Australia Toluene Market Size, Share, Trends and Forecast by Technology, Application, and Region, 2025-2033

Australia Toluene Market Overview:

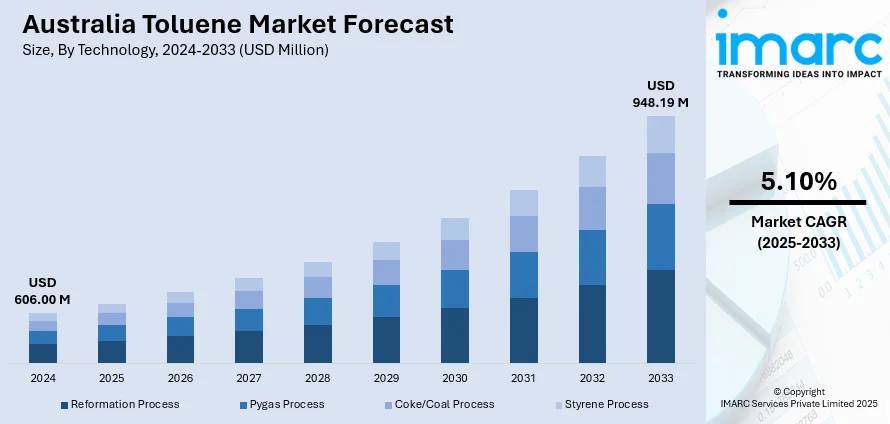

The Australia toluene market size reached USD 606.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 948.19 Million by 2033, exhibiting a growth rate (CAGR) of 5.10% during 2025-2033. The growing demand for toluene in the automotive, paint, and coatings industries is a major driver for market expansion, as it is widely used as a solvent in these sectors. In addition to this, the expansion of industrial activities, increased production of petrochemicals, and rising consumer demand for products such as adhesives and coatings are some of the major factors augmenting Australia toluene market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 606.00 Million |

| Market Forecast in 2033 | USD 948.19 Million |

| Market Growth Rate 2025-2033 | 5.10% |

Australia Toluene Market Trends:

Expansion in the Paint and Coatings Industry

The industry is witnessing significant growth due to the growing demand in the paint and coatings sector. Toluene, with its superb solvent characteristics, is extensively applied in the manufacture of paints, varnishes, and coatings. The Australia toluene market growth is largely influenced by the increasing demand for protective and decorative coatings in construction activities for residential and commercial buildings. With the Australian construction industry growing, there is a greater demand for toluene products, which are used to make paints, coatings, and finishes. A recent industry report states that in seasonally adjusted terms, the total construction work done increased by 0.5% to $73,936.9 Million during the December quarter. This growth in construction spending reflects a broader trend of toluene market expansion, with toluene serving a key function in fulfilling the growing demand for high-performance coatings. The automotive industry, with application to vehicle refinishing and repair, is also driving the need for coatings based on toluene. The trend is also supported by ongoing developments in product formulations enhancing the efficiency and environmental footprint of toluene as a solvent, with greener alternatives coming upstream to minimize volatility and enhance overall coating sustainability. This is likely to continue fueling demand for toluene in Australia.

To get more information on this market, Request Sample

Rising Demand from the Adhesives Industry

The adhesives sector is expanding in Australia, thus fueling the toluene requirement. Toluene is an essential solvent in the manufacture of industrial adhesives, construction adhesives, packaging, and automotive adhesives. The strong building industry, in which the increased demand for adhesives that are strong bonding agents for building material, flooring, and insulation systems is propelling the demand for adhesives. As per industry reports, Australia's automotive industry is projected to grow to 2.50 Million Units by 2033, with a CAGR of 7.60% from 2025-2033. The expansion of the automotive industry also contributes significantly to the toluene requirement, where adhesives play pivotal roles in their manufacturing processes, such as assembling vehicles and electronic equipment. While manufacturers seek to develop longer-lasting, tougher, and greener adhesive products, toluene continues to be a basic solvent as it can dissolve resin and other chemical compounds, producing high adhesive quality and strength. The trend is further propelled by an increase in consumers purchasing products requiring adhesives, such as furniture, electronic goods, and consumer products, causing steady increases in the demand for toluene.

Australia Toluene Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on technology and application.

Technology Insights:

- Reformation Process

- Pygas Process

- Coke/Coal Process

- Styrene Process

The report has provided a detailed breakup and analysis of the market based on the technology. This includes reformation process, pygas process, coke/coal process, and styrene process.

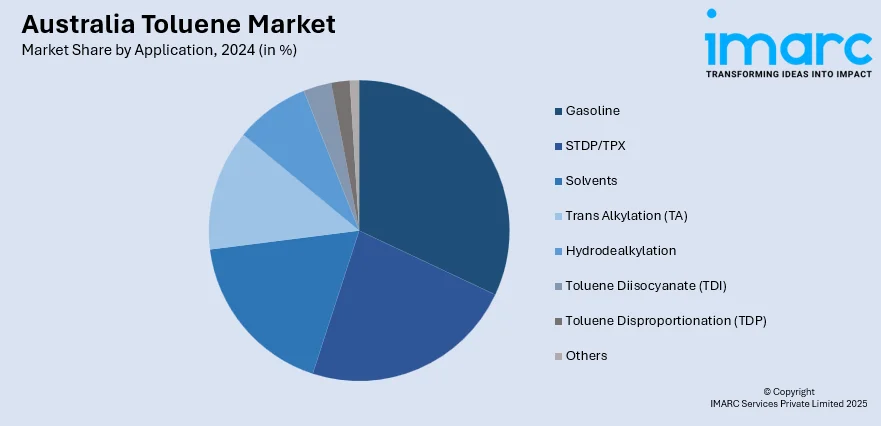

Application Insights:

- Gasoline

- STDP/TPX

- Solvents

- Trans Alkylation (TA)

- Hydrodealkylation

- Toluene Diisocyanate (TDI)

- Toluene Disproportionation (TDP)

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes gasoline, STDP/TPX, solvents, trans alkylation (TA), hydrodealkylation, toluene diisocyanate (TDI), toluene disproportionation (TDP), and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Toluene Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Reformation Process, Pygas Process, Coke/Coal Process, Styrene Process |

| Applications Covered | Gasoline, STDP/TPX, Solvents, Trans Alkylation (TA), Hydrodealkylation, Toluene Diisocyanate (TDI), Toluene Disproportionation (TDP), Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia toluene market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia toluene market on the basis of technology?

- What is the breakup of the Australia toluene market on the basis of application?

- What is the breakup of the Australia toluene market on the basis of region?

- What are the various stages in the value chain of the Australia toluene market?

- What are the key driving factors and challenges in the Australia toluene market?

- What is the structure of the Australia toluene market and who are the key players?

- What is the degree of competition in the Australia toluene market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia toluene market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia toluene market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia toluene industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)