Australia Television Market Size, Share, Trends and Forecast by Technology, Screen Size, Features, End User, and Region, 2025-2033

Australia Television Market Overview:

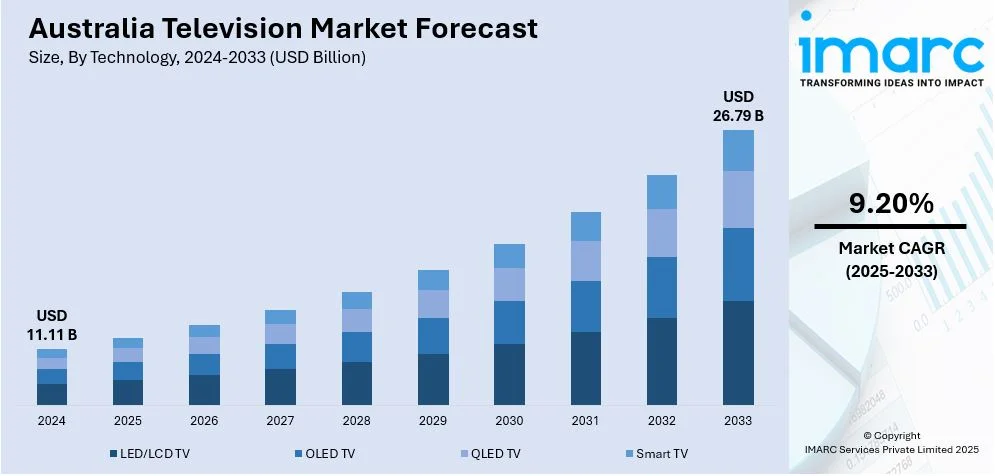

The Australia television market size reached USD 11.11 Billion in 2024. Looking forward, the market is projected to reach USD 26.79 Billion by 2033, exhibiting a growth rate (CAGR) of 9.20% during 2025-2033. The high broadband penetration, increasing ownership of smart televisions, and rising use of over-the-top (OTT) streaming platforms are propelling the market growth. Furthermore, improvements in mobile internet connectivity, growing demand for on-demand video content, domestic content production, and favorable government regulations are stimulating the market growth. Apart from this, multicultural audience preferences, diverse international and local content rights, hybrid broadcast broadband television (HbbTV), and inflating per capita income are providing a thrust to the Australia television market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 11.11 Billion |

| Market Forecast in 2033 | USD 26.79 Billion |

| Market Growth Rate 2025-2033 | 9.20% |

Key Trends of Australia Television Market:

Expansion of High-Speed Internet and Broadband Access

The widespread availability of high-speed internet has profoundly influenced how television is accessed in Australia. The implementation of the National Broadband Network (NBN) has provided millions of households with faster and more reliable internet connectivity, enabling the transition toward streaming platforms and Internet Protocol Television (IPTV) services. The Australian government has also committed AUD 3 billion to upgrade the NBN to full fiber-to-the-premises (FTTP) for 1.5 million more homes by 2030, aiming to deliver speeds up to 1 Gbps and boost digital infrastructure resilience. These upgrades make it easier for users to stream high-definition and 4K content without buffering, improving overall user experience. In addition to wired networks, alternatives like Starlink have become important in rural areas. High-speed access is now a prerequisite for modern TV consumption, and the availability of better broadband influences what services consumers adopt. As of early 2024, the median fixed internet speed in Australia stood at 54.41 Mbps, sufficient for streaming high-quality video content across multiple devices. This infrastructural improvement is central to the long-term growth of Australia’s television market, enabling more flexible, on-demand, and data-driven viewing experiences.

To get more information on this market, Request Sample

Rising Smart TV Penetration

Smart TVs are playing a major role in driving digital content consumption in Australia. By the end of 2023, 75.6% of households owned a smart TV, a rise from 70.9% in 2022, indicating rapid adoption across age groups and income levels. These TVs provide seamless access to streaming apps like Netflix, YouTube, and Disney+ without external devices, making them a default viewing option in many homes. Enhanced features, such as 4K resolution, organic light-emitting diode (OLED) displays, integrated voice assistants, Sare further boosting consumer demand. These trends reflect broader consumer migration toward connected living and personalized viewing. Smart TVs also support targeted advertising and interactive viewing, prompting broadcasters and marketers to invest more in digital strategies, which is driving the Australia television market growth.

Growth of 4K and 8K Displays

The Australian television market is witnessing significant growth due to the swift adoption of 4K and 8K display technologies. Consumers are increasingly focused on high-quality visuals, vivid colors, and an immersive viewing experience, which has made ultra-high-definition TVs a favored option among households. The surge in streaming services providing 4K content, alongside the increasing appeal of large-screen televisions for home entertainment, is further propelling this trend. Furthermore, improvements in broadcasting standards and the reduced cost of higher-resolution models are motivating more consumers to make upgrades. As consumer preferences evolve toward premium viewing experiences, the focus on ultra-HD televisions continues to influence buying behaviors and drive innovation. This escalating interest has greatly fueled the rising Australia television market demand for advanced display technologies.

Growth Drivers of Australia Television Market:

Rising Disposable Incomes

The increase in disposable incomes across Australia is allowing consumers to allocate more funds toward lifestyle and entertainment products, such as premium televisions. With enhanced purchasing power, numerous households are transitioning from standard models to larger, high-definition, and feature-rich televisions that elevate their viewing experiences. This trend highlights a growing desire for quality and luxury in home entertainment. As consumers continue to focus on improved living standards, the demand for advanced TVs is anticipated to grow, prompting manufacturers to develop innovative products that meet changing expectations.

Expanding Streaming Services

The swift expansion of over-the-top (OTT) platforms is reshaping viewing preferences in Australia, making smart TVs equipped with integrated streaming features increasingly sought after. Consumers are looking for easy access to platforms that offer on-demand movies, sports, and series straight from their television screens. This fusion of content and technology is driving sales of connected devices and is redefining home entertainment. According to Australia television market analysis, the increasing adoption of streaming services will continue to be a key factor in smart TV growth, motivating manufacturers to create user-friendly interfaces and enhanced connectivity options.

Growing Gaming Culture

There is a notable rise in gaming culture in Australia, which is profoundly influencing the television market. Gaming fans increasingly require TVs that can deliver high refresh rates, ultra-low latency, and exceptional graphics compatibility to enrich their gaming experiences. Large screens featuring advanced display technologies like OLED and QLED are becoming the go-to option for this audience. As e-sports and casual gaming continue to rise in popularity, television manufacturers are developing models specifically designed for an immersive gaming experience. This trend is expected to further solidify gaming as a crucial element driving the adoption of advanced television models in Australia.

Opportunities of Australia Television Market:

Rising Demand for Affordable Premium Models

One of the most promising opportunities in the Australian television market is aimed at mid-range consumers who desire premium viewing experiences without the steep price. As living standards rise, this demographic increasingly seeks larger screens, advanced display technologies, and smart features that provide good value. By offering competitively priced premium models, manufacturers can effectively cater to this demand while appealing to budget-conscious households. This trend broadens the customer base and enables brands to cultivate long-term loyalty by presenting a combination of affordability and high quality. By targeting this segment, companies can enhance their market presence and differentiate themselves from competitors focused solely on the high-end or budget segments.

Content Partnerships

Strategic alliances between television manufacturers and content providers represent a significant growth opportunity in Australia. With the swift expansion of OTT platforms and gaming services, consumers now prioritize televisions that offer direct, effortless access to their preferred content ecosystems. Collaborating with streaming services, sports networks, or gaming firms can enhance user experience and create exclusive offerings that draw in customers. This strategy increases product appeal and solidifies brand positioning in a competitive landscape. For manufacturers, these partnerships present an opportunity to differentiate their products while capitalizing on consumer loyalty to content providers. By incorporating content partnerships into their product strategies, television brands can create a comprehensive entertainment ecosystem that caters to various consumer preferences and encourages long-term engagement.

Customization and Localization

Another significant opportunity in the Australian television market is providing region-specific customization and localized features. Consumers are increasingly interested in televisions that align with their cultural, linguistic, and content preferences. For example, incorporating local streaming applications, Australian sports content, or user interfaces designed for regional audiences can greatly enhance product attractiveness. This emphasis on localization extends beyond content, encompassing features such as parental controls, accessibility options, and energy efficiency tailored to local requirements. Manufacturers who prioritize the development of products that mirror the lifestyle and viewing habits of Australian consumers can forge stronger connections within the market. Customization also allows brands to distinguish themselves in a competitive environment by offering a personalized experience, ultimately nurturing brand loyalty and supporting long-term market growth.

Challenges of Australia Television Market:

High Competition and Price Pressure

The television market in Australia is characterized by intense competition, featuring a plethora of global and regional brands that provide a diverse array of products. The intense competition among companies has led to competitive pricing strategies, forcing businesses to reduce prices in order to draw in customers and gain market share. Although consumers enjoy the advantage of lower-priced televisions, manufacturers grapple with diminishing profit margins and the challenge of achieving sustainable long-term profitability. The necessity to reconcile quality with cost-effectiveness drives brands to streamline their production, distribution, and marketing practices. For newcomers to the market, securing a position is especially daunting, given the dominance of established players. Moreover, price sensitivity among Australian consumers is increasing, leading them to extensively compare features and prices prior to making a purchase. This scenario compels companies to consistently innovate while keeping prices attractive, presenting a substantial challenge to maintaining financial health and continual growth.

Rapid Technology Obsolescence

The swift pace of technological advancements in the television industry represents another significant hurdle for the Australian market. Innovations like 4K, 8K, OLED, QLED, and smart technologies evolve rapidly, rendering older models outdated within brief periods. While this stimulates consumer interest in the latest models, it also compels manufacturers and retailers to handle excess inventory and frequent product launches. Consumers may experience indecision due to the rapid changes, often postponing purchases in anticipation of newer, better, and more affordable options. On the flip side, manufacturers face substantial research and development expenses to stay competitive while also offering affordability. This relentless quest for innovation can induce considerable financial pressure and necessitate adjustments in the supply chain. The brief life cycles of products ultimately challenge brands in establishing lasting value and loyalty in such a quickly changing environment.

Shift to Mobile and Tablet Viewing

The increasing inclination toward mobile phones and tablets as primary sources of entertainment poses a long-term obstacle for the television market in Australia. With streaming services and applications readily accessible on portable devices, a significant number of consumers, especially younger audiences, are opting for the convenience of on-the-go viewing over traditional television. This change in behavior diminishes reliance on household televisions, impacting demand growth within the industry. Additionally, as mobile and tablet screens continue to enhance in size, resolution, and connectivity, they present a viable substitute for large-screen televisions. This trend compels television manufacturers to reevaluate their strategies, concentrating on distinctive features such as ultra-high definition displays, immersive audio, and smart home integration to stay relevant. The challenge lies in persuading consumers that televisions still provide experiences that mobile devices cannot fully replicate, particularly in shared and family viewing contexts.

Australia Television Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on technology, screen size, features, and end user.

Technology Insights:

- LED/LCD TV

- OLED TV

- QLED TV

- Smart TV

The report has provided a detailed breakup and analysis of the market based on the technology. This includes LED/LCD TV, OLED TV, QLED TV, and Smart TV.

Screen Size Insights:

- Small Screen (Below 32 inches)

- Medium Screen (32 to 50 inches)

- Large Screen (Above 50 inches)

A detailed breakup and analysis of the market based on the screen size have also been provided in the report. This includes small screen (below 32 inches), medium screen (32 to 50 inches), and large screen (above 50 inches).

Features:

- High-Resolution Displays

- 4K

- 8K

- HDR (High Dynamic Range)

- Audio Enhancement

- Dolby Atmos

- DTS X

- Connectivity Options

- Bluetooth

- Wi-Fi

- HDMI

- Voice Control and AI Integration

The report has provided a detailed breakup and analysis of the market based on the features. This includes high-resolution displays (4K and 8K), HDR (high dynamic range), audio enhancement (Dolby Atmos and DTS X), connectivity options (Bluetooth, Wi-Fi, and HDMI), and voice control and AI integration.

End User Insights:

.webp)

- Entertainment Enthusiasts

- Budget-Conscious Consumers

- Tech Enthusiasts

- Gamers

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes entertainment enthusiasts, budget-conscious consumers, tech enthusiasts, and gamers.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Television Market News:

- In 2024, British sports streaming platform DAZN acquired Foxtel for approximately USD 2.25 billion (AU$ 3.4 billion). The deal is intended to broaden Foxtel’s access to global sports content and boost the international reach of Australian sports programming.

- In 2024, Screen Australia partnered with Los Angeles-based Dynamic Television to co-fund the development of up to four scripted TV projects. Each project is eligible for up to USD 66,000 (AU$ 100,000) in funding, with the goal of enhancing the international appeal and success of Australian television content.

Australia Television Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | LED/LCD TV, OLED TV, QLED TV, Smart TV |

| Screen Sizes Covered | Small Screen (Below 32 inches), Medium Screen (32 to 50 inches), Large Screen (Above 50 inches) |

| Features Covered |

|

| End Users Covered | Entertainment Enthusiasts, Budget-Conscious Consumers, Tech Enthusiasts, Gamers |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia television market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia television market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia television industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The television market in Australia was valued at USD 11.11 Billion in 2024.

The Australia television market is projected to exhibit a compound annual growth rate (CAGR) of 9.20% during 2025-2033.

The Australia television market is expected to reach a value of USD 26.79 Billion by 2033.

The Australia television market is evolving with trends such as rising adoption of smart TVs, integration of advanced display technologies like OLED and 8K, and increasing demand for gaming-optimized models. Consumers also favor sleek, energy-efficient designs and seamless connectivity with streaming services and smart home systems.

Market growth is driven by rising disposable incomes enabling premium purchases, expanding e-commerce channels improving product accessibility, and strong demand for large-screen models enhancing home entertainment. The surge in content consumption, government emphasis on energy efficiency, and growing influence of lifestyle upgrades are also fueling sustained adoption across consumer segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)