Automotive Collision Repair Market Size, Share, Trends and Forecast by Product Type, Service Channel, Vehicle Type, and Region, 2025-2033

Automotive Collision Repair Market Size and Share:

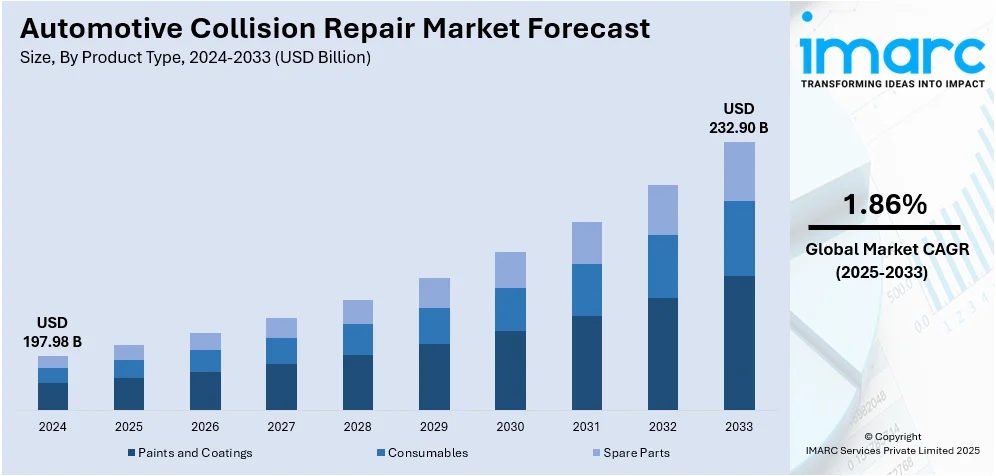

The global automotive collision repair market size was valued at USD 197.98 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 232.90 Billion by 2033, exhibiting a CAGR of 1.86% from 2025-2033. Europe currently dominates the market, holding a market share of 42.0% in 2024. The dominance of the market is owing to the well-established automotive industry, high adoption of advanced repair technologies, and strong regulatory standards promoting safety. The presence of skilled workforce, expanding vehicle parc, and increasing preference for quality repair solutions further contribute to the automotive collision repair market share in Europe.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 197.98 Billion |

|

Market Forecast in 2033

|

USD 232.90 Billion |

| Market Growth Rate 2025-2033 | 1.86% |

A continuous rise in global vehicle ownership, along with increasing road congestion, inevitably results in greater risks of collisions and accidents. As the number of vehicles operating in urban and rural regions increases, the need for collision repair services is rising. This factor guarantees a steady demand for repairs, strengthening the market growth. Apart from this, the implementation of digital diagnostic systems, precise instruments, and automated repair methods is greatly improving service efficiency and precision. These technologies enable repair shops to manage contemporary vehicles equipped with sophisticated electronics and intricate designs. By enhancing response times and guaranteeing superior quality, technology fosters client trust and market growth.

To get more information on this market, Request Sample

The United States is a crucial segment in the market, driven by the expansion of certified repair networks and community-oriented service centers, which enhance accessibility, elevate service quality, and increase client confidence. These initiatives also aid in establishing industry standards by fostering skilled workforce development and compliance with advanced repair techniques. For instance, in 2025, CARSTAR opened CARSTAR Village Collision Center in Dearborn, Michigan, expanding its collision repair network. The facility services all vehicle makes and models and is working toward I-CAR Gold Class and OEM certifications. The center also supports several local community organizations.

Automotive Collision Repair Market Trends:

Rising Road Traffic and Accident Rates

The automotive collision repair industry is significantly influenced by the consistent rise in global road traffic, which directly elevates the likelihood of accidents and damage from collisions. According to the World Health Organization (WHO), around 1.19 million individuals lose their lives each year due to road traffic accidents, underscoring the magnitude of the problem. This concerning figure highlights the ongoing necessity for prompt and effective repair methods to fix damaged cars, guaranteeing their safety and roadworthiness. Collision repair services handle structural issues as well as cosmetic and performance concerns, which are crucial for maintaining both value and functionality. The ongoing increase in traffic congestion guarantees that the need for top-notch repair services stays strong, with accident rates being a key driver of the sustained growth of the global automotive collision repair industry.

Robust Automotive Industry

The overall expansion of the automotive sector generates significant momentum for the collision repair market, as the increasing vehicle count inherently results in higher repair and maintenance demands. The rise in production and sales of passenger cars, commercial vehicles, and advanced technology models generates a substantial pool of vehicles that need continuous maintenance. Emerging mobility trends promote the increased use of hybrid and electric vehicles (EVs), leading to a higher demand for specialized repair services that facilitate market diversification. The International Energy Agency (IEA) forecasts that worldwide electric vehicle sales will increase by 25% by the conclusion of 2025, representing the swift adoption of eco-friendly transportation options. The growth of vehicle fleets utilized for business activities, logistics, and personal transport increases the demand for collision repair services. The growing demand is complemented by investments in service networks, equipment, and skilled workforce to guarantee that changing client expectations are fulfilled.

Sustainable Innovations

The introduction of sustainable repair materials is a key factor impelling the market growth, as industry players increasingly focus on eco-friendly solutions that align with global sustainability goals. In 2024, BASF Coatings unveiled new sustainable clearcoats at Automechanika Frankfurt, produced using recycled tires through its ChemCycling technology. These Ccycled® products, marketed under Glasurit and R-M brands, not only contributed to reducing waste and CO₂ emissions but also enhanced operational efficiency for repair shops. By offering faster drying times, these coatings lower energy usage, supporting cost-effectiveness and environmental responsibility simultaneously. Such innovations reflect the growing importance of sustainability in shaping repair practices, as both individuals and businesses demand greener alternatives. The integration of recycled materials into high-performance products demonstrates how technological advancements can align with ecological commitments, reinforcing sustainability as a powerful driver of expansion and modernization in the global automotive collision repair market.

Automotive Collision Repair Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automotive collision repair market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, service channel, and vehicle type.

Analysis by Product Type:

- Paints and Coatings

- Consumables

- Spare Parts

Spare parts stand as the largest component in 2024, holding 65.1% of the market, accredited to their essential function in maintaining the performance, safety, and durability of vehicles post-repair. The steady need for top-notch replacement parts supports the popularity of this segment, as vehicle owners and service providers emphasize dependability and performance. Producers and vendors emphasize providing a broad selection of components customized for various vehicle types, improving accessibility and client contentment. The presence of authentic components, along with continual enhancements in material quality and design, reinforces their market standing. Repairs covered by insurance also drive consistent demand for spare parts, as the coverage generally involves replacement with authorized components. Ongoing advancements in manufacturing methods, effective distribution systems, and increasing focus on sustainable and recyclable materials boost the attractiveness of spare parts. Their crucial role in returning vehicles to original specifications secures their top status in the worldwide automotive collision repair sector.

Analysis by Service Channel:

- OEMs

- Aftermarket

- Others

OEMs represent the largest segment, accounting for 55.6% market share because of their robust brand trust, superior technical knowledge, and guarantee of quality standards. They offer clients authentic components, specialized equipment, and highly skilled technicians, guaranteeing accuracy, dependability, and more durable repair results. Their well-established dealership and service networks provide broad accessibility, boosting client trust and loyalty. OEMs invest heavily in research activities, allowing them to incorporate cutting-edge repair technologies and digital solutions into their service offerings. Robust alliances with insurance companies enhance their market stance, ensuring smooth repair procedures and customer ease. Furthermore, OEMs focus on complying with stringent safety and regulatory standards, making certain that repair services meet industry criteria. Their ongoing emphasis on innovation, client contentment, and sustainability strengthens their leadership, establishing them as the favored service option in the automotive collision repair industry.

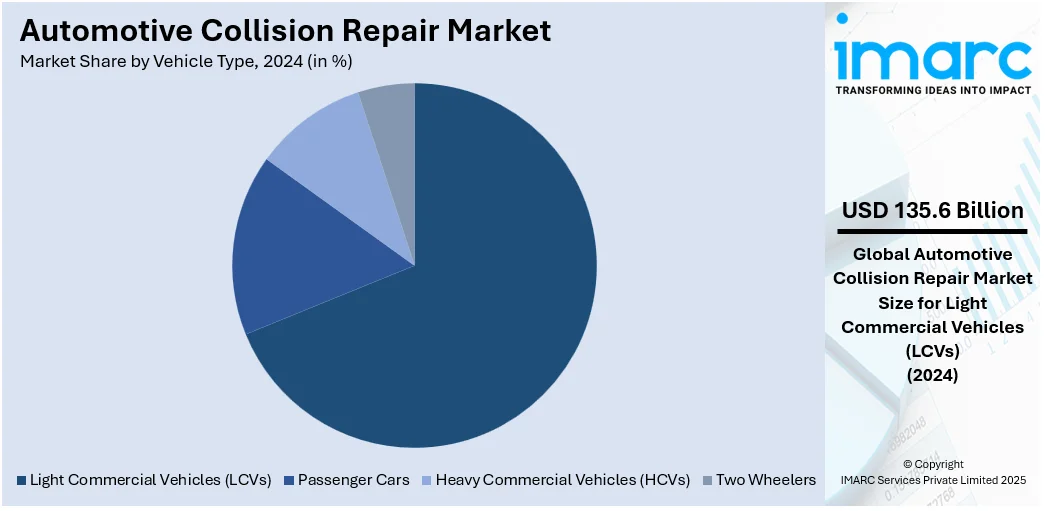

Analysis by Vehicle Type:

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Two Wheelers

Light commercial vehicles (LCVs) lead the market with 68.5% of market share in 2024. The dominance of the segment is attributed to their widespread use in logistics, transportation, and business functions, leading to increased repair and maintenance demands. The rising uptake among small and medium businesses, along with the growth of e-commerce and last-mile delivery services, is driving the need for dependable repair solutions. The segment benefits from robust insurance protection, guaranteeing that repair services are readily available and backed. Improvements in repair technologies, access to premium spare parts, and a strong network of expert service providers also enhance the prevalence of LCVs in this segment. Moreover, fleet owners and operators emphasize prompt maintenance and repairs to ensure efficiency and operational dependability, resulting in steady demand. The integration of intense usage, increasing reliance on business, and focus on preserving vehicle performance guarantees that LCVs stay prominent in the automotive collision repair sector.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the largest market share of 42.0%, owing to its robust automotive manufacturing foundation, sophisticated technological framework, and well-established service ecosystem that guarantees superior repair quality. The area has a substantial and older vehicle fleet, ensuring steady demand for maintenance and repair services. Strong regulatory frameworks focusing on road safety and vehicle efficiency lead to increased acceptance of approved repair methods. The availability of well-trained technicians and ongoing investment in training initiatives boost service effectiveness and accuracy. Extensive insurance availability throughout European nations additionally bolsters the market by enabling clients access to repair services. For example, in 2024, Steer Automotive Group launched Steer Electric, its first purpose-built EV repair center in Eastleigh, Hampshire. The 14,000 sq ft facility was equipped with advanced EV technology and aluminum structural repair capabilities. This aimed positions the group to meet the growing demand for EV repair services.

Key Regional Takeaways:

United States Automotive Collision Repair Market Analysis

In North America, the market portion held by the United States was 75.10%, experiencing a rise in the demand for automotive collision repair because of the growing sales of hybrid and electric vehicles (H/EVs). The International Energy Association reports that over 360,000 EVs were purchased in the United States in the initial quarter of 2025, approximately 10% higher than in the equivalent timeframe the year before. With the user shift toward sustainable transportation, the intricacy of H/EVs is resulting in an increased maintenance and repair needs, requiring specialized collision repair services. Innovative materials, battery parts, and safety technologies in H/EVs are encouraging repair networks to upgrade tools and technician expertise. This change promotes increasing acceptance of automotive collision repairs among different service networks. Additionally, insurers are modifying policies to cater to H/EV-related damage coverage, which in turn affects the frequency of collision repairs. The incorporation of digital diagnostics and intelligent repair systems supports the trend, boosting service efficiency.

North America Automotive Collision Repair Market Analysis

The North America automotive collision repair industry is propelled by a mix of robust industry fundamentals and beneficial economic factors. Increasing vehicle ownership and ongoing demand for personal transportation are leading to a continuous need for repairs, bolstered by a vast and varied vehicle fleet. The area benefits from the implementation of advanced technology, as repair shops are progressively outfitted with contemporary diagnostic instruments, online systems, and premium materials to guarantee accuracy and effectiveness. Robust insurance integration enhances user trust, whereas effectively designed regulatory systems promote compliance with safety and quality benchmarks. The presence of qualified experts and ongoing training initiatives significantly improve service abilities throughout the industry. In 2025, I-CAR launched a national Registered Apprenticeship Program (RAP) for the collision repair industry, addressing the technician shortage. The program offers two years of paid on-the-job learning and technical instruction, leading to a US Department of Labor certification.

Europe Automotive Collision Repair Market Analysis

Europe is experiencing a significant rise in automotive collision repair work accredited to an increase in car ownership in urban and rural regions. As reported by the International Energy Agency, EVs sales in Europe exceeded 900,000 in Q1 2025, with 625,000 units sold within the European Union. With a growing number of people possessing cars for everyday travel and recreation, the need for repair services after accidents is also increasing. Old vehicle fleets paired with elevated car usage rates result in higher wear and damage occurrences, requiring regular collision repairs. The rising awareness about vehicle appearance and performance further contributes to this demand. Improved insurance protection and prolonged vehicle warranties also encourage regular maintenance involvement. Besides this, with urban driving conditions becoming more congested, slow-speed collisions and small dings are frequent, necessitating expert repairs.

Asia Pacific Automotive Collision Repair Market Analysis

The Asia-Pacific region is witnessing a continuous increase in the adoption of automotive collision repair, driven by the growing number of car service centers in urban and semi-urban areas. For example, Maruti Suzuki aims to establish 500 service centers in FY 2025-26, with 91 facilities already in place. With the rise in vehicle ownership, particularly in urban regions, service centers are essential for providing prompt and effective collision repairs. The growth of licensed and independent repair shops enhances access to sophisticated repair options and fosters competition, leading to better service quality and affordability. Technological enhancements, such as digital paint matching and frame alignment equipment, are being progressively adopted throughout centers. This boost in infrastructure also establishes a pipeline of skilled workers educated in contemporary repair methods.

Latin America Automotive Collision Repair Market Analysis

Latin America is experiencing a rise in automotive collision repair adoption because of the increase in passenger cars, light commercial vehicles (LCVs), and motorcycles, driven by higher disposable income. By 2025, the typical yearly income in Brazil is roughly BRL 40,200, equating to about USD 7,025.63 annually. With the enhancement of economic conditions, car ownership is becoming attainable for a wider segment of the population, leading to the growth of the regional vehicle fleet. This rise results in additional vehicles on the road and heightens the chances of accidents, increasing the need for repair services.

Middle East and Africa Automotive Collision Repair Market Analysis

The Middle East and Africa are witnessing an increase in automotive collision repair usage owing to the rising instances of road accidents and deaths. As per Car Accident Statistics and Road Safety in the UAE (2025), 45% of accidents involve drivers aged 18–30, frequently due to inexperience and reckless actions. With increasing urban traffic levels and varying safety adherence, accident frequencies stay elevated, leading to significant vehicle repairs. The ongoing demand for restoration services enhances the presence of collision repair shops, which are progressively investing in sophisticated repair technologies and technician training to satisfy needs.

Competitive Landscape:

Major participants in the industry are concentrating on strategic efforts to improve efficiency, service quality, and user satisfaction. They are putting money into cutting-edge repair technologies, digital systems, and automated solutions to enhance processes and minimize turnaround times. Ongoing endeavors are undertaken to enhance supply chain networks, guaranteeing access to top-notch components and materials. Collaborations with insurers and workshops are being strengthened to deliver integrated services and enhanced value to clients. Moreover, focus is given to training initiatives that enhance employee competencies, together with sustainable methods to comply with environmental regulations, ultimately bolstering their market standing. In 2024, Auto Additive launched its OEM-grade 3D printed parts, tools, and jigs for the collision repair industry. The company focused on sustainability by using additive manufacturing to reduce waste and carbon footprints. It collaborated with industry leaders like HP and GM to drive innovation.

The report provides a comprehensive analysis of the competitive landscape in the automotive collision repair market with detailed profiles of all major companies, including:

- 3M Company

- Automotive Technology Products LLC

- Caliber Collision

- Continental AG

- Denso Corporation

- DuPont de Nemours Inc.

- Eastman Chemical Company

- Faurecia SE

- Honeywell International Inc.

- IAC Group

- Magna International Inc.

- Robert Bosch GmbH

- Tenneco Inc.

Latest News and Developments:

- July 2025: Johnson College launched an Automotive Collision Repair program through its WAVE department, offering over 500 hours of hybrid training in collaboration with I-CAR, Toyota of Scranton, and Sherwin-Williams. Students gained real-world automotive repair experience through paid, hands-on training and industry-recognized instruction.

- June 2025: CCC launched its CCC Pay Workflow tool for the automotive repair industry, aiming to streamline pay management by offering technicians clearer pay visibility and enabling managers to track pay tasks digitally. The tool addressed technician retention issues linked to pay-related stress and replaced manual, paper-based systems common in collision repair shops.

- May 2025: PPG launched new clearcoats in the US for premium and value-focused automotive repair, enhancing bodyshop productivity with fast-drying SC300 Series and energy-saving DELTRON NXT DC7020 solutions. These products supported quick curing, VOC compliance, and high-gloss finishes, addressing evolving repair demands.

- May 2025: PPG launched new clearcoat solutions in the US aimed at value-focused and premium automotive repair, introducing the SC300 Series for cost-effective, quick-drying results and the Deltron NXT DC7020 for high-gloss, energy-saving performance in collision repair applications.

- May 2025: Kinetic partnered with Chilton Auto Body to launch a new 10,000-square-foot digital automotive repair hub in San Carlos, expanding precision repair and calibration services in the Bay Area. The facility supported EVs, AVs, and ADAS-equipped vehicles using AI and robotics, and marked Kinetic’s first Bay Area hub serving five Chilton locations.

Automotive Collision Repair Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Paints and Coatings, Consumables, Spare Parts |

| Service Channels Covered | OEMs, Aftermarket, Others |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), Two Wheelers |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, Automotive Technology Products LLC, Caliber Collision, Continental AG, Denso Corporation, DuPont de Nemours Inc., Eastman Chemical Company, Faurecia SE, Honeywell International Inc., IAC Group, Magna International Inc., Robert Bosch GmbH and Tenneco Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive collision repair market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global automotive collision repair market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive collision repair industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive collision repair market was valued at USD 197.98 Billion in 2024.

The automotive collision repair market is projected to exhibit a CAGR of 1.86% during 2025-2033, reaching a value of USD 232.90 Billion by 2033.

The automotive collision repair market is supported by rising vehicle ownership, increasing road traffic, and a growing focus on road safety awareness. Advances in repair technology, wider availability of insurance coverage, and the rising demand for quality parts and services also support the market growth. Expanding vehicle fleets and urbanization further offer a positive outlook.

Europe currently dominates the automotive collision repair market, accounting for a share of 42.0%. The dominance of the region is owing to its well-established automotive industry, high adoption of advanced repair technologies, and strong regulatory standards promoting safety. The presence of skilled workforce, expanding vehicle parc, and increasing preference for quality repair solutions further enhance the region’s market leadership.

Some of the major players in the automotive collision repair market include 3M Company, Automotive Technology Products LLC, Caliber Collision, Continental AG, Denso Corporation, DuPont de Nemours Inc., Eastman Chemical Company, Faurecia SE, Honeywell International Inc., IAC Group, Magna International Inc., Robert Bosch GmbH, Tenneco Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)