Australia Testing and Commissioning Market Size, Share, Trends and Forecast by Service Type, Commissioning Type, Sourcing Type, End Use Sector, and Region, 2025-2033

Australia Testing and Commissioning Market Overview:

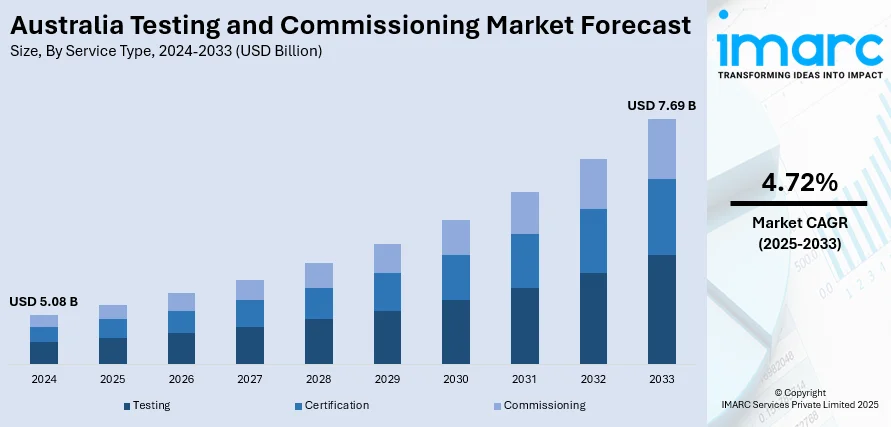

The Australia testing and commissioning market size reached USD 5.08 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.69 Billion by 2033, exhibiting a growth rate (CAGR) of 4.72% during 2025-2033. The Australia testing and commissioning market is driven by factors such as the transition to renewable energy, infrastructure development, regulatory compliance, and the adoption of advanced technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.08 Billion |

| Market Forecast in 2033 | USD 7.69 Billion |

| Market Growth Rate 2025-2033 | 4.72% |

Australia Testing and Commissioning Market Trends:

Infrastructure Modernization and Government Investment in Transport & Utilities

Among the key drivers for the testing and commissioning market in Australia is the nation's intensified infrastructure upgrading activities, particularly in the transport and utilities sectors. The federal and state governments are actively investing in constructing and modernizing railways, airports, roads, power grids, and water supplies in order to accommodate a rising urban population and make them sustainable. Projects such as the Inland Rail project, Sydney Metro, and large airport redevelopment are propelling the demand for intensive testing and commissioning services to ensure safety, compliance, and operational efficiency prior to public utilization. Testing and commissioning are essential on these projects to ensure that all parts—electrical, mechanical, and civil—function harmoniously and satisfy regulatory requirements. For instance, in intricate rail infrastructure, signal systems, track layout, and integration of rolling stock have to be thoroughly tested. Likewise, upgrading utilities with the installations of renewable energy or deploying smart grids requires extensive electrical and performance testing.

To get more information on this market, Request Sample

Surge in Renewable Energy Projects and Sustainability Mandates

Another driver of the Australian testing and commissioning market is the development of renewable energy projects due to climate objectives and sustainability requirements. With the rollout of solar, wind, hydro, and battery storage systems in Australia replacing fossil fuels, there is a pressing demand for advanced testing and commissioning to confirm performance, safety, and grid harmony. Renewable energy installations encompass cutting-edge technology and may operate in decentralized or hybrid modes of operation. For example, solar farms must pass through string-level testing, inverter calibration, load handling, and real-time monitoring before synchronization to the national grid. Wind turbines need dynamic balance testing, gearbox alignment, and control system verification. These technical tests require highly skilled commissioning teams and advanced test equipment, hence the huge demand across the industry. In addition to this, financial investors and energy regulators increasingly insist on validated T&C documentation as a prerequisite for approvals, investor confidence, and insurance. The incorporation of microgrids and battery energy storage systems (BESS) adds to the complexity of commissioning, necessitating real-time data gathering and power quality testing. As Australia strives for net-zero emissions and expands its renewable energy capacity, the requirement for testing and commissioning services takes center stage—not just for functional guarantees but also for environmental responsibility and system reliability.

Australia Testing and Commissioning Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on service type, commissioning type, sourcing type, and end use sector.

Service Type Insights:

- Testing

- Certification

- Commissioning

The report has provided a detailed breakup and analysis of the market based on the service type. This includes testing, certification, and commissioning.

Commissioning Type Insights:

- Initial Commissioning

- Retro Commissioning

- Monitor-Based Commissioning

A detailed breakup and analysis of the market based on the commissioning type have also been provided in the report. This includes initial commissioning, retro commissioning, and monitor-based commissioning.

Sourcing Type Insights:

- Inhouse

- Outsourced

The report has provided a detailed breakup and analysis of the market based on the sourcing type. This includes inhouse and outsourced.

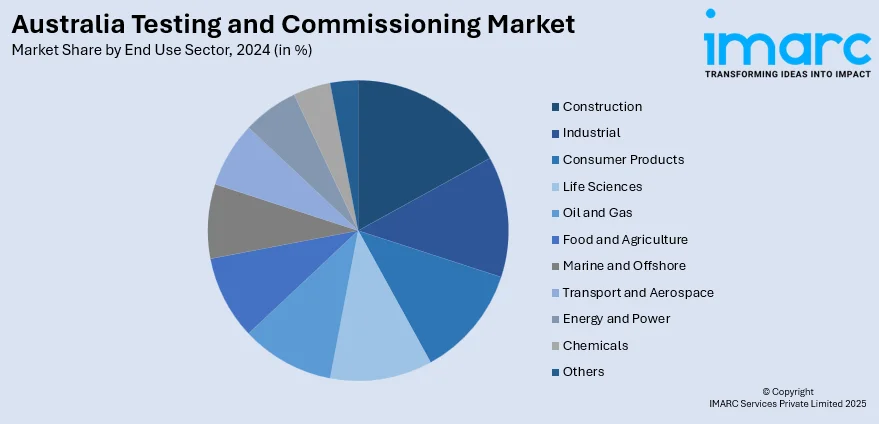

End Use Sector Insights:

- Construction

- Industrial

- Consumer Products

- Life Sciences

- Oil and Gas

- Food and Agriculture

- Marine and Offshore

- Transport and Aerospace

- Energy and Power

- Chemicals

- Others

A detailed breakup and analysis of the market based on the end use sector have also been provided in the report. This includes construction, industrial, consumer products, life sciences, oil and gas, food and agriculture, marine and offshore, transport and aerospace, energy and power, chemicals, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Testing and Commissioning Market News:

- October 2024: VH Global Sustainable Energy Opportunities (GSEO), in partnership with Birdwood Energy, completed the construction, testing, and commissioning of two hybrid solar and battery storage projects in New South Wales, Australia. Each site featured a 4.95 MW solar photovoltaic system co-located with a DC-coupled, two-hour 4.95 MW battery energy storage system (BESS).

- September 2024: Transport for NSW awarded an AUD 322 million contract to John Holland Pty Ltd for the initial enabling works of Parramatta Light Rail Stage 2. This phase included constructing the first 1.3 km of track and a 320-meter bridge over the Parramatta River, in addition to testing and commissioning activities.

- August 2024: Rohde & Schwarz Australia secured a contract to supply integrated communication and control systems for the Royal Australian Navy's first three Hunter-class frigates. The project involved the design, manufacture, integration, testing, and commissioning of the NAVICS system, which serves as the central communications infrastructure for the vessels.

Australia Testing and Commissioning Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Testing, Certification, Commissioning |

| Commissioning Types Covered | Initial Commissioning, Retro Commissioning, Monitor-Based Commissioning |

| Sourcing Types Covered | Inhouse, Outsourced |

| End Use Sectors Covered | Construction, Industrial, Consumer Products, Life Sciences, Oil and Gas, Food and Agriculture, Marine and Offshore, Transport and Aerospace, Energy and Power, Chemicals, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia testing and commissioning market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia testing and commissioning market on the basis of service type?

- What is the breakup of the Australia testing and commissioning market on the basis of commissioning type?

- What is the breakup of the Australia testing and commissioning market on the basis of sourcing type?

- What is the breakup of the Australia testing and commissioning market on the basis of end use sector?

- What are the various stages in the value chain of the Australia testing and commissioning market?

- What are the key driving factors and challenges in the Australia testing and commissioning market?

- What is the structure of the Australia testing and commissioning market and who are the key players?

- What is the degree of competition in the Australia testing and commissioning market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia testing and commissioning market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia testing and commissioning market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia testing and commissioning industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)