Australia Toys and Games Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Australia Toys and Games Market Size and Share:

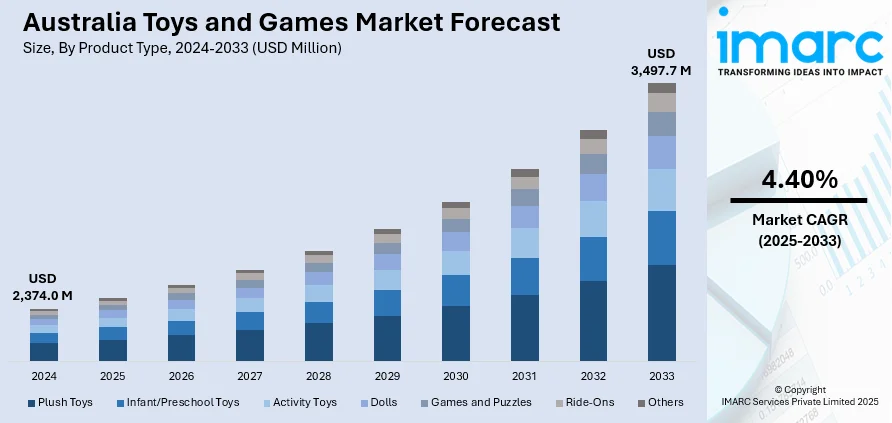

The Australia toys and games market size reached USD 2,374.0 Million in 2024. Looking forward, the market is expected to reach USD 3,497.7 Million by 2033, exhibiting a growth rate (CAGR) of 4.40% during 2025-2033. Rising disposable incomes, strong e-commerce presence, growing demand for science, technology, engineering, and mathematics (STEM) based products, licensed merchandise popularity, eco-conscious consumer preferences, surging influencer-led trends, and seasonal gifting peaks are some of the key factors boosting the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,374.0 Million |

| Market Forecast in 2033 | USD 3,497.7 Million |

| Market Growth Rate 2025-2033 | 4.40% |

Key Trends of Australia Toys and Games Market:

Rising Disposable Incomes and Premium Toy Demand

Consumer purchasing pattern is heavily majorly impacted by the increase in disposable income. For instance, in Q4 2024, the disposable income in Australia reached USD 261.9 billion, compared to 258.2 billion US dollars in the preceding quarter. This was about a 1.4% increase over last quarter. Consequently, parents are more willing to invest in value-oriented and expensive products that offer higher-quality, better-designed, are safer and more educational and developmental. This trend is particularly pronounced in urban regions, where dual-earning households have commonly been observed. The product sales in this category are buoyed by the willingness to pay for toys that have longer shelf-life, multifunctional use or fit with aspirational parenting goals. Moreover, the rising disposable income is enabling users to buy gifts on occasions other than birthdays and festivals, which is another factor providing a positive Australia toys and games market outlook.

To get more information of this market, Request Sample

E-Commerce Expansion and Product Accessibility

Growing penetration of e-commerce platforms is a significant factor driving the market growth in Australia. Online shopping provides consumers with more convenience to shop around a wide variety of local and international brands, often provided with competitive prices, discount combos, and in-depth product comparisons. Retail platforms like Amazon Australia, Kogan, and The Iconic, as well as specialists in toys such as Toymate and Mr Toys Toyworld, are optimizing user experience by offering easy navigation, solid return policies, and targeted marketing. Moreover, eCommerce also provides easier access to niche or specialty products that are not stocked in a physical store, enabling smaller or emerging brands to access a wider market. Furthermore, real-time consumer reviews and influencer endorsements being incorporated in online listings are boosting customer confidence and aiding in swift purchases, which is another factor supporting the Australia toys and games market growth.

Rising Popularity of STEM and Educational Toys

STEM and educational toys are gaining substantial traction in the Australia market, driven by growing awareness among parents regarding the importance of early cognitive development and future skill readiness. Educational institutions and parenting communities are increasingly emphasizing hands-on learning, problem-solving, and logic-based play, features embedded within most STEM-focused toy offerings. These products range from basic building kits and coding games to robotics sets and science experiment boxes, catering to various age groups. The Australian government’s continued investment in digital literacy and STEM education further reinforces consumer preference for such toys. Retailers are responding by expanding shelf space and online visibility for STEM categories, while manufacturers are enhancing product design to include modularity, adaptability, and curriculum alignment. Apart from this, the rising acceptance of these toys as tools for both entertainment and foundational learning is reshaping consumer expectations, elevating educational value as a primary purchase consideration, which is boosting the Australia toys and games market share.

Growth Drivers of Australia Toys and Games Market:

Increasing Influence of Licensed and Franchise-Based Toys

Licensed toys based on blockbuster films, popular TV shows, and trending video games are playing a major role in driving toy sales across Australia. These products resonate strongly with children, who often seek out characters they recognize and admire from entertainment media. Licensed merchandise creates strong emotional connections and brand loyalty, encouraging repeat purchases and collection building. Moreover, manufacturers often align product launches with major film or game releases, boosting seasonal and promotional sales. Limited-edition and exclusive lines tied to global media events generate excitement among consumers, including adult collectors. The ongoing success of franchises like Marvel, Star Wars, and gaming brands continues to shape consumer preferences, making character-driven toys a consistent growth driver within the market.

Parental Preference for Developmental Play

Modern parenting in Australia is increasingly focused on choosing toys that offer educational and developmental value, which is further boosting the Australia toys and games market demand. Parents are actively seeking playthings that support creativity, cognitive skills, fine motor development, and social interaction. This preference has boosted demand for puzzles, construction sets, science kits, and board games that encourage active engagement and learning. As screen time becomes a growing concern, toys that combine fun with educational purpose are gaining greater appeal among health- and development-conscious families. Moreover, educators and early childhood experts often endorse these products, further validating their importance in childhood development. As a result, toy brands that focus on developmental benefits are experiencing increased consumer trust and loyalty, making this a strong and sustained growth driver in the Australian toy market.

Seasonal and Cultural Gift-Giving Traditions

Australia’s vibrant calendar of holidays, birthdays, and cultural celebrations plays a significant role in driving toy sales. Events like Christmas, Easter, and school milestones create key purchasing moments where consumers actively seek gifts for children. These occasions fuel short-term demand spikes and encourage bulk buying, especially of themed or limited-edition toys. In addition to mainstream holidays, multicultural events and school-related rewards also contribute to year-round gifting. Toy companies frequently align their marketing and product launches with these events, offering special packaging, exclusive items, or promotional deals to boost appeal. The emotional aspect of gifting further strengthens consumer willingness to spend on toys, reinforcing its value in both family bonding and celebration. These cyclical patterns ensure consistent revenue flow for manufacturers and retailers alike.

Opportunities in Australia Toys and Games Market:

Eco-Friendly and Sustainable Toy Innovation

As sustainability becomes a central concern among Australian consumers, toy manufacturers have a significant opportunity to innovate with eco-conscious product lines. Parents are increasingly opting for toys that reflect environmentally responsible values, favoring options made from recycled plastics, biodegradable materials, and sustainably sourced wood or fabric. Brands that incorporate minimal or recyclable packaging also gain consumer favor. This shift is not only driven by environmental awareness but also by regulatory pressure and educational campaigns promoting green choices. As demand for ethical and sustainable consumption grows, toy companies can strengthen brand loyalty and market positioning by prioritizing transparency, ethical sourcing, and long-term ecological impact. Offering environmentally friendly toys is no longer just a niche but an essential competitive strategy in the evolving market landscape.

Growth of Adult and Collector Toy Segments

The toys and games market in Australia is expanding beyond children, with a rising number of adults engaging in collectible, hobby-based, and nostalgia-driven toys. Millennials and Gen Z consumers are fueling this trend by seeking products that reflect their childhood, interests, or fandoms. From limited-edition action figures and anime collectibles to board games and model kits, the adult toy segment offers manufacturers and retailers new avenues for revenue. According to the Australia toys and games market analysis, these consumers often have greater disposable income and are willing to invest in premium, high-quality products for personal enjoyment or collection. The growing popularity of “kidult” culture and collector communities is also amplifying demand through social media and online forums, making adult-focused toys a valuable and sustainable market opportunity.

Integration of Augmented Reality and Interactive Features

Technology is reshaping the toy industry, with the fusion of physical toys and digital interactivity opening major growth opportunities. Australian consumers, especially children, are highly receptive to toys that include features like augmented reality (AR), app integration, voice activation, or motion sensing. These technologies enhance traditional play by creating immersive, personalized experiences that engage kids beyond screen time. AR-enabled puzzles, educational games, and interactive figurines are gaining popularity for combining entertainment with learning. Tech-integrated toys also appeal to parents looking for innovative, engaging alternatives that support cognitive and creative development. As digital-native generations grow, brands that successfully merge physical and digital play will stand out, tapping into a market that values both novelty and meaningful engagement in toy experiences.

Australia Toys and Games Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Plush Toys

- Infant/Preschool Toys

- Activity Toys

- Dolls

- Games and Puzzles

- Ride-Ons

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes plush toys, infant/preschool toys, activity toys, dolls, games and puzzles, ride-ons, and others.

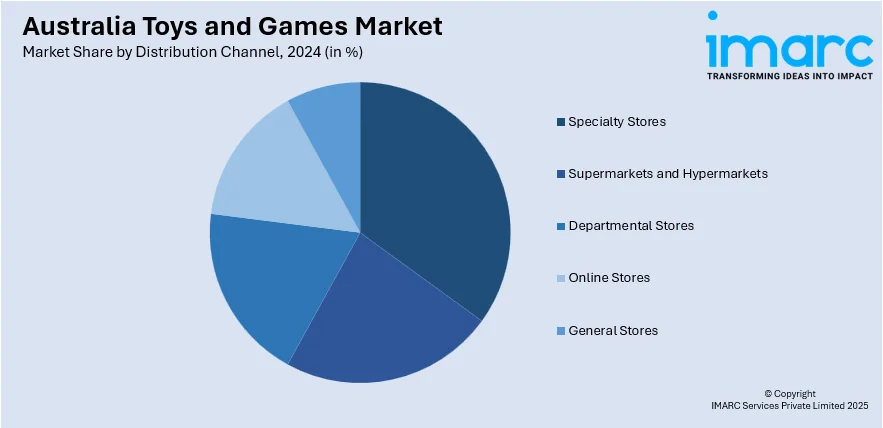

Distribution Channel Insights:

- Specialty Stores

- Supermarkets and Hypermarkets

- Departmental Stores

- Online Stores

- General Stores

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes specialty stores, supermarkets and hypermarkets, departmental stores, online stores, and general stores.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Toys and Games Market News:

- In 2024, Spin Master renewed and expanded its toy license agreement with Universal Products & Experiences for the "How to Train Your Dragon" franchise. This agreement includes worldwide rights to produce toys such as dolls, action figures, and playsets, aligning with the upcoming live-action film set to release in June 2025.

- In 2024, Totally Toys inaugurated its fourth store at the Fairfield & Co Centre in Idalia, Townsville, completing its regional presence in North Queensland alongside existing locations in Rockhampton, Mackay, and Cairns.

Australia Toys and Games Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | USD Million |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Plush Toys, Infant/Preschool Toys, Activity Toys, Dolls, Games and Puzzles, Ride-Ons, Others |

| Distribution Channels Covered | Specialty Stores, Supermarkets and Hypermarkets, Departmental Stores, Online Stores, General Stores |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia toys and games market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia toys and games market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia toys and games industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The toys and games market in Australia was valued at USD 2,374.0 Million in 2024.

The Australia toys and games market is projected to exhibit a CAGR of 4.40% during 2025-2033.

The Australia toys and games market is projected to reach a value of USD 3,497.7 Million by 2033.

Key trends in Australia toys and games market include rising demand for educational and STEM-based toys, increasing popularity of licensed merchandise, and growth in digital and interactive gaming. Sustainable and eco-friendly toys are also gaining traction, alongside a surge in online retail channels and personalized play experiences.

The Australia toys and games market is driven by rising disposable incomes, increasing demand for educational and interactive toys, and the strong influence of licensed characters. Growth in e-commerce, tech integration in toys, and changing parenting preferences toward developmental play further fuel market expansion across diverse age groups.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)