Australia Veterinary Market Size, Share, Trends, and Forecast by Product, Animal Type, and Region, 2026-2034

Australia Veterinary Market Overview:

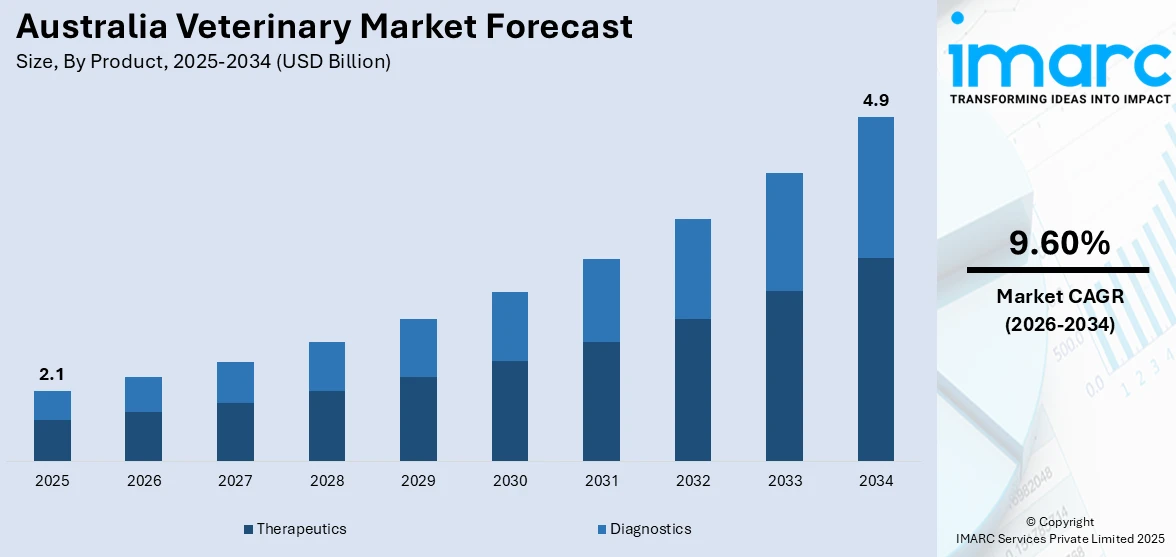

The Australia veterinary market size reached USD 2.1 Billion in 2025. Looking forward, the market is expected to reach USD 4.9 Billion by 2034, exhibiting a growth rate (CAGR) of 9.60% during 2026-2034. The market is propelled by the increasing pet ownership and humanization of pets, advances in veterinary medicine and technology, rising awareness about animal health and welfare, growth of pet insurance, expansion of specialty veterinary services, demographic changes and urbanization, and regulatory developments and compliance.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.1 Billion |

| Market Forecast in 2034 | USD 4.9 Billion |

| Market Growth Rate (2026-2034) | 9.60% |

Key Trends of Australia Veterinary Market:

Increasing Pet Ownership and Changing Attitudes Toward Pets

The growth in the veterinary business in Australia can be associated with the escalating pet ownership and transforming perception about pets. According to RSPCA, Australia has approximately 28.7 million pets. The growth is being driven by a variety of demographic variables such as single-family growth, aging populations, urbanization amongst others. Individuals living in solitude or small families mostly use pets as companions, which again increases the demand for pets and their service offerings. There has also been a change in attitudes of Australians toward their pets. They are increasingly being regarded as members of the family, and owners do not hesitate to spend considerable amounts of money on them through veterinary services, such as routine check-ups and vaccinations to advanced treatments such as dentistry, orthopedic surgery, and sophisticated diagnostic tests. Besides this, humanization of pets has opened opportunities for holistic and preventive health care options that include pet insurance, wellness programs, and dietary supplements.

To get more information on this market Request Sample

Rising Awareness About Animal Health and Welfare

The veterinary industry in Australia is expanding due in large part to rising public awareness about the necessity of animal health and welfare. Public concerns about the moral treatment and care of animals and government legislation around animal health have raised awareness. More stringent laws prohibiting animal abuse, breeding welfare requirements, and import limitations on exotic pets have all been introduced to boost the awareness regarding the importance of protecting the health and welfare of farm and companion animals. Media coverage and education efforts have also helped raise public knowledge of common pet health issues, including as preventable viral diseases, dental disorders, and obesity. Besides this, the increasing number of pet adoptions from shelters and rescues which can be attributed to public campaigns is further propelling the market growth. As per RSPCA, around 69% of Australian households own pets, with dogs being highly prevalent (48%), followed by cats at 33%. This increase in the number of pet adoptions is further boosting the demand for veterinary services.

Growth Factors of Australia Veterinary Market:

Expansion of Pet Insurance and Financial Accessibility

The growing uptake of pet insurance in Australia is significantly enhancing access to veterinary care. When entrepreneurs invest in insurance schemes, they tend to access professional care regarding preventive, diagnostic, and intensive medical care. Pet insurance will reduce pet vet bills, allowing high-value services to be available to more customers regardless of their income. Some insurers have also been providing customised packages on chronic illness, surgery, and even wellness care. This monetary buffer gives owners the confidence in making healthcare decisions without procrastination. As competition grows among providers, affordable monthly payment options and digital claims processes are making veterinary care more mainstream, especially in urban and suburban areas, supporting the overall Australia veterinary market demand.

Advances in Veterinary Technology and Services

Technological innovation is reshaping veterinary practices across Australia. From digital imaging and in-house diagnostics to telehealth consultations and laser surgeries, veterinary clinics are adopting cutting-edge tools to improve care accuracy and efficiency. Advanced diagnostic capabilities like blood analyzers, wearable pet monitors, and AI-assisted imaging support early disease detection and better treatment outcomes. Veterinary hospitals are increasingly offering specialized services, such as dental care, orthopedics, oncology, and rehabilitation. These service expansions are transforming clinics into multi-functional animal health centers. The rise of tele-vet platforms also enables virtual consultations, especially useful in remote or underserved areas. According to the Australia veterinary market analysis, these technological advancements are driving client satisfaction, improving clinical results, and attracting both new clients and professional talent to the sector.

Government Initiatives and Regulatory Support

The Australian government’s active involvement in animal health and welfare is a key enabler for the veterinary industry. Regulatory frameworks supporting livestock health, disease surveillance, and national biosecurity have led to increased demand for professional veterinary services. Additionally, funding and grants for rural veterinary programs help address care shortages in remote areas. Government-backed campaigns on zoonotic disease prevention and responsible pet care further stimulate demand for regular vet check-ups and vaccinations. Educational outreach and collaboration with industry bodies ensure that standards are maintained across clinics. These coordinated efforts reinforce public trust in veterinary services and create a more structured environment for market growth, particularly in both the companion animal and livestock segments.

Australia Veterinary Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product and animal type.

Product Insights:

- Therapeutics

- Vaccines

- Parasiticides

- Anti Infectives

- Medical Feed Additives

- Others

- Diagnostics

- Immunodiagnostic Tests

- Molecular Diagnostics

- Diagnostic Imaging

- Clinical Chemistry

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes therapeutics (vaccines, parasiticides, anti infectives, medical feed additives, and others) and diagnostics (immunodiagnostic tests, molecular diagnostics, diagnostic imaging, clinical chemistry, and others).

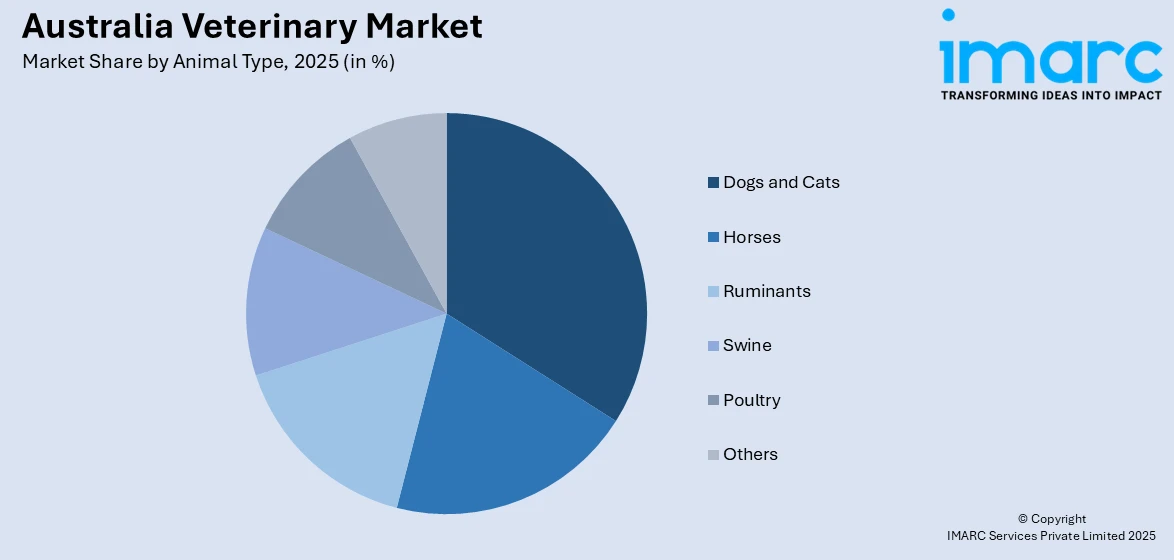

Animal Type Insights:

Access the comprehensive market breakdown Request Sample

- Dogs and Cats

- Horses

- Ruminants

- Swine

- Poultry

- Others

A detailed breakup and analysis of the market based on the animal type have also been provided in the report. This includes dogs and cats, horses, ruminants, swine, poultry, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Veterinary Market News:

- In February 2025, Medigrowth Australia 's announced the launch of Kindered, its new company for medicinal cannabis. The company also initiated crowdfunding project targeted to revolutionize veterinary care by utilizing medicinal cannabis.

- March 20, 2024: The CVS Group, a veterinary consolidator from the UK, announced the expansion of its presence in Australia by acquiring over a dozen veterinary clinics. This signals a trend of increasing ownership concentration in the Australian veterinary profession, similar to levels seen in the UK and US. The company plans to acquire more practices in Australia, aiming to capitalize on the growing pet population and consumer willingness to invest in veterinary care.

Australia Veterinary Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Animal Types Covered | Dogs and Cats, Horses, Ruminants, Swine, Poultry, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia veterinary market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia veterinary market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia veterinary industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The veterinary market in Australia was valued at USD 2.1 Billion in 2025.

The Australia veterinary market is projected to exhibit a CAGR of 9.60% during 2026-2034.

The Australia veterinary market is projected to reach a value of USD 4.9 Billion by 2034.

The Australian veterinary market is witnessing a shift toward integrated wellness care, with increasing use of wearable health trackers and personalized treatment plans. Mobile veterinary services are expanding, improving access in regional areas. Additionally, sustainability in animal healthcare, including eco-friendly pharmaceuticals and waste reduction, is becoming a growing industry focus.

The increasing awareness about animal mental health and behavior management is driving demand for professional veterinary support. Government initiatives supporting disease surveillance and animal welfare compliance further boost the sector. Moreover, rising demand for premium pet insurance plans is enabling pet owners to afford advanced treatments, fueling overall market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)