Australia Wealth Management Market Report by Business Model (Human Advisory, Robo Advisory, Direct Plan-Based/Goal-Based, Comprehensive Wealth Advisory, Hybrid Advisory), Provider (FinTech Advisors, Banks, Traditional Wealth Managers, and Others), End User (High Net Worth Individuals, Ultra High Net Worth Individuals, Corporates, and Others) and Region 2026-2034

Australia Wealth Management Market Size and Trends:

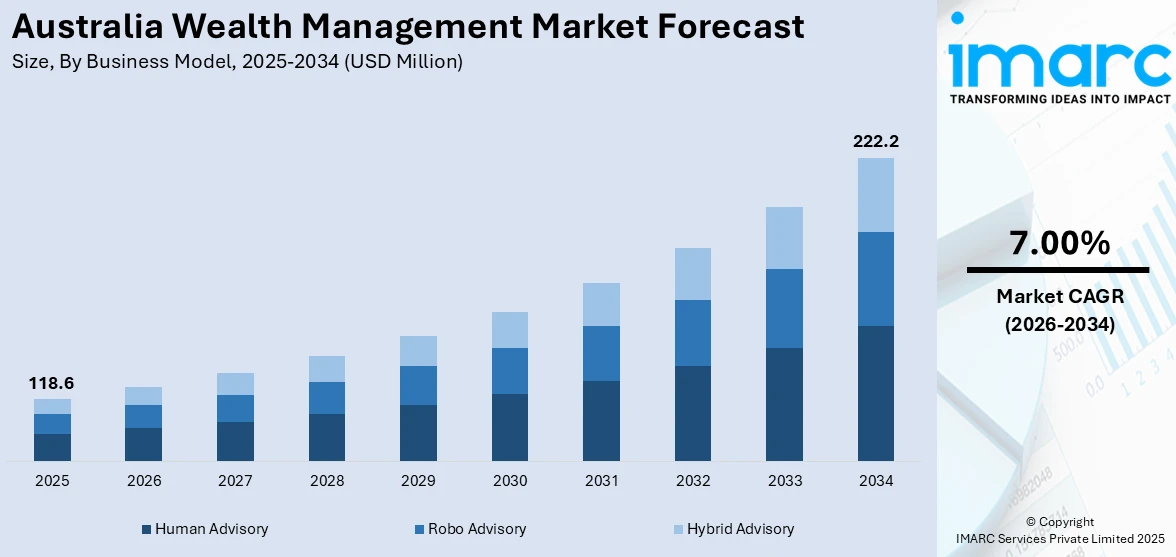

The Australia wealth management market size reached USD 118.6 Million in 2025. Looking forward, the market is expected to reach USD 222.2 Million by 2034, exhibiting a growth rate (CAGR) of 7.00% during 2026-2034. Rising high-net-worth individuals, strong economic growth, regulatory reforms, a robust superannuation system, rapid digital transformation, surging demand for retirement planning, availability of tax incentives, and globalization offering new investment opportunities are some of the factors fueling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 118.6 Million |

|

Market Forecast in 2034

|

USD 222.2 Million |

| Market Growth Rate 2026-2034 | 7.00% |

Key Trends of Australia Wealth Management Market:

Increasing Number of High-Net-Worth Individuals (HNWIs)

High penetration of HNWI population is a leading factor behind the development of the wealth management market in Australia. The common services that HNWIs look for are investment management, estate planning and tax strategies, which is further creating demand for specialized wealth management firms. This is further supported by Australia's good economic performance, increasing property values, and strong entrepreneurial landscape. The HNWI need a higher level of advice to manage their assets properly and protect and maintain their wealth, which is further accelerating the market growth.

To get more information on this market Request Sample

Regulatory Frameworks Like FOFA

Australia’s wealth management market is also shaped by stringent regulatory frameworks, particularly the Future of Financial Advice (FOFA) reforms. Introduced to increase transparency and reduce conflicts of interest, these regulations have improved investor trust in financial advisory services. FOFA prohibits commissions on financial products and ensures that advisors act in the best interest of their clients. Moreover, wealth management firms have adapted by offering fee-based services and comprehensive financial planning, which align with FOFA’s regulatory requirements, thus fostering a more robust market. The enhanced transparency and trust contribute to long-term market growth and client retention.

Digital Transformation in Financial Services

The digital transformation of financial services is a major catalyst for growth in Australia’s wealth management market. The adoption of fintech innovations, including robo-advisors, digital investment platforms, and mobile applications, is enhancing the accessibility of wealth management services. These technologies offer clients real-time portfolio insights, personalized investment recommendations, and greater control over their financial planning. As digital tools simplify complex financial processes, a wider audience, including younger investors and tech-savvy individuals, is being attracted to wealth management services.

Growth Drivers of Australia Wealth Management Market:

Growing Demand for Ethical and Sustainable Investing

One of the key growth drivers for Australia's wealth management industry is the growing demand for ethical and sustainable investing. Australian investors are increasingly becoming socially and environmentally aware, actively looking for investment opportunities that meet their personal values. This is especially noticeable among high-net-worth and younger investors, who give environmental, social, and governance (ESG) considerations a lot of weight when choosing their portfolios. Wealth managers are responding by providing customized ESG portfolios, green bonds, and socially responsible investment funds. The trend is further driven by Australia's vulnerability to climate issues, including bushfires and water shortages, which have increased focus on sustainability. Consequently, wealth management companies that are able to supply transparent, responsible investment solutions are emerging with a competitive advantage. This shift toward value investing is redefining client expectations and creating new opportunities for product innovation and long-term client interaction.

Superannuation System and Retirement Planning Requirements

Compulsory superannuation system in Australia is a distinguishing and influential propeller of Australia's wealth management sector. With compulsory employer and employee contributions, Australians build up substantial retirement savings during their working years, generating a large pool of assets demanding continuous investment advice and management. With increasingly complicated retirement planning because of longevity, volatile market conditions, and shifting regulatory environments, demand is rising for professional wealth management services. People are looking for customized approaches to maximize superannuation performance, minimize tax liabilities, and provide sustainable income streams in retirement. In addition, the shift toward defined contribution rather than defined benefit schemes has placed more financial onus on individuals, adding further reason for professional financial advice. Superannuation optimization, risk management, and retirement income planning are areas in which wealth managers are particularly well-placed to take advantage of this increasing requirement, given the continued growth of Australia's aging population.

Independent Advice Growth and Regulation Reforms

According to the Australia wealth management market analysis, the move toward independent financial advice, driven by regulation changes, is another source of wealth management growth. In the wake of widespread investigations into banking sector misconduct, including the Royal Commission into Banking, Australians increasingly are wary of financial advice in connection with large institutions. Consequently, there is increasingly high demand for independent advisers who offer unbiased, client-driven service. Regulatory reform has promoted openness, which has resulted in product manufacturing being demarcated from financial advice in numerous firms. This has created space for smaller, independent wealth management providers to enter the marketplace and develop trust with clients looking for customized, conflict-free advice. Moreover, the emergence of fee-for-service business models, as opposed to commission-based compensation, has increased the industry's credibility and better aligned advisor incentives with client results. These structural shifts are helping to restore consumer confidence and fueling steady growth in the independent wealth advisory space.

Opportunities of Australia Wealth Management Market:

Intergenerational Wealth Transfer

One of the most significant opportunities in the Australian wealth management market lies in the ongoing intergenerational wealth transfer. As Australia's baby boomer generation continues to age, a massive shift of assets is occurring from older generations to their children and grandchildren. This shift offers a rare chance for wealth managers to establish long-term connections with younger clients who are receiving large sums of money yet have little financial know-how. These new beneficiaries are different from their forebears in that they have distinct financial priorities, typically revolving around sustainability, investing in technology, and lifestyle objectives. Advisors who are able to differentiate services to accommodate changing expectations among younger Australians, like digital-first communication, values-based investing, and adaptive financial planning, will gain the most. Moreover, engaging families with intergenerational wealth education and estate planning can provide client retention and loyalty strengths. Capturing the new generation early and gaining insight into their unique financial behaviors is fundamental to long-term business growth in the sector.

Broadening Services for Women and Under-Served Segments

There is increasing recognition of under-served client segments in the Australian wealth management market share, such as women, who constitute a significant and empowered segment. Australian women are accumulating financial influence through career development, business ownership, and wealth accumulation. Nevertheless, they often report being ignored or under-served by mainstream financial services, frequently because of antiquated attitudes about financial literacy or decision-making authority. This gap presents an enormous opportunity for wealth management companies that can provide more comprehensive, customized services that meet the specific financial needs of women, like planning during career interruptions, differences in pay between women and men, and increased life expectancy. Opportunities also exist to serve culturally and linguistically diverse communities throughout Australia, especially in Sydney and Melbourne, where multicultural populations are growing aggressively. Advisers who create culturally nuanced, multilingual offerings and champion inclusive communication can access these burgeoning markets and grow their business in a diverse society.

Scaling Business through Technology

Australia's high-tech populace and robust fintech infrastructure provide a wealth manager with a tremendous opportunity to scale business via digital platforms. With customers looking for effortless digital experiences, incorporating technology in wealth management solutions is no longer a choice yet a competitive imperative. From automated portfolio management and risk profiling through AI to interactive financial planning platforms, technology allows firms to efficiently serve clients while delivering a high degree of personalization. This is especially useful for engaging with mass affluent clients who do not yet qualify for the usual advisory services and need financial advice. Hybrid models blending digital capabilities with human advice are found to be especially effective in the Australian marketplace, balancing convenience with trust. In addition to that, the utilization of data analytics enables businesses to have greater insight into their clients' behavior, thus more proactive and personalized advice. Adopting technology enhances client satisfaction along with advisor productivity and long-term growth, which further contributes to the increase in Australia wealth management market demand.

Australia Wealth Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on business model, provider, and end user.

Business Model Insights:

- Human Advisory

- Robo Advisory

- Direct Plan-Based/Goal-Based

- Comprehensive Wealth Advisory

- Hybrid Advisory

The report has provided a detailed breakup and analysis of the market based on the business model. This includes human advisory, robo advisory (direct plan-based/goal-based, comprehensive wealth advisory), and hybrid advisory.

Provider Insights:

- FinTech Advisors

- Banks

- Traditional Wealth Managers

- Others

A detailed breakup and analysis of the market based on the provider have also been provided in the report. This includes fintech advisors, banks, traditional wealth managers and others.

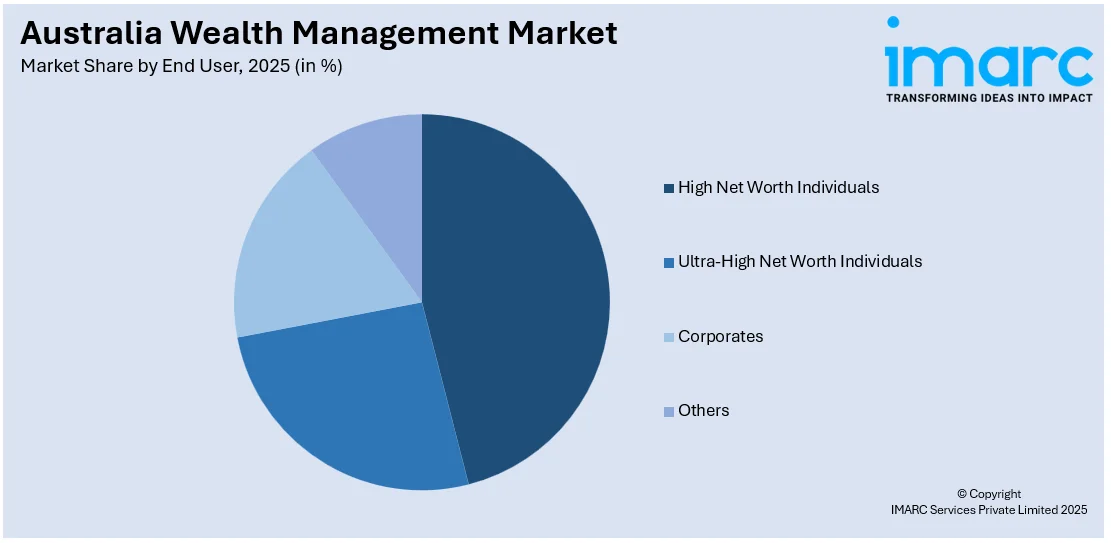

End User Insights:

Access the comprehensive market breakdown Request Sample

- High Net Worth Individuals

- Ultra-High Net Worth Individuals

- Corporates

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes high net worth individuals, ultra-high net worth individuals, corporates, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Wealth Management Market News:

- In August 2025, Goldman Sachs Group Inc. revealed intentions to grow its private wealth management team in Australia to seize the opportunity presented by a surge in self-made multimillionaires and family fortunes seeking global investment options.

- In September 2025, Insignia CEO Scott Hartley and Vanguard Australia MD Daniel Shrimski became members of the Financial Services Council board, with Hartley resuming his role after a two-year break. Hartley, in his role as chief executive of the financial services company since March 2024, possesses expertise in financial advice, superannuation, and corporate and institutional wealth.

- In 2024, ANZ and Blackstone recently launched a new wealth management fund in Australia, aiming to tap into the country's growing demand for diversified investment solutions. This partnership marks a significant development in the Australian wealth management sector, offering clients enhanced opportunities to invest in global assets. The fund seeks to leverage Blackstone's expertise in alternative investments and ANZ's local market presence to provide a unique product for high-net-worth individuals and institutional clients.

- In 2024, Australian-owned wealthtech company HeirWealth launched its innovative platform designed to streamline estate planning and intergenerational wealth transfer. This digital solution allows users to efficiently manage assets, create customized inheritance plans, and ensure the secure transfer of wealth across generations. By leveraging advanced technology, HeirWealth offers transparency and control for users, addressing the growing need for comprehensive estate planning tools in Australia’s evolving financial landscape.

Australia Wealth Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Business Models Covered |

|

| Providers Covered | FinTech Advisors, Banks, Traditional Wealth Managers, Others |

| End User Covered | High Net Worth Individuals, Ultra High Net Worth Individuals, Corporates, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia wealth management market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia wealth management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia wealth management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia wealth management market was valued at USD 118.6 Million in 2025.

The Australia wealth management market is projected to exhibit a CAGR of 7.00% during 2026-2034.

The Australia wealth management market is expected to reach a value of USD 222.2 Million by 2034.

Key trends in the Australia wealth management market include rising demand for sustainable and ethical investments, growing adoption of digital and hybrid advisory models, and increased focus on personalized financial planning. Additionally, independent advisors are gaining traction as clients seek transparent, conflict-free advice amid shifting regulatory and generational wealth dynamics.

The Australia wealth management market is driven by a robust superannuation system, rising demand for retirement planning, and a growing focus on ethical investing. Regulatory reforms promoting transparency and the shift toward independent advice also support growth, along with increased digital adoption and intergenerational wealth transfer shaping evolving client expectations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)