Australia Tourism Market Report by Travel Purpose (Leisure Tourism, Business Tourism, Medical Tourism, Cultural and Heritage Tourism, and Others), Travel Type (Solo, Group), Tourism Type (Domestic Tourism, International Tourism), Mode of Booking (OTA Platform, Direct Booking), Age Group (Below 30 Years, 30 to 41 Years, 42 to 49 Years, 50 Years and Above), and Region 2025-2033

Australia Tourism Market Size and Share:

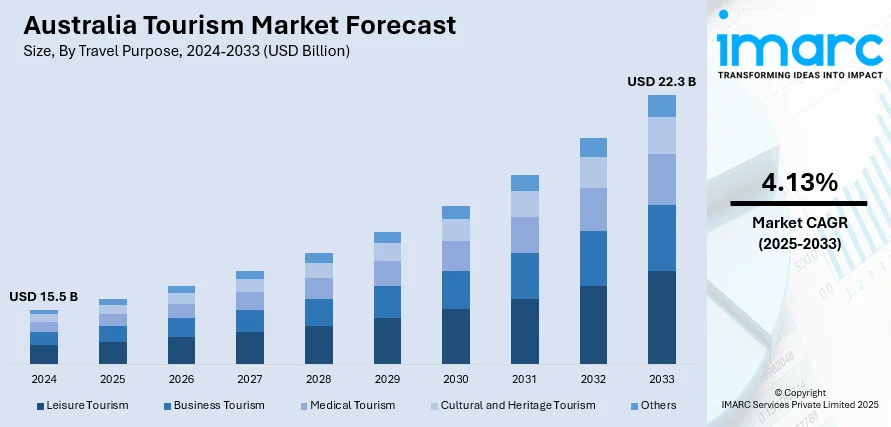

The Australia tourism market size reached USD 15.5 Billion in 2024. Looking forward, the market is expected to reach USD 22.3 Billion by 2033, exhibiting a growth rate (CAGR) of 4.13% during 2025-2033. There are various factors that are driving the market, which include natural attractions, rising focus on sustainable experience, favorable government initiatives, and increasing utilization of digital marketing and social media to attract potential tourists.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 22.3 Billion |

| Market Growth Rate 2025-2033 | 4.13% |

Key Trends of Australia Tourism Market:

Natural Attractions

Tourism Australia states that in June 2024, there were approximately 660,330 visitor arrivals. Australia's natural beauty, cultural landmarks, and pleasant climate are drawing more and more tourists. Its natural attractions are a major source of foreign visitor traffic. Uluru holds great significance for the Anangu Indigenous people. Its spiritual and cultural significance, together with the legends and customs surrounding it, frequently captivate visitors. Additionally, the massive sandstone monolith’s changing colors, particularly at sunrise and sunset, provide breathtaking views that appeal to photographers and nature enthusiasts. Besides this, Australia’s national parks feature a wide range of ecosystems, ranging from tropical rainforests and arid deserts to temperate forests and alpine regions. They offer a unique flora and fauna that appeal to nature lovers and researchers. Australia is also known for its iconic views including the Sydney Opera House and Sydney Harbour Bridge.

To get more information of this market, Request Sample

Rising Focus on Sustainable Experience

On 6 September 2024, Accor accomplished a significant step forward in its sustainability journey with the Sustainable Tourism Certification of its 100th hotel in Australia by Ecotourism Australia. There is a wide availability of eco-friendly hotels, lodges, and resorts that are certified for their sustainability practices in Australia. These accommodations frequently recycle their waste, employ renewable energy, and prioritize water conservation. In natural destinations like the Great Barrier Reef and tropical rainforests, eco-resorts are designed to minimize environmental impact while offering unique experiences. Sustainable building materials and procedures are frequently utilized by these resorts, which prioritize harmony with the natural world. Travelers are becoming more conscious of their travel choices and choosing travel destinations and services that align with their values. Besides this, tour operators are adopting practices that reduce their environmental footprint such as using electric or hybrid vehicles, minimizing waste, and supporting local communities. Furthermore, governing agencies in Australia are promoting sustainability through various initiatives and standards. This includes supporting certifications like EarthCheck and Green Globe, which help businesses and destinations meet sustainability criteria.

Growth Drivers of Australia Tourism Market:

Strategic Government Support and Funding

Government initiatives have played a pivotal role in propelling Australia’s tourism sector. Programs like Tourism Australia's “Come and Say G’day” campaign and regional development grants aim to attract both international and domestic travelers. Financial incentives for tourism infrastructure, upgrades to airports and transport, and public-private partnerships have also encouraged investment in new attractions and accommodations. Furthermore, streamlined visa policies and international marketing efforts are strengthening Australia’s global brand as a travel destination. Post-pandemic recovery plans have specifically targeted tourism as a key economic lever, with regional dispersal strategies boosting visitation beyond major cities. This policy-driven backing offers long-term stability and scalability for the sector, helping attract high-yield tourists and diversify the nation’s tourism offerings across both coastal and inland areas.

Diverse Cultural and Indigenous Experiences

Australia’s rich multicultural heritage and Indigenous history are major tourism draws, offering immersive, authentic experiences that appeal to global travelers seeking meaningful cultural engagement. Initiatives promoting Aboriginal-guided tours, native storytelling, art trails, and bush food experiences have gained prominence. Additionally, the rise of interest in historical landmarks, colonial heritage towns, and migrant community festivals has expanded Australia’s cultural tourism landscape. Cities like Melbourne and Sydney are capitalizing on this diversity through curated neighborhood tours, food festivals, and arts precincts, which boosts the Australia tourism market demand. The government and private sector are increasingly integrating cultural narratives into tourism experiences, giving travelers a deeper understanding of the country’s social fabric. This cultural depth enhances Australia’s global appeal and broadens the market base across age groups and nationalities.

Expansion of Events and Sports Tourism

Events and sports tourism is a major driver of Australia’s tourism growth, supported by the country’s world-class infrastructure and global reputation for hosting large-scale events. Major sporting tournaments like the Australian Open, Formula 1 Grand Prix, and upcoming 2032 Brisbane Olympics attract international visitors and boost local economies. Music festivals, arts exhibitions, food and wine expos, and business conferences further fuel demand across both peak and shoulder seasons. These events not only stimulate short-term hotel, transport, and hospitality revenues but also contribute to long-term brand equity and repeat visitation. Government and city councils are increasingly bidding for international events to promote tourism dispersal and revitalize urban areas. This segment plays a critical role in sustaining year-round travel demand and cross-sector economic benefits.

Opportunities of Australia Tourism Market:

Growth in Medical and Wellness Tourism

Australia’s high-quality healthcare system, combined with its reputation for safety and cleanliness, offers a significant opportunity to develop medical and wellness tourism. With global travelers increasingly seeking destinations for elective surgeries, rehabilitation, and holistic wellness retreats, Australia is well-positioned to tap into this demand. Cities like Sydney, Melbourne, and Brisbane are home to world-class medical facilities that can attract international patients, especially from Asia-Pacific countries. In parallel, wellness resorts offering mental health, detox, and spa experiences in natural settings such as the Blue Mountains or Byron Bay are gaining traction. By promoting bundled medical and wellness travel packages, Australia can diversify its tourism offerings while catering to an aging global population and health-conscious travelers seeking trustworthy, regulated care abroad.

Digital Transformation and Smart Tourism

The rise of digital platforms presents vast opportunities to reshape the Australia tourism market share. Virtual reality previews, AI-driven itinerary planning, and contactless payment systems are enhancing convenience and personalization. Smart tourism applications—such as real-time crowd management, interactive city guides, and multilingual translation tools—are improving visitor engagement and satisfaction. For operators, digital adoption enables better data analytics, targeted marketing, and streamlined operations. With Australia’s strong ICT infrastructure and high smartphone penetration, the country can lead in implementing tech-driven travel experiences across both urban centers and remote areas. Embracing digital innovation will not only attract tech-savvy travelers but also increase the competitiveness of Australian tourism in the global market, particularly among millennials and Gen Z tourists who seek seamless, tech-enabled journeys.

Agritourism and Culinary Travel Expansion

Australia’s rich agricultural landscape and diverse culinary culture offer untapped potential in agritourism. Travelers are increasingly seeking farm-to-table experiences, winery tours, and rural homestays that showcase local produce and food traditions. Regions like Margaret River, Barossa Valley, and Tasmania are becoming hubs for culinary tourism, offering hands-on experiences such as grape harvesting, cheese-making, and seafood foraging. This trend supports rural economies, encourages sustainable travel, and highlights Australia’s agricultural innovation. Additionally, multicultural food scenes in urban areas present opportunities for food tours, cooking classes, and heritage dining experiences. As global interest in authentic, locally sourced cuisine grows, Australia can position itself as a premium culinary destination, combining scenic rural charm with gourmet experiences tailored to both domestic and international travelers.

Government Support of Australia Tourism Market:

Strategic Marketing and Global Promotion Initiatives

The Australian government actively supports the tourism sector through its national marketing body, Tourism Australia. This agency is crucial in promoting Australia as a premier leisure and business travel destination globally. Initiatives include multi-channel marketing campaigns like "Come and Say G'day," which target key international markets and leverage storytelling, social media, and influencer partnerships to highlight Australia's unique experiences. Significant funding is allocated to these campaigns, aiming to restore and surpass pre-pandemic visitor expenditure levels. This strategic promotion helps to counter global competition and maintain Australia's brand appeal, ensuring a consistent influx of international visitors and supporting the industry's long-term growth and recovery.

Investment in Resilient Infrastructure and Recovery Programs

Recognizing the impact of natural disasters, the Australian government provides targeted funding for tourism infrastructure development and recovery. Programs such as the "Building Resilient Tourism Infrastructure Fund" offer grants to businesses in disaster-affected regions, enabling them to strengthen facilities against future events like floods and bushfires. These investments focus on innovative engineering solutions, alternative power sources, and essential upgrades to ensure the longevity and sustainability of tourism assets. Beyond disaster recovery, broader packages like the "Tourism and Travel Support Package" fund initiatives for infrastructure improvements, aiming to enhance the overall visitor experience and build a more robust, future-proof tourism sector across the country.

Workforce Development and Business Capability Building

The government is committed to strengthening the tourism workforce and enhancing business capabilities through various support programs. Initiatives like "The Hub" platform (Hospitality, Tourism and Travel Employment and Skills Platform Grant Program) receive funding to provide online training and upskilling for hospitality workers, addressing labor shortages and improving service quality. Furthermore, programs like the "Quality Tourism Framework Grant Program" support small and medium tourism businesses in improving industry standards, product development, and digital distribution. These efforts ensure businesses are better equipped to meet evolving market demands, enhance the visitor experience, and remain competitive, contributing to a more professional and sustainable tourism industry.

Challenges of Australia Tourism Market:

High Travel and Living Costs for Tourists

Australia is often perceived as a high-cost destination, which can deter budget-conscious travelers, especially from emerging markets. Airfares, accommodation, dining, and internal transport are generally more expensive compared to competing destinations in Asia and parts of Europe. The strength of the Australian dollar also affects inbound tourism, particularly when exchange rates make travel less affordable. Additionally, peak-season surcharges and limited low-cost internal travel options further strain visitor budgets. This pricing pressure reduces Australia’s appeal among backpackers, students, and long-stay travelers. To remain competitive, the tourism industry must explore flexible pricing models, promote off-peak travel, and develop cost-effective packages without compromising on experience quality. Addressing cost-related concerns is essential to attracting a broader range of global visitors in a competitive international market.

Seasonal Tourism Dependency

Many of Australia’s top tourist destinations—such as the Great Barrier Reef, Whitsundays, and ski resorts—are highly seasonal, leading to fluctuating visitor numbers throughout the year. According to the Australia tourism market analysis, these seasonal peaks put pressure on infrastructure, workforce availability, and service quality during high-demand months, while off-peak periods bring underutilized resources and reduced income for local businesses. Seasonal volatility also affects staff retention, with tourism operators struggling to maintain year-round employment for skilled workers. Weather-dependent experiences, like beach activities and wildlife tours, further restrict travel windows. This irregularity makes business planning and revenue forecasting difficult for operators. To mitigate the risks, the tourism industry must develop off-season attractions, promote diverse experiences year-round, and support policies that help smooth tourism flows across different regions and seasons.

Environmental Risks and Climate Vulnerability

Australia’s tourism market faces growing threats from climate change and environmental degradation. Frequent bushfires, floods, coral bleaching, and extreme weather events have already impacted key tourist destinations like the Great Barrier Reef and national parks. These events not only disrupt travel plans but also damage the natural attractions that form the foundation of Australia's tourism appeal. Rising temperatures and sea levels could further affect coastal infrastructure, wildlife habitats, and outdoor recreation. Negative media coverage of environmental crises may deter international visitors and reduce trust in destination stability. While sustainability efforts are underway, long-term adaptation strategies and disaster resilience planning remain inconsistent. Proactively addressing climate-related risks is essential for safeguarding the future of Australia’s tourism sector and maintaining global traveler confidence.

Australia Tourism Market News:

- 14 May 2024: Qantas, an Australian airline, will increase the frequency of flights on the Bengaluru-Sydney route from mid-December. The airline will increase the frequency from five flights a week to one every day between the two cities.

- 21 November 2023: Virgin Australia planned to enhance tourism in Uluru as it announced two new direct services from Melbourne and Brisbane that will be introduced next year. Launched in partnership with the Northern Territory Government and Voyages Indigenous Tourism Australia, the new services will have more than 62,000 seats per year to the Red Centre, connecting tourists directly to the spiritual heartland of Australia while providing more choice and value to travelers.

Australia Tourism Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on travel purpose, travel type, tourism type, mode of booking, and age group.

Travel Purpose Insights:

- Leisure Tourism

- Business Tourism

- Medical Tourism

- Cultural and Heritage Tourism

- Others

The report has provided a detailed breakup and analysis of the market based on the travel purpose. This includes leisure tourism, business tourism, medical tourism, cultural and heritage tourism and others.

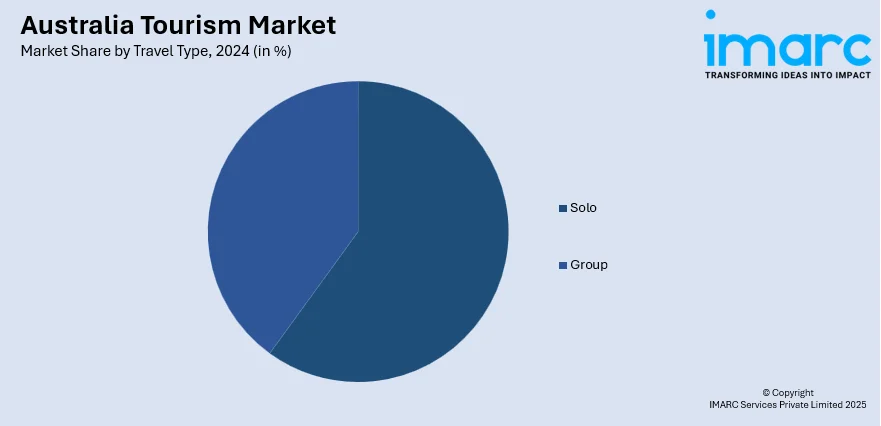

Travel Type Insights:

- Solo

- Group

A detailed breakup and analysis of the market based on the travel type have also been provided in the report. This includes solo, and group.

Tourism Type Insights:

- Domestic Tourism

- International Tourism

The report has provided a detailed breakup and analysis of the market based on the tourism type. This includes domestic tourism and international tourism.

Mode of Booking Insights:

- OTA Platform

- Direct Booking

A detailed breakup and analysis of the market based on the mode of booking have also been provided in the report. This includes OTA platform, and direct booking.

Age Group Insights:

- Below 30 Years

- 30 to 41 Years

- 42 to 49 Years

- 50 Years and Above

The report has provided a detailed breakup and analysis of the market based on the age group. This includes below 30 years, 30 to 41 years, 42 to 49 years, and 50 years and above.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Tourism Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Travel Purposes Covered | Leisure Tourism, Business Tourism, Medical Tourism, Cultural and Heritage Tourism, Others |

| Travel Types Covered | Solo, Group |

| Tourism Types Covered | Domestic Tourism, International Tourism |

| Mode of Bookings Covered | OTA Platform, Direct Booking |

| Age Groups Covered | Below 30 Years, 30 to 41 Years, 42 to 49 Years, 50 Years and Above |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia tourism market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia tourism market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia tourism industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The tourism market in Australia was valued at USD 15.5 Billion in 2024.

The Australia tourism market is projected to exhibit a CAGR of 4.13% during 2025-2033.

The Australia tourism market is projected to reach a value of USD 22.3 Billion by 2033.

Australia’s tourism market is being reshaped by regenerative eco-travel, wellness and adventure tourism, and Indigenous and regional cultural experiences, with digital and culinary tourism also rising, while shorter, frequent trips and sports/astro-tourism diversify demand.

Australia’s tourism market is driven by strong international arrivals, government promotional campaigns, and major event hosting. Expanding air connectivity, visa facilitation, and investment in tourism infrastructure also support growth, especially across urban hubs and coastal destinations targeting high-value travelers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)