Automotive Connectors Market Size, Share, Trends and Forecast by Connection Type, Connector Type, System Type, Vehicle Type, Application, and Region, 2025-2033

Automotive Connectors Market Size and Share:

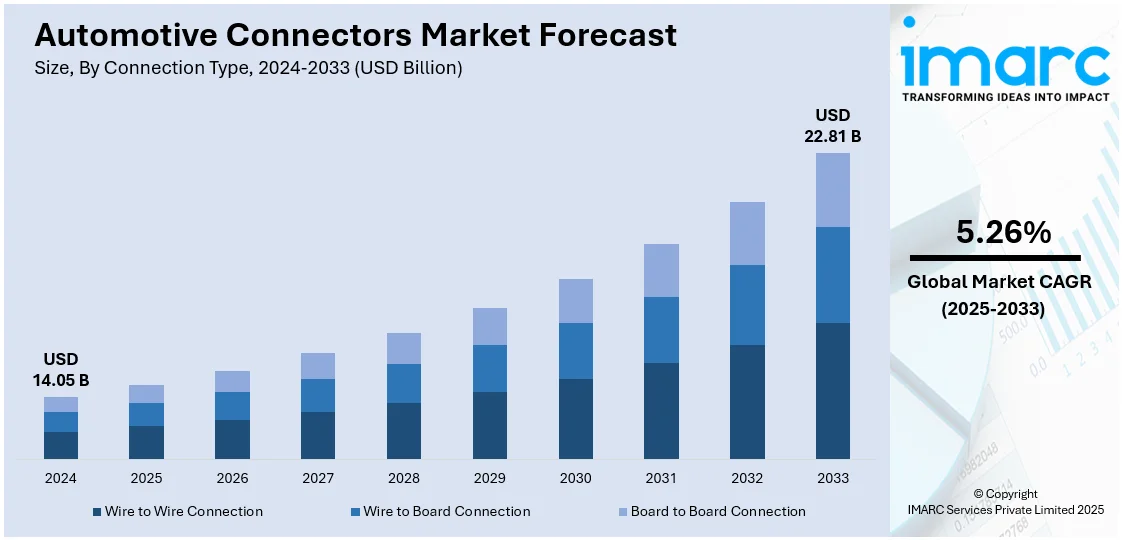

The global automotive connectors market size was valued at USD 14.05 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 22.81 Billion by 2033, exhibiting a CAGR of 5.26% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of 40.3% in 2024. The market is witnessing robust growth due to the rising demand for advanced vehicle technologies, including electric vehicles, autonomous systems, and connectivity features. The rise in safety standards and regulatory requirements further drives the need for high-performance connectors. Moreover, as vehicle electrification and digitalization progress, the automotive connectors market share is expected to expand significantly.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 14.05 Billion |

|

Market Forecast in 2033

|

USD 22.81 Billion |

| Market Growth Rate 2025-2033 | 5.26% |

The automotive connectors market is driven by the increasing demand for advanced vehicle electronics and the growing adoption of electric vehicles (EVs). According to the report published by IEA, electric car sales are projected to reach 17 million in 2024 representing over 20% of global sales. In Q1 2024, sales grew 25% year-on-year. In 2023 sales hit 14 million (18% of total) with a 35% increase. China, Europe, and the US dominate accounting for 95% of sales. As cars are increasingly connected the demand for high-performance connectors to enable infotainment systems, ADAS and powertrains has increased. Further, the tightening regulatory environment for safety and emissions, coupled with technological development in connectivity and automation is further driving automotive connectors market growth. The transition to electric and hybrid vehicles also hastens the requirement for specialized connectors in EV battery systems.

The United States automotive connectors market is driven by the growing demand for advanced vehicle technologies such as autonomous driving systems, electric vehicles (EVs) and enhanced infotainment systems. According to industry reports, electric vehicle sales in the U.S. surged 15.2% in Q4 2024 reaching 365,824 units and totaling 1.3 million for the year a 7.3% increase from 2023. Notable models included the Tesla Model Y and Ford Mustang Mach-E while 2025 is projected to see EVs account for nearly 10% of total sales. The transition to electric and hybrid cars demands specialized connectors for effective power management and battery systems. Furthermore, more stringent safety standards, higher uptake of connectivity features and developments in ADAS (Advanced Driver Assistance Systems) are driving market growth. These drivers combined necessitate the demand for high-performance reliable automotive connectors in the United States market.

Automotive Connectors Market Trends:

Increase in Electric Vehicle (EV) Adoption

The adoption of electric vehicles (EVs) is driving significant demand for specialized connectors particularly for battery systems and power management. As EVs rely heavily on efficient energy storage and distribution connectors play a crucial role in ensuring seamless power flow. As per the report released by IBEF, the Electric Vehicle (EV) market in India is anticipated to expand dramatically from $3.21 billion in 2022 to $113.99 billion by 2029, representing a Compound Annual Growth Rate (CAGR) of 66.52%. Additionally, the market for EV batteries is projected to grow from $16.77 billion in 2023 to $27.70 billion by 2028, largely fueled by robust government support and investments that are encouraging this sector's development. The increasing number of EVs on the road and advancements in battery technology require high-performance connectors for charging systems and battery management. The automotive connectors market forecast predicts continued growth in demand driven by the expansion of the electric vehicle sector.

Rise in Vehicle Connectivity

The growth of vehicle connectivity spurred by developments in infotainment, navigation and telematics systems is profoundly boosting the use of high-end automotive connectors. As cars grow smarter with options such as real-time communication, navigation systems and entertainment, the need for robust and efficient connectors is crucial for enabling these features. With expanding use of 5G, cloud computing and AI in automobiles the demand for strong connectors is likely to go up. The automotive connectors market outlook indicates continued expansion driven by these innovations.

Shift Toward Wireless and Hybrid Connections

The automotive industry is witnessing a shift toward wireless and hybrid connections complementing traditional wired connectors to enhance vehicle performance and reduce system complexity. Wireless technologies such as Bluetooth and Wi-Fi are increasingly used for non-critical applications reducing the need for physical connectors and simplifying vehicle architecture. For instance, in April 2025, Hyundai Motor India updated the Alcazar SUV with a wireless adapter for Android Auto and Apple CarPlay, enhancing connectivity. Available for Prestige (excluding entry-level), Platinum and Signature variants the adapter plugs into the USB port, allowing seamless access to apps without cables improving the overall in-car experience. Hybrid connections combining wired and wireless solutions offer flexibility and efficiency. This trend is driven by the need for better data transfer, ease of installation and cost-effectiveness creating increased automotive connector market demand for innovative connector solutions.

Automotive Connectors Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automotive connectors market, along with forecast at the global and regional levels from 2025-2033. The market has been categorized based on connection type, connector type, system type, vehicle type, and application.

Analysis by Connection Type:

- Wire to Wire Connection

- Wire to Board Connection

- Board to Board Connection

Wire to wire stand as the largest connection type in 2024, holding around 32.1% of the market. Wire-to-wire connectors will continue to be the largest connection type in the automotive connectors market due to their applicability in a broad range of electrical systems within vehicles. Wire-to-wire connectors provide a safe and stable means of connecting different wires offering good power and data transmission between different car components. They are very crucial in the powertrain systems, lighting systems and control units. The increased sophistication of car electrical systems and the need for more advanced features continue to drive the growth of wire-to-wire connectors in the automotive market.

Analysis by Connector Type:

- PCB Connectors

- IC Connectors

- RF Connectors

- Fiber Optic Connectors

- Others

PCB connectors lead the market with around 53.0% of market share in 2024. PCB (Printed Circuit Board) connectors dominate the automotive connectors market because they are a pivotal component in interconnecting various electronic devices in a vehicle. PCB connectors have wide applications in advanced vehicle systems like infotainment, navigation and safety systems where high-density connections are required. Because of their small size, high reliability and ability to transfer advanced data and power they suit modern vehicles. As vehicles become increasingly electronic and interconnected the demand for PCB connectors increases as well further solidifying their market dominance.

Analysis by System Type:

- Sealed Connector System

- Unsealed Connector System

Sealed connector systems lead the market with around 60.0% of market share in 2024. Sealed connector systems lead the automotive connectors market due to their ability to protect critical electrical connections from harsh environmental conditions such as dust, moisture and extreme temperatures. These connectors are vital for maintaining the reliability and longevity of vehicle systems, particularly in outdoor and high-performance applications like lighting, powertrains and under-hood components. Their durability ensures that electrical systems remain intact despite exposure to challenging environments driving their widespread adoption in modern vehicles. The growing demand for robust and secure connectors further solidifies their market leadership.

Analysis by Vehicle Type:

- Passenger Cars

- Commercial Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Electric Vehicles

Passenger cars lead the market with around 73.7% of market share in 2024. Passenger cars lead the automotive connectors market due to their high production volumes and the increasing integration of advanced electronic systems. As vehicles become smarter with the inclusion of infotainment, advanced driver-assistance systems (ADAS) and connectivity features the demand for reliable and high-performance connectors rises. Passenger cars require a variety of connectors for power distribution, communication, safety and comfort systems making them the dominant segment. The growing trend towards electric vehicles (EVs) and connected cars further contributes to the increasing use of connectors in passenger cars.

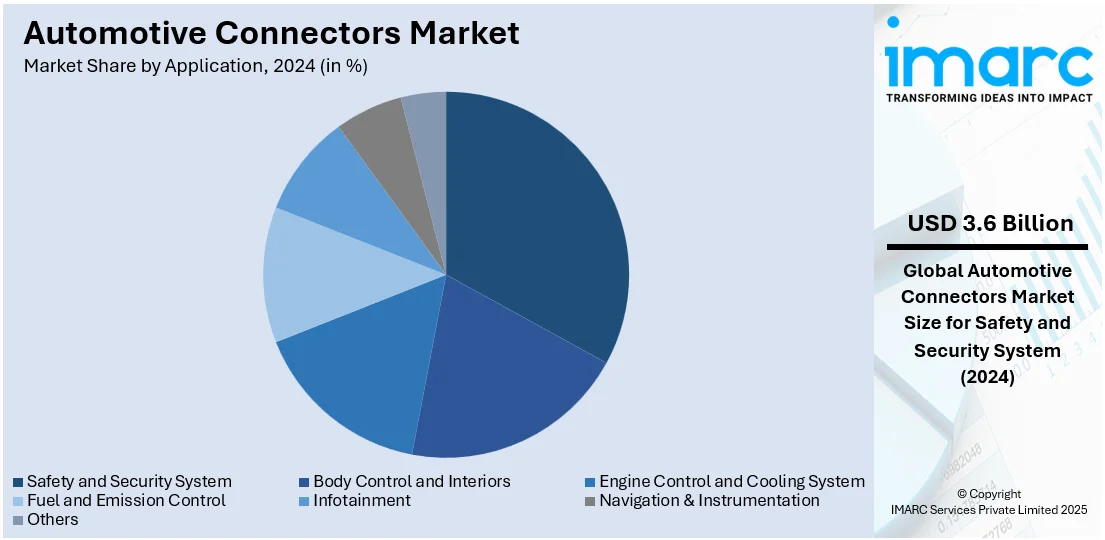

Analysis by Application:

- Body Control and Interiors

- Safety and Security System

- Engine Control and Cooling System

- Fuel and Emission Control

- Infotainment

- Navigation & Instrumentation

- Others

Safety and security systems leads the market with around 25.6% of market share in 2024. Safety and security systems lead the automotive connectors market due to the growing emphasis on vehicle safety features like airbags, anti-lock braking systems (ABS), electronic stability control and advanced driver-assistance systems (ADAS). These systems rely on robust connectors for power, data transmission and signal control to ensure timely and accurate operation. As automakers focus on enhancing vehicle safety and meeting stringent regulatory requirements, the demand for high-performance reliable connectors in safety and security systems continues to drive market growth.

Regional Analysis:

- Asia Pacific

- North America

- Europe

- Middle East and Africa

- Latin America

In 2024, Asia-Pacific accounted for the largest market share of over 40.3%. The Asia-Pacific region holds the largest share of the automotive connectors market, primarily due to its leading role in vehicle manufacturing, especially in nations such as China, Japan, and South Korea. The rapid expansion of the automotive sector, spurred by the rising demand for electric vehicles (EVs) and advanced automotive technologies, amplifies the necessity for dependable and high-quality connectors. Furthermore, the region's commitment to enhancing manufacturing efficiency, embracing technological innovations, and adopting smart, connected vehicles plays a significant role in the growth of the automotive connectors market in Asia-Pacific.

Key Regional Takeaways:

North America Automotive Connectors Market Analysis

North America is witnessing significant growth in the automotive connectors market, driven by the increasing demand for advanced vehicle technologies and the rise of electric vehicles (EVs). The growing focus on vehicle electrification, autonomous driving, and connectivity is pushing automotive manufacturers to integrate sophisticated connector solutions. With the region’s strong automotive production capabilities, manufacturers are investing heavily in modernizing assembly lines to accommodate the latest connector technologies. Additionally, the demand for high-performance connectors is rising due to regulatory pressures on safety and emissions, which require more complex electrical systems in vehicles. The shift toward smart, connected, and energy-efficient vehicles further accelerates the need for reliable and adaptable connectors. As the demand for EVs and advanced vehicle features rises, North America’s automotive connectors market is set to expand, driven by technological advancements, increased vehicle production, and the need for robust electrical connectivity solutions.

United States Automotive Connectors Market Analysis

In 2024, the United States accounted for over 85.80% of the automotive connectors market in North America.The United States is witnessing rising demand for automotive connectors driven by growing investment in automobile manufacturing and export activities. In 2023, the International Trade Administration reported that the United States exported about 1.6 million light vehicles and around 160,000 medium and heavy trucks. Increasing initiatives to expand production capacity and modernize assembly lines are fueling the integration of advanced automotive connectors in vehicle systems. As manufacturers allocate more capital towards high-performance vehicles and electric vehicle platforms, the need for reliable electrical connectivity becomes crucial. This investment surge in automobile manufacturing supports greater adoption of automotive connectors for enhanced communication, safety, and control. Moreover, evolving regulatory standards and safety protocols encourage the use of compact and durable connector systems. Growing technological sophistication in vehicles is further pushing automotive manufacturers to employ highly adaptable connector solutions. The combination of rising investments and technological integration continues to drive the automotive connectors market in the United States.

Europe Automotive Connectors Market Analysis

Europe is observing strong momentum in automotive connectors demand due to growing vehicle ownership. As reported by the International Council on Clean Transportation, Europe saw approximately 10.6 million new car registrations in 2023 across its 27 Member States, reflecting a 14% increase compared to 2022. The region's steady rise in personal and commercial vehicle registrations is pushing manufacturers to implement reliable connectivity solutions in their models. With the expansion of car fleets, the requirement for advanced electrical systems supported by durable automotive connectors is growing. Rising expectations for driving assistance, infotainment, and power management features make connectors vital in modern vehicles. This trend is prompting OEMs and suppliers to upgrade connector designs that support safety and communication functions. The emphasis on efficiency and performance across diverse vehicle categories amplifies this demand. As vehicle ownership becomes more prevalent across urban and suburban zones, the automotive connectors market in Europe is being driven by the need for enhanced system integration and reliability.

Latin America Automotive Connectors Market Analysis

Latin America is seeing an upward trend in automotive connectors usage due to growing passenger cars supported by growing disposable income. For instance, Brazil passenger cars market unit sales are expected to reach 1.94 million in 2029. Increasing consumer spending is enabling a broader population to purchase vehicles, fueling demand for robust and efficient connector systems. As passenger car production scales up, the adoption of advanced automotive connectors that support safety, infotainment, and engine control is expanding. The growing affordability of vehicles is linked to economic progress, encouraging manufacturers to integrate reliable connectors that ensure consistent vehicle performance.

Middle East and Africa Automotive Connectors Market Analysis

Middle East and Africa are undergoing rising demand for automotive connectors owing to growing urban population and rising demand in electric and autonomous vehicles. According to the UAE Ministry of Energy and Infrastructure, there were approximately 8,000 electric vehicles registered in the country as of 2023. Expanding cities and improving infrastructure are increasing the need for modern mobility solutions, boosting the automotive sector’s growth. As interest in electric and autonomous vehicles intensifies, connector systems that support complex electrical architectures are gaining traction. The shift towards smart mobility and cleaner transport is fueling the integration of durable and adaptable automotive connectors.

Competitive Landscape:

The automotive connectors industry is highly competitive, with major players concentrating on innovation, product advancement, and strategic collaborations to sustain their market presence. Companies are channeling investments into advanced connector technologies that cater to the rising demand for electric vehicles, autonomous driving, and connected car innovations. Prominent manufacturers are dedicated to creating robust, high-performance connectors designed to support intricate electrical systems while adhering to regulatory requirements. Additionally, regional competitors are emerging, offering affordable solutions customized to meet local manufacturing demands. As the trends of vehicle electrification and digitalization continue to accelerate, competition within the automotive connectors sector is anticipated to intensify.

The report provides a comprehensive analysis of the competitive landscape in the automotive connectors market with detailed profiles of all major companies, including:

- Amphenol Corporation

- Aptiv PLC

- Hirose Electric Co., Ltd.

- Japan Aviation Electronics Industry, Ltd.

- Kyocera AVX (Kyocera Corporation)

- Lumberg Holding GmbH & Co. KG

- Molex LLC (Koch Industries)

- Rosenberger Group

- Sumitomo Wiring Systems, Ltd. (Sumitomo Electric Industries, Ltd.)

- TE Connectivity

- Yazaki Corporation

Latest News and Developments:

- April 2025: ZF introduced an optical multi-gigabit Ethernet solution for vehicle electrical systems, enabling data transmission up to 50 Gbit/s over 40 meters. The company adapted its ProAI high-performance computer to integrate with automotive-grade optical fibers using the IEEE 802.3cz-2023 standard.

- February 2025: Hirose Electric Co., Ltd. launched the AU1 Series wire-to-board connector for automotive applications, which is compatible with USB 3.2. It supported high-speed data transmission with robust performance in automotive environments.

- January 2025: Amphenol Corporation unveiled its DuraSwap™ Concentric Connectors and Type 6 Charging Gun. The DuraSwap™ connectors, tailored for swappable battery systems in electric two- and three-wheelers, supported up to 100A continuous current, offered bi-directional mating, and were IP67-rated for durability.

- January 2025: Yamaichi Electronics upgraded its Y-Lock Pullforce connector system to support electric vehicle battery applications. The new Y-Lock V4 series featured a double locking mechanism and a two-part stiffener to prevent misalignment and short circuits.

Automotive Connectors Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Connection Types Covered | Wire to Wire Connection, Wire to Board Connection, Board to Board Connection |

| Connector Types Covered | PCB Connectors, IC Connectors, RF Connectors, Fiber Optic Connectors, Others |

| System Types Covered | Sealed Connector System, Unsealed Connector System |

| Vehicle Types Covered |

|

| Applications Covered | Body Control and Interiors, Safety and Security System, Engine Control and Cooling System, Fuel and Emission Control, Infotainment, Navigation & Instrumentation, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Amphenol Corporation, Aptiv PLC, Hirose Electric Co., Ltd., Japan Aviation Electronics Industry, Ltd., Kyocera AVX (Kyocera Corporation), Lumberg Holding GmbH & Co. KG, Molex LLC (Koch Industries), Rosenberger Group, Sumitomo Wiring Systems, Ltd. (Sumitomo Electric Industries, Ltd.), TE Connectivity, Yazaki Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive connectors market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global automotive connectors market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive connectors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive connectors market was valued at USD 14.05 Billion in 2024.

The automotive connectors market is projected to reach USD 22.81 Billion by 2033, exhibiting a CAGR of 5.26% from 2025-2033.

The automotive connectors market is driven by the growing demand for advanced driver-assistance systems (ADAS), increasing demand for electric and hybrid vehicles, and the growing integration of electronic components in vehicles. Additionally, stricter safety regulations and the push for connected car technologies are boosting market growth.

Some of the major players in the automotive connectors market include Amphenol Corporation, Aptiv PLC, Hirose Electric Co., Ltd., Japan Aviation Electronics Industry, Ltd., Kyocera AVX (Kyocera Corporation), Lumberg Holding GmbH & Co. KG, Molex LLC (Koch Industries), Rosenberger Group, Sumitomo Wiring Systems, Ltd. (Sumitomo Electric Industries, Ltd.), TE Connectivity, Yazaki Corporation, etc.

The Asia Pacific market accounted for 40.3% of the automotive connectors market in 2024 due to the robust growth of the automotive sector, technological advancements, and an increasing interest in electric vehicles. Additionally, the rising consumer demand for connected and intelligent vehicle features further contributes to the market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)