Australia Wallpaper Market Size, Share, Trends and Forecast by Wallpaper Type, Distribution Channel, End User, and Region, 2026-2034

Australia Wallpaper Market Summary:

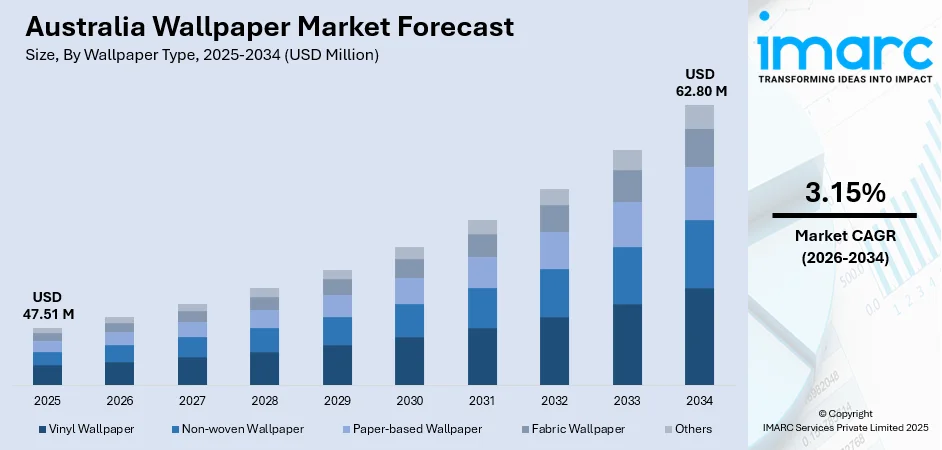

The Australia wallpaper market size was valued at USD 47.51 Million in 2025 and is projected to reach USD 62.80 Million by 2034, growing at a compound annual growth rate of 3.15% from 2026-2034.

The Australia wallpaper market is experiencing steady expansion, as consumers increasingly prioritize personalized interior design and home aesthetics. Growing interest in renovation activities, particularly among urban homeowners and renters seeking affordable transformation options, is driving demand across residential and commercial sectors. The rise of do-it-yourself (DIY) culture, coupled with advancements in peel-and-stick technology and digital printing, is making wallpaper more accessible to broader demographics. Sustainability concerns are reshaping consumer preferences towards eco-friendly materials, while nature-inspired and coastal-themed designs reflecting Australian identity continue to gain momentum across the market share.

Key Takeaways and Insights:

-

By Wallpaper Type: Vinyl wallpaper dominates the market with a share of 36.96% in 2025, owing to its exceptional durability, moisture resistance, and suitability for high-traffic commercial and residential environments. The segment benefits from growing demand for easy-to-maintain and long-lasting wall coverings.

-

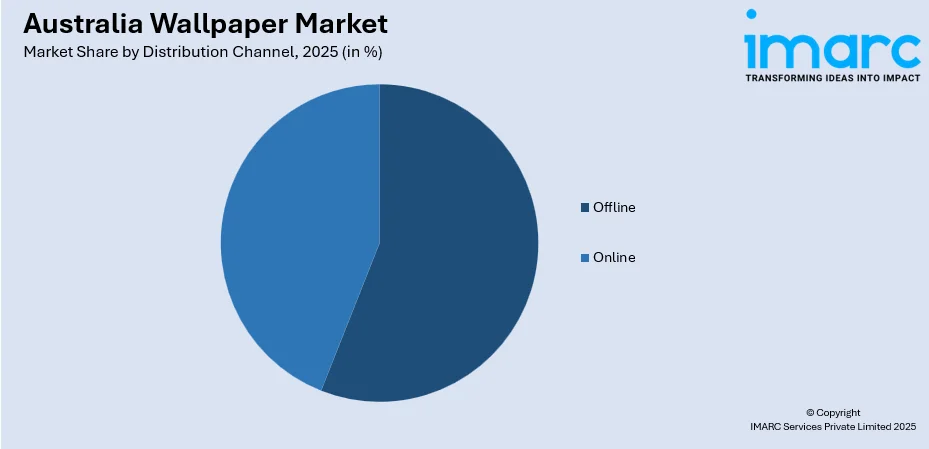

By Distribution Channel: Offline leads the market with a share of 55.99% in 2025. This dominance is driven by consumer preference for tactile evaluation, professional consultation services, and immediate product availability through specialty stores and home improvement retailers.

-

By End User: Commercial exhibits a clear dominance in the market with 54.15% share in 2025, reflecting strong demand from the hospitality, healthcare, retail, and corporate sectors seeking durable, aesthetically appealing wall treatments for professional environments.

-

By Region: Australia Capital Territory & New South Wales represents the largest region with 30% share in 2025, driven by the concentration of commercial construction activities, premium hospitality developments, and higher disposable incomes enabling premium interior design investments in Sydney metropolitan areas.

-

Key Players: Key players drive the Australia wallpaper market by expanding product portfolios, enhancing design innovation, and strengthening distribution networks. Their investments in sustainable manufacturing, digital printing technology, and partnerships with interior designers accelerate adoption and ensure consistent product availability across diverse consumer segments.

To get more information on this market Request Sample

The Australia wallpaper market is advancing as homeowners, businesses, and interior designers embrace versatile wall covering solutions for aesthetic enhancement and spatial transformation. Rising renovation activity is a primary catalyst, with KPMG Australia reporting that renovation spending climbed to account for 40% of total residential construction expenditure in 2023-24, representing a significant shift from new builds toward home improvements. This trend directly benefits the wallpaper industry as consumers seek cost-effective methods to refresh interiors without major structural changes. The commercial sector demonstrates particularly strong demand, with hotels, restaurants, offices, and healthcare facilities investing in Type II vinyl wallcoverings that meet stringent durability and fire safety requirements. Growing environmental consciousness is driving innovations in sustainable materials, including recycled paper substrates and water-based inks. The market is also benefiting from technological advancements in digital printing and peel-and-stick applications that expand design possibilities and simplify installation processes.

Australia Wallpaper Market Trends:

Rise of Nature-Inspired and Australiana Designs

Australian consumers increasingly favor wallpaper designs that reflect their connection to the natural environment and local identity. Patterns showcasing native wildflowers like eucalyptus, wattle, and banksia, along with wildlife motifs, such as cockatoos and kangaroos, are particularly appealing in residential uses. This biophilic design movement aligns with the broader Australiana interior trend emphasizing earthy tones and organic textures that bring outdoor elements indoors, creating calming atmospheres within urban living spaces.

Growing Adoption of Peel-and-Stick Removable Solutions

Removable peel-and-stick wallpaper is gaining substantial traction among Australia's growing rental population seeking customization options without lease violations. Major retailers stock extensive ranges of self-adhesive wallpapers, enabling renters in Melbourne, Sydney, and Brisbane to personalize spaces with easy application and damage-free removal. This trend supports the broader DIY culture while addressing practical concerns about temporary living arrangements and evolving design preferences. The popularity of short-term rentals and frequent relocation among young professionals further accelerates demand, as consumers seek stylish, low-commitment décor solutions that can be updated or removed effortlessly.

Expanding E-Commerce and Digital Retail Channels

The growth of e-commerce and digital retail platforms is transforming wallpaper purchasing behavior in Australia. As per IMARC Group, the Australia e-commerce market size was valued at USD 536.0 Billion in 2024. Online channels provide consumers with access to a wide range of designs, price points, and customization options that are not always available in physical stores. Virtual room visualizers, digital samples, and influencer-driven inspiration help buyers make confident purchase decisions. E-commerce reduces geographic limitations, enabling manufacturers to reach regional and remote consumers effectively. Competitive pricing, direct-to-consumer (D2C) models, and convenient delivery options further encourage online wallpaper sales.

Market Outlook 2026-2034:

The Australia wallpaper market outlook remains positive, as renovation activities continue to outpace new construction and consumer appetite for interior personalization strengthens. Sustained investments in commercial developments, particularly in the hospitality and healthcare sectors, are expected to maintain demand for durable Type II vinyl wallcoverings. The market generated a revenue of USD 47.51 Million in 2025 and is projected to reach a revenue of USD 62.80 Million by 2034, growing at a compound annual growth rate of 3.15% from 2026-2034. Innovations in sustainable materials and digital printing technologies will continue to expand design possibilities while addressing environmental concerns. Rising adoption of premium, custom-designed wallpapers in residential and boutique commercial spaces is further expected to support steady market expansion over the forecast period.

Australia Wallpaper Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Wallpaper Type | Vinyl Wallpaper | 36.96% |

| Distribution Channel | Offline | 55.99% |

| End User | Commercial | 54.15% |

| Region | Australia Capital Territory & New South Wales | 30% |

Wallpaper Type Insights:

- Vinyl Wallpaper

- Non-woven Wallpaper

- Paper-based Wallpaper

- Fabric Wallpaper

- Others

Vinyl wallpaper dominates with a market share of 36.96% of the total Australia wallpaper market in 2025.

Vinyl wallpaper maintains its leading position in Australia due to exceptional durability and versatility across both residential and commercial applications. The material's inherent moisture resistance, stain repellency, and scrubbable surface make it particularly suitable for high-traffic environments, including hotels, hospitals, schools, and restaurants. In Australia, manufacturers produce Type II commercial vinyl wallcoverings locally using certified inks, meeting stringent industry standards for fire safety and indoor air quality.

The segment benefits from technological advancements enabling diverse aesthetic options, ranging from textured finishes mimicking natural materials to vibrant digital prints. Commercial projects increasingly specify vinyl wallcoverings that comply with Australian Standard fire certification requirements while delivering design flexibility. The hospitality sector demonstrates strong preference for fabric-backed vinyl solutions that combine elegant appearances with practical maintenance requirements, supporting sustained demand growth across the professional interior design segment.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

Offline leads with a share of 55.99% of the total Australia wallpaper market in 2025.

Offline distribution channels maintain dominance in the Australia wallpaper market, as consumers prioritize tactile product evaluation before purchasing decisions. Physical retail environments enable customers to assess texture, color accuracy, and pattern scale, which remain difficult to replicate through digital interfaces. In-store consultations also help buyers receive expert guidance on material suitability, durability, and maintenance requirements. Additionally, physical stores build greater purchase confidence for high-value wallpaper investments used in long-term interior projects.

Specialty wallpaper showrooms and interior design studios continue to attract commercial clients requiring coordinated selections across large-scale projects. These channels offer sample ordering services, professional installation referrals, and customization options that justify premium pricing. The offline segment also benefits from immediate product availability, eliminating shipping delays, particularly important for time-sensitive renovation projects where contractors require coordinated material deliveries to maintain construction schedules efficiently. Strong relationships between designers, contractors, and retailers further strengthen offline sales channels.

End User Insights:

- Residential

- Commercial

Commercial exhibits a clear dominance with a 54.15% share of the total Australia wallpaper market in 2025.

The commercial segment drives the Australia wallpaper market through consistent demand from the hospitality, healthcare, corporate, and retail sectors requiring durable wall treatments. CBRE's Hotels Australia Overview and Outlook report demonstrated that Sydney's hotel sector achieved record revenue per available room (RevPAR) growth of 5% year-on-year in 2024, with 5,700 new hotel rooms under construction nationally. This hospitality expansion directly correlates with increased demand for premium commercial wallcoverings that enhance guest experiences while meeting operational durability requirements.

Commercial wallpaper specifications increasingly require Type II vinyl classifications ensuring compliance with fire safety standards, abrasion resistance, and cleanability essential for high-traffic professional environments. In Australia, healthcare facilities prioritize wallcoverings featuring antimicrobial properties and easy disinfection capabilities, while corporate offices seek sophisticated designs that reinforce brand identity and workplace aesthetics. The commercial segment benefits from larger project volumes and repeat specification by interior designers establishing long-term supplier relationships.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales represents the leading region with a 30% share of the total Australia wallpaper market in 2025.

Australia Capital Territory & New South Wales dominate the national wallpaper market, driven by Sydney's position as the country's largest commercial and hospitality hub. JLL reported that Sydney was set to record five new office project completions totaling 85,444 square meters in 2024. This concentrated commercial development activity generates substantial demand for professional-grade wallcoverings across corporate headquarters, retail spaces, and mixed-use developments. Ongoing refurbishment of aging office stock further supports replacement demand for high-performance wallpapers.

The region benefits from higher average disposable incomes enabling premium interior design investments and a concentration of architectural and interior design firms specifying wallpaper for residential and commercial projects. Affluent homeowners increasingly adopt customized and designer wallpaper solutions to reflect personalized aesthetics. Strong presence of luxury residential developments and high-end apartments further sustains demand for premium wallcoverings. Additionally, rising interest in sustainable and digitally printed wallpapers is encouraging designers to specify innovative products within high-end projects across the region.

Market Dynamics:

Growth Drivers:

Why is the Australia Wallpaper Market Growing?

Growth of Hospitality and Commercial Interior Design Sectors

The expansion of Australia’s hospitality, tourism, retail, and commercial sectors is significantly driving wallpaper demand. Australia’s travel and tourism industry is projected to contribute USD 314.4 Billion to the national economy in 2025, based on data from the World Travel & Tourism Council (WTTC). Hotels, restaurants, cafés, offices, and retail outlets increasingly use wallpaper to create distinctive brand identities and immersive interior environments. Feature walls, textured designs, and custom prints help businesses differentiate their spaces and enhance customer experience. Commercial wallpaper solutions are favored for their durability, ease of maintenance, and design flexibility compared to traditional wall finishes. Ongoing investments in hotels, mixed-use developments, and office refurbishments support consistent demand. Wallpaper also allows faster interior refresh cycles, enabling businesses to update aesthetics without major renovation costs. The rise of co-working spaces and boutique hospitality concepts further encourages creative interior applications. As commercial interiors increasingly prioritize visual appeal and experiential design, wallpaper continues to gain traction across Australia’s non-residential construction and renovation landscape.

Increasing Preferences for Sustainable and Eco-Friendly Interiors

Wallpaper and other interior décor choices are being influenced by Australian customers' growing awareness about environmental issues. Eco-friendly wallpapers composed of natural fibers, recyclable materials, and water-based inks are becoming more popular. Non-toxic wall coverings that promote healthier interior environments are gaining traction across the country. Younger homeowners and households that care about the environment are especially concerned about sustainability. In response, producers are providing products that are sourced ethically and complement green building techniques. Because wallpaper lasts longer than periodic repainting, it also contributes to sustainability objectives by lowering material waste. Green certifications and sustainability standards further promote the use of eco-friendly wall coverings in commercial projects. This move towards sustainable home design makes contemporary wallpaper options more appealing and establishes eco-friendly products as a developing market niche in Australia.

Rising Residential Renovation and Home Improvement Activities

The Australia wallpaper market is strongly driven by sustained growth in residential renovation and home improvement and decor activities. As per IMARC Group, the Australia home decor market size reached USD 15.6 Million in 2024. Homeowners increasingly focus on interior upgrades to enhance aesthetics, functionality, and property value rather than relocating. Wallpaper is gaining popularity as a cost-effective alternative to repainting, offering instant visual transformation with minimal disruption. Renovation trends emphasize personalized interiors, feature walls, and statement designs, all of which favor wallpaper adoption. Older housing stock in metropolitan and suburban areas is undergoing modernization, boosting demand for decorative wall coverings. Additionally, increased time spent at home has heightened consumer awareness of interior design, encouraging investment in stylish living spaces. Wallpaper’s ability to conceal wall imperfections further adds to its appeal in renovation projects. The availability of easy-to-install, peel-and-stick options supports DIY renovation trends, reducing reliance on professional installers.

Market Restraints:

What Challenges the Australia Wallpaper Market is Facing?

Competition from Alternative Wall Finishing Options

Alternative wall finishing techniques like paint, textured coatings, and decorative panels continue to compete with the wallpaper sector. Due to its widespread availability, easier application procedures, and less material costs, paint continues to be the most popular wall treatment option. Many customers believe that wallpaper installation calls for expert help, which raises additional expenses.

Higher Costs of Materials and Installation

In Australia, the wallpaper sector faces obstacles because of rising labor and material prices. Price-conscious customers may be discouraged from choosing wallpaper since professional wallpaper installation fees increase product expenses. Additionally, fluctuations in raw material costs and supply chain constraints further pressure manufacturers and installers, limiting pricing flexibility and affecting overall market affordability.

Limited Consumer Awareness About Modern Products

There are issues with consumer perception of contemporary wallpaper products and their ease of installation. Many prospective clients have antiquated perceptions of the challenging removal procedures and constrained design possibilities typical of previous generations. It is still necessary for the industry to educate consumers about modern peel-and-stick technologies, sustainable materials, and a variety of aesthetic options.

Competitive Landscape:

The Australia wallpaper market is characterized by moderate competition among international brands, domestic manufacturers, and specialty distributors serving diverse consumer segments. Companies compete through product differentiation, design innovations, and distribution network expansion. Australian manufacturers emphasize local production and sustainability credentials, while international brands leverage design heritage and extensive pattern libraries. Competition intensifies around commercial contracts requiring specialized certifications and performance specifications. Strategic partnerships with interior designers and architects influence commercial project specifications, while retail channel relationships determine residential market accessibility.

Australia Wallpaper Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Wallpaper Types Covered | Vinyl Wallpaper, Non-woven Wallpaper, Paper-based Wallpaper, Fabric Wallpaper, Others |

| Distribution Channels Covered | Online, Offline |

| End Users Covered | Residential, Commercial |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia wallpaper market size was valued at USD 47.51 Million in 2025.

The Australia wallpaper market is expected to grow at a compound annual growth rate of 3.15% from 2026-2034 to reach USD 62.80 Million by 2034.

Vinyl wallpaper dominated the market with a share of 36.96%, driven by exceptional durability, moisture resistance, and suitability for both commercial and residential high-traffic environments requiring easy maintenance.

Key factors driving the Australia wallpaper market include rising renovation activities, expanding commercial construction, growing consumer demand for personalized interiors, sustainability preferences, and technological advancements in removable and digital-printed wallpapers.

Major challenges include competition from alternative wall finishing options, elevated material and installation costs, limited consumer awareness of modern products, and perception barriers regarding installation complexity and removal processes.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)