Australia Water Treatment Chemicals Market Size, Share, Trends and Forecast by Type, End-User, and Region, 2025-2033

Australia Water Treatment Chemicals Market Overview:

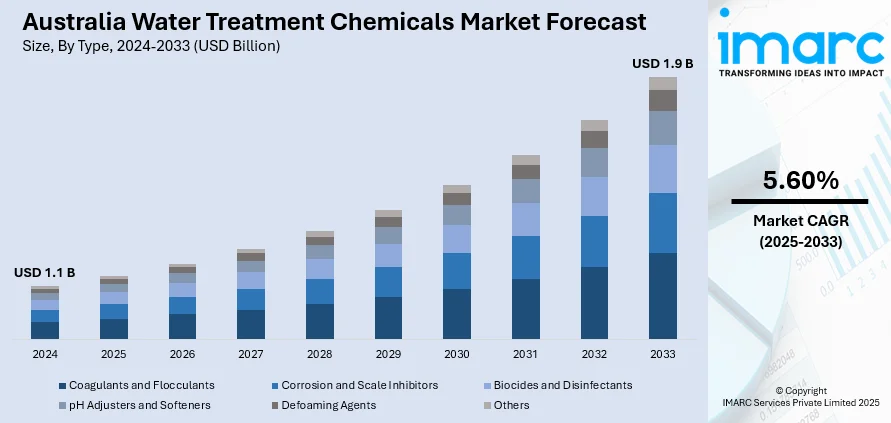

The Australia water treatment chemicals market size reached USD 1.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.9 Billion by 2033, exhibiting a growth rate (CAGR) of 5.60% during 2025-2033. Stricter water quality regulations, rapid urbanization, expansion of the mining sector, rising environmental concerns, industrial expansion, aging infrastructure upgrades, increasing water reuse initiatives, preference for eco-friendly chemicals, and adoption of smart water technologies are some of the factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.1 Billion |

| Market Forecast in 2033 | USD 1.9 Billion |

| Market Growth Rate 2025-2033 | 5.60% |

Australia Water Treatment Chemicals Market Trends:

Regulatory Pressure on Water Quality Standards

The government continues to enforce strict water quality regulations to ensure safe drinking water and environmentally sound wastewater discharge, which is propelling the Australia water treatment chemicals market growth. This regulatory landscape is shaped by the Australian Drinking Water Guidelines (ADWG) and various state-specific environmental acts, which mandate the use of effective chemical treatments to manage contaminants. Water utilities, municipal bodies, and industrial stakeholders are under increasing pressure to comply with limits on microbial content, pH balance, and chemical residues. This has further burgeoned the demand for disinfectants, coagulants, and corrosion inhibitors. Moreover, regulatory audits and reporting requirements have incentivized adoption of high-performance chemical solutions that offer both efficacy and traceability, which is fueling the market growth. This compliance-driven purchasing behavior has led to strategic partnerships with chemical suppliers that can offer consistent quality, certification, and technical support.

To get more information on this market, Request Sample

Rapid Urbanization and Population Growth

As per the Australia water treatment chemicals market forecast, growing urban population, particularly in metropolitan areas such as Sydney, Melbourne, and Brisbane, has created sustained pressure on municipal water supply and sewage systems. Increased residential demand for potable water and the corresponding rise in wastewater generation require scalable and efficient chemical treatment processes. Urban councils are investing in advanced chemical dosing systems and water reuse initiatives, both of which depend on consistent availability of high-performance treatment chemicals. Moreover, infrastructure upgrades in suburbs and peri-urban zones are also generating new demand for chemicals used in desalination, reverse osmosis, and sludge management, which is providing a positive Australia water treatment chemicals market outlook. Additionally, housing and commercial development projects often necessitate temporary or mobile water treatment units, fueling demand in the construction segment. As infrastructure expands, the need for effective water quality control becomes more acute, making chemical treatments a critical operational input.

Expansion of Mining and Resource Industries

Australia’s mining and resource extraction sectors are among the largest industrial consumers of water, especially in regions such as Western Australia and Queensland. For instance, in 2025, The government increased its financial support for Iluka Resources' rare earths refinery in Western Australia, providing an additional USD 260 million loan, bringing the total to USD 1.04 billion. This initiative aims to reduce reliance on China for critical minerals essential for wind turbines, electric vehicles, and defense systems Operations such as mineral beneficiation, ore processing, and dust suppression rely heavily on water, which must be treated before discharge or reuse. Moreover, increasing regulatory scrutiny on environmental impact has prompted mining companies to enhance their water treatment systems, leading to higher consumption of flocculants, pH adjusters, scale inhibitors, and anti-foaming agents, which is boosting the Australia water treatment chemicals market share. The industry’s focus on water recovery and zero-liquid discharge systems is also pushing demand for specialty treatment chemicals that support closed-loop operations. Furthermore, mine expansions and new exploration projects are being approved with strict water management conditions, further embedding chemical treatment requirements into project planning.

Australia Water Treatment Chemicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and end-user.

Type Insights:

- Coagulants and Flocculants

- Corrosion and Scale Inhibitors

- Biocides and Disinfectants

- pH Adjusters and Softeners

- Defoaming Agents

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes coagulants and flocculants, corrosion and scale inhibitors, biocides and disinfectants, pH adjusters and softeners, defoaming agents, and others.

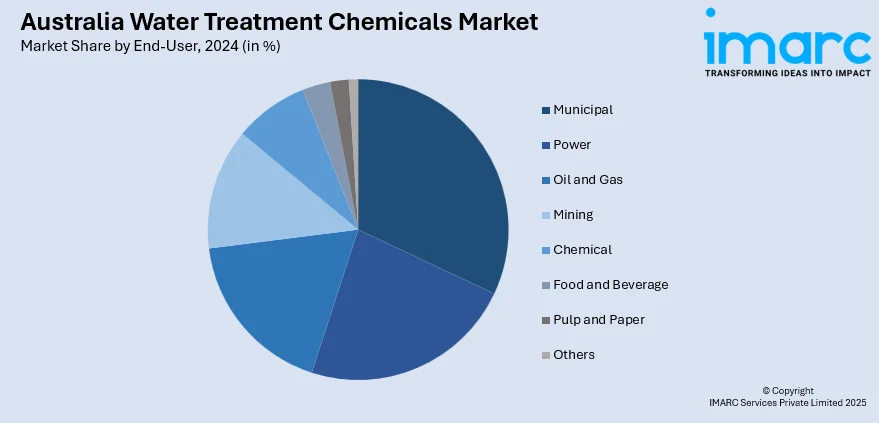

End-User Insights:

- Municipal

- Power

- Oil and Gas

- Mining

- Chemical

- Food and Beverage

- Pulp and Paper

- Others

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes municipal, power, oil and gas, mining, chemical, food and beverage, pulp and paper, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Water Treatment Chemicals Market News:

- In 2025, Monash University researchers developed a new powdered water filter capable of removing over 95% of per- and polyfluoroalkyl substances (PFAS) “forever chemicals” in under a minute. The breakthrough material offers a low-cost, scalable solution for Australia's contaminated water systems and is undergoing trials with local utilities.

Australia Water Treatment Chemicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Coagulants and Flocculants, Corrosion and Scale Inhibitors, Biocides and Disinfectants, pH Adjusters and Softeners, Defoaming Agents, Others |

| End-Users Covered | Municipal, Power, Oil and Gas, Mining, Chemical, Food and Beverage, Pulp and Paper, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia water treatment chemicals market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia water treatment chemicals market on the basis of type?

- What is the breakup of the Australia water treatment chemicals market on the basis of end user?

- What is the breakup of the Australia water treatment chemicals market on the basis of region?

- What are the various stages in the value chain of the Australia water treatment chemicals market?

- What are the key driving factors and challenges in the Australia water treatment chemicals market?

- What is the structure of the Australia water treatment chemicals market and who are the key players?

- What is the degree of competition in the Australia water treatment chemicals market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia water treatment chemicals market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia water treatment chemicals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia water treatment chemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)