Australia Vehicle Leasing Market Size, Share, Trends and Forecast by Type, Mode of Booking, and Region, 2025-2033

Australia Vehicle Leasing Market Overview:

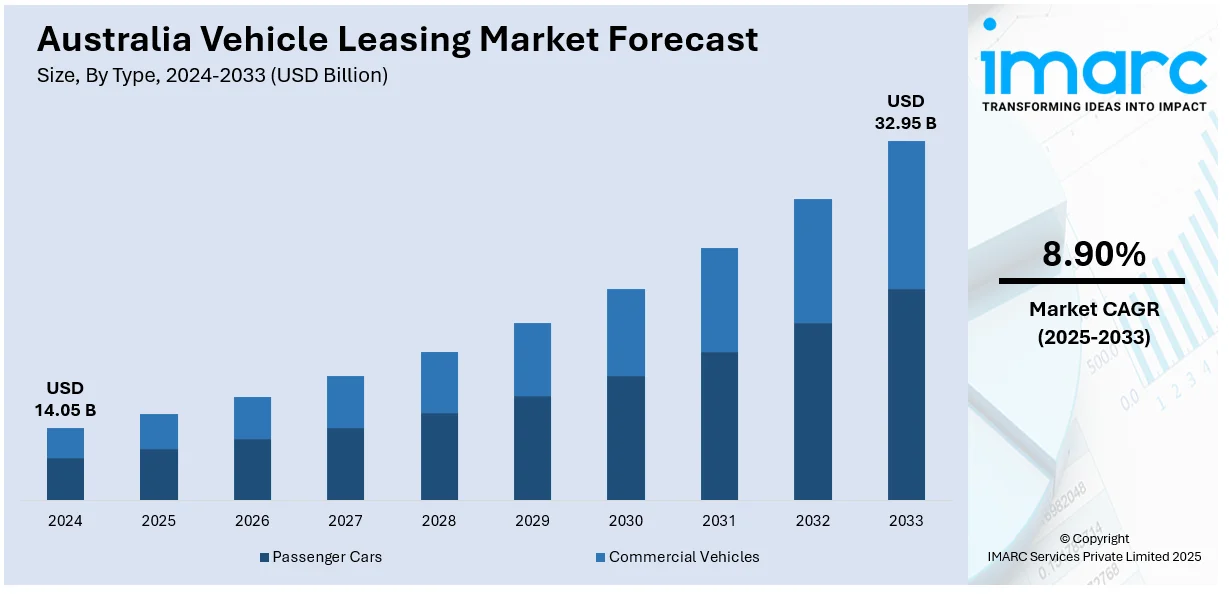

The Australia vehicle leasing market size reached USD 14.05 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 32.95 Billion by 2033, exhibiting a growth rate (CAGR) of 8.90% during 2025-2033. The growing adoption of fleet leasing among corporate organizations as an intelligent response to maximize their fleet management practice is offering a favorable market outlook. Moreover, Australians are shifting away from conventional perceptions of car ownership due to changing lifestyle attitudes and metropolitan mobility patterns. This trend, along with the increasing range of electric vehicles (EVs) and hybrids available for lease is expanding the Australia vehicle leasing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 14.05 Billion |

| Market Forecast in 2033 | USD 32.95 Billion |

| Market Growth Rate 2025-2033 | 8.90% |

Australia Vehicle Leasing Market Trends:

Increasing Corporate Preference for Fleet Leasing

Corporate organizations throughout Australia are increasingly embracing vehicle leasing as an intelligent response to maximize their fleet management practice. The trend is driven by the need to minimize capital spending and transform fixed costs into variable ones. Companies see the fiscal benefits of leasing over owning, especially in the areas of enhanced cash flow management, tax advantage, and lower administrative cost. Leasing firms are also providing bundled packages, such as maintenance, insurance, and roadside services, which are found appealing by corporate customers looking for hassle-free mobility. Additionally, as tighter environmental laws are enforced, businesses are constantly trying to upgrade their fleets using more fuel-efficient and low-emission cars, a move that is more cost-effective through leasing than through outright acquisition. This demand by the corporate sector is positively working towards the continued growth of the leasing market in Australia.

To get more information on this market, Request Sample

Shifting Attitudes Towards Car Ownership

Australians are shifting away from conventional perceptions of car ownership due to changing lifestyle attitudes and metropolitan mobility patterns. This trend is encouraged by the increasing recognition of the economic inefficiencies linked with holding depreciating assets such as cars. Leasing offers a low-cost, convenient option that is well-suited for urban residents, particularly younger individuals, who prefer access over ownership and emphasize convenience, lower down payments, and more frequent vehicle upgrades. With congested city streets and limited parking becoming common concerns for urban residents, they are constantly looking for leasing as an increasingly flexible mobility solution. Furthermore, with the advent of online platforms, vehicle leasing is becoming more accessible, transparent, and easy to use, hence promoting increased trust and adoption by technologically advanced individuals. This shift in automotive culture is contributing to the Australia vehicle leasing market growth.

Expanding Availability of Electric and Hybrid Leasing Options

The increasing range of electric vehicles (EVs) and hybrids available for lease is greatly rising the appeal of vehicle leasing in Australia. Green consciousness is rising, and people are making their transportation options consistent with sustainability objectives. Leasing is now a realistic point of entry for numerous individuals and businesses attempting to switch to low-emission vehicles without incurring the high initial costs of EV ownership. Auto leasing companies are meeting this trend by increasing their hybrid and electric offerings, frequently packaged with promotions like charging points access, maintenance packages, and government rebates. Concurrently, the Australian government is aggressively encouraging EV purchases through tax relief and subsidies, thus enhancing the attractiveness of leasing green cars. While the charging infrastructure for electric mobility is growing fast, leasing continues to play its role as a bridge towards mass adoption of EVs. The IMARC Group predicts that the Australia EV market size is projected to attain USD 171.6 Billion by 2033.

Australia Vehicle Leasing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and mode of booking.

Type Insights:

- Passenger Cars

- Commercial Vehicles

The report has provided a detailed breakup and analysis of the market based on the type. This includes passenger cars and commercial vehicles.

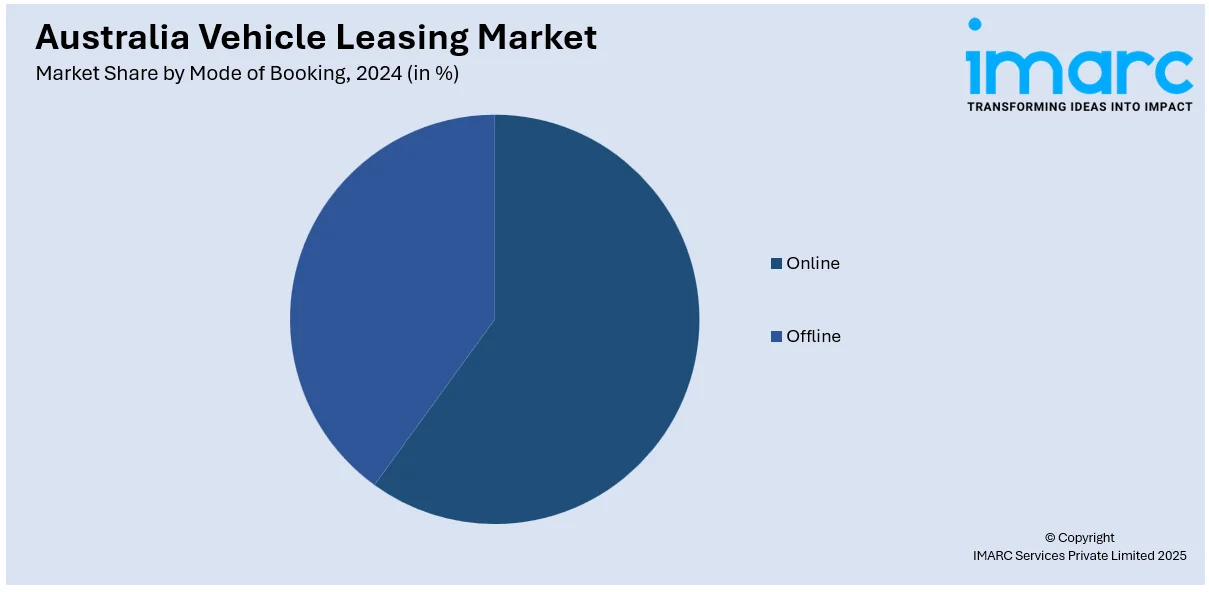

Mode of Booking Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the mode of booking have also been provided in the report. This includes online and offline.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Vehicle Leasing Market News:

- In July 2024, Novated Lease Australia (NLA), introduced a new app designed to make managing leases easier for customers and enhance its experience and personalization credentials. The app, which is available only to NLA customers, provides the ability to monitor, claim, and manage leases anywhere, anytime. It provides the facility for viewing bundled budgets for fuel, tires, insurance, registration, and servicing. The app also simplifies the reimbursement process, enabling users to file claims and view their status in real time, and provides personalized notifications and direct access to instantaneous customer support.

- In May 2025, CarTrawler, the global B2B technology leader in car rental solutions to the world's travel industry, announced an agreement to form a new car rental relationship with Virgin Australia. This is another key airline partnership launch for CarTrawler and is an important milestone towards advancing the travel experience for Virgin Australia customers.

Australia Vehicle Leasing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Passenger Cars, Commercial Vehicles |

| Mode of Bookings Covered | Online, Offline |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia vehicle leasing market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia vehicle leasing market on the basis of type?

- What is the breakup of the Australia vehicle leasing market on the basis of mode of booking?

- What is the breakup of the Australia vehicle leasing market on the basis of region?

- What are the various stages in the value chain of the Australia vehicle leasing market?

- What are the key driving factors and challenges in the Australia vehicle leasing market?

- What is the structure of the Australia vehicle leasing market and who are the key players?

- What is the degree of competition in the Australia vehicle leasing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia vehicle leasing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia vehicle leasing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia vehicle leasing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)