Australia Waterproof Textiles Market Size, Share, Trends and Forecast by Raw Material, Fabric Type, Application, and Region, 2026-2034

Australia Waterproof Textiles Market Summary:

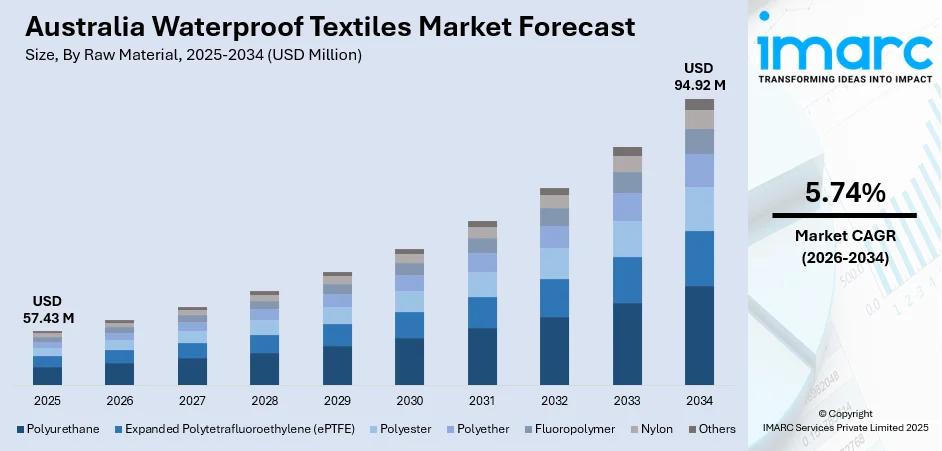

The Australia waterproof textiles market size was valued at USD 57.43 Million in 2025 and is projected to reach USD 94.92 Million by 2034, growing at a compound annual growth rate of 5.74% from 2026-2034.

The Australia waterproof textiles market is experiencing sustained growth, driven by the nation's vibrant outdoor culture and increasing demand for high-performance weather-resistant fabrics. Rising participation in hiking, camping, and marine activities is fueling consumption across apparel, footwear, and industrial applications. Technological advancements in membrane systems, breathable coatings, and sustainable fabric engineering are enhancing product functionality and consumer appeal. The growing environmental awareness is encouraging adoption of eco-friendly waterproofing solutions.

Key Takeaways and Insights:

- By Raw Material: Polyester dominates the market with a share of 30% in 2025, owing to its exceptional durability, cost-effectiveness, and versatility across outdoor apparel and industrial applications. The material's inherent moisture-wicking properties and compatibility with advanced waterproof coatings continue to drive widespread adoption throughout the Australian market.

- By Fabric Type: Laminated or coated woven leads the market with a share of 55% in 2025. This dominance reflects the superior waterproofing performance achieved through membrane lamination and coating technologies that deliver both water resistance and breathability, meeting consumer expectations for comfort in outdoor environments.

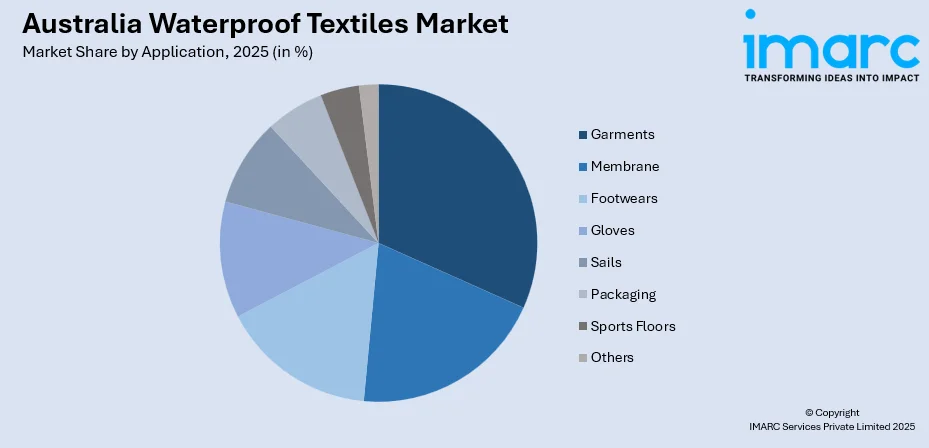

- By Application: Garments represent the largest segment with a market share of 30% in 2025, reflecting strong consumer demand for waterproof jackets, rainwear, and outdoor apparel that combines weather protection with style and functionality for Australia's diverse climatic conditions.

- Key Players: Key players are driving the Australia waterproof textiles market expansion through continuous innovations in fabric technologies, expansion of sustainable product portfolios, and strategic partnerships with outdoor brands. Their investments in eco-friendly coatings, breathable membranes, and circular economy initiatives strengthen market positioning.

To get more information on this market Request Sample

The Australia waterproof textiles market is propelled by the nation's deeply entrenched outdoor lifestyle and expanding adventure tourism sector. Australians demonstrate exceptional enthusiasm for outdoor activities, with participation in bushwalking reaching approximately 3.7 million adult participants nationally during 2023-24, according to AusPlay survey data. This surge in outdoor recreation directly correlates with heightened demand for performance waterproof fabrics across garments, footwear, and camping equipment. The Australian climate's variability, ranging from tropical regions to temperate zones, necessitates versatile weather-resistant textiles. Additionally, the growing consciousness about sustainable fashion is redirecting consumer preferences towards environmentally responsible waterproof solutions manufactured using recycled materials and reduced-impact coatings. Industrial sectors, including construction, mining, and emergency services, continue to require durable protective textiles, further expanding market opportunities across diverse application segments.

Australia Waterproof Textiles Market Trends:

Rising Adoption of Sustainable Waterproofing Technologies

The Australian waterproof textiles industry is witnessing accelerated adoption of environmentally responsible manufacturing processes and materials. Manufacturers are incorporating water-based coatings, recycled polyester fibers, and bio-based membrane technologies to reduce environmental footprint. The Australian Government's clothing product stewardship scheme, Seamless, which became operational in July 2024 with 62 brand members, is driving industry-wide commitment to circular textile practices. This initiative aims to divert clothing from landfill while encouraging brands to design more durable and recyclable garments, supporting Australia waterproof textiles market growth.

Integration of Advanced Plasma-Based Fabric Treatment

The integration of advanced plasma-based fabric treatment is enabling high-performance, eco-friendly water-repellent finishes without relying on harmful chemicals. Plasma technology modifies fabric surfaces at a molecular level, improving durability, breathability, and long-term resistance to water, stains, and abrasion. Its ability to create uniform, energy-efficient coatings supports innovation in outdoor gear, workwear, and sports apparel. Moreover, the method reduces water and chemical consumption, aligning with Australia’s rising sustainability expectations and strengthening adoption across premium textile manufacturers seeking cleaner and more efficient waterproofing solutions.

Growing Demand from Outdoor Recreation and Tourism Sectors

Australia's robust outdoor culture continues to drive substantial demand for waterproof textiles across camping, hiking, and marine applications. Australians undertook approximately 15.2 Million camping and caravan trips in 2024, generating over USD 14 Billion in economic activity. This sustained enthusiasm for outdoor pursuits translates directly into increased consumption of waterproof garments, tents, and equipment. The growing adventure tourism segment, particularly in regions like Queensland and Tasmania, further amplifies requirements for high-performance weather-resistant fabrics.

Market Outlook 2026-2034:

The Australia waterproof textiles market outlook remains positive, underpinned by sustained consumer interest in outdoor activities and ongoing technological innovations in fabric engineering. The market generated a revenue of USD 57.43 Million in 2025 and is projected to reach a revenue of USD 94.92 Million by 2034, growing at a compound annual growth rate of 5.74% from 2026-2034. Increasing emphasis on sustainability will continue to reshape product development, with eco-friendly membranes and recyclable waterproof materials gaining prominence. Industrial applications in protective workwear will expand alongside growing infrastructure and resource sector activities.

Australia Waterproof Textiles Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Raw Material | Polyester | 30% |

| Fabric Type | Laminated or Coated Woven | 55% |

| Application | Garments | 30% |

Raw Material Insights:

- Polyurethane

- Expanded Polytetrafluoroethylene (ePTFE)

- Polyester

- Polyether

- Fluoropolymer

- Nylon

- Others

Polyester dominates with a market share of 30% of the total Australia waterproof textiles market in 2025.

Polyester maintains its leading position in the Australian waterproof textiles market owing to its exceptional balance of performance characteristics and cost efficiency. The material offers inherent resistance to shrinking, stretching, and wrinkling while accepting waterproof coatings and laminations effectively. Australian outdoor apparel manufacturers favor polyester for its durability under harsh ultraviolet (UV) exposure and its ability to maintain structural integrity across diverse climatic conditions from tropical Queensland to temperate Tasmania.

Its quick-drying nature and resistance to moisture absorption make it ideal for outdoor clothing, sportswear, tents, and marine applications widely used across the country. Polyester fabrics also support advanced membrane bonding and seam-sealing processes, enabling reliable long-term performance. Additionally, its affordability, easy manufacturability, and consistent supply strengthen its dominance among Australian textile producers and brands focused on functional waterproof products.

Fabric Type Insights:

- Dense Woven

- Laminated or Coated Woven

- Others

Laminated or coated woven leads with a share of 55% of the total Australia waterproof textiles market in 2025.

Laminated or coated woven fabrics command the largest share of the Australian waterproof textiles market due to their superior waterproofing capabilities combined with breathability characteristics essential for active outdoor use. These fabrics utilize membrane technology or coating applications that create effective water barriers while allowing moisture vapor transmission, preventing internal condensation during physical activities. Australian consumers particularly value this performance balance for hiking, camping, and marine applications.

The segment continues to evolve through technological advancements in membrane materials and coating formulations. Manufacturers are developing perfluorochemical (PFC)-free durable water repellent treatments and bio-based lamination technologies to address environmental concerns while maintaining performance standards. Additionally, innovations in recyclable multilayer composites and low-energy lamination processes are expanding application potential. These advancements help producers deliver high-performance, sustainable waterproof fabrics aligned with Australia’s growing preference for eco-conscious outdoor products.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Membrane

- Garments

- Jackets

- Waterproof Jackets

- Leisurewear

- Others

- Footwears

- Gloves

- Sails

- Packaging

- Sports Floors

- Others

Garments exhibit a clear dominance with a 30% share of the total Australia waterproof textiles market in 2025.

The garments segment leads application categories, driven by strong consumer demand for waterproof outerwear suited to Australia's variable weather conditions. Waterproof jackets, raincoats, and outdoor apparel constitute the primary consumption categories, with urban and suburban consumers increasingly adopting functional waterproof clothing for daily commuting and recreational activities. The blending of fashion aesthetics with technical performance has broadened market appeal beyond traditional outdoor enthusiasts.

Various Australian sustainable outdoor apparel brands manufacture women's waterproof garments using recycled plastic bottles with sizes ranging from XS to 5XL. This approach addresses both performance requirements and growing consumer preference for environmentally responsible products. The expansion of outdoor recreation and adventure tourism participation continues to underpin demand for waterproof garments across demographic segments. As per IMARC Group, the Australia adventure tourism market is set to attain USD 138.0 Billion by 2033, exhibiting a growth rate (CAGR) of 11.14% during 2025-2033.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales hold prominence in the market, driven by concentrated population centers in Sydney and surrounding metropolitan areas. The region's diverse geography encompassing coastal areas, mountain ranges, and bushland creates sustained demand for weather-resistant fabrics across outdoor apparel and equipment categories.

Victoria & Tasmania represent significant market contributors with strong outdoor recreation cultures and textile manufacturing heritage. Frequent rainfall, coastal winds, and colder temperatures make waterproof and breathable fabrics essential for daily use, tourism, and outdoor recreation.

Queensland's tropical and subtropical climate drives demand for lightweight breathable waterproof textiles suitable for marine activities and wet season conditions. The region's significant camping and caravan tourism sector supports consumption of waterproof camping equipment and protective apparel.

Northern Territory & South Australia lead the Australia waterproof textiles market because their extreme and varied climates create strong demand for durable, weather-resistant materials. The Northern Territory’s tropical monsoons, heavy rainfall, and high humidity require reliable waterproof apparel, outdoor gear, and protective workwear.

Western Australia demonstrates the growing demand aligned with expanding adventure tourism and outdoor recreation participation. The state's diverse environments, from coastal regions to outback areas, necessitate versatile waterproof textile solutions for varied climatic conditions.

Market Dynamics:

Growth Drivers:

Why is the Australia Waterproof Textiles Market Growing?

Growth of Outdoor Recreation and Adventure Activities

The rising popularity of outdoor recreation in Australia is a major driver of the waterproof textiles market. Activities, such as hiking, camping, trail running, fishing, boating, and off-road exploration, have become integral to lifestyle preferences across regions. These pursuits demand durable, lightweight, and breathable waterproof fabrics that can withstand unpredictable weather, from heavy rain to coastal winds. Consumers increasingly prioritize comfort, mobility, and long-term performance, pushing brands to adopt advanced coatings, laminated membranes, and seam-sealed designs. Tourism-heavy states also experience stronger demand as visitors require protective apparel and gear suited for diverse terrains. With outdoor sports participation expanding across age groups, retailers and manufacturers are broadening product portfolios to include jackets, tents, backpacks, and marine textiles designed for harsh environments. This sustained outdoor culture and increasing travel activities continue to drive innovations, premiumization, and market growth for waterproof textiles. As per IMARC Group, the Australia travel and tourism market is set to reach USD 21.1 Billion by 2033, exhibiting a growth rate (CAGR) of 2.11% during 2025-2033.

Technological Advancements in Fabric Treatment and Coating

Rapid advancements in fabric treatment technologies are significantly boosting the Australia waterproof textiles market. Innovations, such as plasma-based surface modification, nano-coatings, and advanced polyurethane and acrylic formulations, are enabling manufacturers to create fabrics that offer stronger waterproofing, improved breathability, and enhanced mechanical strength. In April 2024, the Clean Energy Finance Corporation committed USD 2.5 Million to Xefco as part of a USD 10.5 Million seed extension round. The company focuses on utilizing plasma to develop a highly effective, waterless approach for dyeing and finishing textiles, which could reduce global water pollution by up to 20% and lower carbon emissions by 3%. This funding will be utilized to broaden the firm’s presence in Victoria. Modern laminated membranes provide better vapor transmission, reducing discomfort during high-activity use, while eco-friendly PFC-free coatings appeal to sustainability-conscious consumers. These treatments also improve resistance to dirt, oils, and abrasion, extending garment and gear lifespan. The growing adoption of digital coating processes and low-energy lamination techniques supports efficiency and consistent quality across production lines.

Increased Demand from Industrial, Mining, and Agricultural Sectors

Australia’s robust industrial landscape, including mining, construction, agriculture, and logistics, plays a crucial role in driving demand for waterproof textiles. Workers in these fields operate in environments exposed to heavy rain, humidity, water splashes, chemicals, and abrasive conditions, requiring highly durable protective clothing and gear. Waterproof textiles used in workwear, gloves, footwear, and safety covers help ensure worker safety and productivity. The mining sector, particularly in Western Australia and South Australia, necessitates strong resistance to harsh weather, mud, and dust. Similarly, agricultural workers rely on waterproof fabrics for daily tasks in unpredictable outdoor settings. Companies increasingly specify high-performance standards related to tear strength, moisture resistance, and breathability, encouraging manufacturers to offer premium textile solutions. Regulatory emphasis on workplace safety further promotes compliance-driven adoption. As industrial activity expands and modernization continues, the demand for functional and resilient waterproof textiles remains consistently strong.

Market Restraints:

What Challenges the Australia Waterproof Textiles Market is Facing?

Intense Import Competition from Low-Cost Producers

Australian waterproof textile manufacturers face significant competition from imports originating in lower-cost manufacturing regions, particularly China and India. These imports offer price advantages that challenge domestic producers despite potentially lower quality standards. Local manufacturers must differentiate through quality, sustainability credentials, and service capabilities to maintain market position against import pressure.

Raw Material Price Volatility and Supply Chain Constraints

Fluctuations in petroleum-derived raw material prices directly impact waterproof textile production costs, creating margin pressures for manufacturers. Polyester, polyurethane, and other synthetic materials used in waterproof fabrics remain subject to global commodity price movements. Supply chain disruptions and currency fluctuations further compound cost management challenges for industry participants.

Technical Complexity and Sustainability Trade-offs

Achieving optimal waterproofing performance while meeting environmental sustainability requirements presents ongoing technical challenges. Many effective waterproofing treatments historically relied on perfluorinated compounds facing increasing regulatory scrutiny. Developing PFC-free alternatives that match traditional performance levels requires substantial research investment and manufacturing process modifications, creating barriers for smaller market participants.

Competitive Landscape:

The Australia waterproof textiles market features a competitive landscape, comprising international performance apparel brands, domestic textile manufacturers, and emerging sustainable fashion labels. Global companies leverage established brand recognition and advanced membrane technologies to capture premium market segments. Australian manufacturers differentiate through local production capabilities, rapid response to domestic requirements, and specialized applications for the unique Australian climate and outdoor conditions. Recent industry consolidations indicate ongoing market restructuring. Sustainability credentials increasingly influence competitive positioning as consumers and retailers prioritize environmentally responsible suppliers.

Recent Developments:

- In May 2025, Defab obtained all intellectual property rights of Wax Converters Textiles in Australia, uniting famous waterproof canvas brands like Dynaproof, Billabong, DX12, BullDuck, and Coolabah under Defab’s 49 years of experience in Australian textile manufacturing. The purchase enabled Defab to improve fabric coatings, waterproofing capabilities, and longevity within these existing product lines.

Australia Waterproof Textiles Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Polyurethane, Expanded Polytetrafluoroethylene (ePTFE), Polyester, Polyether, Fluoropolymer, Nylon, Others |

| Fabric Types Covered | Dense Woven, Laminated or Coated Woven, Others |

| Applications Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia waterproof textiles market size was valued at USD 57.43 Million in 2025.

The Australia waterproof textiles market is expected to grow at a compound annual growth rate of 5.74% from 2026-2034 to reach USD 94.92 Million by 2034.

Polyester dominated the market with a share of 30%, driven by its durability, cost-effectiveness, compatibility with waterproof coatings, and growing availability of recycled variants meeting sustainability preferences.

Key factors driving the Australia waterproof textiles market include expanding outdoor recreation participation, government sustainability initiatives supporting circular textile practices, technological advancements in eco-friendly waterproofing treatments, and growing industrial demand for protective workwear.

Major challenges include intense import competition from low-cost producers, raw material price volatility affecting production costs, technical complexity in developing sustainable waterproofing alternatives, and supply chain constraints impacting manufacturing efficiency.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)