Australia Wearables Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2026-2034

Australia Wearables Market Overview:

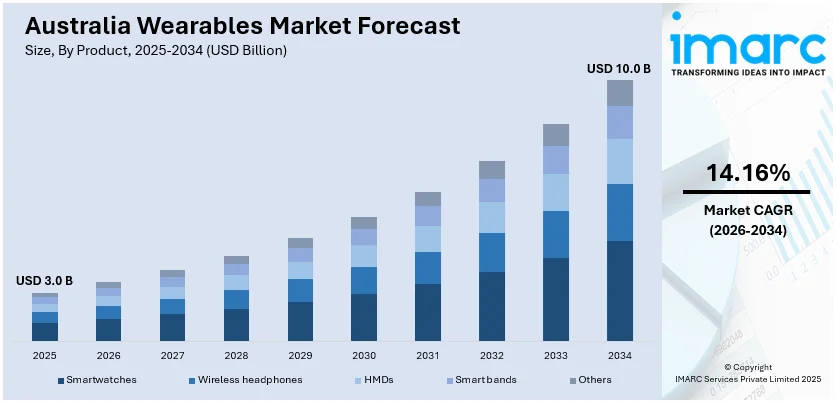

The Australia wearables market size reached USD 3.0 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 10.0 Billion by 2034, exhibiting a growth rate (CAGR) of 14.16% during 2026-2034. The market is growing, owing to the increasing demand for fitness and health-oriented devices, smart wearables in elderly care, and fashion-forward products. As consumers seek advanced health tracking, safety features, and stylish designs, the market continues to expand across various demographics.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 3.0 Billion |

| Market Forecast in 2034 | USD 10.0 Billion |

| Market Growth Rate 2026-2034 | 14.16% |

Australia Wearables Market Trends:

Rising Adoption of Fitness and Health-Oriented Wearables

Demand for fitness-oriented wearables, such as smart bands and smartwatches is growing significantly. Australians are also getting intensely health-aware, and that is translating into amplified adoption of wearables to track activity, heart rate, sleep patterns, and even stress levels. For example, in October 2024, Samsung launched the Galaxy Ring in Australia, offering advanced wellness tracking with personalized insights, making it the first country in South-East Asia and Oceania to debut this wearable. Further, that aligns with the rising popularity of total wellness and total health solutions, especially in the cities. The inclusion of sophisticated sensors and artificial intelligence (AI) based features has facilitated the ability of users to monitor their fitness targets with more precision. Wearables are now being used not just by fitness enthusiasts but also by those who want to enhance their overall health. The growth of virtual fitness plans and customized health information from these wearables is also fueling consumer demand. Australian health insurance firms are encouraging wearable usage by providing discounts for those who regularly monitor their health statistics, fueling the market further.

To get more information on this market Request Sample

Expansion of Smart Wearables in the Elderly Care Sector

The Australian market for smart wearables is expanding in the older adults' care industry. The amplifying population of old people results in a stimulating demand for health monitoring and safety for the geriatric population. Moreover, smart wearables, such as smartwatches with features to detect falls, monitor heart rates, and trigger emergency calls are becoming more popular among caregivers and elderly populations. These devices offer security, enabling geriatric Australians to stay independent while connected to their family and health care professionals. Wearables for older users come with easy-to-use interfaces, big screens, and medical-grade sensors to capture accurate health data. Additionally, integration with telemedicine and remote monitoring services is augmenting the function of wearables in geriatric care. As the geriatric population accelerates in Australia, wearables adoption in this market is anticipated to boost, providing a larger market opportunity for healthcare providers and wearable technology firms.

Increased Demand for Fashion-Forward Wearables

In Australia, fashion accessories over technology devices are now how wearables are observed. Wearables like smartwatches, wireless earbuds, and fitness trackers are now created with a modern, stylish design to be embraced by more than just technology-savvy individuals but also by fashion consumers. For instance, in December 2024, Apple's AirPods Pro 2 received approval from Australia's Therapeutic Goods Administration (TGA) as medical devices, allowing them to be used as hearing aids and for hearing tests, with software updates pending. Moreover, companies are working with designers and influencers to come up with wearables that marry technology and luxury fashion. This is observed with the amplified adoption of limited-edition smartwatches, collaborations by designers, and interchangeable watch straps that come in various tastes and styles. Shoppers are wanting wearables that fit into their personal fashion taste while still giving them leading features. This shift towards fashionable wearables is best seen with young generations, where they want products that perfectly fit into their style of life as well as provide the advantage of advanced health tracking, connectivity, and functionality. Consequently, more fashion and luxury brands have entered the market for wearables, further sustaining this trend within Australia.

Australia Wearables Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on product and distribution channel.

Product Insights:

- Smartwatches

- Wireless headphones

- HMDs

- Smart bands

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes smartwatches, wireless headphones, HMDs, smart bands, and others.

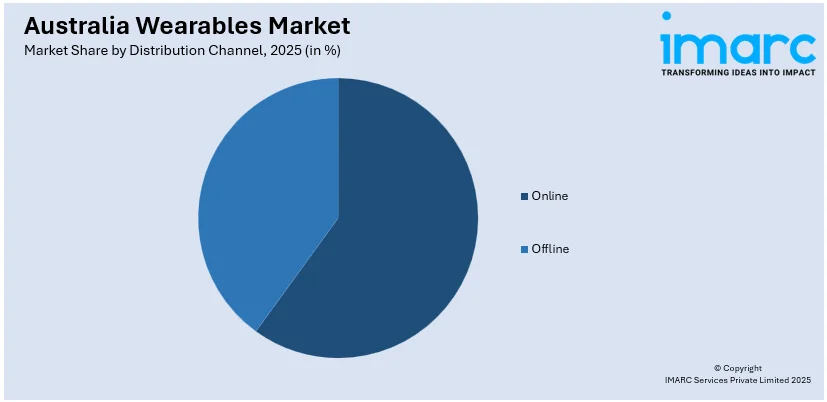

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Wearables Market News:

- In February 2024, Australia launched the National Digital Health Strategy 2023-2028, aiming to enhance healthcare through digital innovations like wearables and AI-driven tools. The strategy prioritizes connected, person-centered, and data-driven healthcare, fostering a secure and inclusive system to empower Australians in managing their health effectively.

Australia Wearables Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Smartwatches, Wireless Headphones, HMDs, Smart Bands, Others |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia wearables market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia wearables market on the basis of product?

- What is the breakup of the Australia wearables market on the basis of distribution channel?

- What is the breakup of the Australia wearables market on the basis of region?

- What are the various stages in the value chain of the Australia wearables market?

- What are the key driving factors and challenges in the Australia wearables?

- What is the structure of the Australia wearables market and who are the key players?

- What is the degree of competition in the Australia wearables market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia wearables market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia wearables market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia wearables industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)