Australia Vegan Chocolate Market Size, Share, Trends and Forecast by Chocolate Type, Nature, Sales Channel, and Region, 2025-2033

Australia Vegan Chocolate Market Overview:

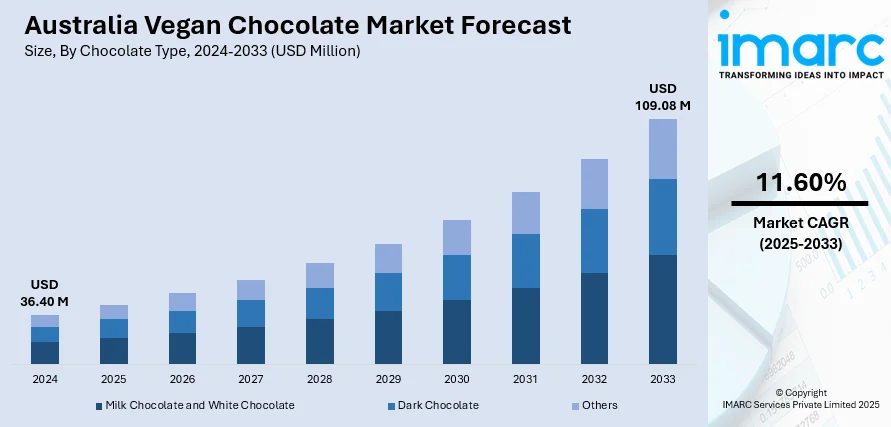

The Australia vegan chocolate market size reached USD 36.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 109.08 Million by 2033, exhibiting a growth rate (CAGR) of 11.60% during 2025-2033. The market is driven by growing customer demand for plant-based and dairy-free options. Moreover, raising health awareness and increased concerns over animal welfare and the environment are also playing an important role in the shift towards vegan chocolate offerings. Furthermore, growth within specialty retailers and online channels is enhancing product availability, further augmenting the Australia vegan chocolate market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 36.40 Million |

| Market Forecast in 2033 | USD 109.08 Million |

| Market Growth Rate 2025-2033 | 11.60% |

Australia Vegan Chocolate Market Trends:

Rising Consumer Demand for Clean Label and Organic Vegan Chocolate

One of the emerging trends in the market is the growing consumer demand for clean-label and organic food products. This shift is closely linked to the rising popularity of veganism in the country, with approximately 2% of the population now identifying as vegan, according to 2025 industry reports. As more Australians adopt plant-based lifestyles, their expectations for food quality and transparency are also evolving. Within the vegan chocolate segment, consumers are no longer satisfied with products that exclude dairy. They are increasingly seeking chocolates that are also free from artificial additives, preservatives, and genetically modified ingredients. This trend is spearheaded by increased health consciousness and food labeling transparency, which encourages manufacturers to invest in easy-to-formulate ingredients and organic, non-GMO, and Fairtrade certifications. In line with this, brands that emphasize the use of natural sweeteners such as coconut sugar, organic cocoa, and plant fats are becoming popular among health-oriented consumers. Additionally, younger generations, including millennials and Gen Z, are increasingly concerned about where ingredients are sourced from and how they're produced, which is prompting businesses to support ethical sourcing methods and traceability, alongside with enhanced sustainability. In addition, increasing sales of certified organic vegan chocolate products on retail counters and e-commerce websites mirror the increasing market demand for clean, transparent, and health-focused confectionery products in Australia.

To get more information on this market, Request Sample

Retail and E-Commerce Expansion of Vegan Chocolate Brands

The expansion of retail and e-commerce distribution channels is positively impacting the Australia vegan chocolate market growth. Australians have a strong appetite for chocolate, with industry reports indicating an average annual consumption of 32 kilograms per person. In addition to this, with the growing interest in vegan chocolates, major supermarket retailers are expanding shelf space for plant-based foods, such as a wide variety of vegan chocolate products. At the same time, the introduction of health-oriented online platforms and direct-to-consumer platforms is allowing smaller vegan brands to have national reach without the necessity of a bricks-and-mortar presence. In addition to this, subscription models, customized product packs, and targeted online promotions are enabling brands to reach specific target groups, for example, fitness enthusiasts, parents looking for allergen-free products, and eco-friendly consumers. This transition towards digital selling is also supplemented by enhanced cold chain logistics and packaging technologies that maintain product quality during transportation. In addition, digital channels provide avenues for consumer interaction through feedback, reviews, and social media marketing, thus enhancing loyalty. Convenience in online product discovery, along with increasing convenience demand, is driving market penetration and competition among new and emerging vegan chocolate participants in Australia.

Australia Vegan Chocolate Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on chocolate type, nature, and sales channel.

Chocolate Type Insights:

- Milk Chocolate and White Chocolate

- Dark Chocolate

- Others

The report has provided a detailed breakup and analysis of the market based on the chocolate type. This includes milk chocolate and white chocolate, dark chocolate, and others.

Nature Insights:

- Organic

- Conventional

A detailed breakup and analysis of the market based on the nature have also been provided in the report. This includes organic and conventional.

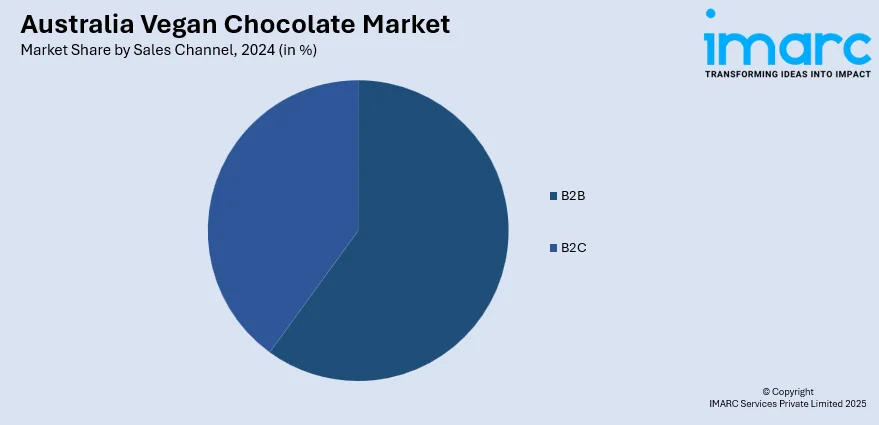

Sales Channel Insights:

- B2B

- B2C

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes B2B and B2C (supermarkets and hypermarkets, convenience stores, online stores, and others).

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Vegan Chocolate Market News:

- On November 6, 2024, New Zealand-based Goodness Kitchen introduced its Choc Bites range in Australia, targeting independent retailers. The product features snap-frozen fruits, such as Cherry, Blueberry, and Strawberry, enrobed in vegan dark chocolate, offering a plant-based alternative to traditional confections. Choc Bites are positioned as versatile treats suitable for various occasions, including pairing with coffee, wine, or as a topping for cereals and oats.

Australia Vegan Chocolate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Chocolate Types Covered | Milk Chocolate and White Chocolate, Dark Chocolate, Others |

| Natures Covered | Organic, Conventional |

| Sales Channels Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia vegan chocolate market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia vegan chocolate market on the basis of chocolate type?

- What is the breakup of the Australia vegan chocolate market on the basis of nature?

- What is the breakup of the Australia vegan chocolate market on the basis of sales channel?

- What is the breakup of the Australia vegan chocolate market on the basis of region?

- What are the various stages in the value chain of the Australia vegan chocolate market?

- What are the key driving factors and challenges in the Australia vegan chocolate?

- What is the structure of the Australia vegan chocolate market and who are the key players?

- What is the degree of competition in the Australia vegan chocolate market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia vegan chocolate market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia vegan chocolate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia vegan chocolate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)