Australia Traction Control System Market Size, Share, Trends and Forecast by Type, Component, Vehicle Type, Distribution Channel, and Region, 2025-2033

Australia Traction Control System Market Overview:

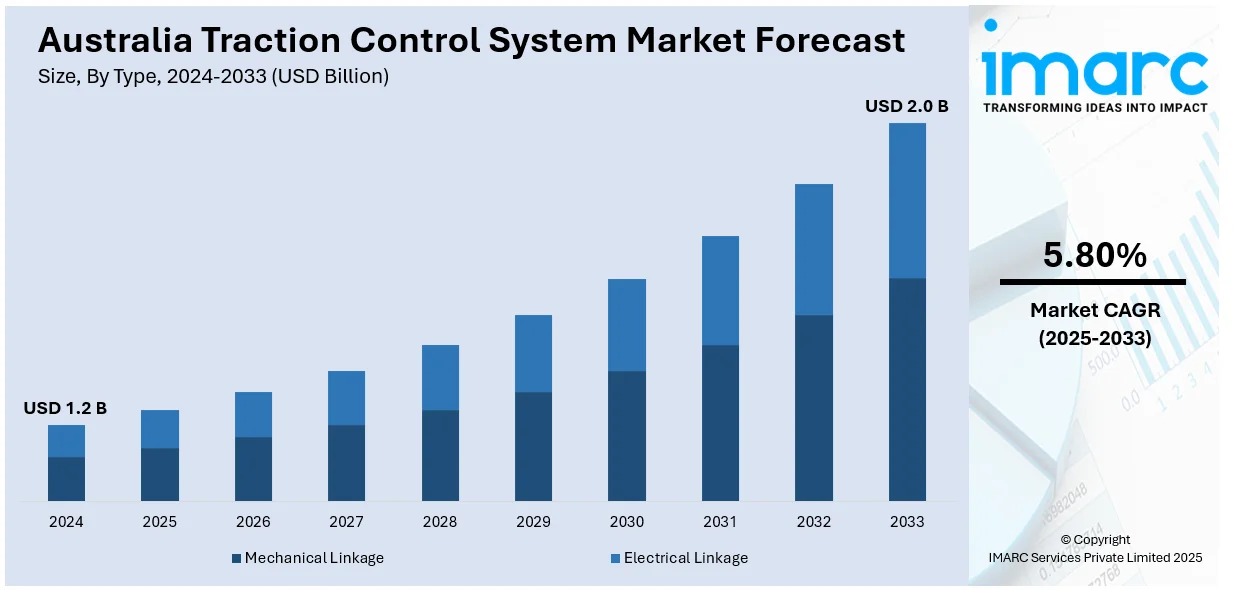

The Australia traction control system market size reached USD 1.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.0 Billion by 2033, exhibiting a growth rate (CAGR) of 5.80% during 2025-2033. Rising vehicle safety regulations, increasing demand for luxury and high-performance vehicles, growing awareness of accident prevention technologies, and expanding electric vehicle adoption are contributing to the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.0 Billion |

| Market Growth Rate 2025-2033 | 5.80% |

Australia Traction Control System Market Trends:

Stronger Push for Vehicle Safety Technologies

Australia is intensifying efforts to reduce road fatalities and serious injuries. This has accelerated the adoption of advanced safety mechanisms in passenger and commercial vehicles. Traction control systems, in particular, are gaining wider integration across new vehicle models due to their proven ability to stabilize vehicles on slippery or uneven surfaces. Growing regulatory emphasis and public sector backing for safer mobility solutions are influencing procurement decisions across fleet operators and individual buyers. Demand is further reinforced by ongoing updates to safety assessment protocols, encouraging manufacturers to prioritize embedded stability systems. This broader shift toward accident prevention through built-in electronics is shaping purchasing standards and contributing to the consistent inclusion of traction control in newer vehicle offerings. These factors are intensifying the traction control system market growth. For example, in June 2024, the National Road Safety Data Hub emphasized the importance of safe vehicles in Australia's goal to eliminate road fatalities and serious injuries by 2030. Advanced safety systems, including traction control, are critical components in achieving this objective.

To get more information on this market, Request Sample

Emphasis on Safety Tech in Heavy-Duty Transport

Based on the traction control system market forecast, government-backed initiatives in New South Wales are spotlighting the role of advanced technologies in heavy vehicle operations. Recent safety guidelines recommend the integration of automatic traction control systems to enhance stability and reduce wheel slip, especially in challenging road conditions. This is encouraging logistics operators and fleet managers to prioritize vehicles equipped with such systems to comply with best practice frameworks. The focus on minimizing risk in freight transport is reinforcing the value of embedded control technologies across Australia’s commercial vehicle segment. As regulatory awareness grows and safety protocols become more specific, original equipment manufacturers and retrofitters are expected to increasingly align product offerings with these safety expectations, reinforcing the use of ATC in both new and existing fleets. For instance, in March 2024, Transport for NSW released a guide detailing safety technology for heavy vehicles, including automatic traction control (ATC) systems. The guide outlines the benefits of ATC in enhancing vehicle stability and reducing wheel slip, contributing to safer road transport operations in New South Wales.

Australia Traction Control System Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, component, vehicle type, and distribution channel.

Type Insights:

- Mechanical Linkage

- Electrical Linkage

The report has provided a detailed breakup and analysis of the market based on the type. This includes mechanical linkage and electrical linkage.

Component Insights:

- Hydraulic Modulators

- ECU

- Sensors

- Others

As per the traction control system market outlook, a detailed breakup and analysis of the market based on the component have also been provided in the report. This includes hydraulic modulators, ECU, sensors, and others.

Vehicle Type Insights:

- ICE Vehicles

- Electric Vehicles

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes ICE vehicles and electric vehicles.

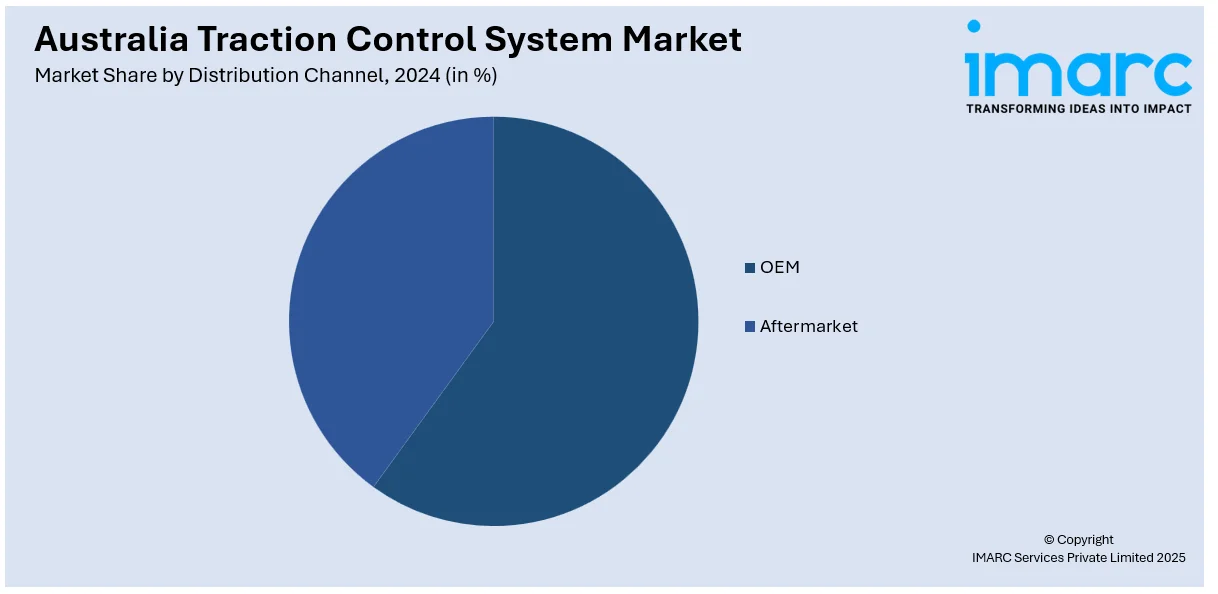

Distribution Channel Insights:

- OEM

- Aftermarket

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes OEM and aftermarket.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Traction Control System Market News:

- In November 2024, Continental developed an electronic brake control system for the Bugatti Bolide, a hypercar featuring integrated anti-lock braking, electronic stability control, and traction control systems. This system is based on the "Motorsports ABS Kit by Continental Engineering Services," enhancing vehicle control for high-performance applications.

Australia Traction Control System Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Mechanical Linkage, Electrical Linkage |

| Components Covered | Hydraulic Modulators, ECU, Sensors, Others |

| Vehicle Types Covered | ICE Vehicles, Electric Vehicles |

| Distribution Channels Covered | OEM, Aftermarket |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia traction control system market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia traction control system market on the basis of type?

- What is the breakup of the Australia traction control system market on the basis of component?

- What is the breakup of the Australia traction control system market on the basis of vehicle type?

- What is the breakup of the Australia traction control system market on the basis of distribution channel?

- What is the breakup of the Australia traction control system market on the basis of region?

- What are the various stages in the value chain of the Australia traction control system market?

- What are the key driving factors and challenges in the Australia traction control system market?

- What is the structure of the Australia traction control system market and who are the key players?

- What is the degree of competition in the Australia traction control system market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia traction control system market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia traction control system market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia traction control system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)