Australia Unified Communications Market Size, Share, Trends and Forecast by Component, Deployment Mode, Organization Size, End User, and Region, 2025-2033

Australia Unified Communications Market Overview:

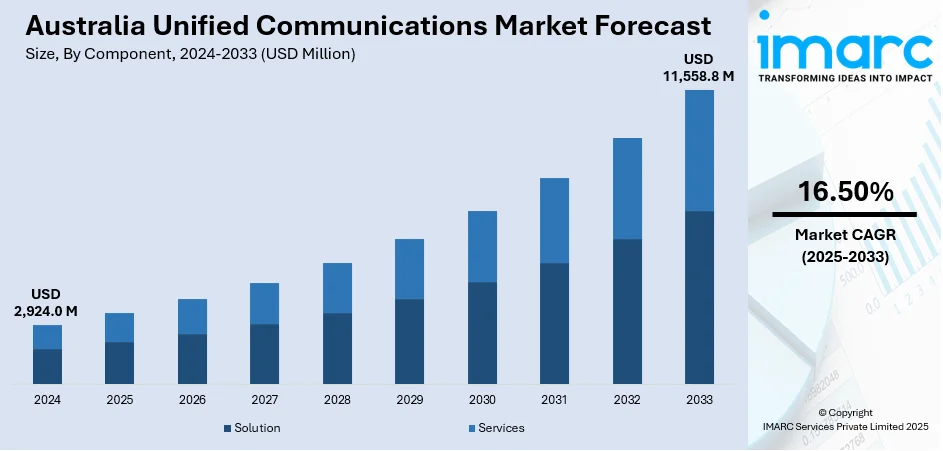

The Australia unified communications market size reached USD 2,924.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 11,558.8 Million by 2033, exhibiting a growth rate (CAGR) of 16.50% during 2025-2033. The growing adoption of hybrid and remote work patterns among businesses is offering a favorable market outlook. This trend, along with the integration of artificial intelligence (AI) and automation in communication platforms, is catalyzing the overall demand. Besides this, the rapid expansion of cloud infrastructure and the ongoing deployment of 5G networks is expanding the Australia unified communications market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,924.0 Million |

| Market Forecast in 2033 | USD 11,558.8 Million |

| Market Growth Rate 2025-2033 | 16.50% |

Australia Unified Communications Market Trends:

Growing Adoption of Hybrid and Remote Work Models

The Australia market is experiencing tremendous growth as businesses continue to embrace hybrid and remote work patterns. According to the RHL Recruitment Australis, in 2024, 14.3% of Australian job postings on Indeed offered remote work opportunities to people, which was more than 3 times higher than pre-pandemic levels. Besides this, businesses from diverse industries are persisting with flexible working environments due to changing employee expectations and operational efficiency. This change is driving continued investments in resilient unified communications (UC) platforms that converge voice, video, messaging, and collaboration tools under one ecosystem. Businesses are now giving dispersed groups of people secure, scalable, and interoperable communication systems to provide continuity in connectivity, productivity, and workflow. Cost-effective unified communication-as-a-service (UCaaS) solutions are now more appealing as they offer ease of deployment, cloud-based platforms capable of scalability, and cost-effectiveness. Businesses are also pursuing solutions that have better security, redundancy, and analytics to retain control of communications. The trend of hybrid work is also impacting information technology (IT) plans, with UC systems at the forefront of digital transformation efforts.

To get more information on this market, Request Sample

Increasing Integration of Artificial Intelligence (AI) and Automation

The Australia UC market is undergoing dynamic growth with artificial intelligence (AI) and automation being added to communication platforms. AI-enabled features like real-time transcription, sentiment analysis, noise cancellation, virtual assistants, and intelligent scheduling are now adding to user experience and operational effectiveness. Companies are increasingly using these features to streamline communication processes, minimize manual tasks, and enhance customer interaction. Automation is being infused into workflows to speed up service delivery, enable chatbots for customer care, and make user interactions across channels more personalized. UC providers are also constantly innovating to integrate machine learning (ML) algorithms that support predictive analytics, enhancing decision-making and network performance. Organizations in Australia are adopting these technologies to gain competitive differentiation and digital maturity. Additionally, AI-powered security solutions are assisting organizations to identify anomalies and protect sensitive communication information. The IMARC Group predicts that the Australia AI market size is expected to reach USD 7,761.0 Million by 2033.

Expanding Cloud Infrastructure and 5G Network Deployment

The rapid expansion of cloud infrastructure and the ongoing deployment of 5G networks is propelling the Australia unified communications market growth. Enterprises are currently migrating from legacy, on-premises systems to cloud-based communication platforms to gain scalability, flexibility, and reduced capital expenditure. Cloud-based UC solutions are enabling real-time collaboration, centralized management, and easier integration with third-party applications. Simultaneously, the rollout of 5G is transforming UC capabilities by offering faster data transmission, ultra-low latency, and enhanced mobility. These improvements are supporting high-definition video conferencing, remote collaboration, and mobile-first communication strategies, even in bandwidth-sensitive environments. Telecom providers and UC vendors are forming partnerships to deliver integrated solutions that optimize the potential of 5G-enabled UC experiences. The IMARC Group states that the Australia 5G network deployment market size is projected to attain USD 15,160.96 Million by 2033.

Australia Unified Communications Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, deployment mode, organization size, and end user.

Component Insights:

- Solution

- Instant and Unified Messaging

- Audio and Video Conferencing

- IP Telephony

- Others

- Services

- Professional Services

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution (instant and unified messaging, audio and video conferencing, IP telephony, and others) and services (professional services and managed services).

Deployment Mode Insights:

- On-premises

- Hosted

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes on-premises and hosted.

Organization Size Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes small and medium-sized enterprises and large enterprises.

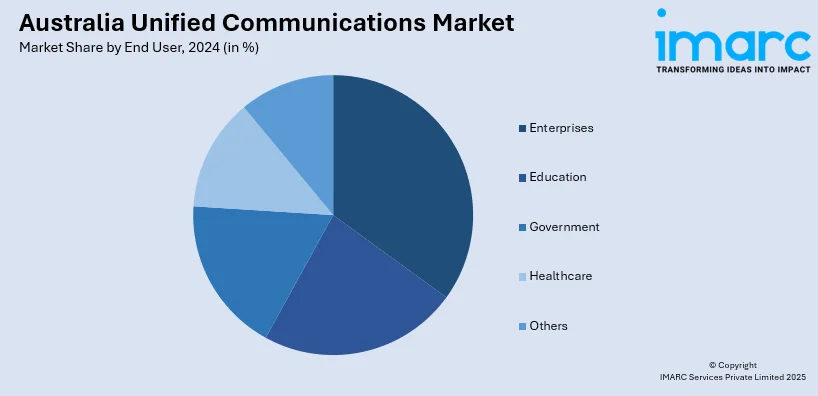

End User Insights:

- Enterprises

- Education

- Government

- Healthcare

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes enterprises, education, government, healthcare, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Unified Communications Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployment Modes Covered | On-premises, Hosted |

| Organization Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| End Users Covered | Enterprises, Education, Government, Healthcare, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia unified communications market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia unified communications market on the basis of component?

- What is the breakup of the Australia unified communications market on the basis of deployment mode?

- What is the breakup of the Australia unified communications market on the basis of organization size?

- What is the breakup of the Australia unified communications market on the basis of end user?

- What is the breakup of the Australia unified communications market on the basis of region?

- What are the various stages in the value chain of the Australia unified communications market?

- What are the key driving factors and challenges in the Australia unified communications?

- What is the structure of the Australia unified communications market and who are the key players?

- What is the degree of competition in the Australia unified communications market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia unified communications market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia unified communications market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia unified communications industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)