Australia Used Cooking Oil Market Size, Share, Trends and Forecast by Source, Application, and Region, 2025-2033

Australia Used Cooking Oil Market Overview:

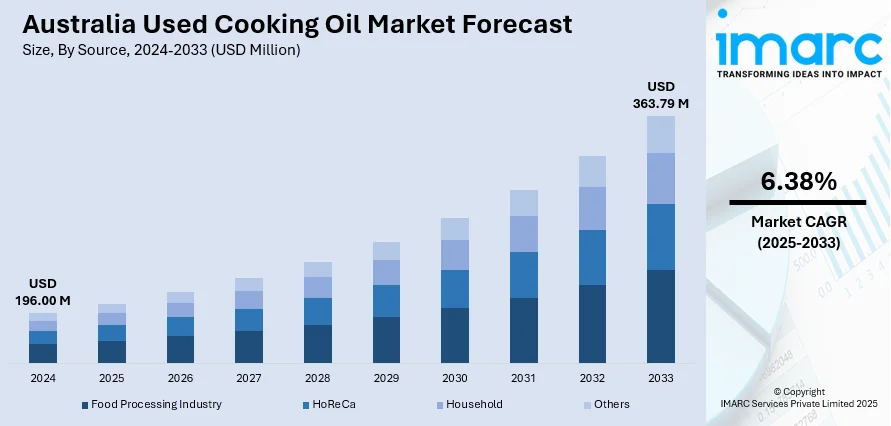

The Australia used cooking oil market size reached USD 196.00 Million in 2024. The market is projected to reach USD 363.79 Million by 2033, exhibiting a growth rate (CAGR) of 6.38% during 2025-2033. Due to government policies, carbon reduction goals, and international climate commitments promoting renewable energy, biodiesel manufacturers are looking for dependable supplies of used cooking oil. Besides this, popular tourist destinations, from coastal regions to cultural hubs, experience heightened food consumption, thus contributing to the expansion of the Australia used cooking oil market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 196.00 Million |

| Market Forecast in 2033 | USD 363.79 Million |

| Market Growth Rate 2025-2033 | 6.38% |

Australia Used Cooking Oil Market Trends:

Growing demand for biofuels

Rising demand for biofuels is fueling the market growth in Australia, as the country is focusing on sustainable energy solutions to reduce carbon emissions and dependence on fossil fuels. As per the IMARC Group, the Australia biofuel market size reached USD 2.79 Billion in 2024. Used cooking oil serves as an efficient, cost-effective, and eco-friendly feedstock for producing biodiesel, a renewable fuel with lower greenhouse gas emissions compared to petroleum diesel. With government policies, carbon reduction targets, and global climate commitments encouraging renewable energy adoption, biodiesel producers are seeking reliable sources of used cooking oil. This has created a strong market pull for collecting and recycling waste oil from food processing units and households. The growing interest from the transport, shipping, and aviation sectors in cleaner fuels is further catalyzing the demand. Additionally, used cooking oil offers advantages, such as minimal competition with food crops and lower production costs, making it a preferred choice for large-scale biofuel production. The rise in domestic and export-oriented biodiesel projects has also led to greater investments in collection, filtration, and processing infrastructure across Australia. By converting used cooking oil into biofuel, the country is supporting its renewable energy goals, strengthening its circular economy, and reducing environmental pollution.

To get more information on this market, Request Sample

Increasing tourism activities

Rising tourism activities are impelling the Australia used cooking oil market growth. As per the data released on the official website of the Australian Government, during the 2023-24 period, tourism had a direct contribution of 2.9% to Australia’s GDP. Popular tourist destinations, from coastal regions to cultural hubs, experience heightened food consumption, particularly fried and specialty dishes, leading to greater availability of used cooking oil for collection. Seasonal tourism peaks, fueled by festivals, holiday periods, and international visitors, are further boosting cooking oil usage and waste generation. Many hospitality businesses, motivated by environmental regulations and sustainability goals, work with certified collectors to ensure proper disposal and recycling of used cooking oil. This waste oil is then repurposed into biodiesel, animal feed additives, and other industrial products, supporting Australia’s renewable energy initiatives and circular economy objectives. Tourism growth is also encouraging investment in collection infrastructure, especially in high-traffic areas, making the recycling process more efficient. As Australia’s tourism industry continues to thrive, the consistent generation of used cooking oil from foodservice outlets catering to visitors will remain a dependable feedstock source, strengthening its role in renewable fuel production and other recycling applications.

Australia Used Cooking Oil Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on source and application.

Source Insights:

- Food Processing Industry

- HoReCa

- Household

- Others

The report has provided a detailed breakup and analysis of the market based on the source. This includes food processing industry, HoReCa, household, and others.

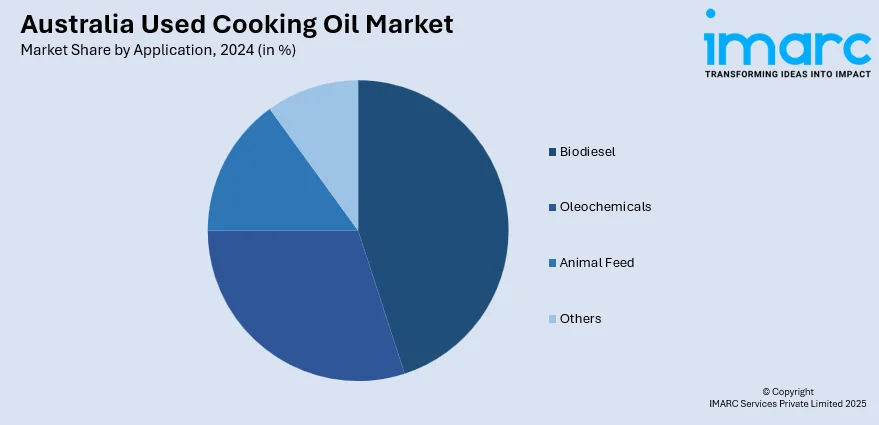

Application Insights:

- Biodiesel

- Oleochemicals

- Animal Feed

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes biodiesel, oleochemicals, animal feed, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Used Cooking Oil Market News:

- In February 2025, Viva Energy created its first ISCC+ certified mass balanced bio-based polymer (recycled food-grade plastic) after successfully processing a batch of used cooking oil at the Geelong refinery, Australia. This was the inaugural use of used cooking oil for producing bio-based polymers via the catalytic cracker at the refinery and its neighboring polypropylene facility. The used cooking oil originated from Intersnack ANZ in New South Wales, where it was utilized to prepare popular Australian snacks, such as Kettle Chips, CC’s, Natural Chip Company products, Thins, and Cheezels.

- In March 2024, Apeiron AgroCommodities, a major collector of used cooking oil in Asia, teamed up with Jet Zero Australia for a project under a suggested 50:50 joint venture. The goal of this collaboration was to create low carbon intensity feedstocks in Australia to satisfy the need for renewable fuels, which involved sourcing waste oils and cultivating non-food crops for hydrotreated esters and fatty acids (HEFA) to produce sustainable aviation fuel (SAF).

Australia Used Cooking Oil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Food Processing Industry, HoReCa, Household, Others |

| Applications Covered | Biodiesel, Oleochemicals, Animal Feed, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia used cooking oil market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia used cooking oil market on the basis of source?

- What is the breakup of the Australia used cooking oil market on the basis of application?

- What is the breakup of the Australia used cooking oil market on the basis of region?

- What are the various stages in the value chain of the Australia used cooking oil market?

- What are the key driving factors and challenges in the Australia used cooking oil market?

- What is the structure of the Australia used cooking oil market and who are the key players?

- What is the degree of competition in the Australia used cooking oil market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia used cooking oil market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia used cooking oil market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia used cooking oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)