Australia Video Surveillance Systems Market Size, Share, Trends and Forecast by System Type, Component, Application, Enterprise Size, Customer Type, and Region, 2025-2033

Australia Video Surveillance Systems Market Overview:

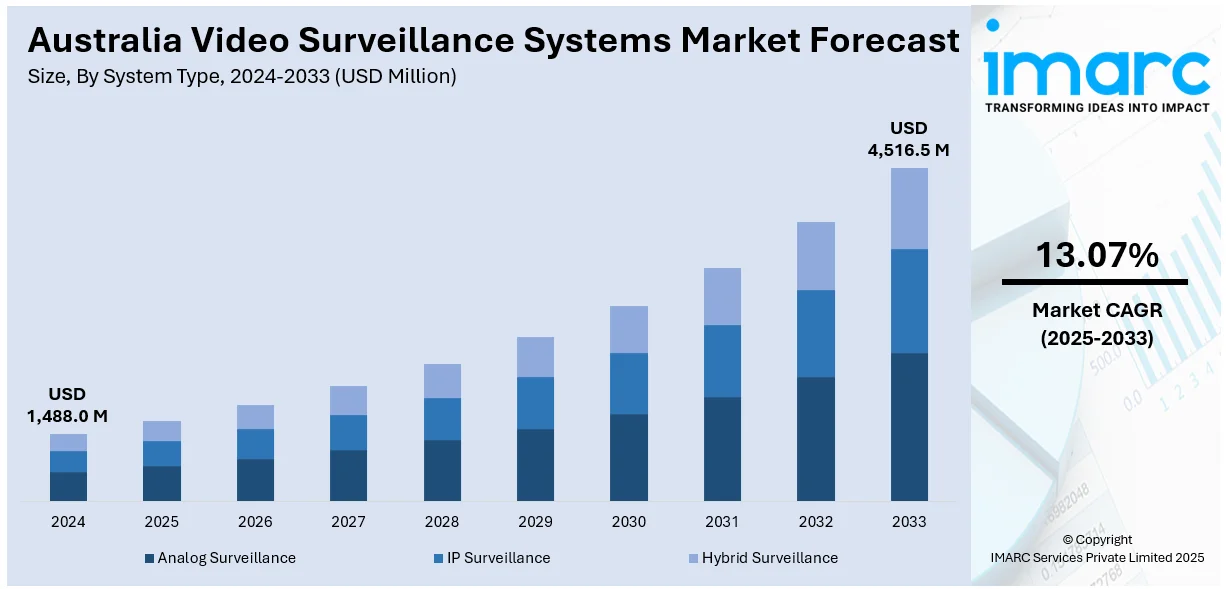

The Australia video surveillance systems market size reached USD 1,488.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 4,516.5 Million by 2033, exhibiting a growth rate (CAGR) of 13.13% during 2025-2033. The market is driven by rising security concerns, increasing adoption of AI and cloud-based solutions, and government investments in smart city projects. The growing demand for real-time monitoring, continual technological advancements, the need for enhanced public safety, cost-effective cloud storage, and compliance with data privacy regulations are some of the major factors augmenting Australia video surveillance systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,488.0 Million |

| Market Forecast in 2033 | USD 4,516.5 Million |

| Market Growth Rate 2025-2033 | 13.13% |

Australia Video Surveillance Systems Market Trends:

Increasing Adoption of AI-Powered Video Surveillance Systems

The market is experiencing a significant shift toward AI-powered solutions. A research report from the IMARC Group indicates that the artificial intelligence market in Australia was valued at USD 2,072.7 Million in 2024. It is projected to grow to USD 7,761.0 Million by 2033, reflecting a compound annual growth rate (CAGR) of 15.17% from 2025 to 2033. Organizations and governmental bodies are consolidating state-of-the-art surveillance technology to improve security, enhance threat detection, and mitigate the costs of operations. Surveillance, particularly AI-powered features, such as facial recognition, license plate recognition, and behavioral analysis, allows for initial monitoring of events live and allows action to be taken before an incident occurs. This trend is driven by increasing security concerns, such as burglary, property destruction, and danger to public safety, particularly in city areas and strategic infrastructure sites. Advances in deep learning and cloud-based analytics are also improving the accuracy and scalability of these systems. AI utilization allows connected surveillance systems to process more data and reduces false alarms. As a result, demand for AI-enhanced surveillance is growing across retail, transportation, and smart city projects, significantly supporting the Australia video surveillance systems market growth.

To get more information on this market, Request Sample

Growth of Cloud-Based Video Surveillance Solutions

In Australia, cloud-based video surveillance systems are gaining popularity due to their cost-effective, easy-to-set-up, and scalable design along with remote access capability. Unlike traditional on-premise systems, which require a sizable investment in hardware and considerable maintenance, cloud solutions offer flexible storage options, simple upgrades, and smooth integration with other IoT devices. Cloud surveillance is fast becoming the go-to solution for many businesses, particularly small and medium-sized enterprises (SMEs), seeking to monitor multiple locations from one central platform. Cloud systems allow constant monitoring from any mobile device, and the rise of remote work has accelerated this trend. In addition to that, cloud service providers improve data security by utilizing encryption and redundancy, which are essential to mitigate concerns around cyber-attacks. Moreover, the shift toward cloud-based solutions is also being driven by government regulations that promote data privacy and cybersecurity. Australia witnessed 47 Million data breaches in 2024, equating to one breach every second, ranking it as the 11th most affected country globally. Thus, the breach density was 1,785 incidents per 1,000 residents. Thus, this is also increasing the need for stronger data governance and privacy practices to protect sensitive financial information. Furthermore, the continuous advancements in bandwidth and 5G technology, offering a reliable and future-proof security infrastructure for various industries, are creating a positive Australia video surveillance systems market outlook.

Australia Video Surveillance Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on system type, component, application, enterprise size, and customer type.

System Type Insights:

- Analog Surveillance

- IP Surveillance

- Hybrid Surveillance

The report has provided a detailed breakup and analysis of the market based on the system type. This includes analog surveillance, IP surveillance, and hybrid surveillance.

Component Insights:

- Hardware

- Software

- Services

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes hardware, software, and services.

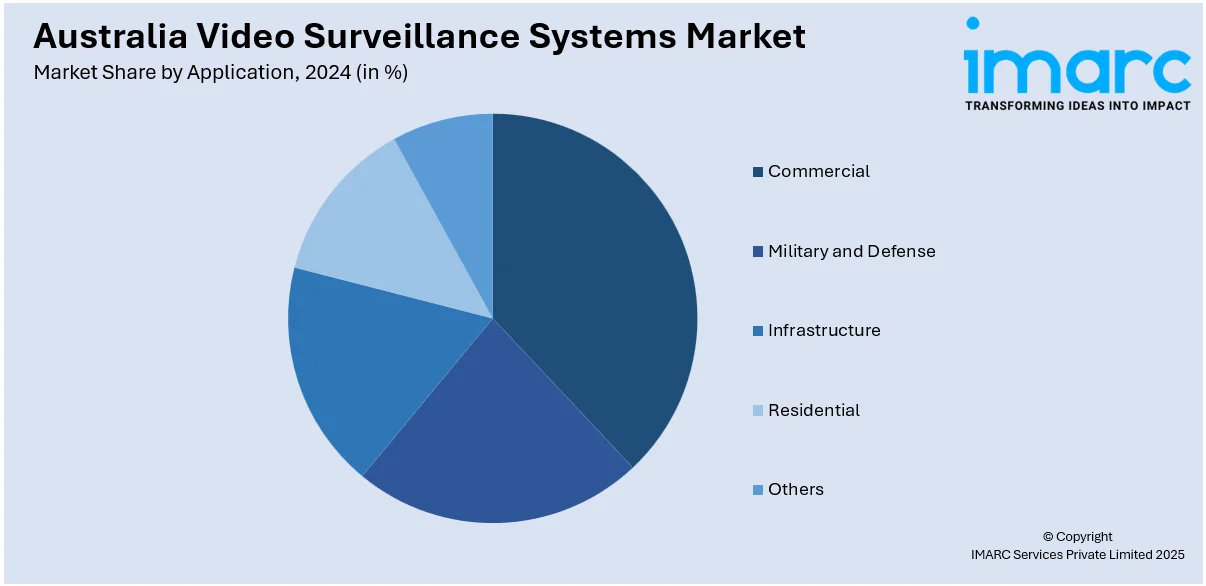

Application Insights:

- Commercial

- Military and Defense

- Infrastructure

- Residential

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes commercial, military and defense, infrastructure, residential, and others.

Enterprise Size Insights:

- Small Scale Enterprise

- Medium Scale Enterprise

- Large Scale Enterprise

A detailed breakup and analysis of the market based on the enterprise size have also been provided in the report. This includes small scale enterprise, medium scale enterprise, and large scale enterprise.

Customer Type Insights:

- B2B

- B2C

The report has provided a detailed breakup and analysis of the market based on the customer type. This includes B2B and B2C.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Video Surveillance Systems Market News:

- April 04, 2025: Synology launched its first AI smart research-grade Wi-Fi camera, CC400W, in Australia and New Zealand. At 2560×1440 resolution and 30 frames per second, this device provides better video quality than other devices, as well as AI functions, including People & Vehicle Detection. With IP65 weather resistance and multiple installations, small business owners and retailers need simple and elegant security solutions. The camera also offers secure video encryption and seamless integration with Synology's surveillance systems.

- October 02, 2024: Amazon launched its series of affordable smart home security cameras in Australia and New Zealand with the Outdoor 4 for AUD 149 (approximately USD 91.80) and Mini 2 for AUD 69 (approximately USD 42.51). Both models offer 1080p HD video quality, motion detection capabilities, and two-way audio, plus easy installation and long battery life. This launch addresses the increasing demand for affordable and user-friendly video surveillance options, reflecting the heightened interest in security across Australia.

Australia Video Surveillance Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| System Types Covered | Surveillance, IP Surveillance, Hybrid Surveillance |

| Components Covered | Hardware, Software, Services |

| Applications Covered | Commercial, Military and Defense, Infrastructure, Residential, Others |

| Enterprise Sizes Covered | Small Scale Enterprise, Medium Scale Enterprise, Large Scale Enterprise |

| Customer Types Covered | B2B, B2C |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia video surveillance systems market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia video surveillance systems market on the basis of system type?

- What is the breakup of the Australia video surveillance systems market on the basis of component?

- What is the breakup of the Australia video surveillance systems market on the basis of application?

- What is the breakup of the Australia video surveillance systems market on the basis of enterprise size?

- What is the breakup of the Australia video surveillance systems market on the basis of customer type?

- What is the breakup of the Australia video surveillance systems market on the basis of region?

- What are the various stages in the value chain of the Australia video surveillance systems market?

- What are the key driving factors and challenges in the Australia video surveillance systems market?

- What is the structure of the Australia video surveillance systems market and who are the key players?

- What is the degree of competition in the Australia video surveillance systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia video surveillance systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia video surveillance systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia video surveillance systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)