Australia Wearable Injectors Market Size, Share, Trends and Forecast by Type, Technology, Application, End Use, and Region, 2026-2034

Australia Wearable Injectors Market Summary:

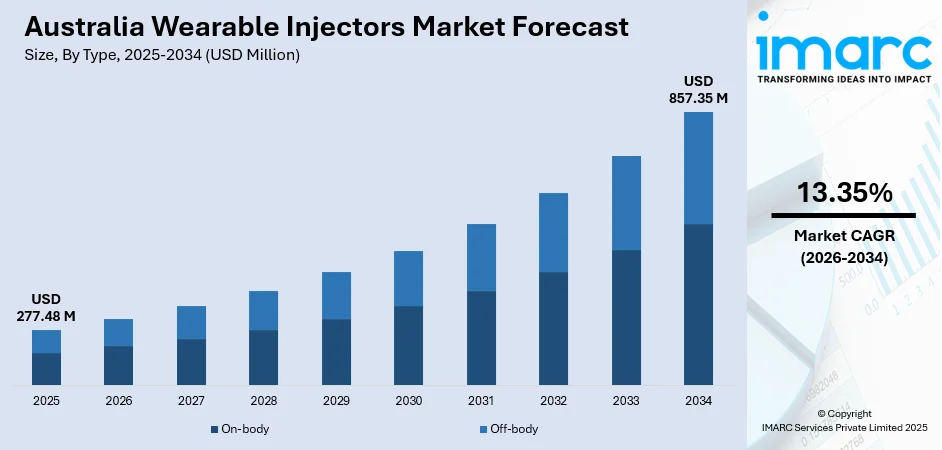

The Australia wearable injectors market size was valued at USD 277.48 Million in 2025 and is projected to reach USD 857.35 Million by 2034, growing at a compound annual growth rate of 13.35% from 2026-2034.

The Australia wearable injectors market is experiencing steady growth driven by increasing adoption of self-administered therapies, rising prevalence of chronic conditions, and growing demand for advanced drug delivery solutions. The convergence of patient-centric healthcare approaches, technological innovations in device design, and expanding biologics treatment landscape creates favorable conditions for market expansion. Healthcare providers and patients increasingly recognize the value of wearable injectors in improving treatment compliance and quality of life, strengthening the Australia wearable injectors market share.

Key Takeaways and Insights:

- By Type: On-body dominates the market with a share of 65% in 2025, driven by their ability to provide hands-free, controlled subcutaneous drug delivery directly attached to the patient's skin, offering convenience for managing chronic conditions requiring frequent self-administration.

- By Technology: Spring-based leads the market with a share of 40% in 2025, attributed to the established reliability, cost-effectiveness, and proven performance of spring-driven mechanisms in delivering consistent, controlled drug doses across various therapeutic applications.

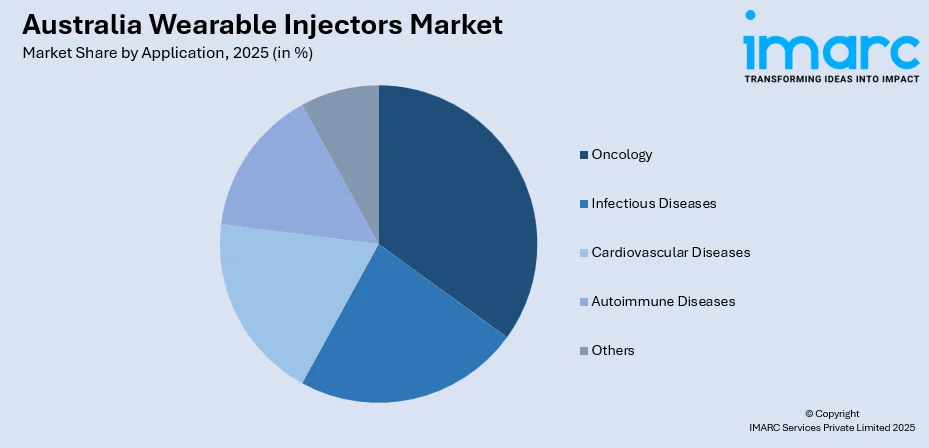

- By Application: Oncology represents the largest segment with a market share of 35% in 2025, owing to the increasing adoption of biologic cancer therapies, growing patient population requiring frequent chemotherapy support medications, and rising demand for convenient home-based cancer care solutions.

- By End Use: Hospitals and Clinics holds the largest share of 55% in 2025, reflecting the primary role of healthcare institutions in initiating wearable injector therapies, providing patient training, and managing complex treatment protocols requiring clinical oversight.

- Key Players: The Australia wearable injectors market features major international medical device companies and pharmaceutical manufacturers competing through technological innovation, strategic partnerships, and drug-device combination product development.

To get more information on this market, Request Sample

The Australian wearable injectors market benefits from supportive regulatory frameworks established by the Therapeutic Goods Administration (TGA), which has created clear pathways for device approvals and combination products. Notably, the Australian government recently rolled out reforms aimed at expediting access to innovative medical devices and medicines — including new, faster approval routes for therapeutics and medical devices. Moreover, the healthcare system's increasing focus on patient-centric care models, home-based treatment options, and cost optimization drives adoption across therapeutic areas. Additionally, Australia's strong presence in biologics research and development, participation in global clinical trials, and expanding biosimilar market create favorable conditions for wearable injector technologies that enable convenient delivery of complex biologic therapies.

Australia Wearable Injectors Market Trends:

Integration of Digital Health Features and Connectivity

Australian healthcare providers are increasingly adopting wearable injectors equipped with digital health capabilities including Bluetooth connectivity, real-time monitoring, and adherence tracking features. In fact, a 2025 pilot at a major Australian hospital demonstrated that remote continuous vital-sign monitoring using wearable sensors can safely and effectively support patient care — reducing risks and enabling home-based / virtual-care delivery under the hospital “virtual care” model. These innovations enable seamless integration with telehealth platforms, allowing healthcare professionals to remotely monitor patient compliance and treatment outcomes. The trend toward connected devices supports better clinical decision-making and enhances patient engagement throughout their treatment journey.

Patient-Centric Design and Improved User Experience

Device manufacturers are prioritizing patient comfort and ease of use through compact, skin-friendly designs featuring intuitive user interfaces. For instance, in August 2025, Enable Injections, Inc. obtained regulatory approval from ANVISA (Brazil’s health regulator) for its enFuse on‑body injector — a hands‑free, on‑body drug‑delivery system designed to facilitate subcutaneous administration of large‑volume medications, creating a more comfortable at‑home or in‑clinic experience for patients. These innovations in miniaturization, ergonomic form factors, and simplified operation reduce patient anxiety associated with self-injection while improving treatment acceptance. These design improvements are particularly important for elderly patients and those managing multiple chronic conditions requiring ongoing biologic therapies.

Drug-Device Combination Product Development

Pharmaceutical companies are increasingly partnering with device manufacturers to develop drug-specific wearable injector platforms optimized for particular biologic formulations. For instance, in May 2024, Enable Injections announced that it had expanded its collaboration with Roche — under which Roche obtains a worldwide, exclusive license to combine its biologic molecules with Enable’s wearable delivery platform (the enFuse system) for subcutaneous administration. These collaborations ensure compatibility between advanced therapeutics and delivery systems, addressing the unique requirements of high-viscosity biologics and large-volume subcutaneous delivery. The trend supports the growing pipeline of biologic therapies entering the Australian market.

Market Outlook 2026-2034:

The Australia wearable injectors market is positioned for substantial growth over the forecast period, supported by aging demographics, rising chronic disease prevalence, and expanding biologics adoption. The convergence of technological innovation, supportive regulatory frameworks, and healthcare system emphasis on cost-effective care delivery creates favorable conditions for market expansion. Continued advancement in device capabilities, broader therapeutic applications, and growing acceptance of home-based care models will drive penetration across healthcare settings. The market generated a revenue of USD 277.48 Million in 2025 and is projected to reach a revenue of USD 857.35 Million by 2034, growing at a compound annual growth rate of 13.35% from 2026-2034.

Australia Wearable Injectors Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | On-body | 65% |

| Technology | Spring-based | 40% |

| Application | Oncology | 35% |

| End Use | Hospitals and Clinics | 55% |

Type Insights:

- On-body

- Off-body

The on-body dominates with a market share of 65% of the total Australia wearable injectors market in 2025.

The on-body wearable injectors segment leads the Australian market, reflecting the strong preference for devices that attach directly to the patient's skin and provide hands-free, controlled subcutaneous drug delivery. In 2024, the Therapeutic Goods Administration (TGA) introduced updated guidance for combination products and wearable drug‑delivery systems, streamlining approval pathways and supporting faster access to innovative devices in chronic disease management. These devices enable patients to continue daily activities without disruption while receiving medication over extended periods. The segment benefits from growing adoption in chronic disease management where frequent self-administration is required, particularly in oncology support therapies, autoimmune conditions, and diabetes management applications.

Technology Insights:

- Spring-based

- Motor-driven

- Rotary Pump

- Expanding Battery

- Others

The spring-based leads with a share of 40% of the total Australia wearable injectors market in 2025.

Spring-based technology dominates the Australian wearable injectors market due to its established reliability, cost-effectiveness, and proven performance in delivering consistent drug doses. These mechanisms offer simplicity in design, require no external power source, and provide predictable delivery rates essential for therapeutic efficacy. The technology has been extensively validated in commercial products, creating strong clinician and patient confidence in spring-driven delivery systems across various therapeutic applications.

Additionally, ongoing advancements in spring materials and compact design have improved device portability, comfort, and user-friendliness. These enhancements support long-term adherence, increase patient satisfaction, and expand the application of spring-based wearable injectors across chronic therapies and home-based treatment settings.

Application Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Oncology

- Infectious Diseases

- Cardiovascular Diseases

- Autoimmune Diseases

- Others

The oncology dominates with a market share of 35% of the total Australia wearable injectors market in 2025.

The oncology segment leads the Australian wearable injectors market, driven by the increasing adoption of biologic cancer therapies and supportive care medications that benefit from convenient subcutaneous delivery. Cancer treatment protocols frequently require administration of colony-stimulating factors, immunotherapies, and targeted biologics that are well-suited for wearable injector delivery. The growing emphasis on outpatient cancer care and quality of life considerations accelerates adoption of devices that reduce clinical visits while maintaining treatment adherence. For example: in 2025, Sarclisa (for multiple myeloma) was administered subcutaneously via an on‑body injector (enFuse® On‑Body Injector from Enable Injections), showing non‑inferior efficacy and safety compared with intravenous infusion — and markedly reducing treatment time to minutes.

The increasing shift toward self-administration, rising prevalence of cancer, and growing awareness of minimally invasive therapies are key growth drivers. Additionally, favorable reimbursement policies and ongoing innovation in wearable injector design are expected to further expand adoption across oncology treatment settings in Australia.

End Use Insights:

- Hospitals and Clinics

- Home Care

- Others

The hospitals and clinics leads with a share of 55% of the total Australia wearable injectors market in 2025.

Hospitals and clinics dominate the Australian wearable injectors market as primary sites for therapy initiation, patient education, and clinical oversight of complex treatment protocols. Healthcare institutions play a crucial role in prescribing wearable injector therapies, training patients on proper device usage, and monitoring treatment outcomes. The institutional setting provides necessary infrastructure for managing adverse events, ensuring appropriate patient selection, and supporting the transition to home-based self-administration. In fact, as of 2025 the Therapeutic Goods Administration (TGA) — Australia’s regulatory body for medical devices — has streamlined its approval pathways for combination drug‑device products, accelerating market entry for next‑generation wearable injectors.

Future adoption in hospitals and clinics is expected to grow with the integration of smart wearable injectors, remote monitoring, and telehealth support. These advancements will enhance patient adherence, optimize treatment outcomes, and streamline clinical workflows for complex therapy management.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales region holds a strong position in the Australia wearable injectors market, driven by Sydney's concentration of major hospitals, oncology centers, and research institutions. The presence of leading healthcare networks, pharmaceutical headquarters, and clinical trial infrastructure supports advanced drug delivery technology adoption. High population density, strong healthcare spending, and access to specialist medical services create robust demand for wearable injector therapies across therapeutic applications.

Victoria represents a significant market contributor supported by Melbourne's thriving medical technology ecosystem and government investment in healthcare innovation. The Victorian Medtech Skills and Device Hub initiative accelerates medical device development and manufacturing capabilities. Strong research collaborations between universities, hospitals, and industry partners foster innovation in drug delivery technologies, supporting wearable injector adoption across the region.

Queensland demonstrates growing demand for wearable injectors driven by expanding healthcare infrastructure and increasing chronic disease prevalence. Brisbane's developing medical technology sector, supported by government funding programs, creates opportunities for advanced drug delivery solutions. The region's distributed population across coastal cities benefits from wearable injector technologies that enable home-based care and reduce travel requirements for ongoing treatments.

These regions present unique opportunities for wearable injectors addressing healthcare access challenges in remote and rural areas. Self-administered drug delivery devices reduce dependence on clinical infrastructure, enabling care continuity for patients distant from major medical centers. Adelaide's healthcare sector and regional health networks increasingly adopt wearable injector technologies supporting patient independence and treatment compliance.

Western Australia's geographically dispersed population creates strong demand for self-administered therapies enabling home-based care. Perth's healthcare system increasingly incorporates wearable injector technologies to serve patients across vast distances. The region benefits from telehealth integration capabilities that allow remote monitoring of wearable injector therapies, supporting treatment adherence and clinical oversight despite geographic separation from major medical centers.

Market Dynamics:

Growth Drivers:

Why is the Australia Wearable Injectors Market Growing?

Growing Demand for Patient-Centric and Home-Based Care

Australia's healthcare system is increasingly focused on improving patient experience through self-care and home-based treatment models. Wearable injectors align with this trend by enabling patients to administer medications independently, safely, and with minimal discomfort. These devices reduce dependence on clinical infrastructure, allowing care continuity even in remote areas. Patients appreciate the flexibility, discretion, and autonomy offered by wearable injectors, particularly those managing long-term therapies. The Australia patient monitoring market, which reached USD 1.3 Billion in 2024, highlights growing adoption of remote and self-care technologies, and is expected to reach USD 3.2 Billion by 2033, reflecting increasing focus on patient-centered care. Healthcare providers benefit from improved treatment compliance and reduced hospital burden as government and private insurers promote efficient care delivery models prioritizing patient convenience.

Rising Prevalence of Chronic Diseases Requiring Biologic Therapies

Australia is witnessing consistent increases in chronic health conditions including diabetes, cancer, multiple sclerosis, and rheumatoid arthritis. These long-term conditions typically require ongoing treatment involving complex biologics and frequent injections. Conventional injection techniques can be painful, inconvenient, and time-consuming for patients needing regular administration. In 2025, the Australian Government Department of Health and Aged Care committed AU $12 million to support development of new Australian‑made medical devices and medicines for people with diabetes and cardiovascular disease, signalling policy‑level support for homecare‑enabling technologies that could include wearable injectors. Wearable injectors address these challenges by enabling painless, controlled, and self-administered drug delivery over extended durations. This innovation enhances medication adherence and empowers patients to manage their health with improved independence and comfort, driving sustained market demand.

Technological Advancements in Drug Delivery Devices

Innovations in wearable injector design including miniaturization, wireless connectivity, intuitive user interfaces, and compatibility with diverse drug formulations are making devices more accessible and appealing. Australian healthcare providers increasingly adopt devices supporting continuous subcutaneous delivery of biologics and personalized dosing. Enhanced safety features, feedback mechanisms, and digital health platform integration enable better monitoring and real-time adherence tracking. Pharmaceutical companies are designing injectable therapies specifically suited for wearable systems, accelerating clinical adoption and reinforcing wearable injectors' role in next-generation treatment protocols.

Market Restraints:

What Challenges the Australia Wearable Injectors Market is Facing?

High Device and Therapy Costs

The relatively high costs associated with wearable injector devices and the biologic therapies they deliver present accessibility challenges. Despite cost benefits from reduced clinical visits, initial device expenses and ongoing therapy costs may limit adoption among price-sensitive healthcare systems and patients without comprehensive insurance coverage.

Complex Regulatory Requirements for Combination Products

Drug-device combination products face complex regulatory pathways requiring coordination between device and pharmaceutical regulatory requirements. While Australia's TGA has established supportive frameworks, the development and approval process for integrated products remains resource-intensive, potentially delaying market entry for innovative wearable injector solutions.

Patient Training and Adoption Barriers

Successful wearable injector use requires adequate patient training and ongoing support. Some patients, particularly elderly individuals or those unfamiliar with medical devices, may face challenges adapting to self-administration technologies. Healthcare systems must invest in education programs and support infrastructure to ensure safe and effective device utilization.

Competitive Landscape:

The Australia wearable injectors market features major international medical device companies and pharmaceutical manufacturers competing through technological innovation, strategic partnerships, and integrated drug-device product development. Market participants emphasize device reliability, patient comfort, and digital health integration to differentiate offerings. Companies invest in research and development to expand therapeutic applications and improve device capabilities. Strategic collaborations between pharmaceutical companies and device manufacturers accelerate development of drug-specific delivery platforms optimized for biologic formulations. The competitive landscape is characterized by ongoing innovation in programmable delivery, connectivity features, and user experience improvements.

Recent Developments:

- In July 2025, BD highlighted new details of its Libertas™ wearable injector, which supports high-viscosity biologics (up to 50 centipoise) and is offered in 2–5 mL and 5–10 mL versions. Designed for large-volume subcutaneous delivery, the device requires no user assembly—simply “peel, stick and click.

- In 2025, Enable Injections continued expanding its presence in the wearable injectors market through its enFuse® On-Body Delivery System. The company reported ongoing partnerships with major pharmaceutical firms to advance on-body biologic delivery, strengthening its position in next-generation drug-administration technologies.

Australia Wearable Injectors Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | On-body, Off-body |

| Technologies Covered | Spring-based, Motor-driven, Rotary Pump, Expanding Battery, Others |

| Applications Covered | Oncology, Infectious Diseases, Cardiovascular Diseases, Autoimmune Diseases, Others |

| End Uses Covered | Hospitals and Clinics, Home Care, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia wearable injectors market size was valued at USD 277.48 Million in 2025.

The Australia wearable injectors market is expected to grow at a compound annual growth rate of 13.35% from 2026-2034 to reach USD 857.35 Million by 2034.

On-body wearable injectors held the largest market share of 65%, driven by their ability to provide hands-free, controlled subcutaneous drug delivery directly attached to the patient's skin for convenient chronic disease management.

Key factors driving the Australia wearable injectors market include growing demand for patient-centric and home-based care, rising prevalence of chronic diseases requiring biologic therapies, technological advancements in drug delivery devices, supportive regulatory environment, and healthcare cost optimization priorities.

Major challenges include high device and therapy costs limiting accessibility, complex regulatory requirements for drug-device combination products, patient training and adoption barriers particularly among elderly populations, and the need for ongoing healthcare system investment in support infrastructure.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)