Australia Trade Finance Market Size, Share, Trends and Forecast by Finance Type, Offering, Service Provider, End User, and Region, 2025-2033

Australia Trade Finance Market Overview:

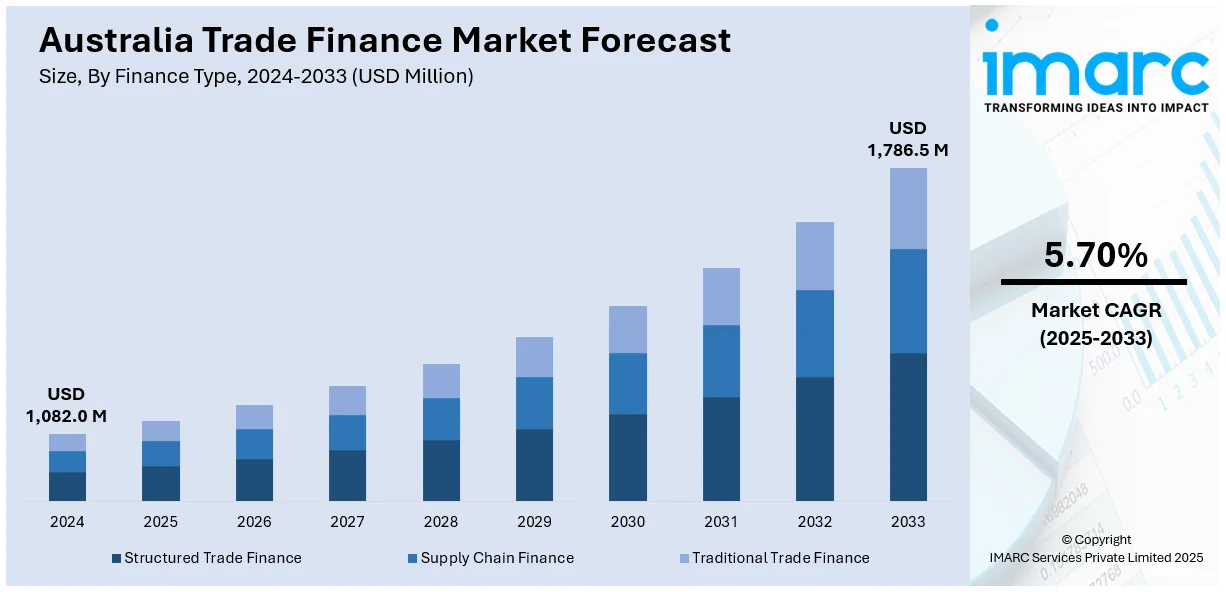

The Australia trade finance market size reached USD 1,082.0 Million in 2024. Looking forward, the market is expected to reach USD 1,786.5 Million by 2033, exhibiting a growth rate (CAGR) of 5.70% during 2025-2033. The rising cross-border trade activities, increasing adoption of digital trade platforms, expanding SME sector, supportive government trade policies, growing demand for supply chain financing, and enhanced financial inclusion initiatives are significantly expanding the Australia trade finance market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,082.0 Million |

| Market Forecast in 2033 | USD 1,786.5 Million |

| Market Growth Rate 2025-2033 | 5.70% |

Key Trends of Australia Trade Finance Market:

Rising Demand for Digital Trade Finance Solutions

The Australia trade finance market growth is driven by a rapid transition towards digital platforms, driven by the need for efficiency, transparency, and faster transaction cycles. For instance, The Australian government began a consultation on adopting the UNCITRAL Model Law on Electronic Transferable Records (MLETR) on September 16, 2024, with the goal of granting legal recognition to digital trade papers. With a focus on small enterprises, this reform aims to reduce the expenses and inefficiencies related to paper-based records. Cross-border goods trade in Australia was worth about AUD1 Trillion (USD 674 Billion) in the preceding fiscal year. Businesses are increasingly adopting blockchain, cloud computing, and AI-integrated trade finance solutions to reduce paperwork, mitigate risks, and streamline documentation processes. This digital shift is particularly benefiting small and medium-sized enterprises (SMEs), which often face challenges in accessing traditional finance channels. The implementation of electronic Bills of Lading and smart contracts is gaining traction, improving traceability and reducing delays in cross-border trade. Additionally, government initiatives and collaborations between banks and fintech firms are accelerating the development of centralized trade finance platforms, enhancing credit accessibility and transaction security. As regulatory frameworks evolve to support these innovations, the digitization trend is expected to redefine traditional banking approaches in trade finance and enable faster, more reliable funding options for exporters and importers across Australia.

To get more information on this market, Request Sample

Growth in Supply Chain Finance Adoption Among SMEs

The Australian trade finance landscape is experiencing a notable rise in the adoption of supply chain finance (SCF), especially among small and medium-sized enterprises. As global supply chains become more complex and cash flow pressures intensify, SMEs are seeking flexible financing models to maintain operational stability. SCF solutions, such as invoice discounting and reverse factoring, offer improved working capital management by enabling faster payments and longer credit terms, which is positively impacting Australia trade finance market outlook. For instance, Spenda Limited stated on February 23, 2025, that it will sell its invoice finance loan book to Grapple Invoice Finance Fund Pty Ltd for $2 Million in order to lower credit risk and strengthen its balance sheet. The acquisition is anticipated to generate $4.3 Million in increased working capital, $2.3 Million in first-loss capital, and operational savings of roughly $600,000 annually. Furthermore, Spenda and Grapple will sign a 24-month referral contract whereby Spenda will get commissions on new clients that are recommended to Grapple. In the first year, Spenda will receive 100% of the net interest margin, and in the second year, 50%. Australian financial institutions are increasingly developing tailored SCF products that address the liquidity needs of smaller businesses engaged in export-import activities. The COVID-19 pandemic further underscored the need for resilient and transparent supply chains, prompting more companies to embrace SCF as a strategic tool. With the added support of digital platforms and financial technologies, SCF is helping bridge the credit gap for SMEs, enhancing their competitiveness in global markets and encouraging inclusive participation in Australia’s expanding international trade network.

Growth Drivers of Australia Trade Finance Market:

Expanding International Trade Activities

Australia’s increasing integration with global markets has significantly boosted the demand for trade finance solutions. Strengthening trade relationships with Asia-Pacific, North America, and Europe has created a need for reliable financial instruments that simplify cross-border transactions and reduce associated risks. As global supply chains become more interconnected, businesses are under pressure to ensure seamless trade flows and maintain financial stability when dealing with international partners. Trade finance offers the support required, as it will offer tools like letter of credit, export financing, and payment guarantees. Such tools enable the companies to keep afloat and develop confidence in global transactions. As the volume of international trade is set to increase, trade finance will also become increasingly important in supporting the process of making transactions between Australian exporters and importers easier and safer.

Increasing Focus on Risk Mitigation

One of the primary drivers boosting the Australia trade finance market demand is the growing need to manage risks associated with international trade. Exporters and importers face challenges such as credit risks, foreign exchange volatility, and the possibility of delayed or non-payments from overseas buyers. Trade finance instruments serve as a safety net by ensuring secured payments, protecting cash flows, and minimizing uncertainties. Banks and financial institutions offer solutions like export credit insurance, letters of credit, and hedging tools that enable businesses to trade confidently. This emphasis on risk management is particularly important for small and medium enterprises (SMEs), which are more vulnerable to global uncertainties. As businesses continue expanding across borders, risk mitigation through trade finance becomes essential for maintaining competitiveness and long-term stability.

Rise in Infrastructure and Resource Exports

Australia’s strong position as a major exporter of natural resources and infrastructure-related goods is fueling the need for advanced trade finance solutions. High global demand for commodities such as coal, iron ore, and critical minerals, along with large-scale infrastructure projects, requires significant financing to support smooth international trade operations. Structured trade finance solutions provide the capital flexibility needed to manage these large transactions, cover shipment costs, and mitigate payment delays. Additionally, the growing focus on renewable energy exports and infrastructure modernization across the Asia-Pacific and other regions further amplifies financing requirements. By supporting these sectors with tailored financial products, trade finance institutions help strengthen Australia’s export-driven economy, ensuring that businesses can meet global demand while maintaining strong financial resilience.

Opportunities of Australia Trade Finance Market:

Integration of Blockchain for Transparency

The adoption of blockchain technology offers transformative opportunities in the Australian trade finance market by enhancing transparency, security, and efficiency in cross-border transactions. Blockchain enables real-time verification of trade documents, ensures immutability of records, and significantly reduces risks of fraud or tampering. By providing a shared, traceable ledger accessible to all stakeholders, banks, exporters, importers, and regulators, it helps streamline compliance and reduce paperwork. The technology also shortens transaction cycles by automating contract execution through smart contracts, improving speed and reducing costs. For small and medium enterprises (SMEs), blockchain adoption creates greater trust and credibility when dealing with international partners. As digitalization becomes mainstream, blockchain-based platforms are expected to unlock new levels of security and operational resilience in trade finance activities across Australia.

Green and Sustainable Finance Solutions

Sustainability is becoming a defining trend in global finance, and the Australian trade finance market is no exception. Growing emphasis on environmental, social, and governance (ESG) standards provides banks and financial institutions with opportunities to design sustainability-linked financing solutions. By offering preferential terms for businesses adopting eco-friendly practices, such as reducing carbon emissions or using renewable resources, trade finance can align with broader climate goals. According to the Australia trade finance market analysis, this trend is particularly relevant as industries like agriculture, mining, and energy seek to transition toward greener operations. Sustainable trade finance not only attracts environmentally conscious investors but also enhances the global competitiveness of Australian exporters. With international buyers increasingly prioritizing suppliers that follow ESG principles, sustainability-focused trade finance offerings can create significant opportunities for long-term growth and market differentiation.

Expansion of Export-Oriented Industries

Australia’s growing export-oriented industries create strong opportunities for the expansion of trade finance services. Sectors such as agribusiness, manufacturing, and renewable energy are increasingly participating in global trade, driving higher demand for working capital and structured financing. These industries require support to manage international transactions, mitigate risks, and ensure smooth supply chain operations. The shift toward renewable energy exports, including critical minerals and clean technologies, further accelerates financing needs as global markets pursue sustainability goals. At the same time, agribusiness continues to strengthen Australia’s reputation as a reliable food exporter, necessitating modern financing solutions to support large-scale international contracts. By catering to the financing requirements of these industries, trade finance institutions can play a pivotal role in boosting Australia’s export competitiveness and enhancing economic resilience.

Challenges of Australia Trade Finance Market:

High Compliance and Regulatory Burden

The Australian trade finance market faces significant challenges from the complexity of regulatory requirements and stringent compliance standards. International trade transactions often involve extensive documentation, including customs records, letters of credit, and risk assessments, which create delays and add to administrative costs. Smaller firms, in particular, struggle to navigate these frameworks due to limited expertise and resources. The need to comply with anti-money laundering (AML) rules, know-your-customer (KYC) guidelines, and global trade restrictions further complicates the process. These regulatory hurdles not only slow transaction times but also discourage participation from small and medium enterprises (SMEs). Simplifying processes, promoting digital solutions, and harmonizing international trade regulations are essential steps to reduce burdens and support wider adoption of trade finance services.

Trade Volatility and Geopolitical Risks

Uncertainty in global trade is another critical challenge affecting Australia’s trade finance market. Fluctuating commodity prices, particularly in resources like coal, iron ore, and agricultural goods, create unstable revenue streams for exporters. In addition, geopolitical tensions, protectionist policies, and shifting trade alliances increase risks for businesses engaged in international commerce. Economic downturns and global supply chain disruptions—such as those seen during the pandemic—further amplify financial uncertainties. For lenders and exporters, these conditions heighten exposure to credit defaults and delayed payments, making trade finance more complex and risk-prone. Building resilient financial frameworks, diversifying export markets, and leveraging hedging tools are crucial to minimizing risks. Addressing volatility is essential for ensuring long-term stability and growth in the Australian trade finance sector.

Limited Awareness Among Small Enterprises

A major barrier to trade finance adoption in Australia is the lack of awareness among small and medium-sized enterprises (SMEs). Many smaller businesses remain unfamiliar with the benefits of trade finance, such as improved cash flow, risk mitigation, and easier access to international markets. Limited financial literacy and misconceptions about high costs or strict eligibility criteria prevent SMEs from exploring available solutions. This lack of knowledge restricts their ability to expand globally and capitalize on new opportunities. Moreover, smaller enterprises often lack direct access to banks and specialized financial institutions that provide trade financing. Increasing awareness through education, outreach programs, and partnerships with trade organizations is crucial. By bridging this knowledge gap, SMEs can better utilize trade finance tools to grow competitively in international markets.

Australia Trade Finance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on finance type, offering, service provider, and end user.

Finance Type Insights:

- Structured Trade Finance

- Supply Chain Finance

- Traditional Trade Finance

The report has provided a detailed breakup and analysis of the market based on the finance type. This includes structured trade finance, supply chain finance, and traditional trade finance.

Offering Insights:

- Letters of Credit

- Bill of Lading

- Export Factoring

- Insurance

- Others

A detailed breakup and analysis of the market based on the offering have also been provided in the report. This includes letters of credit, bill of lading, export factoring, insurance, and others.

Service Provider Insights:

- Banks

- Trade Finance Houses

The report has provided a detailed breakup and analysis of the market based on the service provider. This includes banks and trade finance houses.

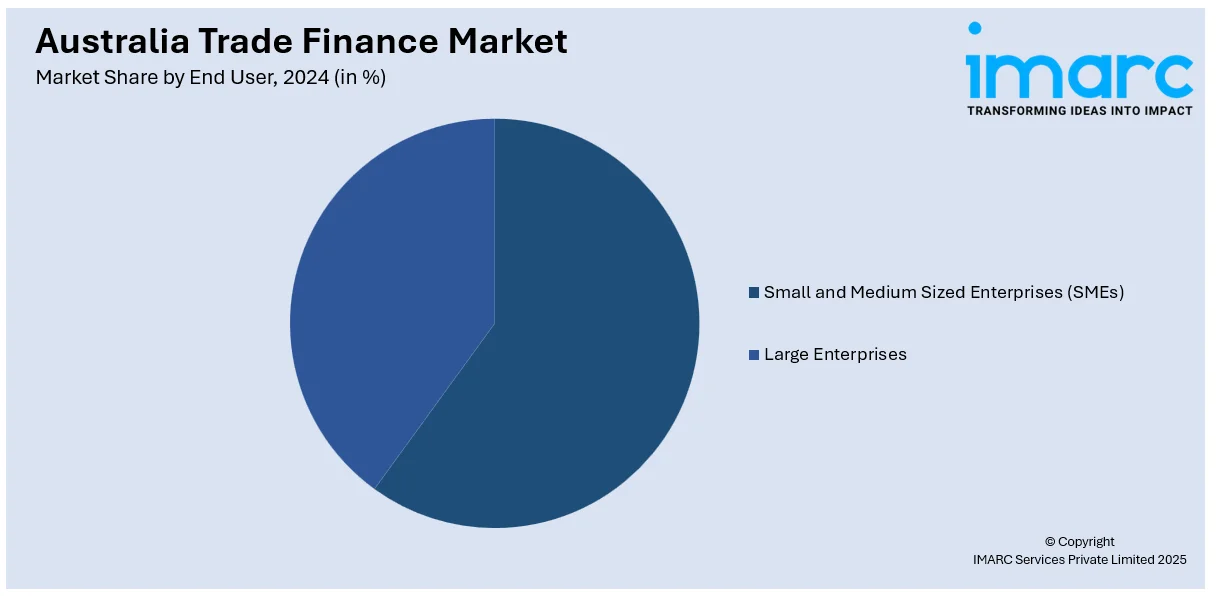

End User Insights:

- Small and Medium Sized Enterprises (SMEs)

- Large Enterprises

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes Small and Medium Sized Enterprises (SMEs) and large enterprises.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Trade Finance Market News:

- In July 2025, Export Finance Australia sanctioned a debt facility worth US$100 Million for the Emerging Africa & Asia Infrastructure Fund (EAAIF). The financing aims to strengthen the fund’s expansion across South and Southeast Asia while promoting greater investment in sustainable infrastructure projects. EAAIF, a blended finance initiative supported by multiple European governments, is overseen by global investment management firm Ninety One.

- In June 2025, Export Finance Australia (EFA) and the Vietnam Development Bank (VDB) entered a Memorandum of Understanding (MoU) aimed at enhancing collaboration and creating fresh avenues for trade and investment between Vietnam and Australia. This agreement represents a significant step forward in their economic ties and comes shortly after the upgrade of the bilateral relationship to a Comprehensive Strategic Partnership.

- In February 2024, HSBC introduced HSBC TradePay in Australia, marking a first-of-its-kind solution in the market. The platform offers businesses a fully digital, streamlined method to manage supplier payments efficiently while simultaneously enhancing their working capital. It is designed to deliver faster and more convenient payment processing for companies.

Australia Trade Finance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Finance Types Covered | Structured Trade Finance, Supply Chain Finance, Traditional Trade Finance |

| Offerings Covered | Letters of Credit, Bill of Lading, Export Factoring, Insurance, Others |

| Service Providers Covered | Banks, Trade Finance Houses |

| End Users Covered | Small and Medium Sized Enterprises (SMEs), Large Enterprises |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia trade finance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia trade finance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia trade finance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The trade finance market in Australia was valued at USD 1,082.0 Million in 2024.

The Australia trade finance market is projected to exhibit a CAGR of 5.70% during 2025-2033.

The Australia trade finance market is projected to reach a value of USD 1,786.5 Million by 2033.

The Australia trade finance market is shaped by the rising adoption of digital platforms, blockchain, and AI-driven solutions to enhance transparency and efficiency. Growing demand for sustainable financing, and supply chain resilience further define market trends, driving modernization and improving access to global trade opportunities.

The Australia trade finance market is driven by expanding international trade, increasing demand for working capital solutions, and the rise of digital financial services. Supportive government policies, growing participation of small and medium enterprises, and emphasis on secure, transparent cross-border transactions further strengthen market growth momentum.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)