Australian Automotive Financing Market Report by Type (New Vehicle, Used Vehicle), Source Type (OEM, Banks, Credit Unions, Financial Institution), Vehicle Type (Passenger Cars, Commercial Vehicles), and Region 2025-2033

Australian Automotive Financing Market Size and Share:

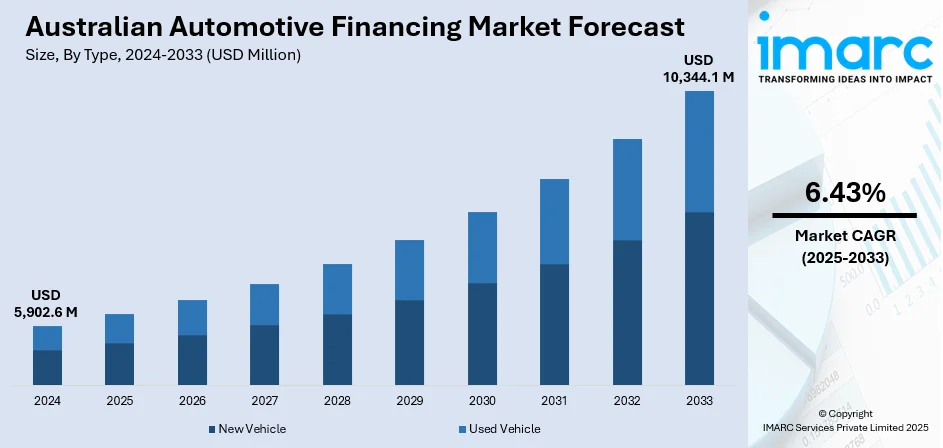

The Australian automotive financing market size reached USD 5,902.6 Million in 2024. Looking forward, the market is expected to reach USD 10,344.1 Million by 2033, exhibiting a growth rate (CAGR) of 6.43% during 2025-2033. The growing vehicle ownership, attractive interest rates, flexible financing options, the rising consumer demand for new and used cars, the availability of online financing platforms, economic stability, and supportive government policies are some of the major factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5,902.6 Million |

| Market Forecast in 2033 | USD 10,344.1 Million |

| Market Growth Rate 2025-2033 | 6.43% |

Key Trends of Australian Automotive Financing Market:

Increasing Vehicle Ownership and Demand

The rising consumer demand for both new and used vehicles fuels the need for automotive financing solutions, enabling more Australians to purchase vehicles. According to data from the Australian Bureau of Statistics, there were 20.1 million registered motor vehicles as of 31 January 2021. The national fleet increased by 1.7% from 2020 to 2021. Toyota topped the list of passenger vehicles for the 16th consecutive year with 3.0 million registrations. Diesel vehicles increased to 26.4% of the national fleet, up from 20.9% in 2016. An increase in registrations was reported in all states and territories. Queensland, South Australia, and the Australian Capital Territory each reported the largest increase from the previous year (2.3%). In contrast, Victoria's fleet grew the least by 0.7%. New South Wales, Victoria and Queensland accounted for 76% of the national fleet. New South Wales had the highest number of registrations with 5.9 million. The Northern Territory had the lowest number of registrations with 163 thousand. Light rigid trucks continued to have the largest growth rate in registrations, increasing 6.0%, followed by articulated trucks with 4.6%. Passenger vehicle registrations increased by 1.2% however, their share of the fleet fell 0.4 percentage points to 73.7%. In contrast, light commercial vehicle registrations increased by 3.3%, rising to 17.5% of the registered fleet.

To get more information on this market, Request Sample

Rising Supportive Government Policies

A stable economy and government initiatives aimed at supporting the automotive industry and consumer spending contributed to the robust growth of the automotive financing market in Australia. For instance, in March 2024, the Australian Renewable Energy Agency (ARENA) announced $4.76 million in funding from the Driving the Nation Program to Europcar Mobility Group for the ‘Electric Rental Vehicle and Charging Infrastructure Rollout’ project. Europcar Mobility Group will install 256 chargers across at least 41 sites around Australia, including metropolitan hubs and regional locations. The $110.6 million project will also encourage airports to consider the integration of EVs into parking, grid connections, and operations. This will support the deployment of around 3,100 rental EVs over the next 3 years.

Shift Toward Flexible Loan Structures

Australian consumers are increasingly looking for automotive financing that offers enhanced flexibility and personalization. Traditional rigid loan structures are being replaced by options such as balloon payments, variable interest rates, and extended terms that alleviate initial financial burdens. These alternatives are particularly appealing to younger buyers and those purchasing higher-priced vehicles as they provide lower monthly payments and improved budget management. Lenders and dealerships are adapting by presenting more customizable plans that fit individual financial situations. This movement is further supported by digital platforms allowing borrowers to simulate and modify repayment scenarios prior to making a commitment. The rising appeal of these tailored financial options is aiding the growth of the Australian automotive financing market share especially among first-time and value-oriented buyers.

Growth Drivers of Australian Automotive Financing Market:

Expansion of Digital Financing Platforms

The increasing reliance on digital platforms is revolutionizing the automotive financing landscape in Australia. Online loan applications, immediate credit approvals, and automated documentation processes have streamlined the borrowing journey making it more convenient and efficient for customers. These platforms are particularly suited to tech-savvy consumers who favor self-service options and reduced paperwork. Improved user interfaces, comparison tools, and pre-approval calculators empower buyers to assess personalized financing options from the comfort of their homes. Financial institutions and car dealers are increasingly investing in digital technologies to stay competitive and capture a broader market. This digital transition is significantly enhancing customer engagement and expediting decision-making thereby boosting Australian automotive financing market demand across urban and regional areas.

Electrification Incentives

The Australian government’s dedication to sustainable transportation paired with automaker-led sustainability efforts is crucial in encouraging financing for electric and hybrid vehicles. Incentives like rebates, lower registration fees, and tax benefits are prompting consumers to consider greener alternatives. In response, financial entities are rolling out attractive loan terms including reduced interest rates and extended repayment periods specifically for eco-friendly vehicles. These offerings align with wider environmental objectives while making the ownership of electric vehicles more financially accessible. As awareness of environmental issues rises, a growing number of buyers are looking at green vehicle financing solutions. This supportive environment is significantly influencing consumer behavior according to Australian automotive financing market analysis, especially among environmentally aware and first-time car buyers.

Rising Popularity of Pre-Owned Cars

The interest in pre-owned vehicles in Australia is growing, driven by affordability, enhanced vehicle quality, and economic uncertainties that make lower-cost options more attractive. This trend has prompted lenders to create specialized financing solutions aimed at the used car market, including shorter loan terms and flexible repayment options. Buyers are now more confident in acquiring certified pre-owned vehicles with financing that competes with new car offers. Moreover, digital marketplaces for used cars often feature integrated loan comparison tools, simplifying access to financing. As consumer confidence in the quality of used cars increases, so does the willingness to finance them, contributing to Australian automotive financing market growth, particularly among budget-conscious and younger consumers.

Australian Automotive Financing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, source type, and vehicle type.

Type Insights:

- New Vehicle

- Used Vehicle

The report has provided a detailed breakup and analysis of the market based on the type. This includes new vehicle and used vehicle.

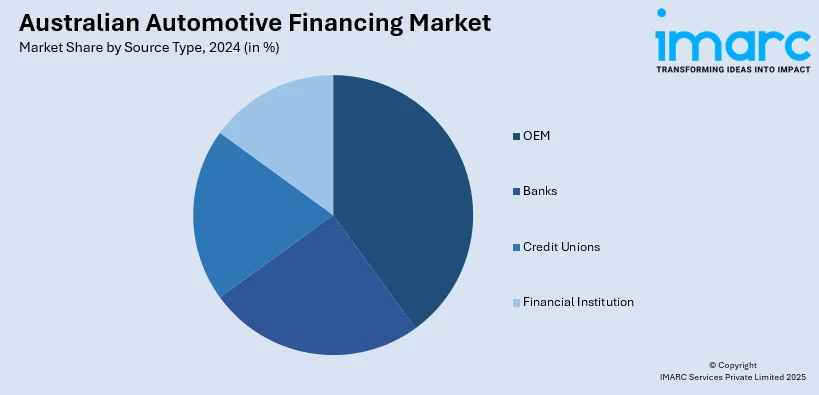

Source Type Insights:

- OEM

- Banks

- Credit Unions

- Financial Institution

The report has provided a detailed breakup and analysis of the market based on the source type. This includes OEM, banks, credit unions, and financial institution.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger cars and commercial vehicles.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australian Automotive Financing Market News:

- In July 2025, Allied Credit announced the acquisition of a USD 1.5bn car finance portfolio from Macquarie Group. This move enhances Allied's market position as a leading auto financier in Australia. The transition is set for Q4 2025, ensuring customers continue to receive quality service and support during the change.

- In June 2025, Hyundai Capital Australia launched Kia Finance, expanding its automotive finance offerings to include all Hyundai Motor Group brands. The company previously introduced Genesis and Hyundai Finance and now provides tailored financial solutions, including a Guaranteed Future Value product, aimed at enhancing vehicle ownership options for customers in Australia.

- In March 2025, Australian Securities and Investments Commission (ASIC) announced its plans to review the motor finance sector, focusing on compliance among lenders and brokers, particularly for vulnerable consumers in regional areas and First Nations communities. The review will assess loan management practices and may lead to enforcement actions to improve consumer protection and experiences in car financing.

- In November 2023, NAB agreed to enter a strategic partnership with fintech lender Plenti Group Limited. Under the partnership, NAB plans to launch a co-branded secured automotive and electric vehicle loan product. NAB and Plenti also developed a proposition to provide customers access to select Plenti renewable energy finance offerings.

- In June 2023, Mahindra & Mahindra Ltd on Wednesday launched its flagship SUV XUV700 in Australia. Given the strategic importance of the market, the introduction of the XUV700 in Australia marks the company's ambitious global expansion strategy and signifies the beginning of a new phase for the brand in the country, Mahindra & Mahindra (M&M) said in a statement.

Australian Automotive Financing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | New Vehicle, Used Vehicle |

| Source Types Covered | OEM, Banks, Credit Unions, Financial Institution |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australian automotive financing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australian automotive financing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australian automotive financing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive financing market in Australian was valued at USD 5,902.6 Million in 2024.

The Australian automotive financing market is projected to exhibit a compound annual growth rate (CAGR) of 6.43% during 2025-2033.

The Australian automotive financing market is expected to reach a value of USD 10,344.1 Million by 2033.

Growth drivers of the market include technological shifts enabling streamlined financing, expanding EV ownership supported by incentives, and surging demand for affordable mobility solutions. Additionally, tighter consumer credit scoring and increasing auto refinancing activity offer lenders new avenues to engage customers and broaden financial product offerings.

The key trend of the Australian automotive financing landscape is evolving with the adoption of digital-first lending tools, near-zero interests electric vehicle loans, and flexible term options. There is increased bundling of maintenance and insurance in finance packages, and a rising appetite for subscription-style access to cars. Growth in data-driven credit scoring and personalized financing plans is also reshaping consumer choices.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)