Australia Textile Chemicals Market Size, Share, Trends and Forecast by Fiber Type, Product Type, Application, and Region, 2025-2033

Australia Textile Chemicals Market Overview:

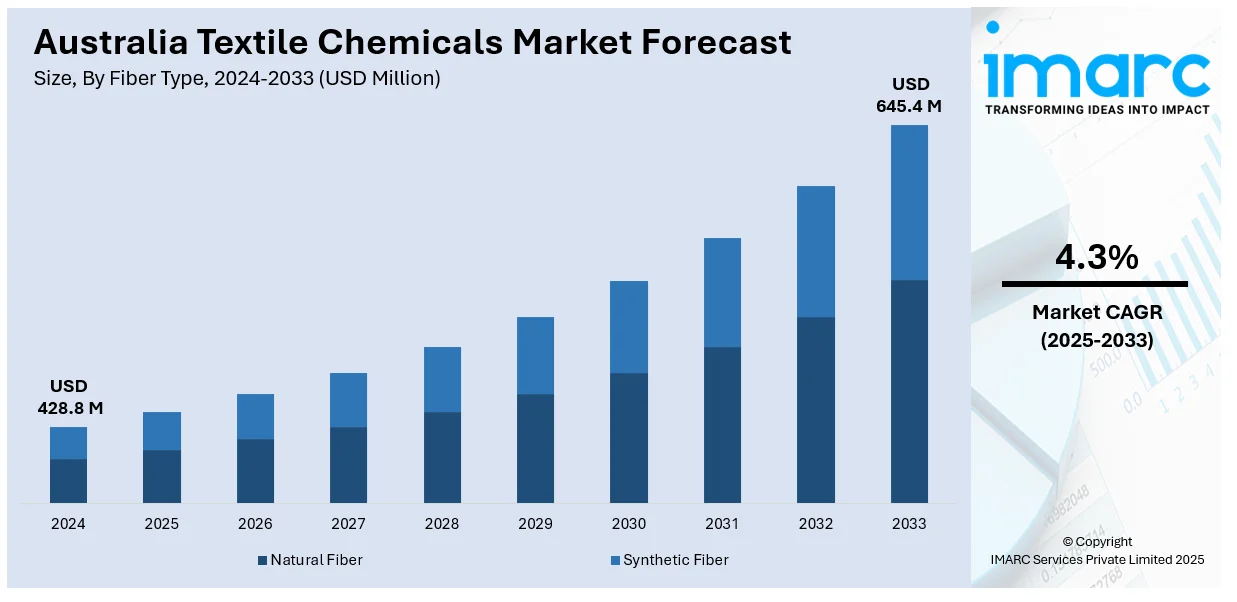

The Australia textile chemicals market size reached USD 428.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 645.4 Million by 2033, exhibiting a growth rate (CAGR) of 4.3% during 2025-2033. Increasing demand for functional finishes, growth in technical textiles, rising sustainability standards, surging eco-friendly dye adoption, healthcare textile innovation, development of water-repellent coatings, digital printing growth, and escalating smart textile applications are factors bolstering Australia textile chemicals market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 428.8 Million |

| Market Forecast in 2033 | USD 645.4 Million |

| Market Growth Rate 2025-2033 | 4.3% |

Australia Textile Chemicals Market Trends:

Demand for Performance-Enhancing Finishes

The Australia textile chemicals industry is experiencing strong growth driven by rising demand for performance-enhancing finishes across industries. Consumers increasingly look for textiles with higher-order functionalities such as water repellency, UV protection, antimicrobial character, and wrinkle resistance, especially in sportswear, healthcare, and outdoor clothing. This increased demand is fueling the uptake of high-performance textile finishing chemicals. Softening finishes, specifically, are becoming increasingly popular because of their effectiveness in improving fabric comfort, durability, and production energy efficiency. Additionally, Australia's strict environmental laws and green initiatives are pushing companies to create environmentally friendly and biodegradable chemical products. Advances in technology, such as the application of nanotechnology and microencapsulation, are further enhancing the performance of textile finishes, such as the provision of temperature control and improved durability. Consequently, the market is on the cusp of further growth, innovation and sustainability at the forefront of its development.

To get more information on this market, Request Sample

Growth in Technical Textiles

Australia is witnessing a steady expansion in the use of technical textiles across sectors such as medical, automotive, defense, and construction. This trend is directly influencing the demand for textile chemicals that can impart properties like flame resistance, ultraviolet (UV) protection, anti-static behavior, and enhanced tensile strength. Medical textiles, in particular, require specialized finishes such as anti-microbial coatings and fluid-repellent treatments, while construction and automotive applications demand high-performance reinforcements that withstand stress, heat, and abrasion. In line with this, government procurement for defense textiles and public infrastructure is also fueling the need for advanced chemical treatments to meet stringent safety and durability standards, which is providing a positive market outlook. The rise of eco-engineered buildings and smart textiles is further contributing to this demand, as manufacturers seek to incorporate energy-efficient and responsive materials.

Shift Toward Eco-Friendly Practices

Sustainability concerns are reshaping procurement decisions across Australia’s textile and apparel industry, leading to a pronounced shift toward environmentally responsible chemical solutions. Brands are actively seeking suppliers that can provide biodegradable auxiliaries, plant-derived softeners, and low-impact dyes, particularly as consumer awareness around textile pollution and water use grows. Retailers are also aligning with global frameworks such as the Zero Discharge of Hazardous Chemicals (ZDHC) program, which are prompting manufacturers to reformulate their finishing processes. The Australian government’s broader climate and environmental policies have further incentivized cleaner production technologies across the textile sector. This shift has triggered a notable increase in demand for low volatile organic compounds (VOC) binders, non-toxic fixatives, and water-saving dyeing chemicals. Textile chemical producers are leveraging this opportunity to reposition themselves as partners in sustainability, offering end-to-end support from chemical audits to process optimization, helping downstream players reduce emissions and wastewater load without compromising fabric quality.

Australia Textile Chemicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on fiber type, product type, and application.

Fiber Type Insights:

- Natural Fiber

- Synthetic Fiber

The report has provided a detailed breakup and analysis of the market based on the fiber type. This includes natural fiber and synthetic fiber.

Product Type Insights:

- Coating and Sizing Chemicals

- Finishing Agents

- Colorants and Auxiliaries

- Surfactants

- Desizing Agents

- Others

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes coating and sizing chemicals, finishing agents, colorants and auxiliaries, surfactants, desizing agents, and others.

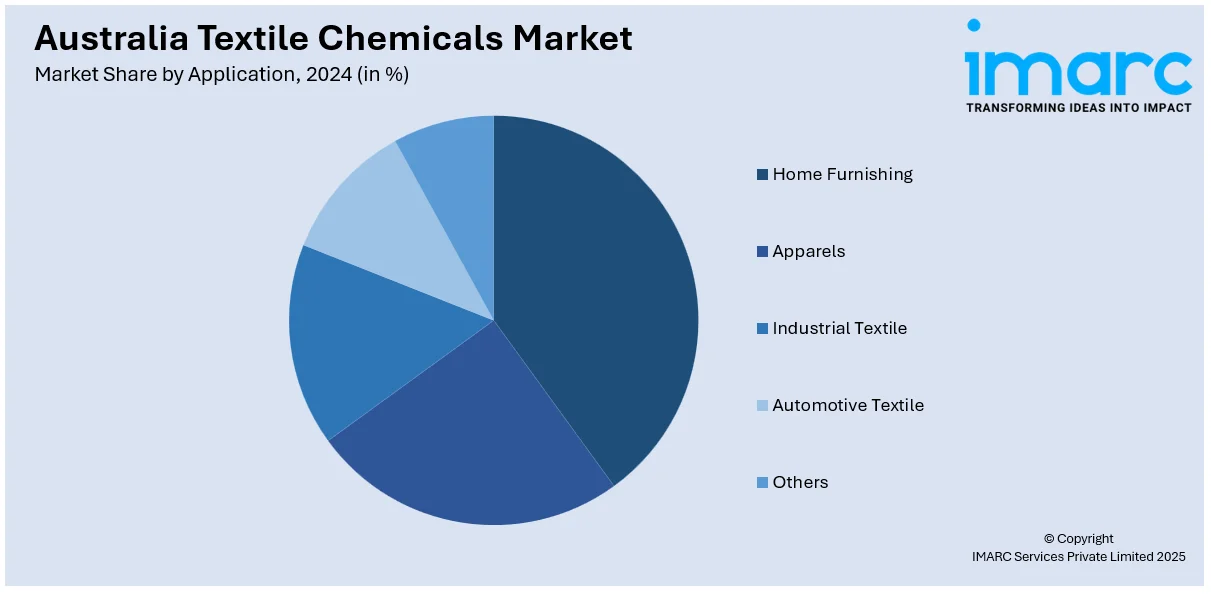

Application Insights:

- Home Furnishing

- Apparels

- Industrial Textile

- Automotive Textile

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes home furnishing, apparels, industrial textile, automotive textile, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Textile Chemicals Market News:

- In 2024, Xefco secured USD 6.8 million in funding to commercialize its patented waterless textile dyeing and finishing technology, Ausora. This innovation utilizes a unique shower plasma process, eliminating the need for water and significantly reducing energy and chemical consumption.

Australia Textile Chemicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fiber Types Covered | Natural Fiber, Synthetic Fiber |

| Product Types Covered | Coating and Sizing Chemicals, Finishing Agents, Colorants and Auxiliaries, Surfactants, Desizing Agents, Others |

| Applications Covered | Home Furnishing, Apparels, Industrial Textile, Automotive Textile, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia textile chemicals market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia textile chemicals market on the basis of fiber type?

- What is the breakup of the Australia textile chemicals market on the basis of product type?

- What is the breakup of the Australia textile chemicals market on the basis of application?

- What is the breakup of the Australia textile chemicals market on the basis of region?

- What are the various stages in the value chain of the Australia textile chemicals market?

- What are the key driving factors and challenges in the Australia textile chemicals market?

- What is the structure of the Australia textile chemicals market and who are the key players?

- What is the degree of competition in the Australia textile chemicals market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia textile chemicals market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia textile chemicals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia textile chemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)