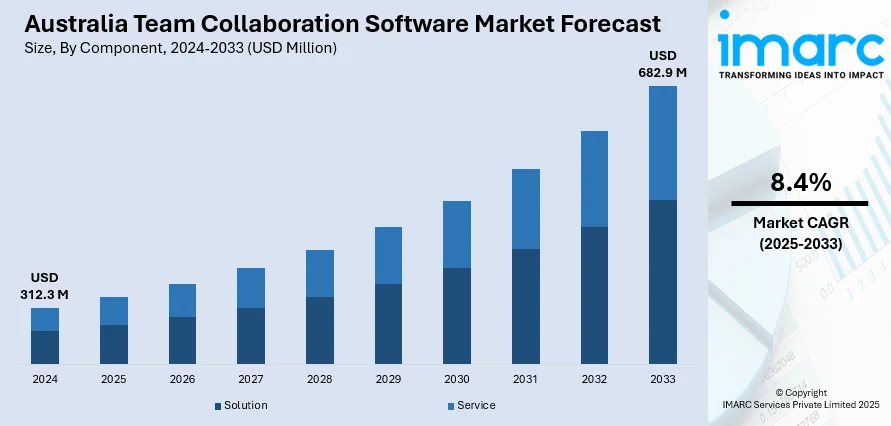

The Australia team collaboration software market size reached USD 312.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 682.9 Million by 2033, exhibiting a growth rate (CAGR) of 8.4% during 2025-2033. The growing demand for efficient and reliable tools that enable seamless communication across dispersed teams, along with increasing investments in employee training and cybersecurity practices, is strengthening the Australia team collaboration software market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 312.3 Million |

| Market Forecast in 2033 | USD 682.9 Million |

| Market Growth Rate 2025-2033 | 8.4% |

Australia Team Collaboration Software Market Trends:

Growing utilization of remote and hybrid work arrangements

Rising employment of remote and hybrid work models is fueling the market growth. As companies are transitioning from conventional office arrangements to more flexible workspaces, workers are relying more on digital platforms to maintain connections, exchange information, and work together on projects. This shift is increasing the adoption of cloud document sharing, video conferencing, project management tools, and instant messaging applications. Australian companies across sectors are recognizing the value of maintaining productivity and workflow continuity regardless of physical location, which is leading to higher investments in robust collaboration solutions. These platforms offer features like real-time editing, task tracking, virtual meetings, and centralized communication channels, making them essential in a hybrid workspace. Moreover, as businesses are prioritizing agility and employee satisfaction, the demand for intuitive and scalable team software continues to rise. Startups and small and medium enterprises (SMEs) are benefiting from affordable cloud-based tools that enable efficient teamwork without geographical barriers. Moreover, in order to support e- learning and remote administrative operations, the government and education sectors are employing these tools. According to the IMARC Group, the Australia e-learning market is set to attain USD 18.6 Billion by 2033, exhibiting a CAGR of 11.70% from 2025-2033.

To get more information on this market, Request Sample

Increasing awareness about data security

Rising awareness among people about data security is fueling the Australia team collaboration software market growth. Companies are looking for collaboration tools that offer robust security attributes, such as end-to-end encryption, safe cloud storage, and multi-factor authentication, to protect against cyber threats and data leaks. High internet penetration in Australia is further boosting the adoption of these tools, as employees frequently access shared documents and communication platforms remotely. As per industry reports, at the beginning of 2024, Australia had 25.21 Million internet users, with an internet penetration rate of 94.9%. With businesses operating in sectors like finance, healthcare, and legal services, which demand high data protection standards, secure collaboration software is becoming a necessity. Organizations prioritize vendors that comply with data privacy regulations and industry standards, ensuring secure handling of both internal and client data. This awareness is also leading to updates and innovations among software providers, who are enhancing security features to stay competitive. Companies are also investing in employee training and cybersecurity practices alongside collaboration software to guarantee comprehensive protection.

Australia Team Collaboration Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, software type, deployment mode, and industry vertical.

Component Insights:

- Solution

- Service

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution and service.

Software Type Insights:

- Conferencing

- Communication and Co-Ordination

A detailed breakup and analysis of the market based on the software type have also been provided in the report. This includes conferencing and communication and co-ordination.

Deployment Mode Insights:

- On-Premises

- Cloud-based

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based.

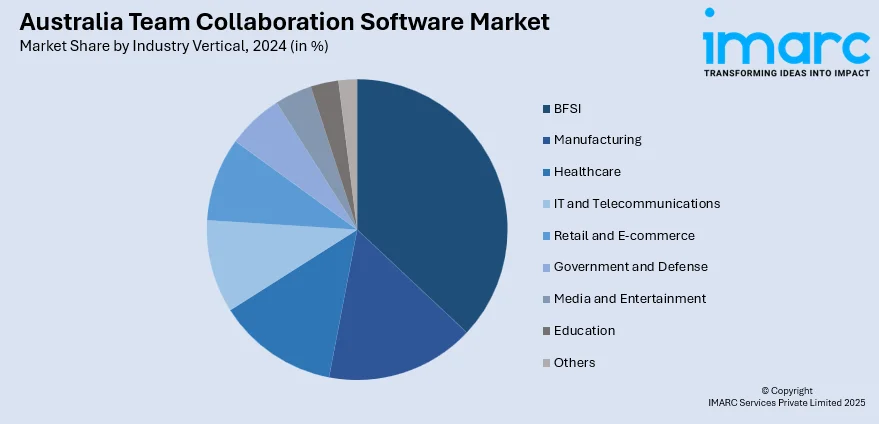

Industry Vertical Insights:

- BFSI

- Manufacturing

- Healthcare

- IT and Telecommunications

- Retail and E-commerce

- Government and Defense

- Media and Entertainment

- Education

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes BFSI, manufacturing, healthcare, IT and telecommunications, retail and e-commerce, government and defense, media and entertainment, education, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Team Collaboration Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Service |

| Software Types Covered | Conferencing, Communication and Co-Ordination |

| Deployment Modes Covered | On-Premises, Cloud-based |

| Industry Verticals Covered | BFSI, Manufacturing, Healthcare, IT and Telecommunications, Retail and E-commerce, Government and Defense, Media and Entertainment, Education, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia team collaboration software market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia team collaboration software market on the basis of component?

- What is the breakup of the Australia team collaboration software market on the basis of software type?

- What is the breakup of the Australia team collaboration software market on the basis of deployment mode?

- What is the breakup of the Australia team collaboration software market on the basis of industry vertical?

- What is the breakup of the Australia team collaboration software market on the basis of region?

- What are the various stages in the value chain of the Australia team collaboration software market?

- What are the key driving factors and challenges in the Australia team collaboration software?

- What is the structure of the Australia team collaboration software market and who are the key players?

- What is the degree of competition in the Australia team collaboration software market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia team collaboration software market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia team collaboration software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia team collaboration software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)