Australia Warehouse Market Size, Share, Trends and Forecast by Sector, Ownership, Type of Commodities Stored, and Region, 2025-2033

Australia Warehouse Market Overview:

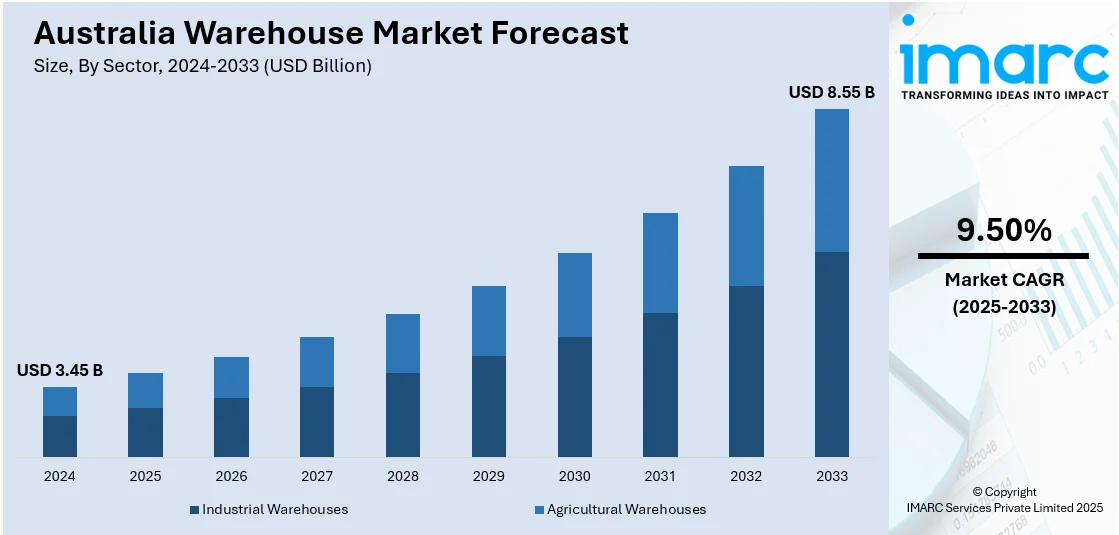

The Australia warehouse market size reached USD 3.45 Billion in 2024. Looking forward, the market is expected to reach USD 8.55 Billion by 2033, exhibiting a growth rate (CAGR) of 9.50% during 2025-2033. The rising e-commerce demand, increasing need for last-mile delivery solutions, industrial automation advancements, the expansion of cold storage facilities for food and pharmaceuticals, and significant investments in logistics infrastructure to support supply chain optimization are among the key factors contributing to the Australia warehouse market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.45 Billion |

| Market Forecast in 2033 | USD 8.55 Billion |

| Market Growth Rate 2025-2033 | 9.50% |

Key Trends of Australia Warehouse Market:

Surge in E-commerce and Demand for Last-Mile Delivery Solutions

The rapid growth of e-commerce is a key driver of the Australian warehouse market, particularly due to the increasing demand for last-mile delivery solutions. The pandemic accelerated the shift to online shopping, and this trend continues to shape consumer behavior in Australia, with online retail sales growing at a rapid pace every year. As e-commerce sales surge, companies require more warehousing space near urban areas to ensure faster deliveries. This has spurred demand for urban and regional distribution centers, particularly those equipped with advanced automated systems for efficient order processing. To meet this demand, warehouse operators are investing in technologies like automated sorting, robotic picking, and real-time inventory management. Companies such as Amazon and Woolworths are expanding their warehouse operations to support faster, same-day delivery, driving innovation and competition within the sector.

To get more information on this market, Request Sample

Increasing Investment in Cold Storage and Temperature-Controlled Warehousing

A significant trend driving the Australia warehouse market growth is the rising demand for cold storage and temperature-controlled warehousing, fueled by the increased need for perishable goods storage in both retail and the pharmaceutical industry. The expansion of e-commerce for food delivery and the growing pharmaceutical and biotechnology sectors have heightened the need for specialized storage solutions for fresh produce, frozen food, and medicines. In 2024, the Australian cold chain logistics market was valued at USD 5 billion and is expected to reach USD 7.1 billion by 2033, exhibiting a CAGR of 4.00% from 2025-2033. This expanding demand is driven by both domestic needs and Australia’s desire to be a key player in the global supply chain for temperature-sensitive products, such as COVID-19 vaccines and biotech goods. The surge in online grocery shopping has also boosted the demand for cold storage. Companies like Linfox and Cold Storage Group are investing in new facilities, such as Linfox’s state-of-the-art refrigerated warehouse in Melbourne, while sustainability concerns are prompting the adoption of energy-efficient technologies, further fueling market growth.

Growth Drivers of Australia Warehouse Market:

Expansion of Third-Party Logistics (3PL) Partnerships

The growing reliance on third-party logistics providers is a major driver of the Australian warehouse market. Businesses in industries are outsourcing distribution and storage to 3PLs to lower costs and improve operational flexibility. This is driven by the necessity of specialized services, including inventory control, tailored packaging, and coordinated supply chain solutions. Businesses can expand operations rapidly without large up-front capital expenditures on infrastructure by entering arrangements with 3PL providers. In addition, the growing sophistication of international supply chains and cross-border commerce has fueled the need for value-added warehousing services. As companies focus on agility and efficiency, 3PL-facilitated warehousing solutions continue to increase their footprint in Australia.

Adoption of Advanced Automation and Smart Technologies

Technological innovation is significantly boosting the Australian warehouse sector, with automation, robotics, and IoT integration enhancing efficiency and accuracy. Businesses are increasingly adopting automated storage and retrieval systems, AI-powered demand forecasting, and real-time inventory tracking to minimize errors and optimize space utilization. According to the Australia warehouse market analysis, these advancements also improve workforce productivity and reduce labor costs amid rising wages and labor shortages. Besides, data analytics usage helps gain improved insights into stock movement and customer demand, enabling more informed decision-making. With e-commerce and omnichannel retailing growing, technology-enabled warehouses are playing increasingly important roles in fulfilling consumers' expectations for speed and precision. The continued digitalization is thus a powerful force behind the development of the warehouse market in Australia.

Urbanization and Strategic Infrastructure Development

Rapid urbanization and infrastructure investment are reshaping the Australia warehouse market demand. As cities expand, the need for strategically located warehouses near urban centers has grown to support faster delivery and reduce transportation costs. Government-backed infrastructure projects, including road, rail, and port upgrades, are further driving market growth by improving connectivity across supply chains. Industrial zones and logistics hubs are being developed in key metropolitan areas, attracting large-scale warehouse construction. This focus on location efficiency is also aligning with the increasing preference for last-mile fulfillment. As both domestic and international companies invest in strategically positioned facilities, urbanization and infrastructure development emerge as crucial growth enablers for the Australian warehouse market.

Australia Warehouse Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on sector, ownership, type of commodities stored, and region.

Sector Insights:

- Industrial Warehouses

- Agricultural Warehouses

The report has provided a detailed breakup and analysis of the market based on the sector. This includes industrial warehouses and agricultural warehouses.

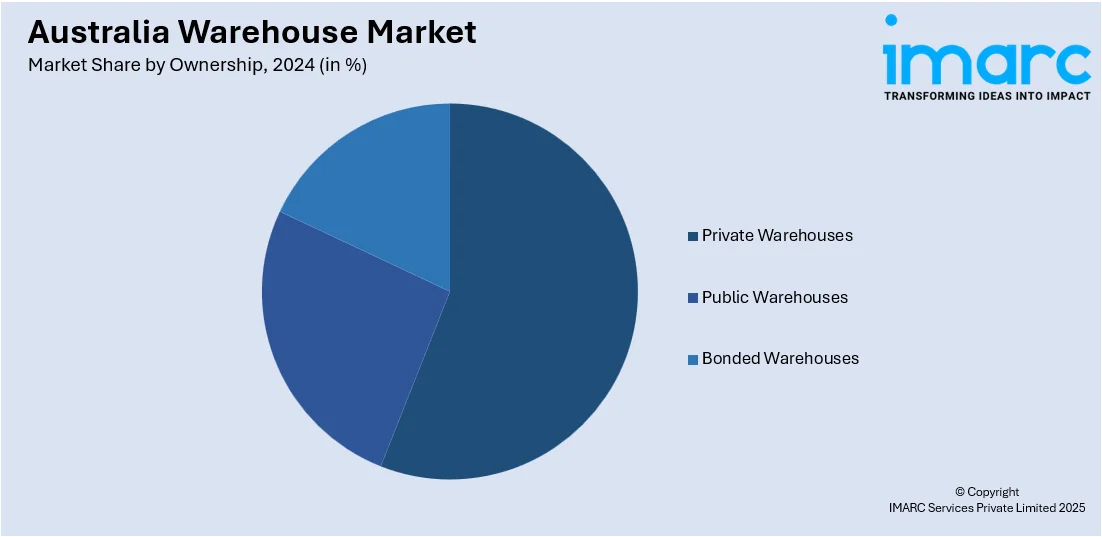

Ownership Insights:

- Private Warehouses

- Public Warehouses

- Bonded Warehouses

A detailed breakup and analysis of the market based on ownership have also been provided in the report. This includes private warehouses, public warehouses, and bonded warehouses.

Type of Commodities Stored Insights:

- General Warehouses

- Specialty Warehouses

- Refrigerated Warehouses

The report has provided a detailed breakup and analysis of the market based on the type of commodities stored. This includes general warehouses, speciality warehouses, and refrigerated warehouses.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Warehouse Market News:

- October 2024: Lely opened a new office and warehouse in Australia to support rising demand from dairy farmers across the region. As robotic milking gains popularity, the expansion ensures enhanced service, flexibility, and support for Australia’s growing dairy sector.

- August 2024: Ingram Micro Australia enhanced warehouse efficiency at its 42,000 m² Eastern Creek facility by implementing Zebra Technologies' intelligent cabinets. These cabinets streamline device storage, automate workflows, and bolster security, eliminating delays previously caused by staff searching for mobile computers. The integration of Zebra's mobile touch computers, printers, tablets, and scanners further optimizes inventory management and return handling, significantly boosting warehouse productivity.

Australia Warehouse Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Industrial Warehouses, Agricultural Warehouses |

| Ownerships Covered | Private Warehouses, Public Warehouses, Bonded Warehouses |

| Types of Commodities Stored Covered | General Warehouses, Speciality Warehouses, Refrigerated Warehouses |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia warehouse market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia warehouse market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia warehouse industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The warehouse market in Australia was valued at USD 3.45 Billion in 2024.

The Australia warehouse market is projected to exhibit a CAGR of 9.50% during 2025-2033.

The Australia warehouse market is projected to reach a value of USD 8.55 Billion by 2033.

The Australia warehouse market is shaped by automation adoption, rising demand for cold storage, and the expansion of e-commerce fulfillment centers. Increasing investment in smart warehouses with robotics, IoT, and data analytics also enhances operational efficiency. Sustainability initiatives, such as energy-efficient facilities and green building designs, also influence market development.

The Australia warehouse market is driven by surging e-commerce activity, increasing demand for third-party logistics, and rising need for temperature-controlled storage. Urbanization and consumer preference for faster deliveries push investment in modern facilities, while technology integration and supply chain optimization further accelerate market expansion and competitiveness.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)