Automotive Backup Camera Market Size, Share, Trends and Forecast by Vehicle Type, Position, Sales Channel, and Region, 2025-2033

Automotive Backup Camera Market Size and Share:

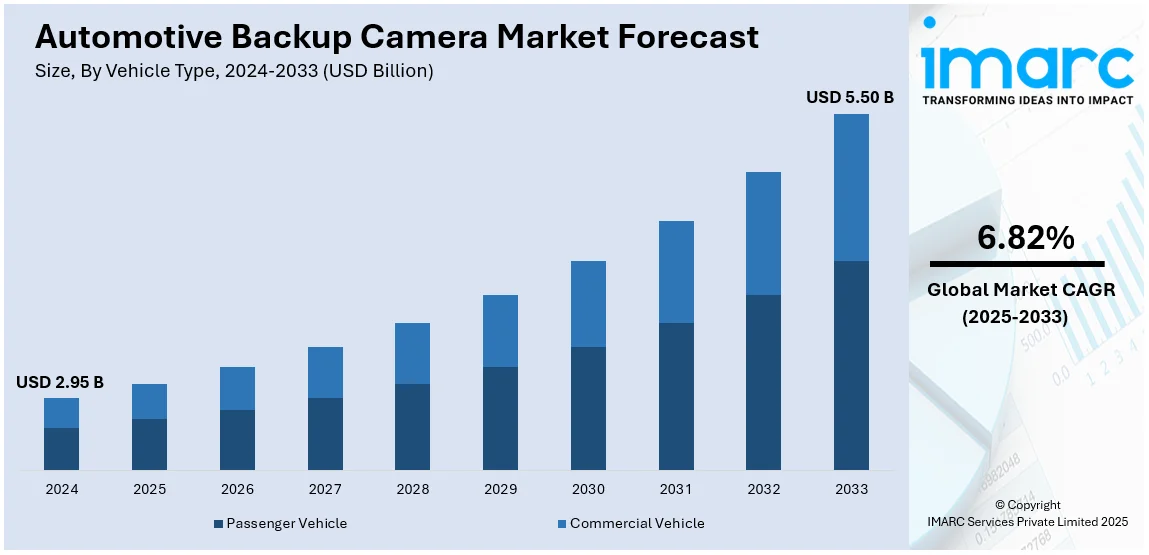

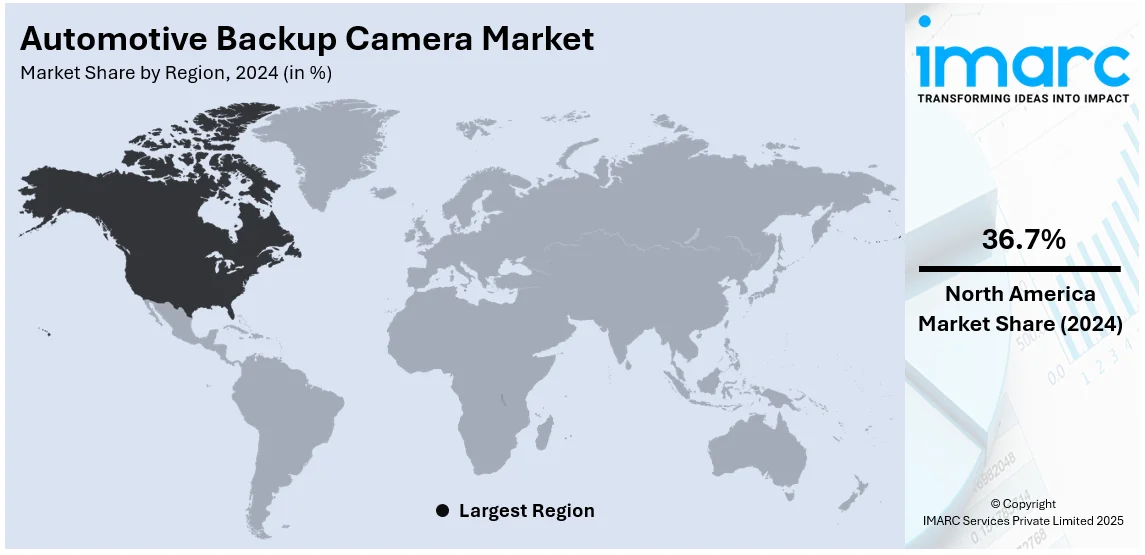

The global automotive backup camera market size was valued at USD 2.95 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 5.50 Billion by 2033, exhibiting a CAGR of 6.82% during 2025-2033. North America currently dominates the market, holding a significant market share of 36.7% in 2024. The market is driven by stringent safety regulations, such as mandatory backup cameras in all new vehicles and robust demand for advanced safety features. Besides this, the automotive backup camera market share is influenced by the strong automotive industry in the region and widespread adoption by automakers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.95 Billion |

|

Market Forecast in 2033

|

USD 5.50 Billion |

| Market Growth Rate (2025-2033) | 6.82% |

As automakers integrate backup cameras into more vehicles, the overall market is experiencing significant growth. Many manufacturers are now offering backup cameras as standard features in new models, responding to customer preferences for enhanced safety. This adoption is also driven by government regulations that require backup cameras in all new vehicles sold. The growing emphasis on vehicle safety has compelled automakers to include advanced safety technologies like backup cameras. By equipping vehicles with backup cameras, manufacturers are meeting the rising demand for safer, more convenient driving experiences. Additionally, the integration of backup cameras enhances the appeal of vehicles, which makes them more competitive in the market. As more automakers adopt these systems, their cost per unit decreases, making them more affordable for mass-market vehicles. Moreover, the widespread adoption of backup cameras aligns with the global trend toward smarter and safer vehicles. As automobile manufacturers continue to embrace these technologies, the market for backup cameras is continuously expanding.

To get more information on this market, Request Sample

The growth in vehicle production is driving the United States automotive backup camera market demand. As vehicle production rises, automakers are integrating backup cameras into more models, encouraging market adoption. The US automotive industry is experiencing steady growth, with more vehicles on the road requiring safety technologies. Many new vehicles now come with backup cameras as standard features, making them essential for safety. Increased vehicle production also means a higher number of vehicles equipped with advanced safety technologies. The surging sales of passenger vehicles, especially in the SUV and sedan segments, drives the adoption of backup cameras. People are becoming more safety-conscious, influencing automakers to include backup cameras in their vehicle designs. Furthermore, government regulations requiring backup cameras in all new vehicles have accelerated their integration into production models. The higher volume of vehicle sales in the US contributes to the increasing need for backup cameras. With an increase in electric vehicles and autonomous cars, the need for backup cameras continues to grow. For instance, in January 2025, Tesla introduced a new Model Y in the US. This long-range all-wheel-drive variant is 25% more expensive than the previous model. It includes supervised full self-driving software as a standard feature. The updated Model Y features redesigned exteriors enhanced interior features, and a slightly extended range of 320 miles (515 km).

Automotive Backup Camera Market Trends:

Increasing vehicle sales

The emerging applications of automotive backup camera systems in commercial vehicles, such as tow trucks and trailers, that cover a larger area on the road and require assistance while parking or reversing are catalyzing the product demand. For instance, in 2023, the United States led the market with commercial vehicles sales totaling USD 35.5 Billion. France, Italy, and Germany followed in the rankings. As more vehicles are sold worldwide, the demand for advanced safety technologies like backup cameras grows. Buyers are increasingly prioritizing safety and convenience when purchasing new vehicles, favoring those with backup cameras. Moreover, governing agencies of various countries are introducing stringent regulations mandating the installation of backup cameras in all new passenger vehicles to reduce the risk to pedestrians from accidents while reversing vehicles. As a result, automakers are responding by incorporating backup cameras into their vehicles, often making them standard equipment. This growing adoption of safety features in new vehicles contributes to the expanding market size.

Rising preference for advanced driver-assistance systems (ADAS)

People are increasingly prioritizing safety features, and backup cameras are integral to ADAS technology. The incorporation of backup cameras helps prevent accidents, thereby introducing vehicles that are safer for both drivers and pedestrians. Many vehicles now come with backup cameras as standard equipment within ADAS packages, improving their adoption. For instance, by fiscal 2028, of the total PV sales with ADAS features, around 55-60% are projected to be utility vehicles. Furthermore, several leading manufacturers are heavily investing in the development of innovative product variants to expand their customer base and maintain a competitive edge in the market. Other factors, includes the growing demand for autonomous driving further emphasizes the need for backup cameras, as they are key in ensuring safe vehicle operation. Moreover, governments are mandating the inclusion of safety technologies, such as backup cameras, in vehicles to reduce accidents. Insurance companies are also offering discounts to individuals who equip their vehicles with ADAS, including backup cameras, encouraging further adoption.

Growing demand for safety features

Backup cameras are seen as essential for preventing accidents during reversing, leading to higher demand for these systems. With more awareness about road safety, drivers are seeking features that provide enhanced visibility and reduce blind spots. Car manufacturers are responding to this requirement by including backup cameras into a wider range of vehicle models. The rise in customer preference for vehicles equipped with advanced safety features is also strengthening market growth. These regulations are compelling automakers to incorporate backup cameras as standard equipment in their vehicles. The availability of backup cameras is particularly valued in urban areas where parking spaces are limited and congested. To cater this demand, in September 2024, Hyundai Alcazar facelift launched with upgraded features, including dual-zone climate control, and a digital key. It retains the 1.5L turbo-petrol and diesel engine options, along with a modern design featuring LED headlamps, a refreshed grille, and premium interior enhancements. The facelift aims to increase sales with advanced tech like a 360-degree camera and ADAS, available in four variants. Moreover, insurance companies are offering discounts for vehicles equipped with advanced safety features, incentivizing people to choose cars with backup cameras. As the number of safety-conscious customers increases, automakers are focusing on including backup cameras in both new models and retrofitting older vehicles.

Automotive Backup Camera Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automotive backup camera market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on vehicle type, position, and sales channel.

Analysis by Vehicle Type:

- Passenger Vehicle

- Commercial Vehicle

Passenger vehicles stand as the largest component in 2024, holding 76.3% of the market. Passenger vehicles are more prevalent worldwide, as they account for a significant share of backup camera adoption. Many individuals prioritize safety features, making backup cameras essential for passenger vehicles to prevent accidents. Moreover, governing agencies of several countries are mandating backup cameras in all new passenger vehicles, driving the demand for these systems. Automakers are integrating advanced safety technologies, including backup cameras, as standard features in passenger vehicles. With increasing concerns about road safety, customers expect these features in their vehicles for enhanced protection. The growing trend of urbanization and limited parking spaces further encourages the installation of backup cameras in passenger cars. The higher production volume of passenger vehicles compared to commercial ones also drives the demand for backup cameras. As safety regulations continue to tighten, the role of backup cameras in passenger vehicles will only increase, ensuring safer driving experiences. Furthermore, inflating disposable incomes in emerging markets are leading to higher sales of passenger vehicles, strengthening the market growth.

Analysis by Position:

- Surface Mounted

- Flush Mounted

- License Mounted

Surface mounted leads the market with 48.7% of market share in 2024. Surface-mounted backup cameras are gaining the majority of market share due to their cost-effective and easy installation. These cameras are often installed on the rear surface of a vehicle, typically above the license plate. Surface-mounted systems provide wide-angle views and are ideal for reducing blind spots while reversing. The simplicity and low installation cost of surface-mounted cameras make them a popular choice for automakers and individuals. In addition, these cameras can be easily added to a wide variety of vehicle models including both new and older vehicles. Surface-mounted cameras offer a quick, straightforward solution for enhancing vehicle safety without significant structural modifications. As a result, they are preferred in both original equipment and aftermarket installations. Their growing presence is also due to their compatibility with other safety technologies like parking sensors and automatic emergency braking. The growing trend of surface-mounted cameras is further driven by customer demand for affordable yet effective safety solutions. While embedded cameras offer more integrated designs, surface-mounted models are more cost-effective for mass-market vehicles. The ability to retrofit surface-mounted cameras in older vehicles is also driving demand, especially in regions where vehicle fleets are aging.

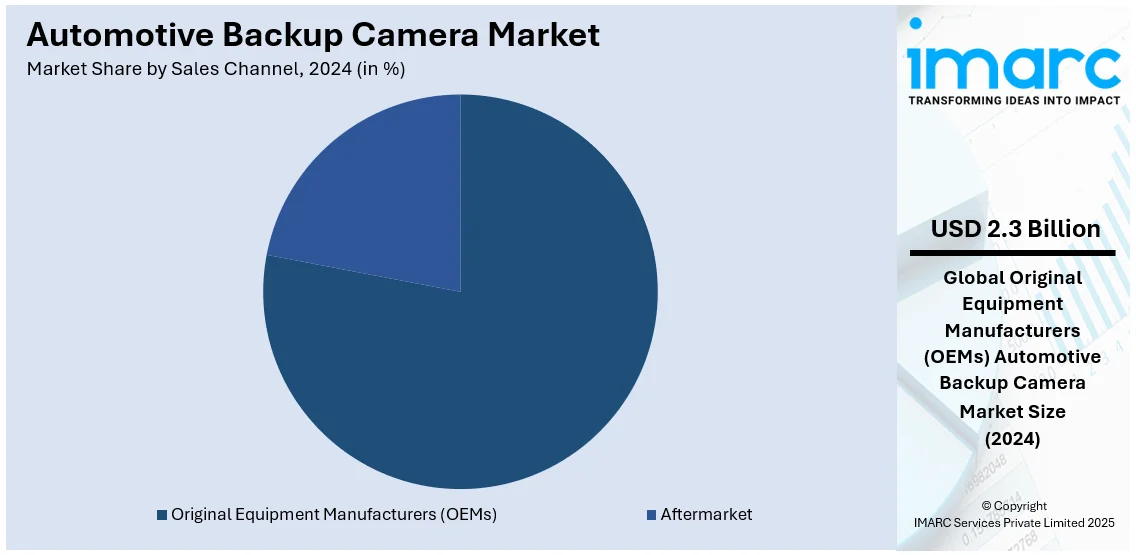

Analysis by Sales Channel:

- Original Equipment Manufacturers (OEMs)

- Aftermarket

Original Equipment Manufacturers (OEMs) dominate the market with 78.2% of market share in 2024. Original Equipment Manufacturers (OEMs) are responsible for equipping new vehicles with backup cameras as standard safety features. Regulations, such as government mandates requiring backup cameras in all new vehicles, further bolster OEM dominance. The large-scale production and supply chain networks of OEMs allow them to meet high demand efficiently. These manufacturers collaborate with automakers to design and integrate backup camera systems tailored to specific vehicle models. OEMs benefit from established relationships with automakers, providing them with exclusive contracts and a larger market share. OEMs also have the advantage of economies of scale, making their systems more affordable for mass-produced vehicles. Backup cameras from OEMs are typically built to meet safety standards, ensuring high quality and reliability. As customer preference shifts toward advanced safety features, automakers are increasingly including OEM backup cameras as standard equipment in their vehicles. Moreover, OEMs’ ability to integrate these systems seamlessly into vehicle designs offers a more polished, aesthetically appealing solution for people.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 36.7%. North America accounts the majority of the market share in the automotive backup camera market due to stringent safety regulations. In December 2024, Canada amended its Motor Vehicle Safety Regulations concerning school buses. The new regulations require better driver visibility systems. School buses must have image recording systems to monitor passing vehicles for safety. The goal is to improve safety standards and reduce accidents around school buses. The regulations allow compliance by November 2027. This change highlights the importance of technology in enhancing school bus safety nationwide. This regulation is significantly increasing the demand for backup cameras across the region, expanding their adoption. Customers in North America are also more safety-conscious, which drives the preference for vehicles equipped with backup cameras. North American automakers are integrating advanced safety technologies including backup cameras, into their vehicle designs. The strong presence of major automakers further strengthens the region's dominance in the market. The rising number of vehicle sales in the US and Canada also contributes to the growth of the backup camera market. Furthermore, the escalating demand for electric vehicles (EVs) in North America, with their advanced safety systems, is further strengthening the market growth. As awareness about vehicle safety features increases, there is a rising preference for cars equipped with backup cameras.

Key Regional Takeaways:

United States Automotive Backup Camera Market Analysis

The United States hold 95.80% of the market share in North America. Advancements in automobile production techniques have spurred a surge in the integration of advanced safety features, including backup cameras. For instance, Since the start of 2021, auto manufacturers have announced investments of more than USD 75 Billion in the US. As manufacturers strive to meet customer expectations for safer and more convenient vehicles, backup cameras are increasingly incorporated as standard or optional features. Enhanced assembly processes and innovative designs are making it feasible to include such technology in a broader range of vehicles, from compact cars to luxury sedans. This inclusion aligns with evolving safety regulations, fostering greater adoption. With precision manufacturing methods, these cameras now offer improved resolution and wider fields of view, enhancing driver awareness during parking and reversing. The seamless integration into vehicle displays adds to user convenience, further driving demand. In a market where safety and technology converge, this trend underscores the growing importance of visual assistance systems in enhancing the overall driving experience.

Asia Pacific Automotive Backup Camera Market Analysis

The influx of capital into automotive production has fuelled advancements in safety technologies, including the widespread use of backup cameras. The India Brand Equity Foundation reports that the automobile sector attracted a cumulative equity FDI inflow of approximately USD 35.65 billion between April 2000 and December 2023. Investments in manufacturing facilities and research are enabling the development of cost-effective and durable cameras, making them more accessible. Suppliers are prioritizing innovation to meet the increasing demand for vehicles equipped with enhanced safety systems. Efforts to cater to a diverse range of buyers, from budget-conscious individuals to luxury seekers, contributing to a rise in adoption rates. The focus on expanding vehicle offerings with advanced features has resulted in streamlined production techniques that integrate backup cameras as essential components. This trend is supported by growing awareness among masses about safety features, which has led to an increase in demand for vehicles equipped with parking and reversing assistance.

Europe Automotive Backup Camera Market Analysis

The expanding pool of vehicle owners is accelerating the incorporation of safety technologies, including backup cameras. The rise in personal and commercial vehicle purchases is creating a demand for advanced safety solutions to improve parking and reversing accuracy. The International Council on Clean Transportation reveals that approximately 10.6 million new cars were registered across the 27 Member States in 2023, marking a 14% increase compared to 2022. Customer preference for vehicles equipped with user-friendly technology is driving automakers to include these systems as integral features. As cars and trucks become a central part of daily life, expectations for safety, ease of use, and enhanced visibility are shaping the market. Backup cameras address common challenges, such as blind spots, by providing real-time visual assistance, which resonates strongly with both new and seasoned drivers. Additionally, compact design innovations allow seamless integration into a variety of vehicle models, enhancing overall functionality and aesthetic appeal. This growing reliance on vehicles has placed visual assistance systems at the forefront of automotive safety enhancements.

Latin America Automotive Backup Camera Market Analysis

Growing disposable income in Latin America is driving the demand for passenger vehicles equipped with advanced safety features, including automotive backup cameras. For example, Latin America's total disposable income is projected to increase by nearly 60% in real terms from 2021 to 2040. Individuals with higher spending power are prioritizing convenience and safety, making backup cameras a sought-after feature in new vehicle purchases. These systems, offering enhanced rear visibility and parking assistance, align with the preferences of a growing middle class seeking value-added features in their cars. Automotive manufacturers are responding to this demand by integrating backup cameras into a broader range of vehicle models, catering to diverse needs. The trend reflects a shift toward safer driving experiences and the increasing importance of safety technologies as a standard offering, contributing to the growing adoption of backup cameras across the region’s expanding passenger car market.

Middle East and Africa Automotive Backup Camera Market Analysis

Expanding logistics services are driving the demand for commercial vehicles equipped with advanced safety features such as backup cameras. For example, the logistics sector currently accounts for 6% of Saudi Arabia's GDP and is expected to contribute 10% by 2030, equating to approximately USD 5.36 billion. Tow trucks, trailers, and other large vehicles operating in this sector require enhanced rear visibility to navigate congested areas and confined spaces safely. Backup cameras provide critical assistance in reducing blind spots, improving maneuverability, and minimizing the risk of accidents during reversing or parking. The growing complexity of logistics operations, along with the requirement for efficient vehicle management, has made these systems essential for improving operational safety and efficiency. Additionally, the adoption of backup cameras addresses challenges associated with handling larger vehicles, ensuring compliance with safety standards while enhancing driver confidence.

Competitive Landscape:

Major firms are pioneering advancements in automotive safety technology. They are constantly improving advanced backup camera systems that include features like object detection and night vision. Through allocating resources to research and development (R&D), major stakeholders are guaranteeing the incorporation of backup cameras into a diverse array of vehicles. Car manufacturers depend on these suppliers to deliver dependable and top-notch backup camera systems that comply with safety regulations. Numerous major participants work together with vehicle manufacturers to provide tailored solutions that match particular car models and safety features. These partnerships promote the extensive use of backup cameras in both new and existing cars. For instance, in January 2024, Valeo partnered with Teledyne FLIR LLC to launch thermal imaging camera technology for the automotive industry. This collaboration seeks to enhance road safety by equipping vehicles with advanced vision systems, allowing for improved detection of obstacles and risks in low visibility situations. Major companies are also broadening their product lines to feature aftermarket backup camera systems, targeting customers who wish to upgrade older cars. In addition, these firms participate in informing customers and enhancing awareness regarding the safety advantages of backup cameras.

The report provides a comprehensive analysis of the competitive landscape in the automative backup camera market with detailed profiles of all major companies, including:

- Continental AG

- EchoMaster

- Gentex Corporation

- HELLA GmbH & Co. KGaA

- Magna International Inc.

- OmniVision Technologies

- Rear View Safety, Inc.

- Robert Bosch GmbH

- Stonkam Co. Ltd.

- Valeo Service

- ZF Friedrichshafen AG

Latest News and Developments:

- April 2024: Peterbilt introduced its Digital Vision System-Mirrors (DVS-M), a rear-view camera system for Model 579 and Model 567 trucks, improving driver safety and visibility. The system includes three HDR cameras with hydrophobic lenses, ensuring clear views in challenging conditions. The cameras are controlled via a joystick and displayed on two HD monitors. Key features include night vision, trailer tracking, and enhanced weather visibility.

- March 2024: Phillips Industries is set to release its largest product yet, the Rear-Vu trailer back-up camera, this summer. Tailored for Class 8 trucks and trailers, the Rear-Vu provides a 170-degree rear view with real-time visibility and 0.25-second latency. Installation takes approximately 10 minutes, enhancing safety by offering clear views of rear bumpers, doors, and up to 20 feet behind the trailer.

- March 2024: ZF Friedrichshafen AG acquired a 6% stake in South Korea’s StradVision, a leader in AI-driven vision processing for autonomous vehicles and ADAS. This acquisition strengthens ZF's capabilities in autonomous driving perception and sensor fusion, further solidifying its position in the expanding self-driving technology market.

- February 2024: VIA Optronics AG partnered with Immervision Inc. to design and develop an innovative automotive camera. The collaboration focuses on creating advanced lens technology for exterior automotive cameras. This partnership aims to improve the functionality and performance of VIA's upcoming automotive camera. The project represents a major advancement in automotive camera innovation.

- January 2024: Continental Aktiengesellschaft introduced a biometric-based Face Authentication Display system, utilizing cameras on the vehicle’s B-pillar and driver console. This system features a two-stage access control process, enabling the vehicle to unlock and start once a registered user is recognized. It also enhances driver monitoring for increased security.

Automotive Backup Camera Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Vehicle Types Covered | Passenger Vehicle, Commercial Vehicle |

| Positions Covered | Surface Mounted, Flush Mounted, License Mounted |

| Sales Channels Covered | Original Equipment Manufacturers (OEMs), Aftermarket |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, China, Japan, India, South Korea, Australia, Indonesia, Germany, France, United Kingdom, Italy, Spain, Russia, Brazil, Mexico |

| Companies Covered | Continental AG, EchoMaster, Gentex Corporation, HELLA GmbH & Co. KGaA, Magna International Inc., OmniVision Technologies, Rear View Safety, Inc., Robert Bosch GmbH, Stonkam Co. Ltd., Valeo Service, ZF Friedrichshafen AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, automotive backup camera market outlook, and dynamics of the market from 2019-2033.

- The automotive backup camera market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive backup camera industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive backup camera market was valued at USD 2.95 Billion in 2024.

The automotive backup camera market is projected to exhibit a CAGR of 6.82% during 2025-2033, reaching a value of USD 5.50 Billion by 2033.

The automotive backup camera market growth is driven by rising safety regulations, such as mandatory backup cameras in new vehicles. Growing customer demand for safety features and advanced driver-assistance systems (ADAS) further fuel adoption. Technological advancements, like object detection and night vision, enhance functionality, making backup cameras more attractive. Increasing vehicle production, especially passenger cars, expands the market. Additionally, the availability of affordable retrofitting options for older vehicles and higher insurance discounts for safety-equipped cars also fuels the market growth.

North America currently dominates the automotive backup camera market, accounting for a share of over 36.7% in 2024 due to strict safety regulations, such as mandatory backup cameras in all new vehicles sold in the United States. Higher demand for advanced safety features and the widespread adoption of backup cameras by automakers further strengthen the market growth. The strong automotive industry in the region, along with major manufacturers integrating these systems into vehicles, also plays a key role.

Some of the major players in the automotive backup camera market include Continental AG, EchoMaster, Gentex Corporation, HELLA GmbH & Co. KGaA, Magna International Inc., OmniVision Technologies, Rear View Safety, Inc., Robert Bosch GmbH, Stonkam Co. Ltd., Valeo Service, ZF Friedrichshafen AG, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)