Australia Waste to Energy Solutions Market Size, Share, Trends and Forecast by Technology, Waste Type, and Region, 2025-2033

Australia Waste to Energy Solutions Market Overview:

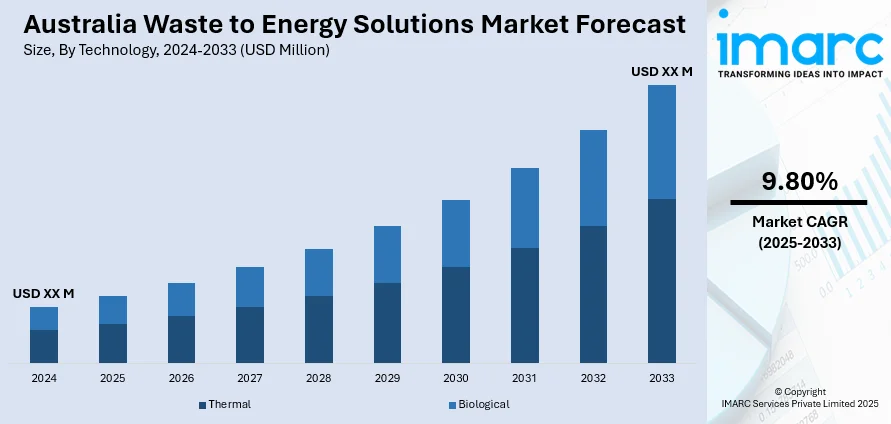

The Australia waste to energy solutions market size reached USD 1,431.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,321.3 Million by 2033, exhibiting a growth rate (CAGR) of 9.80% during 2025-2033. The market grows as a result of robust government policies such as the National Waste Policy that supports recycling and low landfill usage. Technological improvements in gasification, pyrolysis, and anaerobic digestion raise the efficiency and sustainability levels. Growing environmental consciousness and green energy needs further accelerate investment, boosting Australia waste to energy solutions market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,431.8 Million |

|

Market Forecast in 2033

|

USD 3,321.3 Million |

| Market Growth Rate 2025-2033 | 9.80% |

Australia Waste to Energy Solutions Market Trends:

Technological Advancements in Waste-to-Energy Systems

Recent innovations in waste-to-energy technologies are enhancing the efficiency and environmental sustainability of energy recovery processes in Australia. Advancements in gasification and pyrolysis methods enable the conversion of waste materials into valuable energy sources with reduced emissions. For instance, in 2024, Australia’s first large-scale waste-to-energy plant, located in Kwinana, Western Australia, will process 460,000 tonnes of waste annually and generate 38MW of electricity, powering up to 58,000 homes. The facility aims to reduce CO₂ emissions by over 460,000 tonnes per year by diverting waste from landfills and replacing fossil fuel energy. Ramboll serves as the Owner’s Engineer, overseeing design, construction, and environmental compliance. The plant utilizes proven grate technology and advanced flue gas cleaning systems to meet strict environmental standards, with real-time emissions monitoring. These technological improvements not only increase energy output but also minimize environmental impacts, aligning with Australia's renewable energy goals and contributing to the overall growth of the waste-to-energy sector.

To get more information on this market, Request Sample

Integration of Circular Economy Principles

Australia is increasingly adopting waste-to-energy solutions within its circular economy strategy to maximize resource recovery and reduce waste. Through the process of converting non-recyclable materials into energy, these systems enable the minimization of landfill reliance and encourage sustainable waste management processes. Such initiatives as the installation of FOGO (Food Organics Garden Organics) bins in different regions are characteristic of the efforts of the country to recycle organic waste away from landfills and put it to use in energy generation. This integration not only adds value to environmental sustainability but also promotes economic value through employment and new industry development, thus enhancing the Australia waste-to-energy market growth. For instance, in April 2025, an Australian-Middle Eastern consortium led by UAE-based Tribe Infrastructure Group will invest A$1.5 billion to develop a waste-to-energy facility in Parkes, New South Wales. The facility will process 600,000 tonnes of waste annually and generate 60 MW of energy, powering 80,000 homes. Located in the Parkes Special Activation Precinct, it will use advanced technology from Kanadevia Inova (KVI) and support Australia’s transition to a circular economy. Supported by Austrade, the project is part of a broader trend attracting international investment in Australia’s green economy, including plastics recycling and waste-to-energy solutions.

Australia Waste to Energy Solutions Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on technology and waste type.

Technology Insights:

- Thermal

- Biological

The report has provided a detailed breakup and analysis of the market based on the technology. This includes thermal and biological.

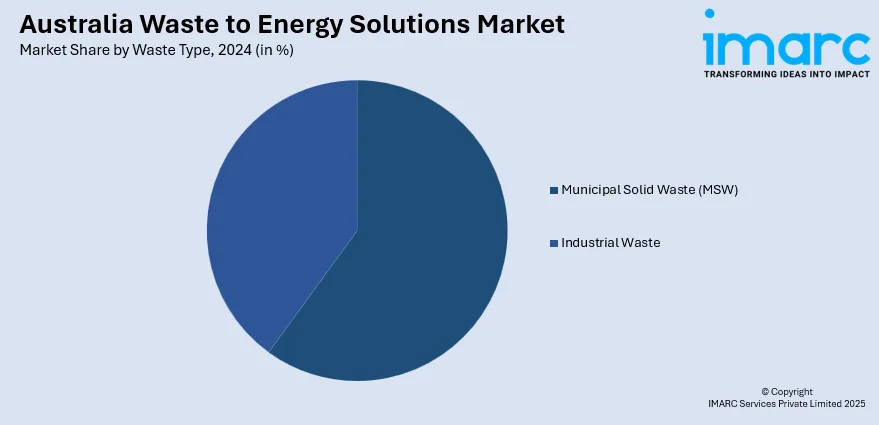

Waste Type Insights:

- Municipal Solid Waste (MSW)

- Industrial Waste

A detailed breakup and analysis of the market based on the waste type have also been provided in the report. This includes municipal solid waste (MSW) and industrial waste.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Waste to Energy Solutions Market News:

- In February 2025, Tellus contributed significantly to Australia's clean energy transition by overseeing the safe management of by-products from the nation’s first operational waste-to-energy (WtE) facility in Kwinana, Western Australia. In collaboration with Kwinana Energy Recovery, Tellus successfully processed the initial 53 tonnes of air pollution control residue (APCr) at its Sandy Ridge site, showcasing its readiness to support similar WtE projects across the country.

- In March 2024, ACCIONA acquired full ownership of the Kwinana Waste-to-Energy project from Macquarie Capital and Dutch Infrastructure Fund, ensuring the project's completion and long-term operation. Scheduled to begin operations by late 2024, the facility will divert up to 460,000 tonnes of waste annually from landfill and generate 38 MW of baseload power—enough to supply over 50,000 households. The project will reduce carbon emissions by over 400,000 tonnes per year and support Western Australia's clean energy goals.

Australia Waste to Energy Solutions Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Thermal, Biological |

| Waste Types Covered | Municipal Solid Waste (MSW), Industrial Waste |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia waste to energy solutions market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia waste to energy solutions market on the basis of technology?

- What is the breakup of the Australia waste to energy solutions market on the basis of waste type?

- What is the breakup of the Australia waste to energy solutions market on the basis of region?

- What are the various stages in the value chain of the Australia waste to energy solutions market?

- What are the key driving factors and challenges in the Australia waste to energy solutions market?

- What is the structure of the Australia waste to energy solutions market and who are the key players?

- What is the degree of competition in the Australia waste to energy solutions market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia waste to energy solutions market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia waste to energy solutions market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia waste to energy solutions industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)