Automotive Flooring Market Size, Share, Trends and Forecast by Product, Material, Vehicle Type, Distribution Channel, and Region, 2025-2033

Automotive Flooring Market Size and Share:

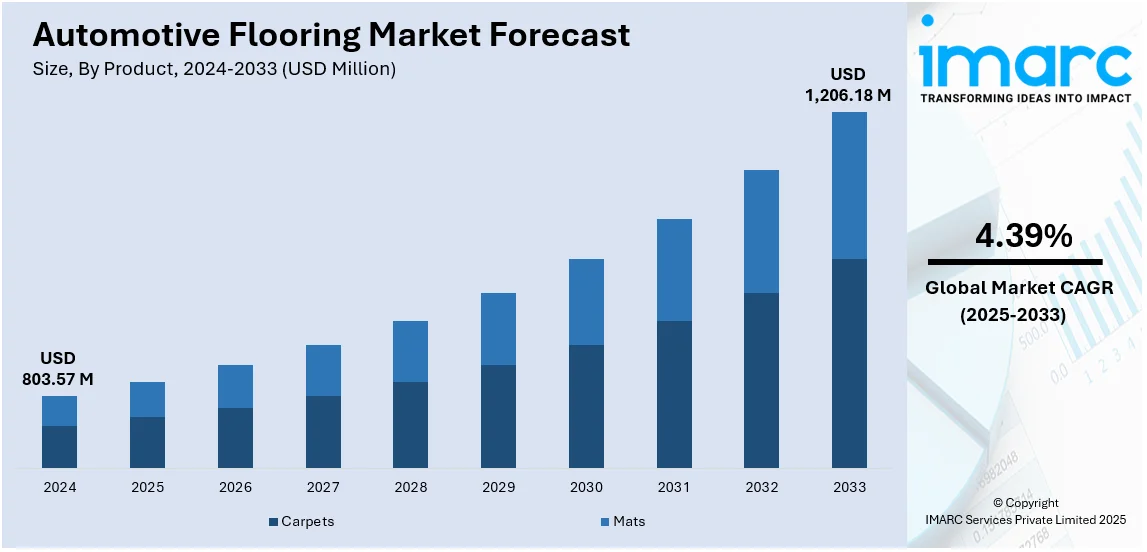

The global automotive flooring market size was valued at USD 803.57 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,206.18 Million by 2033, exhibiting a CAGR of 4.39% from 2025-2033. Asia-Pacific currently dominates the market, holding a market share of over 53.5% in 2024. The automotive flooring market share is expanding, driven by the growing awareness about sanitation and overall hygiene maintenance, increasing production of automobile vehicles, rising vehicle platform complexity, and the widespread adoption of flooring solutions to meet the latest safety standards.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 803.57 Million |

|

Market Forecast in 2033

|

USD 1,206.18 Million |

| Market Growth Rate (2025-2033) | 4.39% |

The increasing vehicle production, combined with the rising demand for comfortable and durable interiors, is impelling the market growth. As more people buy cars, automakers focus on better flooring materials that enhance aesthetics, safety, and noise reduction. The shift toward electric vehicles (EVs) also encourages innovations in lightweight and eco-friendly flooring options. People want stylish and easy-to-clean interiors, motivating manufacturers to develop advanced carpets, mats, and floor coverings. Besides this, the rising awareness among the masses about vehicle insulation is driving the demand for high-quality flooring materials. Apart from this, government regulations on vehicle safety and sustainability promote the usage of non-toxic and recyclable items.

The United States has emerged as a major region in the automotive flooring market owing to many factors. The increasing demand for comfort is fueling the automotive flooring market growth. As more people buy luxury cars, automakers focus on high-quality flooring that offers durability, insulation, and noise reduction. The high adoption of EVs is also creating the need for lightweight and eco-friendly flooring options. According to the data published on the official website of the US Energy Administration, the combined sales of hybrid vehicles (HVs), plug-in hybrid electric vehicles (HEVs), and battery electric vehicles (BEVs) increased from 19.1% of total new light-duty vehicle (LDV) sales in the United States in 2Q24 to 21.2% in 3Q24. Besides this, people prefer stylish and easy-to-clean materials, leading to innovations in carpets, mats, and floor liners. With the growing customization trends, automakers offer premium flooring choices in mid-range vehicles.

Automotive Flooring Market Trends:

Rising production of vehicles

The rising production of vehicles is positively influencing the market. More cars mean more demand for quality flooring materials. It has been reported that the automotive industry market was valued at USD 3.8 Thousand Billion in 2023. Automakers focus on comfort, durability, and aesthetics, creating the need for advanced materials like rubber, carpets, and mats. As people buy more vehicles, especially with growing urbanization activities and better incomes, manufacturers invest in flooring that enhances noise reduction, insulation, and easy maintenance. EVs also play a role, as they need lightweight and eco-friendly flooring options. Additionally, the increasing popularity of luxury and custom cars leads to the demand for high-end flooring materials. Automakers also prioritize sustainability, encouraging the use of recycled and biodegradable items.

Growing investments in urbanization projects

Rising investments in urbanization projects are offering a favorable automotive flooring market outlook. The fundings assist in catalyzing the demand for vehicles, especially in growing cities. At present, more than half of the worldwide population lives in urban areas, up from around one-third in 1950 and anticipated to increase to around two-thirds in 2050. As more roads, highways, and smart city projects come up, transportation needs rise, leading to higher car sales. With better infrastructure, people prefer private cars and commercial vehicles, creating the need for quality automotive flooring. Ride-hailing and public transport fleets are also expanding, requiring durable and easy-to-clean flooring materials. As urban areas grow, the focus shifts towards comfort, noise reduction, and stylish interiors, encouraging innovations in flooring options. With urbanization shaping modern lifestyles, automakers keep enhancing flooring materials to match evolving trends.

Increasing implementation of government regulations

The rising implementation of government regulations is encouraging manufacturers to improve safety, quality, and sustainability. Vehicle safety regulations require flooring to be fire-resistant, slip-proof, and durable to reduce accident risks. In January 2024, The Ministry of Road Transport and Highways issued the Central Motor Vehicles (First Amendment) Rules, 2024 to modify the Central Motor Vehicles Rules, 1989. The regulations went into effect on January 5, 2024. Stricter emission norms encourage the use of eco-friendly and recyclable materials, making car interiors more sustainable. Regulations promoting EVs also lead to the demand for lightweight flooring that enhances energy efficiency. Additionally, hygiene standards for public and commercial transport create the need for antimicrobial flooring solutions. Automakers must comply with these evolving rules, leading to continuous innovations in flooring materials and designs.

Automotive Flooring Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automotive flooring market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, material, vehicle type, and distribution channel.

Analysis by Product:

- Carpets

- Mats

Carpets held 72.2% of the market share in 2024. They offer durability and sound insulation, making them the top choice for most vehicles. They provide a soft and premium feel while effectively reducing road noise and vibrations, enhancing the overall driving experience. Carpets are also highly customizable, allowing automakers to design luxury, sporty, or practical interiors to match different vehicle types. With advancements in stain-resistant and waterproof materials, modern carpets are easier to maintain and last longer. They also help with temperature regulation, keeping interiors cooler in summer and warmer in winter. Automakers prefer carpets because they are cost-effective and can be produced in various textures and colors to fit different market segments. Additionally, the shift toward recyclable and eco-friendly materials has led to the development of sustainable carpet options, further boosting their popularity. With their balance of affordability, comfort, and functionality, carpets continue to dominate the market across all vehicle categories.

Analysis by Material:

- Polyurethane

- Polypropylene

- Nylon

- Rubber

- Others

Nylon accounts for 27.1% of the market share. It is durable, adaptable, and able to withstand wear, making it ideal for high-traffic spots in vehicles. It can handle heavy use without losing its shape or texture, which is why automakers prefer it for long-lasting interiors. Nylon is also resistant to stains and simple to clean, making it a sensible choice for both luxury and everyday vehicles. Its ability to hold color well allows manufacturers to create stylish customized flooring options that match different car interiors. Another big advantage is its moisture resistance, which prevents mold and mildew, keeping car floors fresh and hygienic. As the industry shifts toward eco-friendly materials, recycled nylon is becoming more popular, adding to its dominance. With its balance of durability, style, and low maintenance, nylon remains the top material for automotive flooring, ensuring comfort and performance in vehicles across all price ranges.

Analysis by Vehicle Type:

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Passenger cars hold 77.2% of the market share. With rising urbanization and growing middle-class populations, more people are buying sedans, hatchbacks, and sport utility vehicles (SUVs), driving the demand for high-quality flooring materials. People want comfortable, stylish, and easy-to-maintain interiors, motivating automakers to focus on durable carpets, mats, and soundproof flooring. Passenger cars also prioritize noise reduction and insulation, making flooring materials essential for a smooth and quiet ride. The shift towards EVs and luxury models is further encouraging innovations in lightweight and eco-friendly flooring options. Automakers offer customization and premium features, increasing the use of high-end materials in passenger car flooring. Additionally, with strict regulations on safety and sustainability, manufacturers are developing recyclable and non-toxic flooring solutions. Since passenger cars are produced and sold in massive numbers compared to commercial vehicles, they continue to dominate the market.

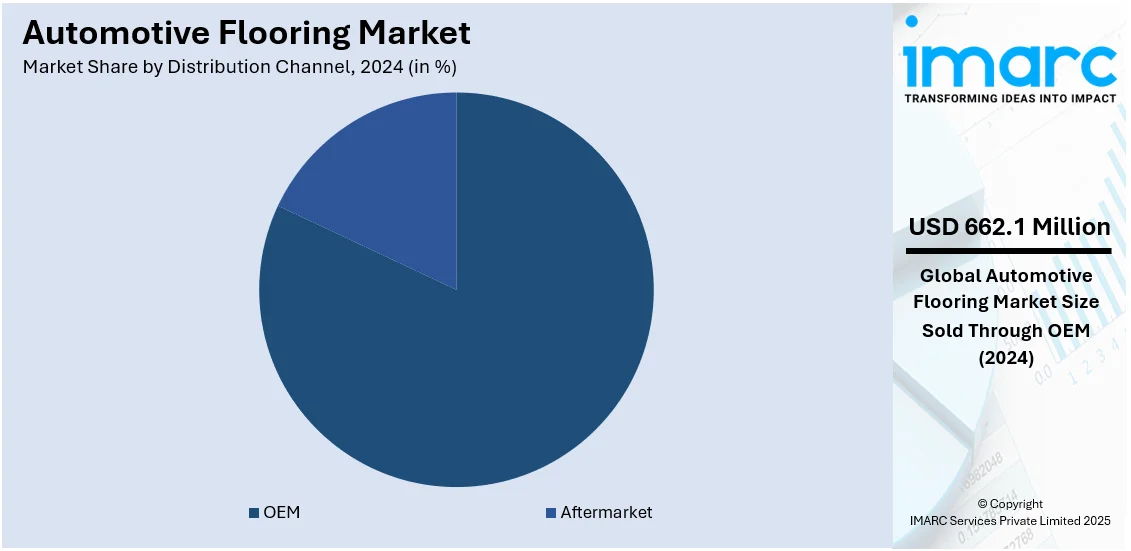

Analysis by Distribution Channel:

- OEM

- Aftermarket

OEM accounts for 82.4% of the market share. Original equipment manufacturers (OEMs) work directly with vehicle manufacturers and integrate their products into the assembly line. They build strong relationships with automakers and provide flooring solutions that meet strict quality, durability, and safety standards. By offering customized designs and technical expertise, OEMs are able to create flooring materials that complement the overall aesthetics and performance of vehicles. They benefit from long-term contracts and high-volume production, which drive economies of scale and keep costs competitive. Their direct involvement in the manufacturing process allows them to respond quickly to market trends and technological advancements. OEMs invest in advanced production techniques and rigorous quality control, ensuring that every component meets industry requirements. This direct distribution channel streamlines the supply chain, reduces lead times, and improves product reliability.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia-Pacific, accounting for 53.5%, enjoys the leading position in the market. The region is recognized because of its well-established automobile base, rising user demand, and increasing manufacturing activities. Nations like China, India, and Japan produce millions of vehicles every year, creating huge demand for high-quality flooring materials. As per figures from the Society of Indian Automobile Manufacturers (SIAM), in 2024, India's automobile sales saw an 11.6% rise, hitting a record 2.5 Crore units, up from 2.3 Crore units in 2023. With rapid urbanization and growing middle-class populations, more people are buying cars, increasing the need for durable and stylish interiors. The area is also a hub for EV production, enabling manufacturers to develop lightweight and eco-friendly flooring solutions. Labor and production costs are lower in many Asian countries, making them attractive for automakers looking to scale up efficiently. Additionally, strict government regulations on vehicle safety and sustainability encourage innovation in recyclable and non-toxic materials. The rising trend of vehicle customization, especially in luxury and mid-range cars, is further fueling the market growth.

Key Regional Takeaways:

United States Automotive Flooring Market Analysis

United States holds a share of 87.30% in the North American market. The high investments in auto manufacturing are impelling the market growth across various vehicle categories in the region. For instance, since the start of 2021, auto manufacturers declared expenditures of more than USD 75 Billion in the US. Expanding production facilities and technological advancements in auto manufacturing are creating the need for durable and high-performance flooring materials. Increased funding in manufacturing plants and research initiatives is supporting the development of innovative flooring solutions that enhance vehicle aesthetics, safety, and durability. Rising user demand for high-quality vehicles with enhanced comfort is further encouraging manufacturers to integrate advanced flooring systems. Additionally, the push for electric and hybrid cars is motivating automakers to wager on lightweight and sustainable flooring materials. Expanding domestic production capabilities are also fostering supply chain advancements, allowing manufacturers to cater to evolving preferences. Automakers are increasingly focusing on improving vehicle interiors, catalyzing the demand for premium flooring options with superior insulation, noise reduction, and wear resistance. Stricter regulations on vehicle safety and interior materials are further shaping the market dynamics in the US, leading to increased research and development (R&D) investments.

Europe Automotive Flooring Market Analysis

The rising user preference for personal mobility is fueling the market growth in Europe. According to the International Council on Clean Transportation, approximately 10.6 Million new vehicles were registered in the 27 EU Member States in 2023, representing a 14% increase compared to 2022. Rising disposable incomes and lifestyle enhancements are encouraging people to invest in vehicles with advanced interiors, including high-quality flooring materials. The shift toward personalized vehicle customization is leading to greater demand for premium flooring options that enhance aesthetics, comfort, and durability. Automakers are focusing on integrating flooring materials that provide superior insulation, noise reduction, and wear resistance to align with user expectations. Expanding production capabilities are also contributing to the availability of a wide range of flooring solutions catering to different vehicle segments. As the transition to EVs accelerates in the area, manufacturers are emphasizing the employment of lightweight and eco-friendly flooring materials to improve overall vehicle efficiency. Stricter regulations on vehicle interiors are further motivating manufacturers to invest in innovative flooring technologies that adhere to safety and environmental standards.

Asia-Pacific Automotive Flooring Market Analysis

The growing foreign direct investment (FDI) in automotive is supporting the market expansion, driven by investments in vehicle manufacturing and component production. According to the India Brand Equity Foundation, the automobile sector in India attracted a total equity FDI inflow of approximately USD 35.65 Billion from April 2000 to December 2023. Increased capital inflows are aiding infrastructure development, leading to an upsurge in vehicle assembly plants and component manufacturing units. Investors are actively financing automotive projects, contributing to a rise in vehicle production and driving the demand for high-performance flooring materials. Big firms are leveraging foreign investments to enhance technological capabilities, resulting in the introduction of advanced flooring solutions with improved durability and aesthetic appeal. Increasing vehicle production is also encouraging flooring manufacturers to introduce cost-effective and high-quality materials tailored to diverse user preferences.

Latin America Automotive Flooring Market Analysis

Increasing disposable incomes in the region are driving the demand for innovative and high-quality flooring materials. According to reports, Latin America's total disposable income was set to grow by nearly 60% from 2021 to 2040. Rising middle-class affordability and growing spending power are enabling people to opt for vehicles with enhanced interior features, including premium flooring solutions. Passenger Cars adoption is increasing, as individuals seek comfortable and durable vehicle interiors, leading manufacturers to introduce flooring materials with advanced insulation and wear resistance. Expanding urban mobility and the shift towards technologically advanced vehicles are further creating the requirement for customized flooring solutions that align with modern automotive designs. Automakers are actively investing in flooring innovations that cater to changing user preferences while maintaining cost-effectiveness.

Middle East and Africa Automotive Flooring Market Analysis

The rising demand for EVs and HVs is encouraging automotive flooring adoption. For instance, in 2023, the UAE sold nearly 35,000 EVs, while Saudi Arabia sold around 1,500. Increasing urban expansion is fostering higher vehicle sales, creating the need for durable and efficient flooring materials. Growing investments in sustainable vehicle production are supporting the use of eco-friendly and lightweight flooring solutions. The increasing awareness among the masses about the benefits of EVs is influencing material choices for enhanced interior efficiency. Rising infrastructure development is leading to higher vehicle ownership, catalyzing the demand for high-performance flooring. Advancements in vehicle technology are promoting the use of innovative flooring solutions that enhance safety and comfort. Expanding automotive imports are strengthening the supply chain for premium flooring materials.

Competitive Landscape:

Key players work on innovating and improving materials to meet the high automotive flooring market demand. Big companies invest in advanced flooring solutions like lightweight, eco-friendly, and soundproof materials to cater to user and regulatory requirements. With the shift towards EVs and luxury vehicles, manufacturers focus on high-quality and customizable flooring to enhance aesthetics and efficiency. Many firms also prioritize recyclable and non-toxic materials to comply with strict environmental regulations. Collaborations with automakers help to create tailored flooring solutions that improve insulation, reduce noise, and refine vehicle interiors. Companies also expand their product lines with smart and anti-slip flooring to offer safety and convenience. Through continuous research, innovations, and partnerships, major industry players keep shaping the market, ensuring long-term growth. For instance, in January 2024, B.I.G. Yarns finalized its initial industrial batches of PET BCF yarns for automotive flooring, boosting innovations and sustainability in manufacturing. The innovative polyester yarns allowed OEMs to produce 100% recyclable mono-polymer carpets, promoting environment friendly vehicle interiors. Through this expansion, B.I.G. Yarns aimed to transform into a comprehensive source of PA6, PP, and PET BCF yarns in the automotive industry.

The report provides a comprehensive analysis of the competitive landscape in the automotive flooring market with detailed profiles of all major companies, including:

- 3M Company

- Auria Solutions (Shanghai Shenda Co. Ltd.)

- Auto Custom Carpets Inc.

- Autoneum Holding AG

- Borgers SE & Co. KGaA

- Conform Automotive

- Foss Performance Materials LLC (AstenJohnson Inc.)

- German Auto Tops Inc.

- Hyosung Corporation

- Suminoe Textile Co. Ltd.

- Toyota Boshoku Corporation

- Walser GmbH

Latest News and Developments:

- January 2025: Motorfloor, the prominent auto-technology start-up, obtained pre-seed financing to grow its automotive flooring product range within the commercial mobility market. The Bhubaneswar-based company, supported by PointOne Capital and angel investors, intended to strengthen its local market presence and sectors. Founder Subrat Kar mentioned that the funds would aid in expanding operations and delivering more value to commercial automotive clients.

- October 2024: Kia Corporation launched a special edition trunk liner and mats for the Kia EV3, created from plastic sourced from the Great Pacific Garbage Patch. Created in partnership with The Ocean Cleanup, this represented one of the initial sustainable automotive flooring options globally. The environment friendly mats were to be offered in chosen markets during the EV3’s debut.

- October 2024: Town & Country Covers unveiled rubber floor mats for the Iveco Daily model, guaranteeing a snug fit using original attachment points. Tailored to complement the interior, these car floor mats were entirely waterproof and simple to maintain. A 13mm raised border was designed to aid in containing spills and dirt, safeguarding the interior of the vehicle.

- September 2024: Prism Worldwide released CIRX™ automotive flooring, which included car mats crafted from Ancora™ C-1082 TPE containing 50% recycled tire material. The cutting-edge material transformed used tires by utilizing Prism’s state-of-the-art technology. CIRX™ established a new standard for sustainability in automotive flooring.

Automotive Flooring Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Carpets, Mats |

| Materials Covered | Polyurethane, Polypropylene, Nylon, Rubber, and Others |

| Vehicle Types Covered | Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles |

| Distribution Channels Covered | OEM, Aftermarket |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, Auria Solutions (Shanghai Shenda Co. Ltd.), Auto Custom Carpets Inc., Autoneum Holding AG, Borgers SE & Co. KGaA, Conform Automotive, Foss Performance Materials LLC (AstenJohnson Inc.), German Auto Tops Inc., Hyosung Corporation, Suminoe Textile Co. Ltd., Toyota Boshoku Corporation, Walser GmbH, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive flooring market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global automotive flooring market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive flooring industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive flooring market was valued at USD 803.57 Million in 2024.

The automotive flooring market is projected to exhibit a CAGR of 4.39% during 2025-2033, reaching a value of USD 1,206.18 Million by 2033.

Automakers are focusing on high-quality flooring that enhances durability, insulation, and noise reduction to improve the overall driving experience. Besides this, the shift towards EVs and luxury vehicles is driving the demand for lightweight, eco-friendly, and premium flooring options. Moreover, people prefer stylish and easy-to-clean materials, encouraging manufacturers to innovate with new designs and technologies.

Asia-Pacific currently dominates the automotive flooring market, accounting for a share of 53.5% in 2024, due to its massive vehicle production, growing middle-class demand, and strong manufacturing base. Lower production costs, rising EV adoption, and strict regulations on safety and sustainability are also encouraging innovations, thereby fueling the market growth in the region.

Some of the major players in the automotive flooring market include 3M Company, Auria Solutions (Shanghai Shenda Co. Ltd.), Auto Custom Carpets Inc., Autoneum Holding AG, Borgers SE & Co. KGaA, Conform Automotive, Foss Performance Materials LLC (AstenJohnson Inc.), German Auto Tops Inc., Hyosung Corporation, Suminoe Textile Co. Ltd., Toyota Boshoku Corporation, Walser GmbH, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)