Australia Used Truck Market Size, Share, Trends and Forecast by Vehicle Type, Sales Channel, End User, and Region, 2025-2033

Australia Used Truck Market Overview:

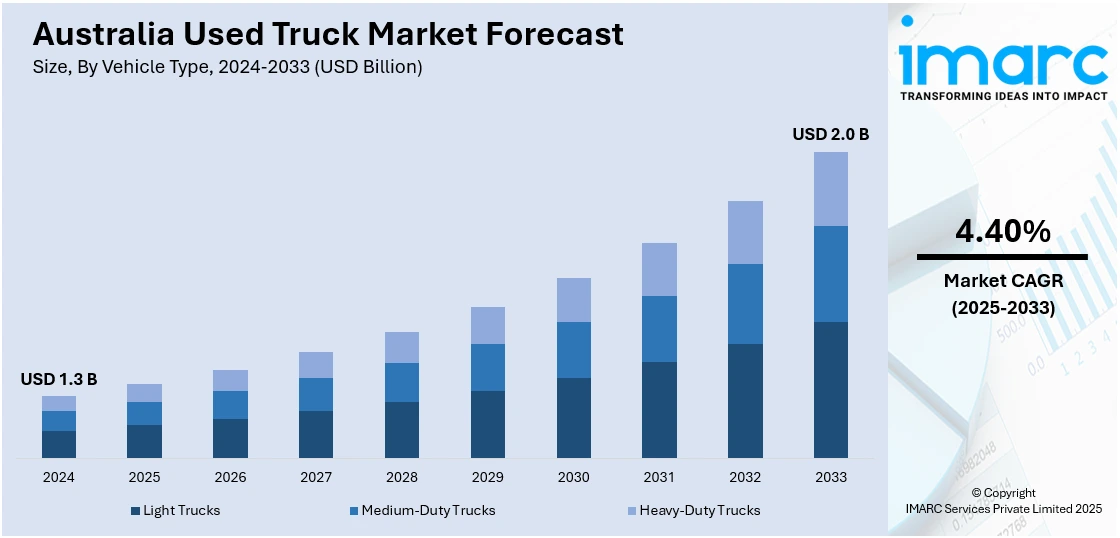

The Australia used truck market size reached USD 1.3 Billion in 2024. Looking forward, the market is expected to reach USD 2.0 Billion by 2033, exhibiting a growth rate (CAGR) of 4.40% during 2025-2033. The market is driven by the growing pressure on freight and logistics firms to keep costs under control, increasing online shopping activities among the masses, and rising shift towards more environment friendly and sustainable transport.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.3 Billion |

| Market Forecast in 2033 | USD 2.0 Billion |

| Market Growth Rate 2025-2033 | 4.40% |

Key Trends of Australia Used Truck Market:

Rising Demand for Cost-Effective Logistics Solutions

Growing pressure on freight and logistics firms to keep costs under control is increasing the used trucks as a realistic option over new models. Small and medium-sized businesses (SMEs), which represent a large majority of Australia's construction and freight sectors, usually operate on limited budgets that make brand-new trucks prohibitively expensive. Used trucks provide lower initial investment, lower depreciation expense, and instant availability, enabling companies to sustain or build fleets without extended procurement lead times. Additionally, Australia's vast geography and distribution of population centers necessitate that road freight networks be made efficient. In such an environment, fleet managers want to maximize total cost of ownership (TCO). Used trucks enable companies to support service levels without disrupting cash flow. Furthermore, the widespread promotion of aftermarket assistance, spare parts, and financing options further adds to the appeal of the used truck market for cost-oriented operators. The IMARC Group predicts that the Australia car accessories market is projected to exhibit a growth rate (CAGR) of 6.20% during 2025-2033.

To get more information of this market, Request Sample

Growth of E-commerce and Urban Freight Sector

The growth of e-commerce and last-mile delivery platforms is positively influencing the market. Online shopping in Australia is increasing, driving the demand for agile and nimble transportation. Urban freight and short-haul deliveries need smaller, more agile vehicles that are often purchased from the used truck industry because of faster deployment and lower capital costs. Lower financial risk and cost savings through pre-owned vehicle purchase are more appealing to smaller transport operators and gig economy players who venture into the logistics industry. Used light-duty and medium-duty trucks are specifically popular for their versatility in the urban context and adherence to city emission regulations. Seasonal peaks in demand for holidays and holiday sales and promotional offerings also propel short-term buying or renting of used trucks, which reinforces market turnover and provides consistent demand all year round.

Regulatory Incentives and Environmental Considerations

Australia's move towards more environment friendly and sustainable transport is facilitating the restructuring in trucks fleets throughout the country. In 2024, The Australian Renewable Energy Agency (ARENA) provided $100 million in finance under the Driving the Nation program in 3 priority areas to facilitate shifting heavy vehicles to electric. As environmental regulations focus on carbon emissions and vehicle efficiency, large freight and logistics companies are changing to newer models with improved environmental performance. This turnover of fleets generates a constant stream of comparatively recent, well-preserved used trucks coming onto the secondary market. These used trucks, usually fewer than five to seven years old, provide newer safety and fuel efficiency features, which appeal to buyers wanting compliance at a lower price than brand-new ones. Government policy favoring recycling and second-use car schemes also supports this trend, by encouraging the reuse of vehicles instead of premature scrappage.

Growth Drivers of Australia Used Truck Market:

Regional and Rural Freight Demand Growth

One of the major growth drivers of Australia's used truck market is ongoing growth in freight and logistics demand within regional and rural regions. Owing to the nation's sheer geography and comparatively scattered population beyond metropolitan regions, land transport is the most convenient way of transporting goods. Agriculture, mining, and construction sectors—where the concentration is high in states like Queensland, Western Australia, and New South Wales—are reliant upon medium and heavy vehicles on a day-to-day basis. Used trucks are the preferred choice for numerous small and medium enterprises operating in these industries as they represent an affordable option to address transportation demands without the associated high cost of capital outlay of new purchase. In addition, the used truck's durability and flexibility to rough conditions and distance driving ensure it is suited to difficult terrain and long-distance hauls. As regional infrastructure development prevails, such as upgrading highways and intermodal terminals, demand for available and dependable freight vehicles enhances the used truck market in backing up these industries.

Value and Accessibility for Small Business Owners

Affordability is the main driver of demand in Australia's second-hand truck market, especially among independent operators and small businesspeople. Sole traders, farming businesses, logistics start-ups, and tradespeople do not have the ability to afford the expenditure of new trucks, which are tightly packaged with higher price tags and high technology. Used trucks are an economical and sensible way to enter the commercial transport business, with options for flexibility in customization and cheaper insurance premiums. Urban areas such as Melbourne and Sydney, where construction, courier operations, and small-scale logistics are expanding quickly, have a tendency to favor used light- and medium-duty trucks, as they are less expensive to acquire and become available faster. Moreover, Australia's highly developed inspection and certification systems also provide assurance that used trucks can be bought with confidence that they are in roadworthy condition. The increased number of online marketplaces and dealer networks throughout the country also simplify the process by which buyers can locate individual models and configurations to fit their requirements, boosting market growth further.

Strong Resale Culture and Extended Vehicle Lifespan

According to the Australia used truck market analysis, the region has cultivated a strong resale culture within its commercial vehicle market, with trucks frequently being retained, upgraded, and resold numerous times during their working life. This is facilitated by a strong network of maintenance services, component suppliers, and vehicle refurbishers that enable used trucks to serve for much longer than their original period. Truck models that are used in Australia are normally designed to withstand, and they can be operated satisfactorily under any condition, whether it is city run or outback freight runs. Consequently, trucks that are retired from major corporate fleets remain valuable to new or third owners. In local markets like Adelaide, Perth, and Darwin, where specialized industries function on thin margins, these rebuilt trucks provide bargains for a fraction of their original cost. Additionally, the availability of aftermarket upgrades, such as emissions retrofits, GPS tracking systems, and improved suspension, allows older trucks to meet newer compliance standards and customer expectations, sustaining demand across various segments of the used truck industry.

Government Support of Australia Used Truck Market:

National Transport Policies Supporting Fleet Modernization

The government of Australia has continued to prioritize transport efficiency and emissions reduction through national policies that indirectly encourage the used truck market. Although a lot of emphasis is put on incentivizing fleet operators to replace their older, higher-emission vehicles with newer vehicles, this results in a consistent supply of good-condition used trucks that feed the secondary market. Road safety, fuel-saving, and logistics performance programs persuade companies to update their fleets, such that older but operational trucks become accessible for small and mid-sized businesses. Since larger fleets replace stock more quickly to meet the above policies, used truck sales gain from higher volume. In addition, Australia's wide geography and dependence on road freight generate constant need for inexpensive transport options, especially in regional and remote locations. In this regard, government policy aimed at improving fleet efficiency has assisted in driving activity within the second-hand truck segment by facilitating a constant supply of pre-owned commercial trucks, and contributing to the Australia used truck market demand.

State-Level Incentives and Regional Transport Programs

Several Australian states have introduced special programs to assist small business owners and regional logistics providers, which tend to have access to used trucks as a less expensive option for fleet acquisitions compared to new purchases. Regional transport subsidies and asset renewal rebates are accessible in some states like Queensland, New South Wales, and Victoria for logistics services being provided in remote or underserved locations. These incentives are particularly beneficial to farmers, tradespeople, and solo freight operators who depend on older model trucks to operate their business. Some programs aid in paying for the upgrade to newer used vehicles that pass emissions or safety standards, while others assist in financing vehicle maintenance or modification expenses. These localized support programs recognize the economic conditions of local communities and offer hands-on support that maintains used trucks as viable and roadworthy. By enhancing upgrades and encouraging roadworthiness among owners of used vehicles, these programs at the state level indirectly improve the sustainability and dependability of the Australia used truck market share.

Support for Emissions Compliance and Retrofitting

The Australian government's drive toward cleaner transport also involves support initiatives that affect the used truck market by encouraging retrofitting and compliance with emissions. Although new trucks are built to latest environmental specifications, a large number of used trucks are still in good condition and can be fitted with emissions-reducing technologies. Initiatives to promote installation of diesel particulate filters, engine management systems, or alternative fuel conversions increase the useful life of used trucks while enhancing the environmental performance. Such incentives are most useful for operators who cannot finance the buying of new electric or hybrid trucks but need to comply with regulations. At the same time, training and certification assistance for mechanics and vehicle inspectors ensures that compliance checks and retrofitting are possible cost-effectively and reliably in both urban and rural settings. In making it economically and logistically viable to refurbish older trucks, government policies save the used vehicle pool value and cut waste in the commercial vehicle supply chain.

Australia Used Truck Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on vehicle type, sales channel, and end user.

Vehicle Type Insights:

- Light Trucks

- Medium-Duty Trucks

- Heavy-Duty Trucks

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes light trucks, medium-duty trucks, and heavy-duty trucks.

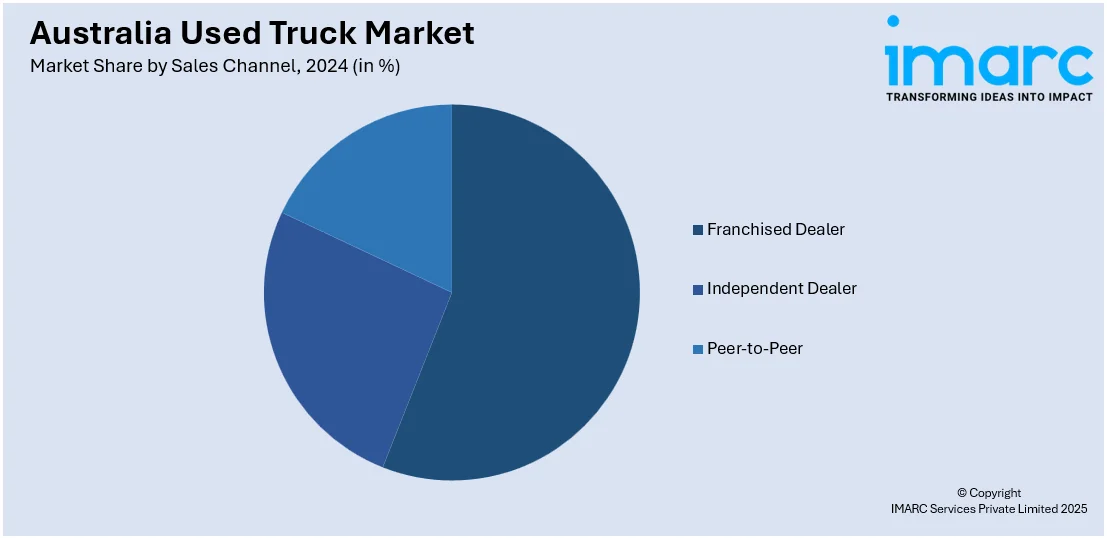

Sales Channel Insights:

- Franchised Dealer

- Independent Dealer

- Peer-to-Peer

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes franchised dealer, independent dealer, and peer-to-peer.

End User Insights:

- Construction

- Oil and Gas

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes construction, oil and gas, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Used Truck Market News:

- In January 2025, with new management in place, Coastal Transport Services revealed plans to grow its operations, selecting the UD Quon as their preferred truck for the expanding fleet. Based at their primary depot in Warnervale on the Central Coast of New South Wales, Coastal Transport Services offers a comprehensive array of logistics and warehousing solutions throughout the state.

- Starting July 1, 2025, Truck Centre Western Australia will operate as a subsidiary of the Volvo Group Australia. The purchase encompasses all 8 current branches and every service center in Western Australia.

Australia Used Truck Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Light Trucks, Medium-Duty Trucks, Heavy-Duty Trucks |

| Sales Channels Covered | Franchised Dealer, Independent Dealer, Peer-to-Peer |

| End Users Covered | Construction, Oil and Gas, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia used truck market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia used truck market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia used truck industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia used truck market was valued at USD 1.4 Billion in 2025.

The Australia used truck market is projected to exhibit a CAGR of 4.31% during 2026-2034.

The Australia used truck market is expected to reach a value of USD 2.0 Billion by 2033.

Recent trends in Australia used truck market include a rise in online transactions and digital marketplaces, increasing aftermarket upgrades like emissions retrofits and telematics, and growing demand for specialty vehicle types such as refrigerated and off-road models. Buyers are also prioritizing certified pre-owned programs and detailed service histories for peace of mind.

The Australia used truck market is driven by strong regional freight demand, affordability for small businesses, and a well-established resale and maintenance ecosystem. Vast geography, expanding rural industries, and cost-conscious operators contribute to consistent demand, while regulatory compliance and aftermarket upgrades extend vehicle life and enhance market sustainability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)