Australia Women Apparel Market Size, Share, Trends and Forecast by Product Type, Season, Distribution Channel, and Region, 2025-2033

Australia Women Apparel Market Size and Share:

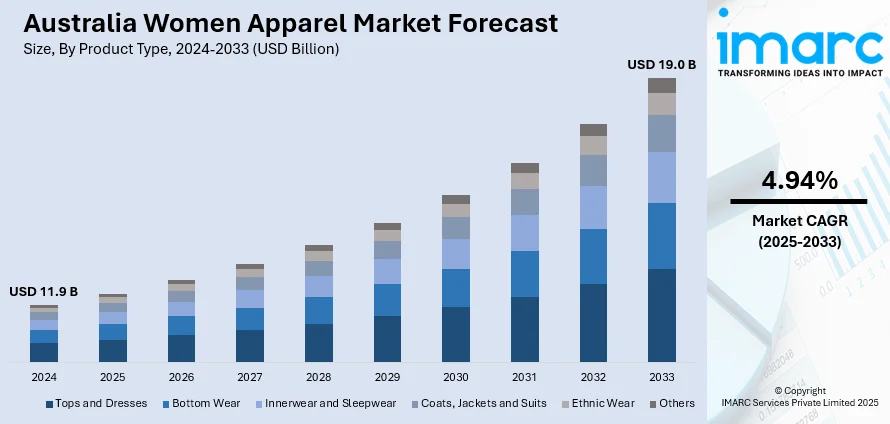

The Australia women apparel market size reached USD 11.9 Billion in 2024. Looking forward, the market is expected to reach USD 19.0 Billion by 2033, exhibiting a growth rate (CAGR) of 4.94% during 2025-2033. The market is fueled by changing fashion, growing consumer purchasing power, and the rising need for environmentally-friendly and ethically manufactured apparel. Moreover, the impact of online retail sites and changing lifestyle patterns towards casual and athleisure wear play a significant role in driving market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 11.9 Billion |

| Market Forecast in 2033 | USD 19.0 Billion |

| Market Growth Rate 2025-2033 | 4.94% |

Key Trends of Australia Women Apparel Market:

Sustainability and Ethical Fashion

Australian consumers are increasingly valuing sustainability in their fashion purchases. This is driven by increasing environmental consciousness and the need for sustainable materials like organic cotton and recycled materials. Companies that embrace transparent supply chains, ethical working conditions, and environmentally friendly production methods are gaining competitive ground. The popularity of second-hand and vintage clothing also indicates this trend, with online platforms like Depop and local thrift shops booming. This movement is not merely material but also includes minimalistic fashion, longevity, and mindful consumption, affecting consumers and brands alike to rethink their fashion approach. For instance, the Sydney Global Sourcing Expo, held in June 2024, focused on sustainability, featuring global exhibitors and seminars on sustainable sourcing, circular fashion, supply chain transparency, and fair labor practices. Notable topics include Australia's "Seamless" initiative to reduce landfill waste, the Living Wage movement, and the rise of conscious fashion among major Australian brands. The event supported brands in adopting eco-friendly, ethical practices in their operations, and further contributed to the expansion of the Australia women apparel market share.

To get more information on this market, Request Sample

Athleisure and Casual Wear Dominance

The athleisure trend's growth in Australia is a worldwide shift toward comfort and practicality for everyday wear. Consumers are influenced by lifestyle factors, such as more home-based work and emphasis on well-being, which drive the need for easy-to-wear clothing that can easily incorporate after-workout sessions as well as daytime outings. Manufacturers are reacting with new materials, fashion-forward activewear, and fashion-meets-performance design. The rise of yoga pants, oversized hoodies, and minimalist sneakers highlights this trend. Stores are widening athleisure collections to suit various demographics, and it is now a mainstay in Australian women's closets. For instance, in 2023, Australia's women's sportswear sector grew by 7% compared to the previous year, outpacing the overall apparel market. The sector achieved a 10% compound annual growth rate (CAGR), driven by the Paris 2024 Olympics' focus on gender parity and increased support for women's sports. This trend is expected to continue, with a projected 4% growth in 2024 for the sportswear market, compared to 2% for the overall apparel and footwear market.

Growth Drivers of Australia Women Apparel Market:

Cultural and Climate-Driven Fashion Preferences

Australia’s women’s apparel market is distinctively shaped by its diverse climate and vibrant cultural milieu, fostering unique growth drivers. With coastal cities basking in year-round sunshine, women’s fashion trends prioritize lightweight fabrics, UV-protective activewear, and versatile sun-smart accessories like wide-brimmed hats and scarves. In urban areas like Perth and Brisbane, green-conscious fashion is an environmental reaction that is both functional and practical in terms of demanding more breezy, airy designs throughout the year. Additionally, Australia's diversity brings the world of design a diverse composition of cultural forms. From Aboriginal-print influences to South Asian craftwork elements and Mediterranean silhouettes, these varied impressions heighten our market and respond to local appreciation as well as export value. This intercultural blending has challenged local designers to develop with fabric fusion and alternative collections that are unique in international fashion circles. Therefore, Australia's multiculturalism and climate give its women's fashion industry a touch of style, driving growth in sustainable, locally meaningful designs and intelligent sun-wear fashion.

Digital Retail, Local Identity, and Lifestyle Integration

The development of digital retail has tremendously powered the Australia women clothing market demand, with local players utilizing e-commerce, social media, and influencer marketing to reach consumers across the country. Others such as The Iconic and Myer's e-commerce site, and boutique brand websites, allow designers to access regional and remote consumers while retaining their specific Australian identity. Capsule collections for seasonal sale, from surf-spirited sportswear to fitted festival wear are promoted via TikTok and Instagram, successfully incorporating local lifestyle aspects such as beach life, music festivals, and outdoor adventure into brand storylines. This smooth blending of fashion with lifestyle and digital interaction creates more consumer loyalty and repeat purchases. Moreover, integration with online marketplaces provides assurance to consumers via easy return policies and flexible delivery models serving wide geographic areas throughout Australia. With mobile shopping increasing, AR-based "try-on" features increase the convenience aspect, further making digital retail immersive. This digital revolution enables homegrown brands to grow and demystifies trend discovery, hence catalyzing inclusive market growth in both urban and regional societies.

Changing Consumer Values and Domestic Brand Patronage

One of the growth drivers in the Australia women apparel market is the growing congruence between shifting consumer values and patronage for locally grown brands. Australian consumers are demonstrating a clear inclination toward locally produced items that embody transparency, quality, and authenticity. This is driven by a need to shop in support of the local economy, particularly in response to global disruption and the growing concerns about the environmental effects of foreign manufacture. Consumers are turning toward brands that embody Australian values—casual sophistication, comfort, and adaptability to lifestyle. Local brands that highlight natural materials, ethical working conditions, and a sense of community identity are on the rise in both metropolitan and regional markets. Moreover, regional pride and storytelling branding—like honoring coastal lifestyle or bushland heritage, enable such labels to differentiate themselves from international fast fashion. That powerful emotional and cultural affinity between consumers and domestic brands continues to drive growth, particularly with Australians increasingly valuing purpose over mass popularity in their fashion choices.

Opportunities of Australia Women Apparel Market:

Development of Indigenous and Culturally Inspired Fashion

According to the Australia women apparel market analysis, one of the most exciting prospects for the market is the development of Indigenous and culturally inspired fashion. Aboriginal and Torres Strait Islander designers and artists are now taking center stage in the fashion world, drawing on their culture to develop clothing lines full of meaning and style. These collections tend to incorporate traditional motifs, hand-painted fabrics, and narrative details that resonate strongly with Australia's country and past. The growing value placed on authenticity and cultural expression provides a special forum for these designers to grow their brands domestically and globally. Government grants and joint ventures with mainstream fashion brands have also started fostering Indigenous entrepreneurship within the fashion industry. For consumers, there is increasing demand to dress in clothing that speaks of a true affinity to place, culture, and identity. This helps facilitate industry diversification and create a more inclusive fashion narrative that speaks across a multicultural Australian society.

Regional Market Penetration and Lifestyle-Centric Design

Australia's vast geography and extremely diverse lifestyles across states present enormous untapped potential for region-specific women's apparel. Designers and brands which produce collections to fit the requirements of women across various climates ranging from the cold highlands of Tasmania to the tropical regions of Northern Queensland, have the potential to own niche segments. For example, moisture-wicking and drying materials work well in humid climates, whereas insulated layers would be more applicable in alpine climates. By the same token, rural and remote women frequently require long-lasting, trendy work and outdoor apparel, opening opportunities for tough yet trendy clothing. Those brands that recognize and address such differences through local campaigns, pop-ups, or regional partnerships can successfully enter markets frequently underserved by the large fashion retailers. In addition, lifestyle trends including outdoor recreation, coastal residence, and urban wellness movements also propel demand for active-luxury hybrids and functionally fashionable clothing, unlocking a wide spectrum of growth opportunities across the Australian market.

Digital Innovation and Customization

Given Australia's high level of internet penetration and digital literacy, women's fashion businesses have a compelling opportunity to harness technology to drive customer engagement and personalization. Customization capabilities where consumers can change colors, fit, and prints on the internet is becoming increasingly popular among young customers who want originality in the clothes they wear. This appeal best suits Australia's cultural orientation towards individuality and expression of style. Virtual try-on features and AI styling recommendations also enhance internet shopping, lowering return rates and boosting the confidence in online buying. There is also space for innovation in fashion subscription services and mobile-first retail platforms, especially those leveraging local influencers and micro-trends to connect with consumers. By marrying fashion and tech, Australian apparel businesses can create stronger, more personalized customer journeys. These technological approaches provide scalability while also assisting small, independent brands in competing with international fashion giants, transforming Australia's tech-savvy shopper demographics into a big growth potential for the women's clothing market.

Challenges of Australia Women Apparel Market:

Geographic Isolation and Supply Chain Complexity

Geographic isolation of the country is one of the leading challenges confronting the Australia women apparel market, and this contributes largely to both the speed and cost of supply chains. The majority of raw materials and processed clothing are sourced from the manufacturing centers in Asia, Europe, and the Americas, resulting in increased lead times and freight costs. Such logistical slowdown is especially hard on fast fashion and seasonal collections, which are dependent on quick turnover of inventories. Customs rules as well as biosecurity checks also hinder the flow of goods, particularly for brands that are trying out organic or plant-based fabrics. Domestic manufacturing, although on the rise, remains limited and often too expensive for mass production. This intricate supply chain complicates it for local brands to compete with global retailers that can scale more quickly and provide cheaper prices. Consequently, inventory management, speed-to-market, and cost control continue to be challenges for both newer and seasoned Australian women's apparel brands.

Market Saturation and Global Retail Pressure

The Australian women's fashion market is increasingly threatened by international retail saturation. International names such as Zara, H&M, and Uniqlo have built up a solid presence in prime cities, providing trendy, value-for-money fashion that is popular with the masses. Such infusions of international players heighten competition and exert pressure on local brands to stand out by virtue of quality, sustainability, or design originality, which are attributes that often come with a cost burden. Furthermore, international e-commerce websites enable customers to forego local options altogether and purchase offshore with wider style ranges and deep discounting. The sheer number of fashion available online overwhelms smaller Australian brands' abilities to keep their products in view and build consumer loyalty. Adding to this is the price sensitivity trend, where shoppers will opt for cheapest rather than locally produced or ethically sourced. This global reach, although providing diversity to consumers, poses a major stumbling block for indigenous brands competing to maintain market share.

Changing Consumer Expectations and Sustainability Requirements

Australian women are becoming increasingly demanding of more from their fashion purchases—not only style and fit but also sustainability, fair sourcing, and openness. Although this change offers promise, it also creates sophisticated issues for domestic brands attempting to satisfy changing consumer values. Adhering to ethical manufacturing standards, maintaining ecological responsibility, and providing these measures with clarity increases expense and operational complexity. Smaller or mid-tier brands find it difficult to execute complete supply chain transparency or undertake circular fashion strategies, particularly without big-boutique investment or infrastructure backing. Moreover, with growing climate awareness, brands need to factor in their environmental impact across packaging to logistics. Slack in demand in a price-conscious market makes balancing the urge for more environmentally friendly practices with demand from consumers that they remain affordable challenging. The difficulty is in taking up more responsible practices and in informing consumers about the value of what is being done, thereby sustainability being a challenging yet inevitable trajectory for long-term competitiveness in Australia's women's fashion market.

Australia Women Apparel Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, season, and distribution channel.

Product Type Insights:

- Tops and Dresses

- Bottom Wear

- Innerwear and Sleepwear

- Coats, Jackets and Suits

- Ethnic Wear

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes tops and dresses, bottom wear, innerwear and sleepwear, coats, jackets and suits, ethnic wear, and others.

Season Insights:

- Summer Wear

- Winter Wear

- All Season Wear

The report has provided a detailed breakup and analysis of the market based on the season. This includes summer wear, winter wear, and all season wear.

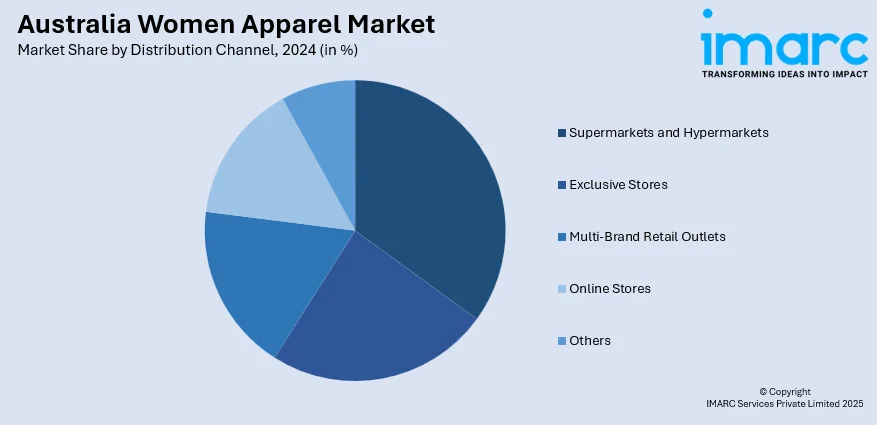

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Exclusive Stores

- Multi-Brand Retail Outlets

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, exclusive stores, multi-brand retail outlets, online stores, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Women Apparel Market News:

- In October 2024, Mosaic Brands, the parent company of Australian clothing labels Rivers, Millers, and Katies, entered voluntary administration due to financial struggles. The ASX-listed company, which operates over 700 stores and employs around 3,000 staff, had previously closed five brands—Rockmans, Autograph, Crossroads, W.Lane, and BeMe—to focus on its core brands and an online marketplace.

- In February 2025, Marie Claire unveiled a bold new redesign for its March 2025 issue, marking its 30th anniversary in Australia. The issue features Hollywood star Renée Zellweger in an exclusive cover shoot and interview, starting a year-long celebration with special events, a refreshed print and digital look, and a bumper birthday issue in September.

- In February 2025, Hanes, which operates in Australia through its subsidiary, Hanes Australasia, partnered with Urban Outfitters to launch an exclusive Hanes Heritage Capsule Collection, featuring 28 pieces of innerwear and apparel for men and women. This limited-edition collection blends nostalgia with modern fashion, showcasing redesigned classics like boxer briefs, ribbed tanks, crew socks, and oversized Beefy-Ts.

Australia Women Apparel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Tops and Dresses, Bottom Wear, Innerwear and Sleepwear, Coats, Jackets and Suits, Ethnic Wear, Others |

| Seasons Covered | Summer Wear, Winter Wear, All Season Wear |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Exclusive Stores, Multi-Brand Retail Outlets, Online Stores, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia women apparel market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia women apparel market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia women apparel industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia women apparel market was valued at USD 11.9 Billion in 2024.

The Australia women apparel market is projected to exhibit a CAGR of 4.94% during 2025-2033.

The Australia women apparel market is expected to reach a value of USD 19.0 Billion by 2033.

Key drivers of Australia women apparel market include rising consumer demand for sustainable and ethically produced clothing, digital retail expansion, and strong support for local brands. Lifestyle shifts toward comfort and activewear, combined with cultural identity and climate-specific needs, also fuel growth across urban and regional fashion segments.

The Australia women apparel market trends include a strong shift toward sustainable fashion, digital retail integration, and culturally inspired designs. Local brands are blending eco-friendly materials with tech-driven personalization, while Indigenous and lifestyle-based collections gain popularity. The market also embraces seasonless, functional styles suited to Australia’s diverse climate and outdoor lifestyle.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)