Australia Water Heater Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2025-2033

Australia Water Heater Market Overview:

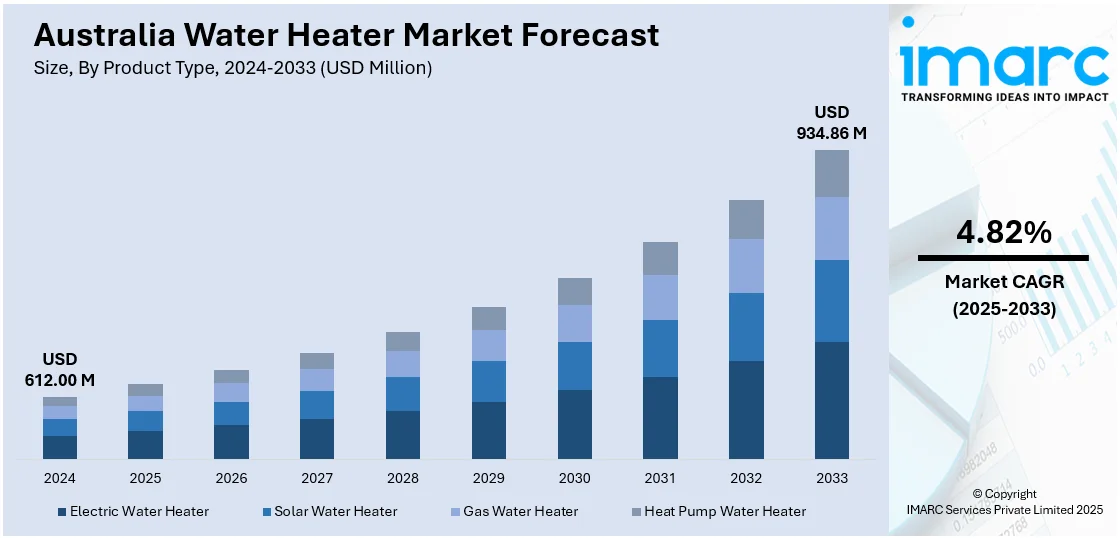

The Australia water heater market size reached USD 612.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 934.86 Million by 2033, exhibiting a growth rate (CAGR) of 4.82% during 2025-2033. The market is evolving towards energy-efficient and sustainable solutions. Heat pump water heaters are gaining popularity due to their low energy consumption and reduced greenhouse gas emissions. Solar water heating systems are also on the rise, leveraging Australia's abundant sunlight to provide eco-friendly hot water solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 612.00 Million |

| Market Forecast in 2033 | USD 934.86 Million |

| Market Growth Rate 2025-2033 | 4.82% |

Australia Water Heater Market Trends:

Expansion of Solar Water Heating Solutions

Solar water heaters are gaining popularity in Australia water heater market outlook as residents turn to renewable energy solutions. The systems use the energy of the sun to heat water, providing a green and cost-effective option compared to conventional gas or electric water heaters. With Australia's high levels of sunlight, solar water heating is a green alternative that minimizes electricity usage and greenhouse gas (GHG) emissions. Government subsidies and rebates also enhance the popularity of solar water heaters, making them even more affordable. This move to solar-powered systems is part of a larger pattern of Australian consumers wanting to make their environment a cleaner place and minimize long-term energy expenses.

To get more information on this market, Request Sample

Adoption of Heat Pump Water Heaters

Heat pump water heaters are also increasingly popular in Australia because of their energy-saving capabilities and sustainability. They exchange heat from surrounding air to hot water, a cleaner alternative compared to conventional electric or gas water heaters. Besides being eco-friendly, they also prove to be cheaper in the long run, since they save on energy usage. This is a change to energy-efficient remedies, which dovetail with increasingly popular consumerism trends to save carbon footprints. Indeed, during the first half of 2023 alone, approximately 60,000 air-source heat pumps (ASHPs) were installed in Australia, a staggering 70% increase from the first half of 2022. This increase is indicative of the nation's push towards electrification as well as away from gas-fired systems, along with the increase in Australia water heater market share thus bolstered by government incentives to live sustainably and be energy-efficient.

Growth of Smart and Hybrid Water Heaters

The rise of smart water heaters reflects the growing demand for advanced technology in home appliances. These systems offer features like remote control, energy consumption monitoring, and customizable heating schedules. Smart water heaters allow users to optimize energy use, leading to reduced utility bills and greater convenience. Hybrid water heaters, which combine multiple heating technologies, such as electric and heat pump systems, are bolstering the Australia water heater market growth. These systems provide flexibility in how water is heated, adapting to varying environmental conditions, and ensuring efficiency. As consumers look for more control over their energy use, smart and hybrid systems are becoming more popular.

Australia Water Heater Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type and application.

Product Type Insights:

- Electric Water Heater

- Solar Water Heater

- Gas Water Heater

- Heat Pump Water Heater

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes electric water heater, solar water heater, gas water heater, and heat pump water heater.

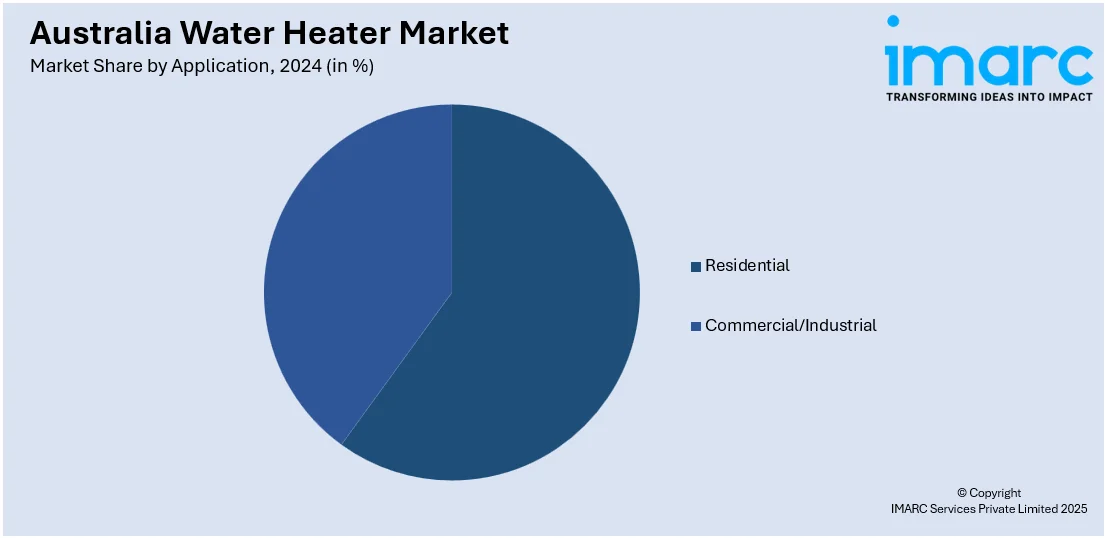

Application Insights:

- Residential

- Commercial/Industrial

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential, and commercial/industrial.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Water Heater Market News:

- In November 2024, Fluidmaster acquired Australia-based Haron International Pty Ltd, a long-time exclusive distributor of its brand in Australia. The acquisition strengthens Fluidmaster's market position and allows for expanded product offerings in Australia. Haron, a leader in plumbing and hardware, introduced several Fluidmaster innovations, including the iconic “green box” fill valve. Fluidmaster, a global leader in toilet components, expects synergies and growth from the acquisition, enhancing service and value for Australian customers.

- In October 2024, Noritz, along with its subsidiary Dux Manufacturing, partnered with ATCO Gas Australia to conduct a field trial of a 100% hydrogen combustion residential water heater in Western Australia. Starting in December 2024, the trial will assess the performance and reliability of the hydrogen-powered water heater for daily use. This initiative aligns with Australia's efforts to transition to clean energy and supports the goal of a carbon-neutral hydrogen society.

Australia Water Heater Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Electric Water Heater, Solar Water Heater, Gas Water Heater, Heat Pump Water Heater |

| Applications Covered | Residential, Commercial/Industrial |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia water heater market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia water heater market on the basis of product type?

- What is the breakup of the Australia water heater market on the basis of application?

- What is the breakup of the Australia water heater market on the basis of region?

- What are the various stages in the value chain of the Australia water heater market?

- What are the key driving factors and challenges in the Australia water heater market?

- What is the structure of the Australia water heater market and who are the key players?

- What is the degree of competition in the Australia water heater market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia water heater market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia water heater market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia water heater industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)