Australia Warehouse Management Systems Market Size, Share, Trends and Forecast by Component, Deployment, Function, Application, and Region, 2025-2033

Australia Warehouse Management Systems Market Overview:

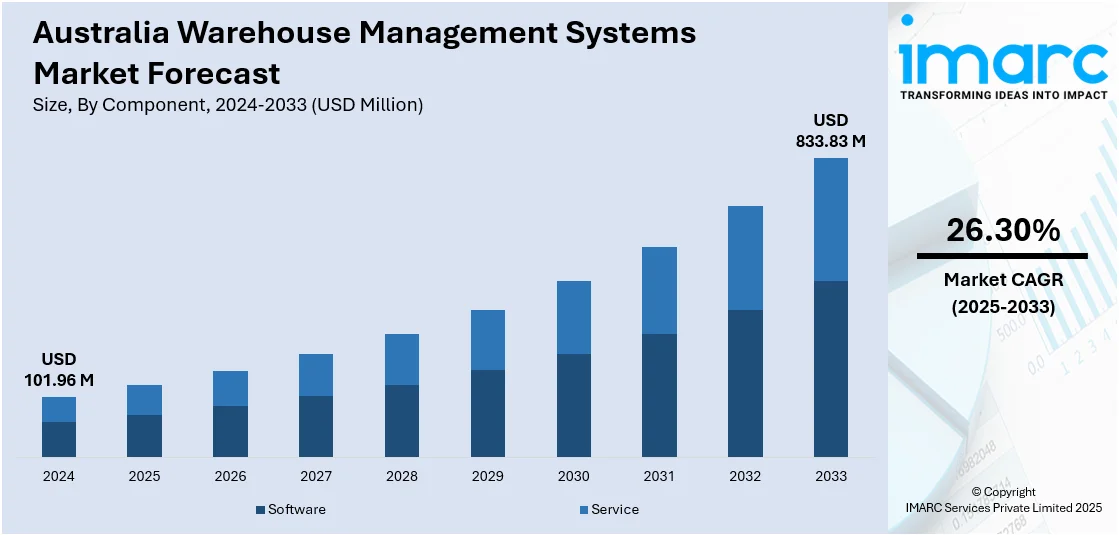

The Australia warehouse management systems market size reached USD 101.96 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 833.83 Million by 2033, exhibiting a growth rate (CAGR) of 26.30% during 2025-2033. At present, the growing expectation for same-day or next-day delivery is leading warehouses to operate faster, driving the demand for advanced systems that offer real-time updates and better workflow regulation. Besides this, the increasing integration of the Internet of Things (IoT) is contributing to the expansion of the Australia warehouse management systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 101.96 Million |

| Market Forecast in 2033 | USD 833.83 Million |

| Market Growth Rate 2025-2033 | 26.30% |

Australia Warehouse Management Systems Market Trends:

Expansion of e-commerce portals

The expansion of e-commerce portals is fueling the market growth. According to PCMI's data, the overall e-commerce volume in Australia for 2024 totaled USD 89.4 Billion. As people are shopping online, warehouses are handling a higher volume of small and diverse orders, driving the demand for solutions that aid in handling and dispatching products swiftly. Warehouse management systems assist in automating order picking, packing, and shipping processes. Real-time inventory tracking helps keep stock levels accurate, reducing delays and backorders. The system also improves order accuracy by guiding staff through optimized picking routes and minimizing human errors. The broadening of e-commerce platforms is encouraging the use of multiple storage locations, and warehouse management systems help coordinate these locations by centralizing data and streamlining operations. The system also manages returns more efficiently, which is important in online shopping where return rates are higher. With increased data from online sales, the system provides better forecasting, aiding businesses in preparing for demand spikes during sales and holiday seasons. The growing expectation for same-day or next-day delivery is leading warehouses to operate faster, and warehouse management systems assist in achieving this with real-time updates. In Australia’s vast geography, this efficiency is becoming more important, making warehouse management systems essential for meeting e-commerce demands and ensuring customer satisfaction.

To get more information on this market, Request Sample

Increasing integration of IoT

The rising adoption of IoT is impelling the Australia warehouse management systems market growth. Sensors and connected devices track the movement and condition of goods in real time, helping managers monitor inventory levels and reduce errors. Smart shelves send automatic updates to the system, which aids in faster order processing and minimizes manual checks. This technology also supports predictive maintenance by monitoring equipment performance and alerting managers before failures occur. Temperature and humidity sensors protect sensitive goods by maintaining ideal storage conditions. With IoT, warehouse staff use handheld or wearable devices to receive live updates and instructions, which improves coordination and decreases downtime. The system collects large amounts of data that support better planning and decision-making. Fleet tracking helps optimize delivery routes and ensures timely shipments. IoT makes warehouse operations more transparent, responsive, and cost-effective. In Australia, where distances are large and demand for fast delivery is high, IoT plays a significant role in meeting customer expectations and staying competitive. As per the IMARC Group, the Australia IoT market is set to attain USD 90.61 Billion by 2033, exhibiting a growth rate (CAGR) of 13.70% during 2025-2033.

Australia Warehouse Management Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, deployment, function, and application.

Component Insights:

- Software

- Service

The report has provided a detailed breakup and analysis of the market based on the component. This includes software and service.

Deployment Insights:

- On-premise

- Cloud

A detailed breakup and analysis of the market based on the deployment have also been provided in the report. This includes on-premise and cloud.

Function Insights:

- Labor Management System

- Analytics and Optimization

- Billing and Yard Management

- Systems Integration and Maintenance

- Consulting Services

The report has provided a detailed breakup and analysis of the market based on the function. This includes labor management system, analytics and optimization, billing and yard management, systems integration and maintenance, and consulting services.

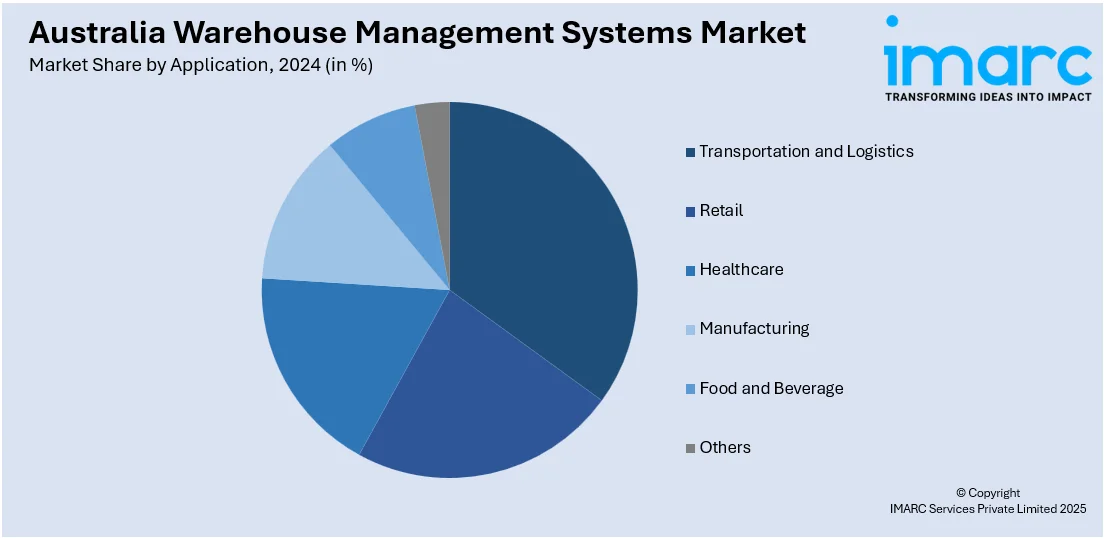

Application Insights:

- Transportation and Logistics

- Retail

- Healthcare

- Manufacturing

- Food and Beverage

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes transportation and logistics, retail, healthcare, manufacturing, food and beverage, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Warehouse Management Systems Market News:

- In September 2024, Softeon, the prominent tier-1 warehouse management system provider dedicated to enhancing warehouse and fulfillment efficiency, announced its expansion into Australia and New Zealand. The logistics community in both countries would have full access to the firm’s extensive range of fulfillment solutions aimed at maximizing value and ensuring rapid return on investment (ROI). The new team, located in Melbourne, Australia, was headed by Scott Gillies, Vice President and Managing Director for the region.

- In September 2024, Rose Rocket, a top provider of enterprise-grade, cloud-native transportation software for trucking firms, revealed a strategic alliance with CartonCloud, Australia’s leading warehouse and transport management software firm. The collaboration was intended to deliver advanced logistics solutions to a transportation sector worth over USD 110 Billion. It aimed to provide improved efficiency, personalization, and effortless network collaboration to logistics firms.

Australia Warehouse Management Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Service |

| Deployments Covered | On-premise, Cloud |

| Functions Covered | Labor Management System, Analytics and Optimization, Billing and Yard Management, Systems Integration and Maintenance, Consulting Services |

| Applications Covered | Transportation and Logistics, Retail, Healthcare, Manufacturing, Food and Beverage, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia warehouse management systems market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia warehouse management systems market on the basis of component?

- What is the breakup of the Australia warehouse management systems market on the basis of deployment?

- What is the breakup of the Australia warehouse management systems market on the basis of function?

- What is the breakup of the Australia warehouse management systems market on the basis of application?

- What is the breakup of the Australia warehouse management systems market on the basis of region?

- What are the various stages in the value chain of the Australia warehouse management systems market?

- What are the key driving factors and challenges in the Australia warehouse management systems market?

- What is the structure of the Australia warehouse management systems market and who are the key players?

- What is the degree of competition in the Australia warehouse management systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia warehouse management systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia warehouse management systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia warehouse management systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)