Australia Video Streaming Market Report by Component (Solution, Services), Streaming Type (Live/Linear Video Streaming, Non-Linear Video Streaming), Revenue Model (Subscription, Transactional, Advertisement, Hybrid), End User (Personal, Commercial), and Region 2025-2033

Australia Video Streaming Market Size and Share:

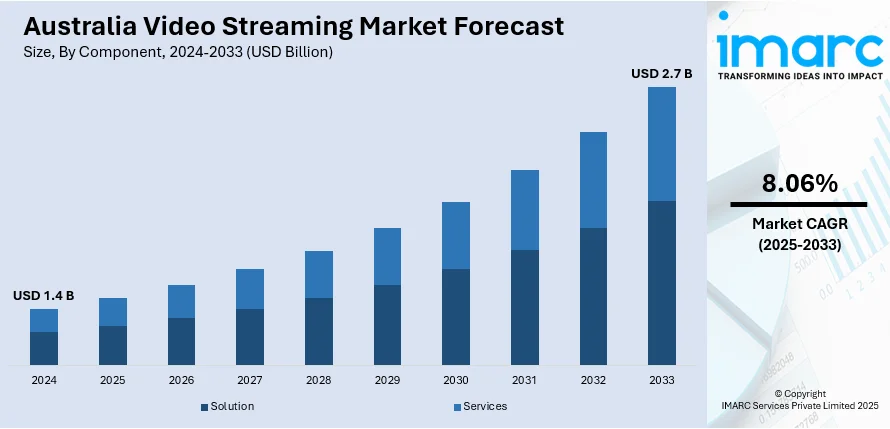

The Australia video streaming market size reached USD 1.4 Billion in 2024. Looking forward, the market is expected to reach USD 2.7 Billion by 2033, exhibiting a growth rate (CAGR) of 8.06% during 2025-2033. The market is driven by the rising demand for improved internet infrastructure and faster broadband rates, which allow people to watch high-definition (HD) and ultra-high-definition (UHD) content without buffering, along with the increasing number of digital advertisements.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.4 Billion |

| Market Forecast in 2033 | USD 2.7 Billion |

| Market Growth Rate 2025-2033 | 8.06% |

Key Trends of Australia Video Streaming Market:

Increased Internet Penetration

The video streaming market in Australia is primarily driven by the increased internet penetration in the country. According to the Australian Internet Statistics 2024, the number of internet users in Australia increased by 248 thousand between 2023 and 2024. This escalation in internet users supported by improved internet infrastructure and faster broadband rates has facilitated people in watching high-definition (HD) and ultra-high-definition (UHD) content without buffering. The improvement in viewing quality makes streaming services more appealing than traditional TV and lower-quality streaming alternatives. Widespread internet connectivity enables more people, even those in rural and distant places, to access video streaming services. This reach expands the potential subscriber base for streaming platforms in the country. Higher internet penetration is frequently associated with increased ownership of smart gadgets, such as smart TVs, tablets, and smartphones. These devices are essential for accessing streaming content, and their widespread use promotes the expansion of the video streaming market.

To get more information of this market, Request Sample

Improved internet infrastructure fosters the expansion of cloud-based services, such as video streaming. Streaming platforms leverage cloud storage and delivery networks to efficiently manage and distribute massive amounts of content to users in Australia. As internet access is becoming more prevalent, competition among internet service provider (ISPs) is driving rates down. More inexpensive internet connectivity enables people to subscribe to various streaming services without incurring hefty data fees.

Digital Advertising

As per the content published on the website of the IAB Australia in June 2024, online advertising expenditure has increased 9.3% year-on-year in Australia. Many video streaming sites, particularly those with free or ad-supported tiers rely on digital advertising as their primary revenue source. The increase in digital ad expenditure enables these platforms to invest in content, enhance the user experience, and provide more competitive services. Advanced digital advertising technologies allow for highly tailored adverts based on user data, preferences, and viewing behaviors. This precision improves the efficiency of advertisements, making it more tempting for marketers to invest in video streaming networks. This personalized strategy ensures that viewers see more relevant adverts, which improves their overall experience. Ad-supported streaming systems, which generate revenue from digital advertising, might provide lower membership fees or even free access to content. This concept appeals to a broader audience, including those who might be unwilling to pay for premium subscriptions. The expansion of digital advertising is resulting in higher ad spending on video streaming platforms. As marketers shift their resources from traditional media to digital channels, video streaming services gain a growing proportion of the advertising market.

Digital advertising enables new ad formats, such as interactive commercials, skippable ads, and dynamic ad placement. These formats engage viewers more successfully and provide advertisers with a higher return on investment (ROI), which encourages additional investments in streaming platforms. Streaming platforms utilize data analytics to provide advertisers with detailed information about viewer behavior and ad performance. This data-driven strategy allows advertisers to enhance their campaigns and makes streaming platforms a more appealing option for ad expenditure.

Growth Drivers of Australia Video Streaming Market:

Expanding On-Demand Content Libraries

The Australia video streaming market is benefiting from the continuous expansion of on-demand content libraries. Platforms are offering an increasingly diverse selection of movies, TV series, documentaries, live events, and niche programs, catering to a broad spectrum of audience preferences. By including both global blockbusters and localized productions, services can appeal to mainstream viewers while also satisfying the tastes of niche audiences. Exclusive original content, combined with strategic licensing agreements, is further boosting subscriber loyalty and engagement. This breadth of choice encourages viewers to explore new genres and remain subscribed over the long term. As competition intensifies, the variety, quality, and regular updating of these content catalogs will remain a crucial factor in sustaining audience growth and platform success.

Rising Smartphone and Smart TV Adoption

The growing adoption of smartphones, smart TVs, and other connected devices is significantly fueling the Australia video streaming market share. With high-resolution screens, user-friendly interfaces, and improved connectivity, consumers can access streaming platforms seamlessly at home or on the go. The widespread use of smart TVs allows for cinematic experiences in living rooms, while mobile streaming caters to the demand for flexibility and convenience. Integration of voice assistants, app stores, and personalized recommendations within these devices further enhances viewing engagement. This accessibility empowers users to consume content whenever and wherever they choose, increasing total watch time and subscriber numbers. As device penetration deepens, streaming services can leverage these platforms to deliver smoother, more immersive, and personalized user experiences.

Competitive Subscription Pricing Models

Flexible and competitive pricing strategies are playing a vital role in attracting and retaining subscribers in the Australia video streaming market growth. Providers are offering a range of subscription options, from low-cost entry plans to premium ad-free packages with added benefits. Bundled deals with telecom operators, internet service providers, or other digital platforms further enhance affordability and convenience for consumers. Seasonal promotions, free trial periods, and loyalty rewards also help reduce subscription barriers and encourage new sign-ups. By catering to different income levels and viewing needs, these tailored pricing models are broadening the market’s reach. The combination of affordability, flexibility, and value-added offerings enables streaming services to engage a wider audience base while maintaining competitiveness in a crowded marketplace.

Opportunities of Australia Video Streaming Market:

Growth in Local Content Production

The Australia video streaming market is witnessing strong growth opportunities through increased investment in locally produced films, TV series, and documentaries. Streaming platforms are collaborating with Australian writers, directors, and production houses to create original content that reflects local culture, values, and storytelling styles. Such productions not only appeal to domestic audiences but also enhance global exposure for Australian talent. Viewers often connect more deeply with relatable characters, familiar landscapes, and culturally relevant narratives, leading to stronger engagement and brand loyalty. Additionally, local content often benefits from government incentives and grants, making it an attractive investment for streaming providers. By prioritizing high-quality Australian productions, platforms can strengthen their competitive position while supporting the growth of the national entertainment industry.

Expansion into Rural and Regional Markets

Untapped rural and regional markets in Australia present substantial opportunities for video streaming platforms as digital infrastructure improves. With ongoing investments in high-speed internet and mobile network coverage, more households in remote areas are gaining reliable access to streaming services. These markets often have fewer entertainment options, creating strong potential for subscriber growth once accessibility barriers are addressed. Offering tailored content, including regional stories and genres relevant to rural audiences, can further enhance the Australia video streaming market demand. Flexible pricing models and offline viewing capabilities can also help overcome connectivity challenges. By actively targeting these regions, streaming providers can broaden their customer base, diversify revenue streams, and contribute to bridging the digital divide across Australia’s geographically diverse population.

Multi-Language and Accessibility Features

Integrating multi-language and accessibility features is becoming an important growth avenue for Australia’s video streaming platforms. The country’s culturally diverse population creates strong demand for content that can be enjoyed in different languages, supported by subtitles, dubbing, or closed captions. Adding these options allows services to reach non-English-speaking audiences, including migrant communities, more effectively. Accessibility tools such as audio descriptions, high-contrast interfaces, and customizable subtitles enhance inclusivity for viewers with visual or hearing impairments. These features not only expand the potential subscriber base but also demonstrate a platform’s commitment to diversity and user experience. As inclusivity becomes a competitive differentiator, investing in robust language and accessibility options can significantly improve audience reach, engagement, and customer loyalty across Australia’s streaming market.

Challenges of Australia Video Streaming Market:

High Competition and Market Saturation

The Australia video streaming market is becoming increasingly competitive, with numerous global and local platforms vying for audience attention. Established players such as Netflix, Disney+, and Amazon Prime Video compete alongside domestic services and niche content providers, making differentiation a significant challenge. Consumers have a vast choice of platforms, leading to subscription fatigue and selective spending on services that offer the best perceived value. To stand out, providers must focus on exclusive content, superior user experiences, and innovative engagement strategies. However, achieving this differentiation requires substantial investment in technology, marketing, and creative production. As competition intensifies, sustaining subscriber growth and loyalty becomes more complex, compelling platforms to continuously innovate while managing costs in a highly saturated marketplace.

Content Licensing and Rights Limitations

Securing rights for popular and in-demand titles remains a persistent challenge for streaming platforms in Australia. Content licensing agreements are often competitive and expensive, with major studios and distributors prioritizing exclusive deals that can restrict access for smaller or newer services. According to the Australia video streaming market analysis, limitations on high-demand films, TV shows, and live events can significantly impact a platform’s attractiveness and hinder long-term viewer retention. Additionally, licensing restrictions may vary by region, meaning some titles available internationally may be absent in the Australian catalog, frustrating consumers. To address this, platforms must balance licensing acquisitions with investment in original programming to fill content gaps. However, developing compelling originals requires substantial time and resources, making this a complex hurdle for many streaming providers.

Rising Infrastructure and Production Costs

Delivering high-quality streaming experiences and producing original content are becoming increasingly costly for platforms in Australia. Rising expenses related to server capacity, bandwidth, and advanced streaming technologies, such as 4K resolution and HDR, can strain operational budgets, especially for smaller providers. Original content production, essential for attracting and retaining subscribers, demands significant investment in talent, equipment, and marketing. Inflationary pressures and competitive bidding for production resources further escalate costs. For platforms without large-scale subscriber bases, these financial demands can limit their ability to innovate or expand their content libraries. To remain profitable, providers must find efficient ways to manage infrastructure expenses while producing engaging, high-quality content that justifies subscription fees in an increasingly competitive market environment.

Australia Video Streaming Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component, streaming type, revenue model, and end user.

Component Insights:

- Solution

- IPTV

- Over-the-top

- Pay TV

- Services

- Consulting

- Managed Services

- Training and Support

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution (IPTV, over-the-top, and pay TV) and services (consulting, managed services, and training and support).

Streaming Type Insights:

- Live/Linear Video Streaming

- Non-Linear Video Streaming

A detailed breakup and analysis of the market based on the streaming type have also been provided in the report. This includes live/linear video streaming and non-linear video streaming.

Revenue Model Insights:

- Subscription

- Transactional

- Advertisement

- Hybrid

The report has provided a detailed breakup and analysis of the market based on the revenue model. This includes subscription, transactional, advertisement, and hybrid.

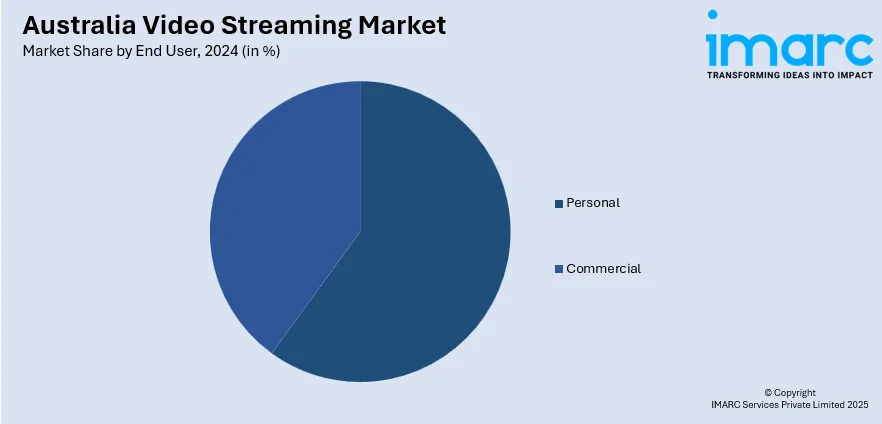

End User Insights:

- Personal

- Commercial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes personal and commercial.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Video Streaming Market News:

- May 2024: Paramount Global is expected to launch its ad-supported streaming service in Canda and Australia. The company also plans to introduce high prices, premium version of the service across Europe.

Australia Video Streaming Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Streaming Types Covered | Live/Linear Video Streaming, Non-Linear Video Streaming |

| Revenue Models Covered | Subscription, Transactional, Advertisement, Hybrid |

| End Users Covered | Personal, Commercial |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia video streaming market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia video streaming market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia video streaming industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The video streaming market in Australia was valued at USD 1.4 Billion in 2024.

The Australia video streaming market is projected to exhibit a CAGR of 8.06% during 2025-2033.

The Australia video streaming market is projected to reach a value of USD 9.5 Billion by 2033.

The Australia video streaming market is witnessing trends such as rising investment in local content production, growing adoption of smart devices, and the integration of multi-language and accessibility features. Increasing competition is driving exclusive content creation, while expanding regional reach and personalized viewing experiences are shaping audience engagement and market growth.

The Australia video streaming market is driven by expanding on-demand content libraries, rising adoption of smartphones and smart TVs, and competitive subscription pricing models. Enhanced user experiences, combined with flexible viewing options, are attracting diverse audiences and boosting engagement across both urban and regional markets.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)