Australia Telecom Market Report by Services (Voice Services, Data and Messaging Services, OTT and Pay-Tv Services), and Region 2025-2033

Australia Telecom Market Size 2025-2033:

The Australia telecom market size reached USD 65.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 78.4 Billion by 2033, exhibiting a growth rate (CAGR) of 1.90% during 2025-2033. The market is mainly driven by the expansion of 5G network, gradual increase in usage of mobile data and rapid growth of IoT solutions within the country. The top 3 players in the market – Telstra, Singtel and TPG – account for 84% of the market share. These companies are enhancing their digital infrastructure and offering competitive data plans to drive future growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 65.0 Billion |

|

Market Forecast in 2033

|

USD 78.4 Billion |

| Market Growth Rate 2025-2033 | 1.90% |

Australia Telecom Market Analysis:

- Major Market Drivers: Key market drivers include the rapid expansion of 5G networks which offers faster speed and lower latency further fostering new applications like IoT and smart cities. Rise in mobile data usage mainly driven by streaming, online gaming and remote work drives the demand for robust data plans. Digital transformation initiatives including cloud services with AI driven automation are important. Regulatory support for spectrum allocation and rural connectivity initiatives also creates a positive outlook for the Australia telecom market growth.

- Key Market Trends: Key market trends include the rapid deployment of 5G networks which leads to enhanced connectivity and new applications. Mobile data usage holds the majority of the Australia telecom market share, mainly driven by streaming and remote work is prompting telecoms to offer unlimited data plans. The rise of IoT is expanding smart home and industrial solutions which is further supported by advanced IoT platforms. Digital transformation through cloud services and AI is gaining momentum while sustainability initiatives and improved rural connectivity are also shaping the market’s future landscape.

- Competitive Landscape: Some of the key market players include Telstra Corporation Limited, Singtel Optus Pty Limited, TPG Telecom Limited, Macquarie Technology Group, and Aussie Broadband Limited. These companies are actively broadening their 5G network and improving their services to attract and retain their customers.

- Challenges and Opportunities: The Australia telecom market faces various challenges like high infrastructure costs associated with 5G deployment, regulatory hurdles and intense competition leading to price wars. Ensuring reliable connectivity in remote and rural areas remain a significant challenge for the service providers. However, there are significant opportunities as well, including the rising demand for IoT solutions which further drives innovation and smart cities and industrial automation. The gradual shift towards remote work and digital services also presents significant opportunities for telecom providers to offer enhanced data plans and cloud services.

Key Trends of Australia Telecom Market:

5G Deployment and Expansion

The rollout of 5G technology in Australia is a key factor in enhancing data speeds, reducing latency and increasing network capacity to support advanced application like augmented reality (AR), virtual reality (VR) and autonomous vehicles. Telstra, Optus, and TPG Telecom are aggressively expanding their 5G networks in order to improve coverage and services quality across the nation which drives the innovation and connectivity advancement. For instance, in July 2023, Telstra deployed Ericsson’s Cloud RAN solution in its commercial 5G network which makes it the first deployment of its kind in Australia. This deployment involves the migration of two carrier frequencies that is 2600 megahertz and 3600 megahertz to Cloud RAN infrastructure. Telstra's implementation of Cloud RAN technology involves the virtualization of the RAN baseband, enabling faster network capacity expansion and new feature rollouts.

Growth in Internet of Things

The growth of the Internet of Things (IoT) in Australia is marked by the widespread adoption of smart home devices and industrial IoT solutions. This expansion is fueled by advancements in connectivity, such as 5G, and enhanced data analytics capabilities. For instance, in 2022, Australian IoT startup funding hit a record high, with an average funding round of A$21.7 million, totalling A$173 million. This growth contrasted with a 22% global drop in IoT startup funding. Despite current economic conditions affecting venture capital, investor confidence in long-term prospects for IoT companies remains high. Telecom providers are actively developing IoT platforms and forging strategic partnerships to support a broad spectrum of applications, from home automation and energy management to industrial automation and smart city initiatives, thereby creating a robust IoT ecosystem.

Rise in Mobile Data Usage

Mobile data consumption holds the majority of the Australia telecom market share. The rise in mobile data usage in Australia is driven by the increased use of streaming services, online gaming and remote working particularly post-pandemic. For instance, as of early 2024 Australia had 25.21 million internet users representing a 94.9 percent internet penetration rate. The country also had 20.80 million social media users which accounted for 78.3 percent of the total population. Additionally, there were 33.59 million cellular mobile connections surpassing the total population at 126.4 percent. As consumers demand more data for high-bandwidth activities telecom companies are responding by offering more unlimited data plans. These plans cater to the growing need for continuous, high-speed internet access, ensuring that users can stream, game and work remotely without worrying about data limits thus enhancing user satisfaction and connectivity.

Growth Drivers of Australia Telecom Market:

Digital Transformation

The rapid advancement of digital transformation across a multitude of sectors is a significant factor driving demand in the Australia telecom market. Companies are increasingly adopting telecom solutions to facilitate remote work, enable real-time collaboration, support cloud communication, and implement Internet of Things (IoT) applications. Reliable connectivity has become crucial for operational efficiency and engaging customers, spanning from healthcare to logistics. In response, telecom providers are customizing enterprise packages, offering high-speed data solutions, and delivering managed services that cater to specific industry requirements. As organizations enhance their infrastructure and transition to digital-first operations, the need for scalable and secure telecom services is growing swiftly. This transformation is altering the competitive environment and greatly contributing to the overall increase in Australia telecom market demand.

Government Support

The role of government investment and regulatory assistance is pivotal in enhancing and fortifying Australia’s telecom sector. Programs aimed at regional broadband, the establishment of 5G infrastructure, and policies focused on digital inclusion are empowering telecom providers to extend their services into areas beyond major cities. These initiatives target the digital divide, ensuring dependable connectivity in rural and underserved communities. Public funding, coupled with partnerships with private operators, is expediting the rollout of next-generation networks and fostering economic growth through enhanced digital access. Moreover, government-supported innovation hubs and regulatory frameworks are promoting advancements in the industry. These strategic investments are creating a foundation for a more connected and inclusive Australia while nurturing sustainable development in the national telecom market.

Growing Enterprise Demand

Large and mid-sized businesses are increasingly seeking out telecom providers for tailored, high-performance communication solutions. With a rising dependence on cloud computing, remote collaboration tools, and cybersecurity measures, organizations require a robust telecom infrastructure to maintain their competitive edge. There is a growing demand for solutions such as dedicated private networks, unified communication platforms, and managed security services. Telecom operators are addressing this need with offerings that emphasize speed, reliability, and data protection. Additionally, industries like finance, healthcare, and manufacturing are looking for telecom support for essential applications and seamless connectivity. According to Australia telecom market analysis, this increase in enterprise demand is not only spurring service innovation but also significantly contributing to long-term revenue growth and market expansion.

Opportunities of Australia Telecom Market:

Expanding Rural Connectivity

One major opportunity in the Australian telecommunications industry is closing the connectivity gap in rural and remote Australia. Most places still lag behind with inadequate or unreliable high-speed internet access, which affects education, health, business performance, and general living standards. The gap provides a chance for telecommunications operators to extend their services in satellite broadband, fixed wireless networks, and cellular coverage. Advances in low-Earth orbit satellite technology and fixed wireless infrastructure are making it more economically feasible to deliver affordable, high-quality internet access to these underserved communities. Governments and private sector players alike are increasingly interested in ensuring digital inclusion in rural areas. By placing emphasis on rural connectivity, telecom companies can access new customer bases and help deliver a more balanced national digital economy.

Rise in Edge Computing

The rising adoption of real-time applications in areas such as gaming, autonomous vehicles, remote monitoring, and smart manufacturing is fueling the demand for edge computing solutions. Telecom companies in Australia have a unique opportunity to provide low-latency connectivity by incorporating edge computing capabilities into their networks. By processing data closer to its source, edge computing boosts speed, minimizes bandwidth consumption, and enhances application responsiveness. As Internet of Things (IoT) applications and artificial intelligence (AI) technologies continue to grow, telecom providers can establish themselves as essential players in real-time digital ecosystems. Providing edge infrastructure and managed services allows these companies to broaden their offerings, foster enterprise innovation, and gain an edge in a market that increasingly prioritizes timely data processing and response.

Cross-Industry Collaborations

Partnerships between telecom providers and various industries offer a significant growth opportunity in the Australian market. Sectors such as mining, agriculture, logistics, and manufacturing require robust, secure, and reliable communication infrastructures tailored for automation, remote operations, and data-heavy processes. Telecom firms can create bespoke connectivity solutions, including private networks and IoT integration, addressing the specific requirements of each industry. These collaborations enable companies to adopt advanced technologies while providing telecom operators with consistent, long-term business clients. The need for specialized telecom services is on the rise, spurred by digital transformation efforts across Australia's essential economic sectors. Aligning strategically with these industries will enhance value creation and open up new revenue opportunities for telecom providers.

Challenges of Australia Telecom Market:

High Infrastructure Costs

A significant challenge within the Australian telecommunications sector is the substantial investment required for infrastructure development, especially in rural and remote areas. The installation of fiber-optic lines, tower construction, and the deployment of satellite or fixed wireless networks necessitate considerable financial resources and intricate planning. These regions often have sparse populations, leading to slower returns on investment, which makes it less appealing for private telecom companies. Although government initiatives provide support, the financial risks and prolonged payback periods continue to obstruct efforts to extend rural coverage. This challenge significantly impairs the objective of closing the digital gap and guaranteeing fair access to high-speed internet. Overcoming these infrastructure expenses is essential for achieving comprehensive telecom coverage and enhancing digital inclusion throughout Australia.

Intense Competition

The telecommunications market in Australia is characterized by intense competition, with numerous established and emerging providers competing for market share. This rivalry has resulted in aggressive pricing tactics, promotional deals, and bundled service offerings, often squeezing profit margins and pressuring profitability. While consumers enjoy the advantages of competitive pricing and enhanced service options, telecom companies struggle to maintain revenue streams while investing in innovation and infrastructure. Additionally, customer churn poses another challenge, as users frequently switch providers in search of superior deals or service. Consequently, telecom firms need to prioritize customer experience, network quality, and unique offerings to retain customer loyalty. The constant demand to surpass competitors complicates market stability, particularly for smaller or newer companies.

Urban Network Congestion

Urban areas in Australia, despite having robust telecom infrastructure, encounter significant challenges due to increasing data usage and population density. The rise of smart devices, streaming platforms, and mobile apps places ongoing stress on city networks. This congestion can result in slower internet speeds, dropped calls, and general service degradation, negatively impacting user satisfaction. To meet this demand, telecom providers must invest in network enhancements, including deploying small cells and optimizing spectrum use. However, these upgrades necessitate careful planning, regulatory approvals, and substantial financial investment. Without ongoing investment and technological advancements, preserving service quality in urban areas remains a continual challenge, which could affect customer retention and brand image.

Australia Telecom Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on services.

Breakup by Services:

To get more information on this market, Request Sample

- Voice Services

- Wired

- Wireless

- Data and Messaging Services

- OTT and Pay-Tv Services

The report has provided a detailed breakup and analysis of the market based on the services. This includes voice services (wired and wireless), data and messaging services, and OTT and pay-tv services.

Voice services in market encompass both wired and wireless options. Wired services primarily landlines are increasingly supplemented by wireless services as mobile phones dominate. The shift towards mobile usage is driven by convenience and the widespread availability of mobile networks. Telecom operators nowadays are enhancing voice quality and reliability integrating VoIP (Voice over Internet Protocol) technologies and offering bundled plans that include voice, data and messaging services to attract and retain customers.

Data and messaging services are pivotal in the Australia telecom market reflecting the rise in mobile internet use. With the proliferation of smartphones consumers demand high-speed data for streaming, gaming and social media. Telecom providers are responding with robust 4G and expanding 5G networks offering higher data limits and unlimited plans. Enhanced messaging services including SMS, MMS and app-based messaging platforms are also integral further supporting the communication needs of both individuals and businesses.

OTT (Over-the-Top) and pay-tv services are key components of the Australia telecom market mainly driven by the increasing preference for streaming content over traditional broadcasting. OTT services like Netflix and Stan offer on-demand access to a vast library of shows and movies appealing to a broad audience. Telecom providers are partnering with these platforms and launching their own streaming services to capture market share. Pay-Tv continues to evolve with flexible subscription models and enhanced content offerings catering to diverse consumer preferences.

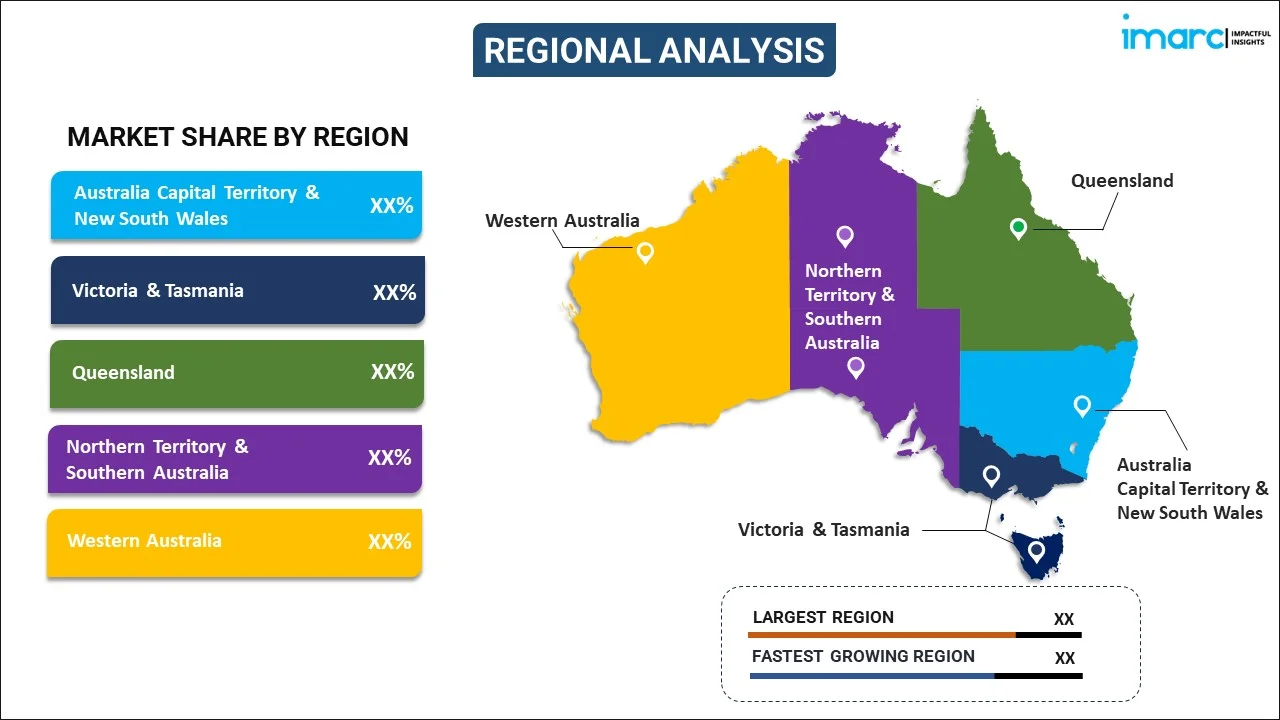

Breakup by Region:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major markets in the region, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

In the Australia Capital Territory and New South Wales, the telecom market is driven by high urbanization and advanced infrastructure. Major cities like Sydney and Canberra see robust demand for high-speed internet and mobile services. The rollout of 5G networks is accelerating, enhancing connectivity and enabling new technologies. Telecom providers focus on upgrading existing networks, expanding fiber optic coverage, and offering comprehensive data and voice packages to meet the needs of a tech-savvy population and a growing number of businesses.

Victoria and Tasmania's telecom markets are characterized by significant investment in both urban and rural connectivity. Melbourne, as a major urban center, leads in adopting advanced telecom services, including 5G and IoT solutions. Providers are enhancing network coverage and capacity to support high data consumption and digital transformation initiatives.

Queensland's telecom market is marked by rapid 5G expansion and increased mobile data usage, driven by a diverse population spread across urban centers like Brisbane and regional areas. The state's growing tech sector and tourism industry demand robust and reliable telecom services. Providers are investing in network upgrades, expanding rural connectivity, and offering competitive data and voice plans.

In the Northern Territory and Southern Australia, the telecom market faces unique challenges due to vast, sparsely populated areas. Despite this, there is a strong push towards improving connectivity, with significant investments in expanding 4G and 5G networks. Providers are focusing on enhancing remote and rural telecom infrastructure to bridge the digital divide.

Western Australia's telecom market is characterized by efforts to enhance connectivity across its expansive and often remote regions. The state is seeing substantial investments in 5G network deployment and the expansion of fiber optic infrastructure. Perth, as the major urban center, drives demand for advanced telecom services, including high-speed data and IoT applications.

Competitive Landscape:

- The report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the key players in the market include Telstra Corporation Limited, Singtel Optus Pty Limited, TPG Telecom Limited, Macquarie Technology Group, and Aussie Broadband Limited.

- Australia telecom market is highly competitive dominated by both regional and global telecom giants. Companies nowadays are aggressively expanding their 5G network and enhancing their service offerings in order to attract and retain their consumers. Telecom industry in Australia is witnessing a major transformation with leading companies investing heavily in coverage and infrastructure while others are focusing on competitive pricing and superior consumer services. Innovation in value added services and technological advancements is a key strategy. The smaller providers and MVNOs (Mobile Virtual Network Operators) also contributing significantly to the competition by offering niche services and competitive pricing is striving to capture a large portion of Australian telecom market share.

Australia Telecom Market News:

- In May 2024, Telstra teamed up with Honda to provide connectivity for the all-new Accord in Australia. This partnership introduces advanced technology including Google built-in integration powered by Telstra's leading mobile network. The collaboration aims to enhance the driving experience by offering improved telemetry data, infotainment system and future Vehicle-to-Everything (V2X) technology. This initiative reflects Telstra's commitment to enhancing the national transport network and Honda's dedication to delivering exceptional customer experiences through innovative products and technology.

- In April 2024, TPG Telecom and Optus have inked a deal to establish a Multi-Operator Core Network (MOCN), enabling TPG to expand its 4G and 5G mobile coverage to 98.4% of Australians. Under the agreement TPG's Australiaal mobile network will expand from 755 to 2,444 sites doubling its national coverage to one million square kilometers. TPG Telecom CEO Iñaki Berroeta highlighted the deal's potential to provide greater value to customers and shareholders while reducing operating costs.

Australia Telecom Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Telstra Corporation Limited, Singtel Optus Pty Limited, TPG Telecom Limited, Macquarie Technology Group, and Aussie Broadband Limited |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia telecom market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia telecom market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia telecom industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia telecom market is projected to exhibit a compound annual growth rate (CAGR) of 1.9% during 2025-2033.

The market is witnessing increased adoption of private 5G networks, growing edge computing integration, and rising demand for smart connectivity in sectors like mining and agriculture. Telecom providers are also focusing on sustainability and infrastructure modernization to support digital transformation across industries.

Widespread rollout of 5G, rising enterprise demand for high-speed communication, and government support for regional connectivity are driving telecom growth. Additionally, increasing data consumption, remote work adoption, and cloud service expansion are accelerating the need for robust and scalable telecom solutions across Australia.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)