Automotive Active Safety System Market Size, Share, Trends and Forecast by Product, Vehicle Type, Fuel Type, Offering, and Region, 2025-2033

Automotive Active Safety System Market Size and Share:

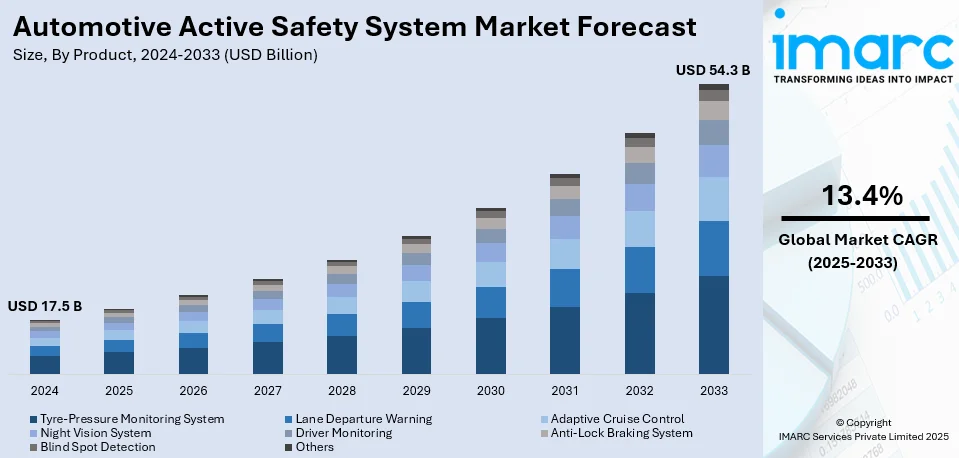

The global automotive active safety system market size was valued at USD 17.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 54.3 Billion by 2033, exhibiting a CAGR of 13.4% during 2025-2033. North America currently dominates the market, holding a significant market share of over 34.0% in 2024. The escalating demand for advanced driver-assistance systems (ADAS), stringent government regulations on vehicle safety, rising user awareness about road safety, and technological advancements, particularly in sensor and software integration, are some of the factors impelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 17.5 Billion |

|

Market Forecast in 2033

|

USD 54.3 Billion |

| Market Growth Rate (2025-2033) | 13.4% |

The increasing consumer demand for safer vehicles, along with stringent government regulations and safety standards, are major contributors to the automotive active safety system market growth. Regulatory mandates, such as the European Union’s Euro NCAP and the U.S. National Highway Traffic Safety Administration (NHTSA) guidelines, push automakers to incorporate advanced safety features. Technological advancements in sensors, radar, LiDAR, AI, and machine learning have significantly improved the effectiveness and precision of active safety systems. The rise in electric and connected vehicles further drives market growth, as these vehicles often incorporate advanced safety technologies for autonomous driving. Additionally, consumer awareness of the benefits of active safety features, such as collision avoidance and lane-keeping assistance, enhances the automotive active safety system market demand. Increasing partnerships between automakers and technology companies, along with the rise of autonomous vehicles, are also fueling market expansion.

The automotive active safety system market in the United States is driven by several factors. Strict regulations from the National Highway Traffic Safety Administration (NHTSA), including the push for advanced driver-assistance systems (ADAS), require automakers to adopt cutting-edge safety technologies. Increased consumer demand for safer vehicles, influenced by growing awareness of road safety, is also a significant factor. Technological advancements in radar, LiDAR, camera sensors, and AI are enhancing the effectiveness of safety features such as lane departure warning, automatic emergency braking, and adaptive cruise control. The rise of electric and autonomous vehicles further accelerates the adoption of these systems, as they require advanced safety technologies for operation. Additionally, the U.S. market’s focus on reducing road accidents and fatalities motivates the integration of active safety systems. Partnerships between automakers and tech companies further promote innovation, expanding the market. For instance, in May 2024, Volvo Buses announced that it has launched an upgraded and new line of smart safety features that is designed to help drivers and increase the safety of all road users, including bus passengers. The features surpass regulatory requirements, are completely integrated into the driving experience, and will be accessible worldwide, as explained by Thomas Forsberg, Head of Safety.

Automotive Active Safety System Market Trends:

Integration of Advanced Technologies

Modern vehicles are equipped with advanced technologies like machine learning (ML), artificial intelligence (AI), advanced sensors, such as radar, light detection and ranging (LIDAR), and cameras. By the end of 2030, around 95%-98% of new vehicles may feature AI technology, as per reports. These technologies help to improve the functionality of the vehicle by offering real-time data processing, predictive analysis, and adaptive responses. AI and ML algorithms can examine large quantities of data in order to forecast possible accidents and implement preventive actions. Sensors ensure accurate detection of obstacles and hazards in the vehicle's environment, providing precise monitoring. The continual development and integration of these technologies improve the efficiency and reliability of active safety systems, leading to vehicles that are safer and more effective. This technological collaboration is essential for advancing autonomous driving capabilities, offering a favorable automotive active safety system market outlook. In line with this, during CES 2024, Bosch introduced an innovative vehicle computer platform that combines infotainment and driver assistance features on a single system on chip (SoC), with the goal of simplifying operations and improving software-defined abilities in automobiles.

Growing Demand for Comprehensive Safety Features

Contemporary buyers are better educated about the advantages of advanced safety technologies and giving more importance to safety when buying cars. This increased consciousness is driven by widespread marketing efforts, educational programs, and prominent endorsements of safety technologies, which represents one of the key automotive active safety system market trends. Furthermore, the increasing number of road accidents and deaths are generating public awareness about the significance of vehicle safety, encouraging individuals to look for vehicles that are equipped with up-to-date safety features. According to the UNECE, every year, approximately 90,000 people are killed in road traffic accidents in the ECE region. The shift towards greater safety consciousness among individuals is not only leading to the adoption of existing technologies but also encouraging continuous innovation and development of new safety solutions to meet evolving expectations. In June 2024, Honda Cars Philippines Inc. introduced the new City Hatchback with Honda SENSING, improving safety with functions, such as adaptive cruise control and collision mitigation braking system, in addition to aesthetic enhancements and advanced interior features, addressing the increasing consumer focus on vehicle safety.

Collaboration and Partnerships in the Automotive Industry

Collaboration and partnerships between car makers, technology providers, and research institutions are key factors supporting the automotive active safety system market growth. Collaboration is required due to the complexity and high cost of developing advanced safety systems. Car manufacturers are teaming up with technology firms that focus on sensors, software, and AI to incorporate advanced safety technologies in their cars. These collaborations promote the exchange of knowledge, assets, and data, speeding up the progress and implementation of cutting-edge safety technologies. The increase in collaborative innovation is improving automotive active safety systems, boosting their effectiveness and accessibility. In June 2024, Robert Bosch GmbH and Microsoft revealed their partnership to utilize generative AI in enhancing automated driving systems with the goal of enhancing vehicle safety and convenience. This collaboration aimed to utilize Bosch's knowledge in the automotive industry and Microsoft's AI technology in order to assist vehicles in improving their ability to evaluate and respond to possible road dangers.

Automotive Active Safety System Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automotive active safety system market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, vehicle type, fuel type, and offering.

Analysis by Product:

- Tyre-Pressure Monitoring System

- Lane Departure Warning

- Adaptive Cruise Control

- Night Vision System

- Driver Monitoring

- Anti-Lock Braking System

- Blind Spot Detection

- Others

Adaptive cruise control stands as the largest component in 2024, holding around 25.7% of the market. The ACCS system acts as a safety enhancer through its ability to manage automobile speeds for maintaining proper vehicle distances between vehicles. The system uses sensors along with radar and cameras to track traffic situations to regulate speed automatically, so drivers become less fatigued and prevent accidents. Its popularity in the market because of its use in high-end and mid-range cars, compatibility with other advanced driver-assistance systems (ADAS), and capacity to greatly enhance road safety. The rise of regulatory measures requiring ACC in new cars and greater user knowledge about its safety advantages are driving the demand for ACC systems, solidifying its position as the leading segment in the market.

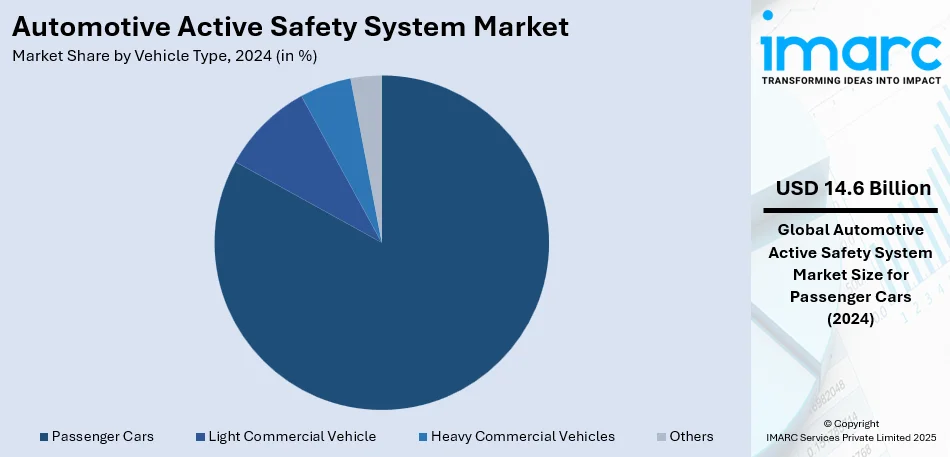

Analysis by Vehicle Type:

- Passenger Cars

- Light Commercial Vehicle

- Heavy Commercial Vehicles

- Others

Passenger cars lead the market with around 83.2% of market share in 2024 according to the automotive active safety system industry outlook. This dominance is credited to the large output and sales numbers of automobiles on a worldwide scale, which is driven by the growing desire for personal transportation and higher levels of disposable income among individuals. Passenger cars include advanced safety features by default and as optional equipment primarily because of rising consumer concerns about safety and strict regulatory mandates. Increasing numbers of passenger cars come equipped with active safety features that include ACC as well as lane departure warning and automatic emergency braking systems. The market maintains its focus on passenger cars due to the increasing use of active safety systems because technology benefits consumer safety through semi-autonomous and autonomous features in passenger cars. In November 2023, Jeremy McClain discussed Continental's upgraded ADAS vision for enhancing Indian automotive safety, which involves incorporating advanced driver assistance systems such as autonomous emergency braking, blind spot detection, and lane-keeping assist to improve vehicle safety and encourage market acceptance in India's changing automotive industry.

Analysis by Fuel Type:

- Diesel Vehicles

- Petrol Vehicles

- Electric Vehicles

- Others

Petrol vehicles make up a notable portion of the automotive active safety system industry, primarily due to their extensive use and popularity among users in the automotive market. Petrol vehicles frequently include various advanced safety systems like tire-pressure monitoring, blind spot detection, and driver monitoring to fulfill user demands for safety and convenience. The continued dominance of petrol vehicles in many global markets ensures a steady demand for these safety features, supported by ongoing advancements in safety technology and increasing regulatory requirements.

Analysis by Offering:

- Hardware

- Software

Hardware includes the physical components necessary for the functioning of safety systems, such as sensors, cameras, radar, LiDAR, and control units. These parts are essential for identifying and examining the environment of the vehicle to offer immediate data for safety purposes. Advancements in sensor technology, increased adoption of ADAS, and strict safety regulations are catalyzing the demand for hardware. The increasing connectivity and autonomy of vehicles are leading to the need for dependable and high-quality hardware, highlighting the importance of this sector in advancing automotive active safety systems.

Software involves algorithms, artificial intelligence (AI), and machine learning (ML) technologies that analyze data from hardware components to make decisions and perform actions. Software plays a crucial role in analyzing sensor information, managing safety features, and enabling smooth cooperation with various vehicle components. The segment is witnessing fast expansion because of the rising intricacy of safety measures, and need for regular enhancements, and the shift toward self-driving vehicles. Advances in software are allowing for more advanced safety features, like predictive analytics and instant decision-making. During IAA Mobility 2023, Robert Bosch GmbH displayed their progress in software-based mobility, highlighting how their newest hardware, software, and services improved vehicle safety, efficiency, and comfort. Important advancements consisted of smart sensors, fresh car computers, and linked software solutions for automated driving and energy control. These advancements showcased Bosch's dedication to influencing the future of intelligent and eco-friendly transportation.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 34.0%. The North American market currently dominates the market because of government safety requirements which match growing customer understanding alongside major automotive companies and technological organizations operating in this market. Regional regulations enforce vehicles to include advanced safety elements which has resulted in substantial growth of such system implementations. A market expansion occurs because consumers are increasingly selecting vehicles that incorporate modern safety features that include ACC along with lane departure warning and automatic emergency braking systems. The automotive industry market expands because leading manufacturers increase their research and development (R&D) commitments coupled with increased focus on road safety features. In January 2024, Magna unveiled an innovative technology at CES 2024 to prevent impaired driving. It combines breath analyzer and camera systems to identify alcohol levels and improve road safety by tackling impaired driving, a leading factor in U.S. traffic deaths.

Key Regional Takeaways:

United States Automotive Active Safety System Market Analysis

In 2024, the United States accounted for the largest market share of over 80.30% in North America. The United States automotive active safety system market is propelled by increasing regulatory mandates promoting vehicle safety. The National Highway Traffic Safety Administration (NHTSA) enforces stringent guidelines that require the integration of safety technologies like blind-spot detection lane departure warning, and automatic emergency braking. In comparison to 2022, the NHTSA's most recent traffic fatality forecasts for 2023 predict higher miles traveled and lower fatality rates. Compared to the 42,514 fatalities recorded in 2022, the government projects that 40,990 persons died in motor vehicle traffic crashes in 2023, a decline of almost 3.6%. These regulations aim to reduce road fatalities, marking a growing need for advanced safety systems. Government incentives for safety innovation, including grants and tax credits, further stimulate industry advancements. In addition, the rising awareness among individuals about vehicle safety features, coupled with preferences for advanced technology, is contributing to the market growth. Technological advancements further bolster market expansion. Innovations in sensor technologies, artificial intelligence, and machine learning enable real-time hazard detection, enhancing system efficiency and reliability. Moreover, increasing urbanization and dense traffic patterns drive the need for adaptive safety systems that ensure safe navigation in congested areas. Finally, substantial investments in R&D by leading companies contribute to market growth.

Asia Pacific Automotive Active Safety System Market Analysis

The Asia Pacific automotive active safety system market is driven by rapid urbanization and rising disposable incomes, fostering greater vehicle ownership and the adoption of safety technologies. According to the CIA, the urban population in China in 2023 was 64.6% of total population. Moreover, countries like China, India, and Japan are witnessing increased vehicle sales, leading to a growing demand for advanced safety systems. In addition, government initiatives and regulatory mandates also drive the market. For instance, China’s New Car Assessment Program (C-NCAP) and India’s Bharat New Vehicle Safety Assessment Program (BNVSAP) emphasize the inclusion of safety technologies like autonomous braking and adaptive cruise control. These policies are incentivizing automakers to prioritize active safety systems. Apart from this, technological advancements and the region's thriving automotive manufacturing sector further propel the market growth. Asia-Pacific is home to leading automakers and suppliers, which invest significantly in developing advanced safety technologies tailored to regional needs. In line with this, concerns among individuals about road safety on account of higher road traffic deaths in the region is underscoring the importance of active safety systems. As a result, this is leading to a shift in consumer preferences toward vehicles equipped with advanced driver-assistance features, further driving market growth.

Europe Automotive Active Safety System Market Analysis

Stringent regulatory frameworks in the European region emphasizing vehicle safety are bolstering the market growth. The European Union (EU) mandates advanced safety features in new vehicles, such as automatic emergency braking, lane-keeping assistance, and driver monitoring systems. The EU’s Vision Zero initiative, targeting zero road fatalities by 2050, is spurring the adoption of active safety technologies. The region is facing high cases of road accidents and deaths, which is catalyzing the need for automotive active safety systems. As per the European Commission, the EU average was 46 road deaths per Million inhabitants. Besides this, region's advanced automotive industry significantly contributes to market growth. Germany, home to major manufacturers like BMW, Volkswagen, and Bosch, is a global leader in automotive innovation, driving the development and integration of cutting-edge safety systems. Moreover, collaborations between automakers and technology providers are further enhancing the market landscape. Apart from this, the increasing consumer awareness about safety technologies and their role in accident prevention is strengthening the market growth. European consumers prioritize vehicles with ADAS features, encouraged by insurance incentives that reward safer vehicles with lower premiums. Furthermore, the rapid development of autonomous and electric vehicles in Europe accelerates the adoption of active safety systems. Countries like Norway and the Netherlands, at the forefront of EV adoption.

Latin America Automotive Active Safety System Market Analysis

The Latin American automotive active safety system market is influenced by improving economic conditions and growing vehicle sales. Countries like Brazil, Mexico, and Argentina are experiencing higher demand for vehicles, fostering the adoption of safety technologies. According to the CEIC, Brazil motor vehicle production was reported at 2,324,838.000 units in December 2023. Moreover, rising awareness of road safety, in a region with a high rate of traffic accidents, also promotes active safety systems. Besides this, government initiatives aimed at enhancing vehicle safety are pivotal. Programs like Mexico’s National Road Safety Strategy emphasize the importance of advanced safety technologies, encouraging automakers to incorporate them into vehicles. Additionally, partnerships between international automakers and local manufacturers boost technology penetration.

Middle East and Africa Automotive Active Safety System Market Analysis

The Middle East and Africa automotive active safety system market is driven by growing urbanization and increasing vehicle ownership. The CEIC reports that the Saudi Arabia motor vehicles sales recorded 758,791 units in December 2023 as compared with 616,491 units in the previous year. Cities like Dubai and Riyadh are adopting smart city initiatives, emphasizing advanced vehicle safety technologies to reduce accidents in urban environments. In line with this, rising road traffic fatalities, especially in countries like South Africa, drive demand for active safety systems. Governments are implementing safety regulations to minimize accidents, which in turn incentivize automakers to integrate technologies like electronic stability control and collision avoidance systems. These factors collectively support the market growth.

Competitive Landscape:

The automotive active safety system market is highly competitive, with key players focusing on innovation, strategic partnerships, and advanced technologies. Leading companies such as Bosch, Continental, ZF, Denso, and Aptiv dominate the market by offering cutting-edge safety solutions like adaptive cruise control, lane departure warning, automatic emergency braking, and blind-spot detection. Technological advancements in AI, LiDAR, radar, and sensor fusion are driving competition, with automakers integrating these systems to enhance vehicle safety and meet stringent regulations. Startups and tech firms are also entering the market, accelerating innovation in autonomous driving and vehicle-to-everything (V2X) communication. Additionally, government mandates for advanced safety features and increasing consumer demand for safer vehicles further intensify competition. Companies invest heavily in research and development (R&D) to improve system accuracy and reliability. The rise of electric and connected vehicles presents new opportunities, pushing manufacturers to enhance their safety solutions for next-generation mobility.

The report has also analysed the competitive landscape of the automotive active safety system market with some of the key players being:

- Robert Bosch GmbH

- Continental AG

- Delphi Group

- ZF Friedrichshafen AG

- Autoliv

- Hyundai Mobis

- Valeo SA

- DENSO Corporation

- Magna International

- FLIR Systems

- Infineon Technologies AG

- FICOSA GROUP

- Peugeot S.A.

- Borg Warner Inc.

- CAx Software Private Limited.

Latest News and Developments:

- October 2024: Volvo Trucks introduced next-generation active safety features to safeguard pedestrians and cyclists, two vulnerable road users, in an effort to move closer to the company's long-term goal of having no accidents involving Volvo trucks.

- August 2024: MESSRING, a well-known supplier of crash test equipment, partnered with Humanetics, a world leader in safety testing solutions. This partnership strengthens the two businesses' long-standing relationship and their shared commitment to improving automobile safety. It also highlights their commitment to provide high-performance, integrated active safety testing equipment.

- May 2024: One of the top artificial intelligence firms in the automotive software market, ANDATA, plans to sell 24.5% of its shares in VAIVA GmbH, a specialist in automobile active safety, to CARIAD Group. To that goal, CARIAD Group and ANDATA inked a share purchase agreement, the conclusion of which is still pending antitrust authorities' approval. After it is finished, CARIAD Group will own all of VAIVA GmbH, which will increase CARIAD's internal knowledge of active safety operations.

- April 2024: Honda Cars India Ltd. (HCIL), one of India's top producers of luxury automobiles, reaffirmed its dedication to safety by adding improved safety features to its lineup, which includes the Elevate, City, City e: HEV, and Amaze. These improvements are in line with the company's global goal of having no fatal traffic accidents involving Honda vehicles worldwide by 2050. Six airbags, three-point Emergency Locking Retractor (ELR) seatbelts, and seatbelt reminders for all five seats are now standard on the well-liked Honda City and Elevate vehicles in all grades.

Automotive Active Safety System Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Tyre-Pressure Monitoring System, Lane Departure Warning, Adaptive Cruise Control, Night Vision System, Driver Monitoring, Anti-Lock Braking System, Blind Spot Detection, Others |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicle, Heavy Commercial Vehicles, Others |

| Fuel Types Covered | Diesel Vehicles, Petrol Vehicles, Electric Vehicles, Others |

| Offerings Covered | Hardware, Software |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Robert Bosch GmbH, Continental AG, Delphi Group, ZF Friedrichshafen AG, Autoliv, Hyundai Mobis, Valeo SA, DENSO Corporation, Magna International, FLIR Systems, Infineon Technologies AG, FICOSA GROUP, Peugeot S.A., Borg Warner Inc., CAx Software Private Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive active safety system market from 2019-2033.

- The automotive active safety system market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive active safety system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive active safety system market was valued at USD 17.5 Billion in 2024.

The automotive active safety system market is projected to exhibit a CAGR of 13.4% during 2025-2033, reaching a value of USD 54.3 Billion by 2033.

The automotive active safety system market is driven by rising vehicle safety concerns, stringent government regulations, increasing road accidents, and advancements in sensor technology. Growing adoption of ADAS, autonomous driving trends, and consumer demand for enhanced safety features further propel market growth. Integration of AI and IoT also boosts innovation and adoption.

North America currently dominates the automotive active safety system market, accounting for a share of 34.0%. Stringent safety regulations, rising road accidents, technological advancements, increasing autonomous vehicles, and growing consumer demand for enhanced vehicle safety features are creating a positive automotive active safety system market outlook further across the region.

Some of the major players in the automotive active safety system market include Robert Bosch GmbH, Continental AG, Delphi Group, ZF Friedrichshafen AG, Autoliv, Hyundai Mobis, Valeo SA, DENSO Corporation, Magna International, FLIR Systems, Infineon Technologies AG, FICOSA GROUP, Peugeot S.A., Borg Warner Inc., CAx Software Private Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)