Automotive Brake System Market Size, Share, Trends and Forecast by Type, Component, Technology, Vehicle Type, Sales Channel, and Region, 2025-2033

Automotive Brake System Market Size and Share:

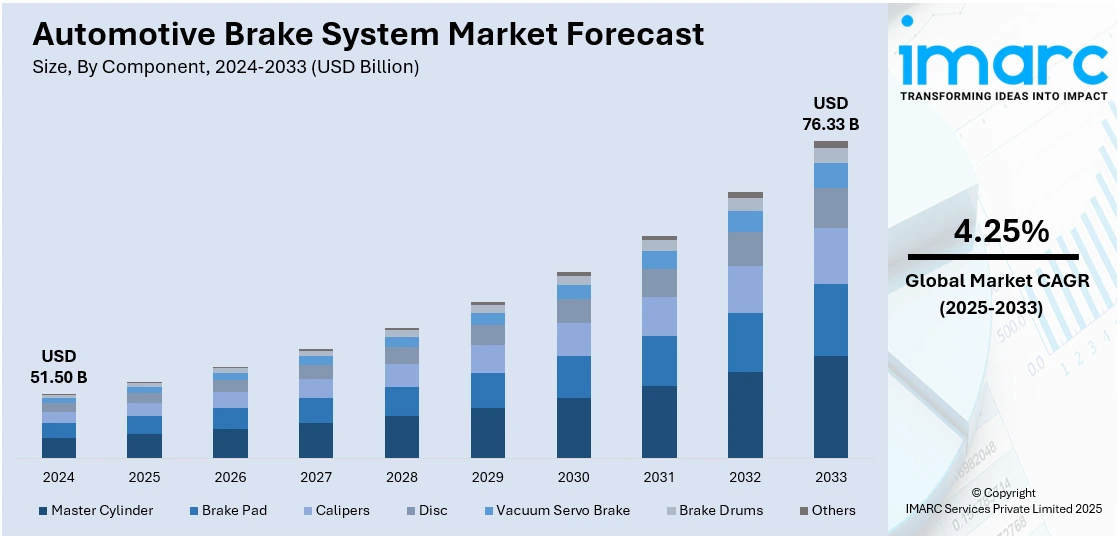

The global automotive brake system market size was valued at USD 51.50 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 76.33 Billion by 2033, exhibiting a CAGR of 4.25% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of 47.4%. The dominance of the market is attributed to the robust automotive manufacturing capabilities, significant technological advancements in brake system components, and the increasing focus on safety regulations. The growing demand for high-performance and fuel-efficient vehicles, along with a rising emphasis on sustainability, further contributes to the expansion of the automotive brake system market share in the Asia Pacific region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 51.50 Billion |

|

Market Forecast in 2033

|

USD 76.33 Billion |

| Market Growth Rate 2025-2033 | 4.25% |

With safety emerging as a top priority for individuals, there is an increase in demand for braking systems that guarantee vehicle stability, shorten stopping distances, and avert accidents. Improved braking systems play a significant role in vehicle safety, making them essential in buying choices and regulatory requirements. In addition, brake systems are advancing through innovations like regenerative braking, which harnesses energy to replenish the vehicle's battery, particularly in electric vehicles (EVs). Autonomous braking systems, integrated with sensors and artificial intelligence (AI), assist in avoiding accidents by automatically engaging brakes when a possible collision is sensed. These innovations are enhancing vehicle performance and safety.

To get more information on this market, Request Sample

The United States plays a critical role in the market, fueled by the progress of sophisticated braking technologies, including autonomous braking systems and brake-by-wire systems, which enhance safety and vehicle performance. Besides this, the increasing popularity of EVs and hybrid cars in the US is driving the need for specialized braking systems, like regenerative braking, which captures energy to recharge the vehicle’s battery. The proportion of electric and hybrid vehicle sales in the US rose in the third quarter of 2024 (3Q24), hitting a historic level. Wards Intelligence estimates suggest that the combined sales of hybrid vehicles, plug-in HEVs, and battery electric vehicles (BEVs) rose from 19.1% of total new light-duty vehicle (LDV) sales in the US.

Automotive Brake System Market Trends:

Government Regulations on Vehicle Safety Standards

Governing bodies worldwide are implementing more rigorous regulations on braking systems, especially concerning automatic emergency braking (AEB) and technologies for avoiding collisions. These rules mandate that vehicles must have sophisticated braking systems to avert accidents and lower death tolls. For instance, in 2024, the U.S. National Highway Traffic Safety Administration (NHTSA) announced that all new passenger vehicles must have AEB systems by September 2029. It mandated AEB to detect performance standards, including pedestrian detection day and night, and automatic braking at speeds up to 90 mph. As safety gains increasing importance, car manufacturers are implementing new braking technologies that meet these required standards. This is catalyzing the demand for more sophisticated, effective, and dependable braking systems. The drive for tighter safety measures is encouraging manufacturers to allocate resources to research activities, fostering market innovation and guaranteeing adherence to new regulatory guidelines.

Technological Advancements

The continuous advancements in brake monitoring technologies, such as electronic brake performance monitoring systems, is impelling the market growth. These innovations allow real-time tracking and diagnostics of brake system performance, enhancing vehicle safety and operational efficiency. By leveraging smart technologies, such systems can monitor key metrics, such as braking force and wear, providing valuable data for predictive maintenance and performance optimization. This helps fleet operators and vehicle owners minimize downtime, reduce maintenance costs, and improve safety compliance. The adoption of such technologies also streamlines regulatory adherence, reducing manual inspections and improving overall fleet management. In 2025, Samsara launched its Electronic Brake Performance Monitoring System (EBPMS) in the UK to help fleets comply with new DVSA brake testing guidelines. The system, part of Samsara’s Smart Trailer solution, enables real-time brake performance tracking, reducing the need for manual tests. It aims to improve compliance, minimize downtime, and cut costs for fleet operators.

Rise in Electric and Hybrid Vehicle Adoption

The growing transition towards electric and hybrid vehicles is positively influencing the market. These vehicles need specialized braking systems, especially because of their regenerative braking features, which recover energy while braking to recharge the battery. This is leading to the creation of advanced braking technologies tailored for electric drivetrains, guaranteeing efficiency and sustainability. Additionally, EVs typically feature varied weight distributions and lighter designs than conventional internal combustion engine (ICE) vehicles, requiring modifications in brake system design to improve performance. The increasing interest in EVs and hybrids, shown by more than 50% of 3-wheelers, roughly 5% of 2-wheelers, and 2% of cars sold in 2024 in India being electric, as per the India Brand Equity Foundation (IBEF), is fueling ongoing advancements in braking technologies. The rise in electric and hybrid vehicle adoption is catalyzing the demand for specialized, high-performance braking systems.

Automotive Brake System Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automotive brake system market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, component, technology, vehicle type, and sales channel.

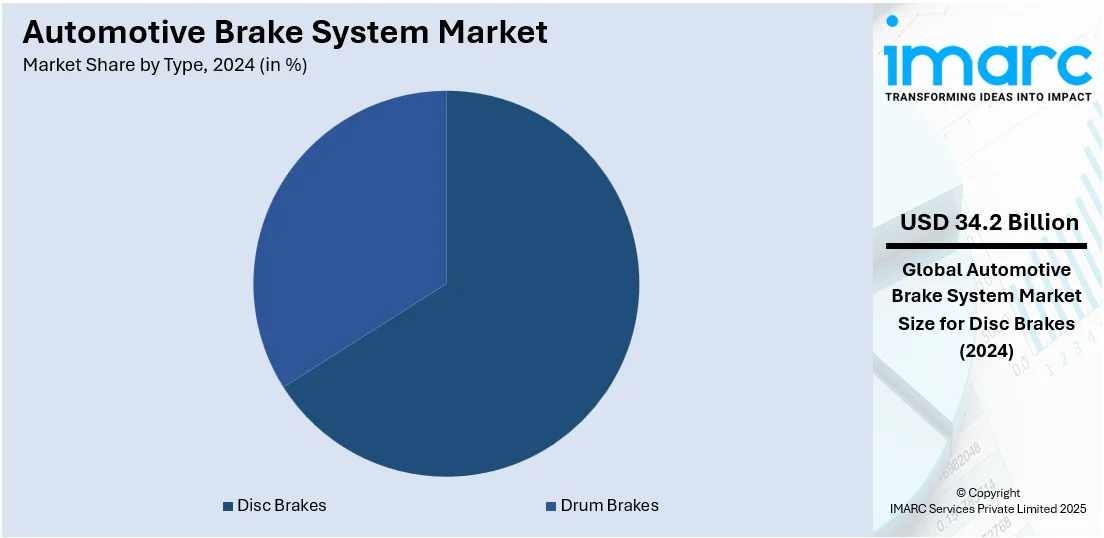

Analysis by Type:

- Disc Brakes

- Drum Brakes

Disc brakes dominate the market, holding a share of 66.4%, because of their enhanced performance, efficiency, and reliability when compared to other braking methods. The configuration of disc brakes offers improved heat dissipation, lowering the chance of brake fade in extreme situations, thus improving their overall braking efficacy. This makes them more efficient in both rapid and heavy-duty scenarios. Moreover, disc brakes provide superior braking strength and sensitivity, enhancing vehicle control and safety. The ongoing progress in disc brake materials, including carbon composite and ceramic, enhances their superiority by providing better durability and less wear. As automakers focus on safety, performance, and efficiency, disc brakes continue to be the favored option for the majority of contemporary vehicles. Their capability to blend effortlessly with sophisticated safety systems, like anti-lock braking systems (ABS) and electronic stability control (ESC), further bolsters their dominance in the market.

Analysis by Component:

- Master Cylinder

- Brake Pad

- Calipers

- Disc

- Vacuum Servo Brake

- Brake Drums

- Others

Master cylinder represents the largest segment attributed to its essential role in the braking system. The master cylinder is vital for the effective functioning of both disc and drum brake systems, serving as the key component that transforms mechanical force from the brake pedal into hydraulic pressure. Its capability to provide steady pressure to the brake fluid guarantees the efficient operation of the braking system. The superiority of master cylinder is also linked to its dependability and longevity, essential for ensuring the brake system's integrity throughout its lifespan. The increasing emphasis on safety aspects and regulatory standards for braking efficiency guarantees an ongoing need for reliable, high-quality master cylinders. Furthermore, as braking systems develop, the master cylinder remains crucial in incorporating new technologies like ABS and electronic brake-force distribution, reinforcing its position in the market. The automotive brake system market forecast predicts steady growth in the master cylinder segment, driven by ongoing advancements in braking technology and rising safety standards.

Analysis by Technology:

- Anti-Lock Braking System (ABS)

- Traction Control System (TCS)

- Electronic Stability Control (ESC)

- Electronic Brake Force Distribution (EBD)

Anti-lock braking system (ABS) holds 31.9% market share because of their essential contribution to improving vehicle safety and performance. ABS stops preventing wheels from seizing while braking, enabling better steering control and lowering the chance of skidding, especially in slippery conditions or during emergency stops. The broad implementation of ABS is propelled by the growing focus on vehicle safety standards, which require the incorporation of advanced safety characteristics in numerous areas. Moreover, the increasing user demand for dependable and high-performance braking systems is further driving the uptake of ABS, as it greatly enhances vehicle stability and decreases stopping distances. The capacity of ABS to effortlessly work with other vehicle systems, including ESC and traction control, strengthens its status as the leading technology. The automotive brake system market outlook suggests continued growth for ABS, as increasing safety regulations and consumer demand for enhanced braking performance fuel its widespread adoption across various vehicle segments.

Analysis by Vehicle Type:

- Passenger Cars

- Commercial Vehicles

Passenger cars lead the market with 75.6% share as they hold a significant share of total vehicle production and usage. The desire for passenger cars persists due to the rising inclination for individual transportation, the heightened demand for comfort and safety, and progress in automotive innovations. As producers maintain their emphasis on user safety, the incorporation of sophisticated braking systems in passenger cars is emerging as a crucial area of concentration. Moreover, passenger cars lead in innovations like regenerative braking systems, which is essential for improving vehicle performance, boosting energy efficiency, and minimizing environmental harm. The segment's leading position is further bolstered by strict regulatory requirements that necessitate enhanced safety features and the continuous advancement of high-performance braking systems to satisfy user demands. With the rising user demand for efficient and technologically advanced vehicles, passenger cars continue to be an important segment in the market.

Analysis by Sales Channel:

- Original Equipment Manufacturers (OEMs)

- Aftermarket

Original equipment manufacturers (OEMs) include the direct supply of brake systems during vehicle production. OEMs provide high-quality, durable braking solutions that are integrated into vehicles at the manufacturing stage. This segment benefits from long-term relationships with automakers and ensures that brake systems meet the specific performance, safety, and regulatory requirements of each vehicle model. OEM brake systems are designed to align with the manufacturer’s specifications, ensuring optimal performance, reliability, and warranty coverage.

The aftermarket segment includes brake system sales for vehicle repairs, replacements, and upgrades post-purchase. This segment is driven by the need for replacement parts due to wear and tear, as well as individuals seeking enhanced braking performance or additional safety features. The aftermarket is characterized by a broad range of products, including entry-level, mid-range, and premium brake components, catering to different vehicle types and user preferences. As vehicles age, the demand for aftermarket brake systems increases, providing opportunities for manufacturers to supply various products at competitive prices.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market with 47.4% because of its significant presence in automotive manufacturing and an increasing focus on technological advancements in braking systems. The area is experiencing a transition towards more efficient, dependable, and sophisticated braking solutions to satisfy changing user demands and tougher regulatory requirements. For example, in 2024, BWI Group began pilot production of its iDBC1 One-Box brake-by-wire system in China. The system used a fully automated, digitalized production line for high precision and quality control. Moreover, the increasing demand for electric and hybrid cars is creating a necessity for specialized braking systems that ensure improved performance, energy efficiency, and safety. Furthermore, the emphasis on lightweight parts and economical solutions in the automotive sector is supporting the market growth in the region. Due to increased investments in research operations, the Asia Pacific region continues to lead in the introduction of advanced materials, braking technologies, and system integration, ensuring enhanced performance, durability, and environmental compatibility, thereby establishing itself as the market leader in automotive brake systems.

Key Regional Takeaways:

United States Automotive Brake System Market Analysis

The market for automotive brake systems in the United States is experiencing expansion with a share of 89.90% fueled by an increase in the demand for electric and hybrid vehicles that feature advanced safety technologies. The increasing use of regenerative braking systems in modern vehicle models is greatly impacting product development. The International Energy Agency reports that in the United States, sales of electric cars increased by approximately 10% annually, exceeding one in ten cars sold in 2024, which further boosts the need for high-performance braking systems in EVs. Moreover, rigorous government regulations concerning vehicle safety standards are hastening the incorporation of electronic brake-force distribution and anti-lock braking systems. The growing investments in smart transportation infrastructure and the transition towards self-driving vehicles are further advancing the adoption of next-generation braking technologies. The growth of connected vehicle platforms is leading to the development of advanced braking systems that improve driver control and safety. Additionally, the inclination of individuals towards performance-driven vehicles featuring agile braking systems is driving the need for high-performance brake parts. Progress in material science is allowing for the creation of lightweight braking systems that enhance fuel efficiency while maintaining performance. Enhanced cooperation between automotive manufacturers and brake system providers is accelerating development timelines and tailored solutions for contemporary vehicle platforms.

Europe Automotive Brake System Market Analysis

The European automotive brake system market is growing consistently, backed by the region's focus on sustainable transport and low-emission mobility. The extensive adoption of electric buses and shared mobility options is resulting in a greater need for energy-efficient and electronically managed braking systems. Moreover, increasing public and private funding in infrastructure for smart mobility is accelerating the implementation of advanced driver assistance systems in all new vehicles. The European Commission states that these developments are projected to protect over 25,000 individuals and avert at least 140,000 serious injuries by 2038, highlighting the vital importance of advanced brake systems in improving road safety. User preferences for luxury vehicles that include adaptive braking systems is also contributing to the automotive brake system market growth. The integration of V2X communication boosts predictive braking systems, enhancing both safety and efficiency. The need for precise braking components in advanced driver-assistance systems (ADAS) is rising. Innovation in electro-mechanical and brake-by-wire systems supports Europe's decarbonization objectives, as lightweight vehicle designs advance brake system technologies.

Asia Pacific Automotive Brake System Market Analysis

The automotive brake system market in the Asia Pacific region is expanding swiftly as a result of the fast-tracking urbanization and the growth of the middle-income demographic. As vehicle production levels escalate, especially in the two-wheeler and light commercial vehicle categories, the need for dependable brake systems is on the rise. As per the Society of Indian Automobile Manufacturers, the sales of two-wheelers reached approximately 19.6 million units, marking a growth rate of 9.1% in FY 2024–25 compared to FY 2023–24, emphasizing the sector's important role in catalyzing the demand for brake system. The demand for safer transit in crowded urban settings is fueling the incorporation of sophisticated braking technologies, including electronic stability control. User awareness and ride-hailing services are promoting the use of durable brake technologies in heavy-duty commercial vehicles. Advancements in hydraulic and air disc braking systems enhance load management and operational oversight.

Latin America Automotive Brake System Market Analysis

The automotive brake system market in Latin America is influenced by the expanding commercial transport industry, advanced public transit systems, government-driven road safety programs, and the growing adoption of mid-range vehicles equipped with improved safety features. Moreover, local manufacturing innovations are encouraging the use of modular and easily maintainable brake parts designed for budget-conscious markets. A significant advancement is the swift increase in the adoption of EVs. As reported by the International Energy Agency, EV sales in Brazil doubled in 2024, with more than 85% of new electric cars coming from China. This change is speeding up the need for sophisticated braking systems tailored for electric drivetrains. With the growth of logistics and delivery services throughout the region, the demand for dependable and durable brake systems is increasing, strengthening market momentum.

Middle East and Africa Automotive brake system Market Analysis

The automotive brake system market in the Middle East and Africa is advancing consistently, bolstered by an increase in the use of off-road and utility vehicles. The growth of infrastructure and industrial development initiatives is catalyzing the demand for robust and effective braking systems in commercial fleets. Reports indicate that new vehicle sales in the UAE totaled 316,000 units in 2024, highlighting a rise in automotive demand that boosts the market growth for braking systems. The increasing worry among urban dwellers regarding vehicle safety is propelling the uptake of advanced braking technologies, especially in premium and commercial markets. The automation of industrial transport is encouraging the adoption of electronic braking systems, improving safety and efficiency in the region.

Competitive Landscape:

Major participants in the market are concentrating on innovation, broadening their product ranges, and improving technological skills to address rising safety and performance requirements. They are putting money into advanced braking technologies, including regenerative braking systems and their integration with ESC and ABS. Efforts are underway to establish collaborations and partnerships with car manufacturers to jointly develop advanced brake technologies. Moreover, players are focusing on sustainability by creating eco-friendly materials and solutions that minimize brake dust and enhance energy efficiency. These initiatives seek to fulfill regulatory standards, enhance vehicle safety, and align with the growing consumer demand for advanced, high-performance braking systems. For instance, in 2025, Brembo and Michelin announced a partnership to launch a smart braking system called Sensify, set for production by 2026. The system uses real-time data and electric actuation to tailor braking at each wheel for better safety and control. Michelin contributes tire intelligence, helping optimize grip and braking based on conditions.

The report provides a comprehensive analysis of the competitive landscape in the automotive brake system market with detailed profiles of all major companies, including:

- Aisin Corporation

- Akebono Brake Industry Co. Ltd

- Astemo, Ltd.

- Brembo N.V.

- Continental AG

- HELLA GmbH & Co. KGaA

- HL Mando Corp.

- Knorr-Bremse AG

- Performance Friction Corporation

- Robert Bosch LLC

- Tenneco Inc.

- ZF Friedrichshafen AG

Latest News and Developments:

- May 2025: Bajaj updated the 2025 Pulsar NS400Z with new sintered brake pads, replacing the older organic ones to improve braking power and reduce fade. Despite retaining Grimecca brake calipers, the changes aim to enhance lever feel and performance.

- April 2025: Nexteer Automotive introduced its electro-mechanical brake-by-wire (EMB) system, replacing traditional hydraulic components with software-controlled actuators. The system enhances braking precision, supports ADAS integration, and optimizes regenerative braking for EVs. It also improves design flexibility, environmental sustainability, and manufacturing efficiency.

- January 2025: ZF introduced a new modular brake system designed to enhance vehicle safety and performance. This innovative system integrates advanced electronic controls with traditional braking components, allowing for improved responsiveness and adaptability across various driving conditions. The modular design facilitates easier integration into different vehicle platforms, supporting the evolving needs of modern automotive engineering.

- January 2025: Bosch successfully tested its hydraulic brake-by-wire system over 2,050 miles to the Arctic Circle, marking its first public road trial. The system eliminates mechanical connections, using redundant electric signals.

Automotive Brake System Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Disc Brakes, Drum Brakes |

| Components Covered | Master Cylinder, Brake Pad, Calipers, Disc, Vacuum Servo Brake, Brake Drums, Others |

| Technologies Covered | Anti-Lock Braking System (ABS), Traction Control System (TCS), Electronic Stability Control (ESC), Electronic Brake Force Distribution (EBD) |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Sales Channels Covered | Original Equipment Manufacturers (OEMs), Aftermarket |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aisin Corporation, Akebono Brake Industry Co. Ltd, Astemo, Ltd., Brembo N.V., Continental AG, HELLA GmbH & Co. KGaA, HL Mando Corp., Knorr-Bremse AG, Performance Friction Corporation, Robert Bosch LLC, Tenneco Inc., ZF Friedrichshafen AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive brake system market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global automotive brake system market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive brake system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive brake system market was valued at USD 51.50 Billion in 2024.

The automotive brake system market is projected to exhibit a CAGR of 4.25% during 2025-2033, reaching a value of USD 76.33 Billion by 2033.

The automotive brake system market is growing because of several factors, including increasing vehicle manufacturing, the growing need for safety features, advancements in brake technology, and stricter safety regulations. Additionally, the rising focus on EVs and hybrid models, coupled with the demand for enhanced performance, is further strengthening the market growth.

Asia Pacific currently dominates the automotive brake system market, accounting for a share of 47.4%. The dominance of the market is because of high vehicle production, strong automotive manufacturing hubs like China, Japan, and India, and a growing demand for advanced safety features. The region's rapid urbanization, increasing disposable income, and expanding EV adoption further contribute to its dominance in the market.

Some of the major players in the automotive brake system market include Aisin Corporation, Akebono Brake Industry Co. Ltd, Astemo, Ltd., Brembo N.V., Continental AG, HELLA GmbH & Co. KGaA, HL Mando Corp., Knorr-Bremse AG, Performance Friction Corporation, Robert Bosch LLC, Tenneco Inc., ZF Friedrichshafen AG, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)