Australia Vocational Training Market Report by Training Type (Technical Training, Soft Skills Training, Safety Training, and Others), Delivery Mode (Online, Offline), End-User (Students, Corporate, Government, and Others), Industry Vertical (Healthcare, IT and Telecommunications, Manufacturing, Retail, and Others), and Region 2026-2034

Australia Vocational Training Market Overview:

The Australia vocational training market size reached USD 14.2 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 29.8 Billion by 2034, exhibiting a growth rate (CAGR) of 8.31% during 2026-2034. The growing industry-driven skill needs in key industries, such as information technology (IT), healthcare, and construction, increasing number of government-backed initiatives, and the integration of online learning platforms and digital tools are some of the factors supporting the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 14.2 Billion |

| Market Forecast in 2034 | USD 29.8 Billion |

| Market Growth Rate 2026-2034 | 8.31% |

Australia Vocational Training Market Trends:

Government Initiatives and Funding Support

Government-backed initiatives and funding are playing a pivotal role in supporting the sector in Australia. In 2024, the Australian Government is allocating $1.6 Billion to enhance reform in the higher education sector for translation and commercialization of university research through a novel stage-gated funding program. Additionally, various other initiatives are being undertaken by the government to provide free or low-cost training to job seekers and young people, particularly in industries facing skill shortages. This has encouraged more individuals to enroll in vocational courses, thereby expanding the market. Moreover, state-specific initiatives, such as "Fee-Free TAFE Skills Agreement" courses introduced to provide vocational training pathways by offering fully subsidized courses in high-demand sectors over 2023 to 2026. These developments ensure that vocational training remains accessible, affordable, and aligned with the country’s long-term economic growth goals.

To get more information on this market Request Sample

Industry-Driven Skills Demand and Partnerships

The evolving needs of key industries, such as information technology, healthcare, and construction, are driving the demand for vocational training in Australia. To address the rise in need for trained professionals, multiple industries have begun collaborating with vocational institutions. For instance, in 2023, TAFE Queensland partnered with Microsoft to offer advanced digital training, providing certifications along with blended learning. This collaboration enabled students to purchase their own software to complete their assessment tasks and instructors can also ask students to present documents directly via Microsoft 365. These industry collaborations ensure that vocational training programs are not only current but are also responsive to emerging trends, guaranteeing a job-ready workforce capable of meeting real-world demands.

Technological Advancements and Online Learning Integration

Technological advancements are a key enabler in transforming vocational education and training, particularly through the integration of online learning platforms and digital tools. The onset of digitalization saw a rise in virtual vocational training programs, catering to a more diverse and geographically dispersed student base. Additionally, in 2024 artificial intelligence (AI) like ChatGPT is allowed in all Australian schools. The adoption of AI and machine learning (ML) for personalized learning pathways has further enhanced the flexibility of vocational education, offering students tailored learning experiences and optimizing completion rates. The convenience and adaptability of online vocational programs have attracted a broader audience, including adult learners and working professionals looking to upskill or change careers, thereby increasing market demand.

Australia Vocational Training Market News:

- July 2024: Lumify Group, Australia’s largest provider of soft skills, corporate ICT, and digital skills training announced the launch of its digital solutions presenting as a standalone business division. This new division marks a major expansion of its digital skills training solutions.

- September 2024: HeliTSA launched EC135 Series airframe/avionics type training consisting of both classic and Helionix systems in Australia and Asia Pacific. The training format is according to the HeliTSA’s popular training model of covering the entire series in one course.

Australia Vocational Training Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on training type, delivery mode, end-user, and industry vertical.

Training Type Insights:

- Technical Training

- Soft Skills Training

- Safety Training

- Others

The report has provided a detailed breakup and analysis of the market based on the training type. This includes technical training, soft skills training, safety training, and others.

Delivery Mode Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the delivery mode have also been provided in the report. This includes online and offline.

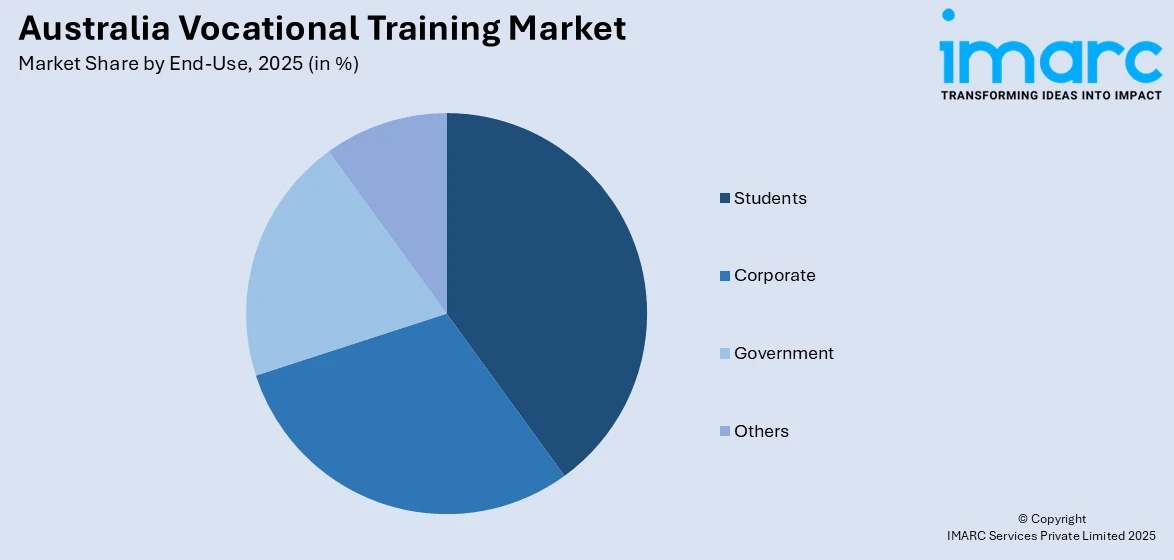

End-Use Insights:

Access the comprehensive market breakdown Request Sample

- Students

- Corporate

- Government

- Others

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes students, corporate, government, and others.

Industry Vertical Insights:

- Healthcare

- IT and Telecommunications

- Manufacturing

- Retail

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes healthcare, IT and telecommunications, manufacturing, retail, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Vocational Training Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Training Types Covered | Technical Training, Soft Skills Training, Safety Training, Others |

| Delivery Modes Covered | Online, Offline |

| End-Users Covered | Students, Corporate, Government, Others |

| Industry Verticals Covered | Healthcare, IT and Telecommunications, Manufacturing, Retail, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia vocational training market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Australia vocational training market?

- What is the breakup of the Australia vocational training market on the basis of training type?

- What is the breakup of the Australia vocational training market on the basis of delivery mode?

- What is the breakup of the Australia vocational training market on the basis of end-user?

- What is the breakup of the Australia vocational training market on the basis of industry vertical?

- What are the various stages in the value chain of the Australia vocational training market?

- What are the key driving factors and challenges in the Australia vocational training?

- What is the structure of the Australia vocational training market and who are the key players?

- What is the degree of competition in the Australia vocational training market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia vocational training market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia vocational training market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia vocational training industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)