Australia Tooling Market Size, Share, Trends and Forecast by Product Type, Material Type, End Use Industry, and Region, 2025-2033

Australia Tooling Market Overview:

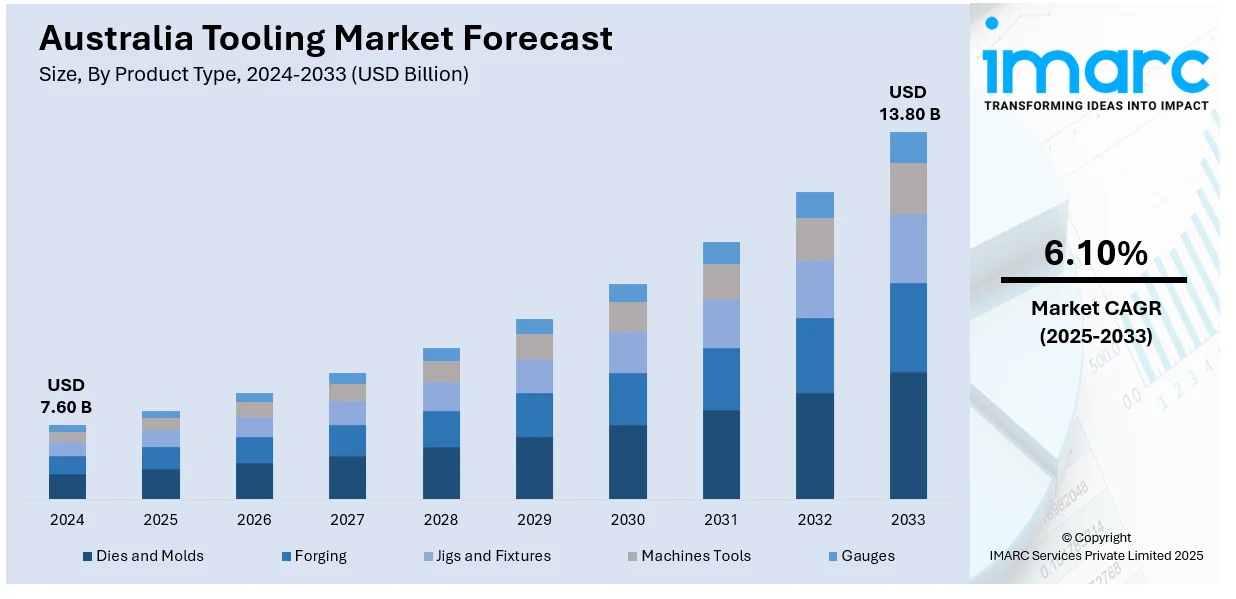

The Australia tooling market size reached USD 7.60 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 13.80 Billion by 2033, exhibiting a growth rate (CAGR) of 6.10% during 2025-2033. The Australia tooling market is being driven by the elevating demand from advanced manufacturing sectors, such as aerospace and automotive, rapid infrastructure development, rising adoption of automation and precision engineering, government support for industrial innovation, and the growing need for high-performance tools to support modular construction and energy-efficient building practices across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7.60 Billion |

| Market Forecast in 2033 | USD 13.80 Billion |

| Market Growth Rate 2025-2033 | 6.10% |

Australia Tooling Market Trends:

Expanding Automotive and Aerospace Sectors

Expansion in Australia's automotive and aerospace sectors is one of the strongest market drivers. Australia has reshaped itself into an important market for high-performance parts, aftermarkets, and precision engineering. Top tooling companies in Australia are providing state-of-the-art tooling systems like jigs, dies, molds, and fixtures to suit changing demands by manufacturers to manufacture lightweight components and high-precision parts. In the aerospace sector, industries are investing in innovative technologies, such as additive manufacturing and composite materials, in order to remain competitive. These new technologies demand special tooling solutions that can achieve complex geometry and high-tolerance requirements. Therefore, the demand for tailor-made tooling and prototyping services is surging due to the necessity for quicker lead times, better accuracy, and more robust tools. Additionally, Australia's integration into the supply chains in international aerospace sectors—for instance, in turbine elements and structural pieces—has lifted standards of tooling quality as well as inventiveness. Firms have started to favor CNC machines, automation-based test solutions, as well as design tools based on simulations, and these need products made of first-grade tooling goods. Thus, the maturity of this sector with government funds and industry RD&D directly addresses the need for leading-edge tools solutions.

To get more information on this market, Request Sample

Infrastructure Development and Construction Boom

Australia's tooling industry is also being driven by the nation's thriving construction and infrastructure industries, which demand a wide range of tools for utilization in operations varying from excavation to finishing. The government's emphasis on infrastructure spending—be it in the form of large highway improvements, public transportation projects, and smart city initiatives—has resulted in a consistent flow of demand for construction-grade tooling, such as cutting tools, hand tools, power tools, and heavy equipment accessories. This development is especially strong in metropolitan cities such as Sydney, Melbourne, and Brisbane, where massive projects are in the pipeline. Structural construction, as well as electrical, plumbing, and interior fitting needs, must be addressed with tooling solutions. Also, the trend toward energy-efficient buildings and green building techniques has necessitated the adoption of specialized tools that support the use of sustainable materials and green building methods. Another strand to this movement is the mounting application of prefabrication and modular construction techniques in Australia. Both processes require highly exact and long-lasting tooling systems to guarantee accuracy in off-site production zones. With construction businesses focused on cost-cutting and minimizing project duration, there is more dependence on groundbreaking, extended-life tools that enhance productivity, safety, and accuracy.

Australia Tooling Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, material type, and end use industry.

Product Type Insights:

- Dies and Molds

- Forging

- Jigs and Fixtures

- Machines Tools

- Gauges

The report has provided a detailed breakup and analysis of the market based on the product type. This includes dies and molds, forging, jigs and fixtures, machines tools, and gauges.

Material Type Insights:

- Stainless Steel

- Iron

- Aluminum

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes stainless steel, iron, aluminum, and others.

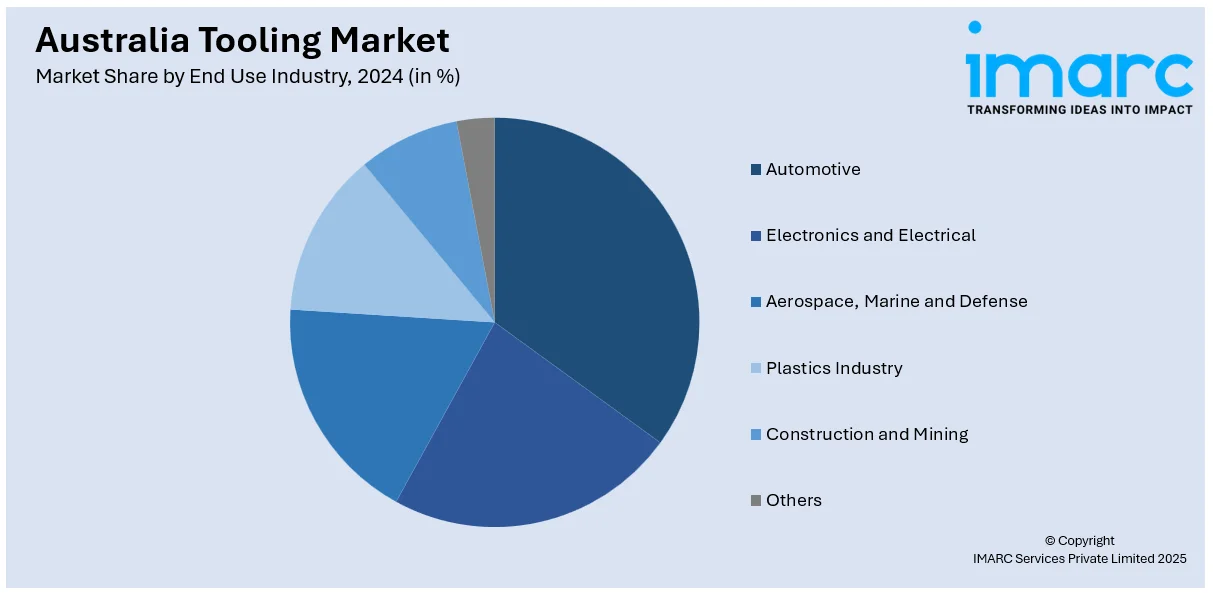

End Use Industry Insights:

- Automotive

- Electronics and Electrical

- Aerospace, Marine and Defense

- Plastics Industry

- Construction and Mining

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes automotive, electronics and electrical, aerospace, marine and defense, plastics industry, construction and mining, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Tooling Market News:

- April 2025: Australia's defense industry announced that it had secured over USD 5 billion in contracts for the F-35 Joint Strike Fighter program. Over 75 companies were reportedly involved in providing essential tooling, sustainment services, and cutting-edge technologies, contributing to the development and maintenance of the F-35 fleet.

- February 2025: Stealth Global Holdings secured exclusive distribution rights for CAT Power Tools, Wesco Power Tools, and Harden Tools in Australia and New Zealand. These agreements—three years for CAT and five years for Wesco and Harden—granted Stealth sole access to sell these brands across all market channels, including retail stores, resellers, B2B sales, and online platforms.

Australia Tooling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Dies and Molds, Forging, Jigs and Fixtures, Machines Tools, Gauges |

| Material Types Covered | Stainless Steel, Iron, Aluminum, Others |

| End Use Industries Covered | Automotive, Electronics and Electrical, Aerospace, Marine and Defense, Plastics Industry, Construction and Mining, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia tooling market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia tooling market on the basis of product type?

- What is the breakup of the Australia tooling market on the basis of material type?

- What is the breakup of the Australia tooling market on the basis of end use industry?

- What are the various stages in the value chain of the Australia tooling market?

- What are the key driving factors and challenges in the Australia tooling market?

- What is the structure of the Australia tooling market and who are the key players?

- What is the degree of competition in the Australia tooling market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia tooling market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia tooling market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia tooling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)