Australia Venture Capital Market Report by Sector (Software, Pharma and Biotech, Media and Entertainment, Medical Devices and Equipment, Medical Services and Systems, IT Hardware, IT Services and Telecommunication, Consumer Goods and Recreation, Energy, and Others), Fund Size (Under $50 M, $50 M to $100 M, $100 M to $250 M, Above $250 M), Funding Type (First-Time Venture Funding, Follow-on Venture Funding), and Region 2025-2033

Australia Venture Capital Market Overview:

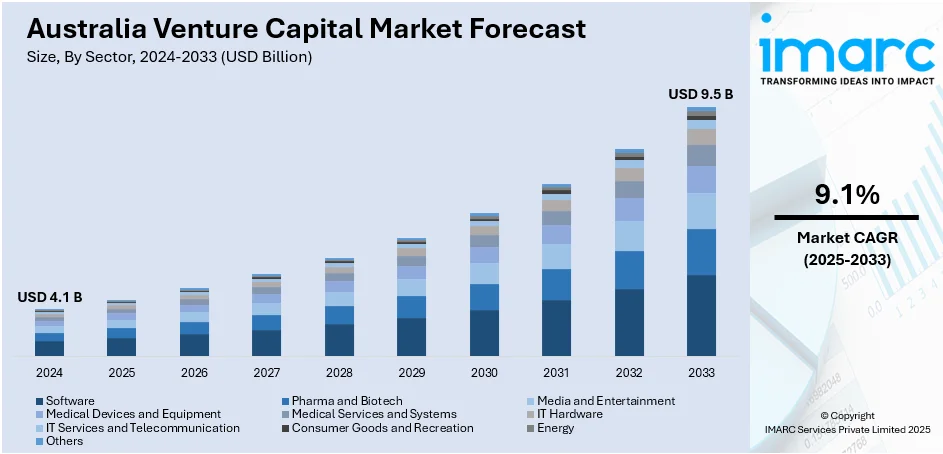

The Australia venture capital market size reached USD 4.1 Billion in 2024. Looking forward, the market is expected to reach USD 9.5 Billion by 2033, exhibiting a growth rate (CAGR) of 9.1% during 2025-2033. The market is driven toward growth by strong startup ecosystems, increasing government incentives, significant innovations, and growing interest in technology sectors such as fintech, healthtech, and clean energy, attracting both domestic and international investors seeking high-growth opportunities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 9.5 Billion |

| Market Growth Rate (2025-2033) | 9.1% |

Key Trends of Australia Venture Capital Market:

Government Support and Policies

The Australian government has been instrumental in boosting the venture capital market through various funding programs and policies that promote innovation and entrepreneurship. For instance, initiatives like Innovation Investment Fund (IIF), Renewable Energy Venture Capital (REVC) Programme, Biomedical Translation Fund (BTF), and Queensland Venture Capital Development Fund (QVCD) all support early-stage companies in various sectors. IIF stimulates innovation by co-investing with private venture capital, while REVC focuses on renewable energy technologies. BTF bridges the gap between biomedical research and commercialization, and QVCD promotes venture capital growth in Queensland's tech sectors. These policies have significantly lowered entry barriers for investors and fostered a culture of innovation. By reducing the financial risks associated with early-stage ventures, the government plays a crucial role in sustaining the growth of venture capital activity, encouraging investments in technology, healthcare, and other high-growth sectors, which, in turn, accelerates economic development.

To get more information on this market, Request Sample

Increasing Focus on Tech and Innovation Sectors

Australia's venture capital market has experienced strong growth due to the rising focus on technology and innovation-driven sectors. Startups in fintech, biotech, artificial intelligence, and clean energy are attracting significant investments as investors seek out opportunities with high growth potential. The country’s strong research institutions and thriving tech ecosystems, particularly in cities like Sydney and Melbourne, provide a solid foundation for new ventures. As digital transformation accelerates across industries, venture capitalists are increasingly attracted to the potential for disruptive technologies to reshape the market. This shift toward tech innovation is a major factor driving both local and international venture capital investments in Australia. For instance, in September 2024, SafetyCulture, an Australian private tech company, secured a $165 million funding round led by Airtree Ventures, bringing its valuation down to $2.5 billion from $2.7 billion last year. This round included $75 million in fresh capital for growth and $90 million in secondary shares sold by early investors and employees. The deal is the largest software-related funding round in 2024 and third-largest overall.

Growing Entrepreneurial Ecosystem

Australia's entrepreneurial ecosystem has expanded rapidly, creating a fertile ground for venture capital growth. For instance, according to industry reports, Australia’s startup ecosystem has experienced remarkable growth, placing third globally in liquidity after the United States and China. In 2024, venture capital investment in Australia represents 0.18% of its GDP, generating 1.5 unicorns for every billion dollars invested, surpassing both China and the U.S. This achievement is driven by the capital efficiency and international market orientation of Australian startups. The increasing number of incubators, accelerators, and coworking spaces across the country has nurtured early-stage startups, providing them with essential resources such as mentorship, networking, and access to investors. Universities and research institutions also contribute to the ecosystem by encouraging commercial spin-offs and partnerships with private investors. For instance, Australia leads globally in university spinout investments, with over half of its universities (25 out of 43) having an investment fund, surpassing the United States (33%) and Europe (40%). Uniseed has played a key role in this development, covering more than 20% of Australian universities. Additionally, 14 institutions access the Brandon BioCatalyst fund, focusing on life sciences. The country's strong pension fund system, with AustralianSuper managing A$341bn and UniSuper A$139bn, also supports this ecosystem. State initiatives like Breakthrough Victoria’s A$2bn fund further drive commercialization efforts. This strong ecosystem not only facilitates the growth of new startups but also attracts venture capitalists who are eager to invest in high-potential ventures.

Growth Drivers of Australia Venture Capital Market:

Rising International Investor Participation

Australia’s venture capital market is experiencing a notable boost from increasing participation by global investors. International venture capital firms are also injecting much larger pools of funding, as well as industry expertise and global networks, and advice. These transnational collaborations also allow Australian startups to reach out to international markets, access more clientele, and compete in the global markets. This inflow of foreign investments enhances the scalability of new ventures with the resources that can be difficult to obtain within the country. Additionally, the partnership with enterprises that have potential experience in different markets tends to contribute to the increase of operational proficiencies, product improvement, and brand awareness. With foreign investors having repeatedly defined Australia as a viable innovation center, their contribution is likely to become an important one in maintaining the range of its market development and start-up competitiveness.

Expanding Corporate Venture Capital (CVC) Activity

Corporate venture capital (CVC) is becoming an increasingly important factor in Australia venture capital market growth. Large corporations across sectors such as finance, energy, telecommunications, and healthcare are launching dedicated investment arms to back high-potential startups. These investments often target innovations aligned with the corporation’s strategic goals, enabling mutual benefits, startups gain funding, mentorship, and market access, while corporations acquire innovative solutions that enhance their competitive edge. CVC-backed startups often enjoy accelerated product development cycles, stronger market positioning, and opportunities for co-branding or joint ventures. This trend is also fostering deeper industry-startup collaboration, helping bridge the gap between innovation and large-scale commercialization. As more corporations recognize the value of engaging with early-stage innovators, CVC activity is expected to keep expanding.

Improved Access to Exit Opportunities

The Australian venture capital market is becoming increasingly attractive due to improved exit pathways for investors and startups. A more active initial public offering (IPO) environment allows high-growth companies to raise substantial capital and reward early backers. Additionally, rising mergers and acquisitions (M&A) activity provides alternative exit routes, enabling investors to realize returns sooner while offering startups integration opportunities with larger entities. Private equity interest in acquiring or partnering with venture-backed firms is also growing, adding another layer of liquidity options. These multiple exit channels increase investor confidence, encouraging greater participation in both early and growth-stage funding rounds. By offering more reliable and profitable exit opportunities, Australia’s venture capital market strengthens its appeal to both domestic and international investors.

Opportunities of Australia Venture Capital Market:

Growth in Impact and ESG Investing

The increasing global and domestic emphasis on sustainability is creating significant opportunities for venture capital firms in Australia. Investors are showing heightened interest in businesses with strong environmental, social, and governance (ESG) credentials, driven by rising consumer demand for responsible practices and stricter regulatory expectations. Startups focusing on renewable energy, waste reduction, social inclusion, and ethical supply chains are attracting substantial attention. For venture capital firms, supporting such companies offers both financial returns and reputational benefits, as they align with long-term societal goals. Moreover, ESG-focused investments often enjoy stronger brand loyalty, easier access to government incentives, and greater appeal to international markets. This shift toward impact-driven investing is expected to accelerate, providing a robust growth avenue for the Australia venture capital market demand.

Untapped Regional Startup Hubs

Beyond Australia’s major urban centers, regional areas are emerging as promising hubs for innovation and entrepreneurship. These locations are seeing the rise of startups in specialized sectors such as agri-tech, mining technology, renewable energy, and regional logistics. Lower operational costs, availability of sector-specific talent, and proximity to key resources give these startups unique competitive advantages. For venture capital firms, investing in regional innovation clusters presents an opportunity to diversify portfolios and tap into high-potential yet underfunded markets. Additionally, government and private sector initiatives aimed at regional economic development are supporting the growth of these ecosystems. As infrastructure and connectivity improve, regional hubs are expected to become increasingly important contributors to Australia’s startup landscape, offering fresh investment prospects for forward-looking VC firms.

Increasing Collaboration with Academia

Australia’s strong academic and research institutions are playing a critical role in generating innovative ideas and technologies with commercial potential, which is further fueling the Australia venture capital market share. Universities and research centers are fostering entrepreneurship through dedicated commercialization programs, incubators, and partnerships with industry. This collaboration provides venture capital investors with early access to groundbreaking projects, including advancements in biotechnology, clean energy, artificial intelligence, and advanced manufacturing. Such partnerships not only help bridge the gap between research and market-ready products but also reduce the risks associated with early-stage investments through shared resources and expertise. By engaging with academia, VC firms can identify disruptive solutions at their inception, secure exclusive investment opportunities, and contribute to building a stronger innovation pipeline in Australia’s evolving venture capital ecosystem.

Challenges of Australia Venture Capital Market:

Limited Late-Stage Funding Availability

In Australia, while early-stage venture capital funding is relatively attainable, a significant challenge lies in securing large-scale investments for late-stage growth. Many high-potential startups struggle to raise the capital required to expand operations, enter international markets, or invest in advanced technologies. This funding gap often compels founders to seek overseas investors earlier than planned, which can lead to a partial relocation of operations, talent, and intellectual property. Such premature international dependency may weaken the domestic innovation ecosystem and reduce the economic benefits for Australia. Expanding the availability of late-stage funding is essential to retaining homegrown talent, ensuring that promising companies can scale effectively, and enabling the country to fully capitalize on its innovation potential.

Economic Uncertainty and Market Volatility

Economic fluctuations pose a considerable challenge to the stability of Australia’s venture capital market. Factors such as rising or fluctuating interest rates, inflationary pressures, and unpredictable shifts in investor sentiment can impact the availability and timing of funding. During periods of uncertainty, investors often adopt a more cautious approach, favoring lower-risk opportunities over early-stage or high-growth ventures. According to the Australia venture capital market analysis, this hesitancy can slow down deal activity, delay fundraising rounds, and restrict the flow of capital to innovative but riskier startups. Additionally, global market volatility, driven by geopolitical tensions, trade disruptions, or international economic downturns, can further influence domestic investment trends. Maintaining consistent investor confidence in such conditions requires resilient market strategies and supportive policy measures to ensure continued capital flow into Australia’s startup ecosystem.

Talent Retention and Scaling Constraints

The Australian startup ecosystem faces ongoing challenges in retaining top-tier talent and scaling businesses beyond domestic borders. With a relatively small home market, startups must expand internationally to achieve significant growth, yet this process is often constrained by limited resources and market access barriers. At the same time, intense competition for skilled professionals, particularly in technology, engineering, and advanced manufacturing, makes talent acquisition and retention increasingly difficult. High demand from both domestic and international employers can lead to talent migration, further straining local capabilities. These challenges can slow product development, reduce operational efficiency, and hinder the execution of growth strategies. Addressing these issues is critical for ensuring that funded startups can maintain momentum and compete effectively on a global scale.

Australia Venture Capital Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on sector, fund size, and funding type.

Sector Insights:

- Software

- Pharma and Biotech

- Media and Entertainment

- Medical Devices and Equipment

- Medical Services and Systems

- IT Hardware

- IT Services and Telecommunication

- Consumer Goods and Recreation

- Energy

- Others

The report has provided a detailed breakup and analysis of the market based on the sector. This includes software, pharma and biotech, media and entertainment, medical devices and equipment, medical services and systems, IT hardware, IT services and telecommunication, consumer goods and recreation, energy and others.

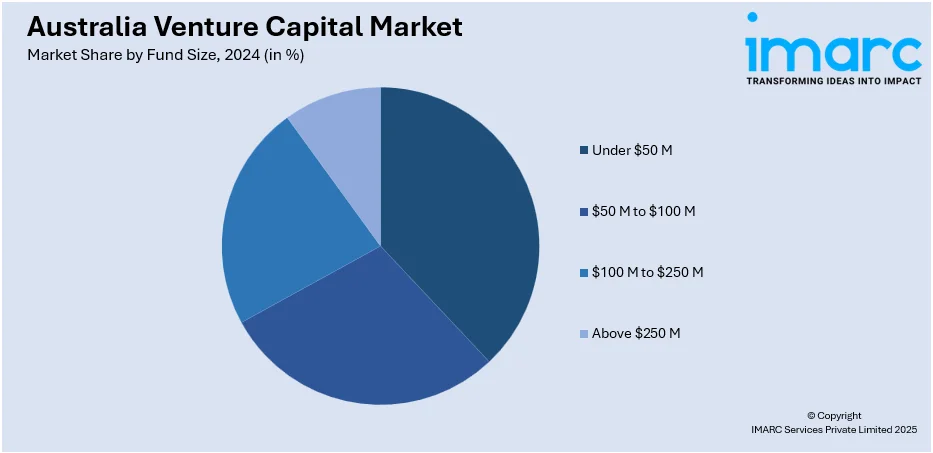

Fund Size Insights:

- Under $50 M

- $50 M to $100 M

- $100 M to $250 M

- Above $250 M

A detailed breakup and analysis of the market based on the fund size have also been provided in the report. This includes under $50 M, $50 M to $100 M, $100 M to $250 M, and above $250 M.

Funding Type Insights:

- First-Time Venture Funding

- Follow-on Venture Funding

The report has provided a detailed breakup and analysis of the market based on the funding type. This includes first-time venture funding and follow-on venture funding.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Venture Capital Market News:

- In July 2023, WEHI, Australia’s oldest medical research institute, launched a $66 million venture capital fund, 66ten. The fund aims to support early-stage scientific discoveries, targeting pre-seed and seed stages, with the goal of replicating past commercial successes like the $400 million sale of royalty rights for the cancer drug Venetoclax. Since its launch, 66ten has made 12 investments, including a project developing a drug for Prader-Willi syndrome. The fund will be invested over 10 years, with financial returns reinvested into WEHI’s research to drive further medical innovations.

- In July 2024, Sydney-based venture capital firm EVP announced that it has raised $20 million for its fifth fund, with plans to grow the fund to $500 million over the next decade. The new "evergreen" fund targets growth-stage software companies in Australia and New Zealand, aiming for investments of up to $20 million per company. EVP currently manages $300 million across its portfolio, which includes over 40 B2B software companies. The fund will focus on underserved segments of the software market and aims for a 25% gross internal rate of return, with investors able to redeem their units quarterly after a three-year holding period.

- In June 2024, Brandon Capital, Australasia’s leading life sciences venture capital firm, launched its sixth fund, Brandon Capital Fund VI, with an initial close of A$270 million (US$ 180 million). The fund supports Australian and New Zealand life sciences startups and scale-ups, with plans to expand into the United Kingdom, Europe, and the United States.

Australia Venture Capital Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Software, Pharma and Biotech, Media and Entertainment, Medical Devices and Equipment, Medical Services and Systems, IT Hardware, IT Services and Telecommunication, Consumer Goods and Recreation, Energy, Others |

| Fund Sizes Covered | Under $50 M, $50 M to $100 M, $100 M to $250 M, Above $250 M |

| Funding Types Covered | First-Time Venture Funding, Follow-on Venture Funding |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia venture capital market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia venture capital market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia venture capital industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The venture capital market in Australia was valued at USD 4.1 Billion in 2024.

The Australia venture capital market is projected to exhibit a CAGR of 9.1% during 2025-2033.

The Australia venture capital market is projected to reach a value of USD 9.5 Billion by 2033.

The Australia venture capital market is witnessing growth driven by increased funding in technology startups, rising interest in clean energy and fintech, and greater participation from international investors. Expanding government support, innovation hubs, and corporate venture arms are further shaping investment patterns, fostering diversification and long-term market development.

The Australia venture capital market is driven by a thriving startup ecosystem, supportive government policies, and increasing investor appetite for high-growth sectors like technology, healthcare, and renewable energy. Enhanced access to global capital and innovation networks further boosts funding opportunities and market expansion potential.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)