Automotive Metals Market Size, Share, Trends and Forecast by Product, Application, End Use, and Region, 2025-2033

Automotive Metals Market Size and Share:

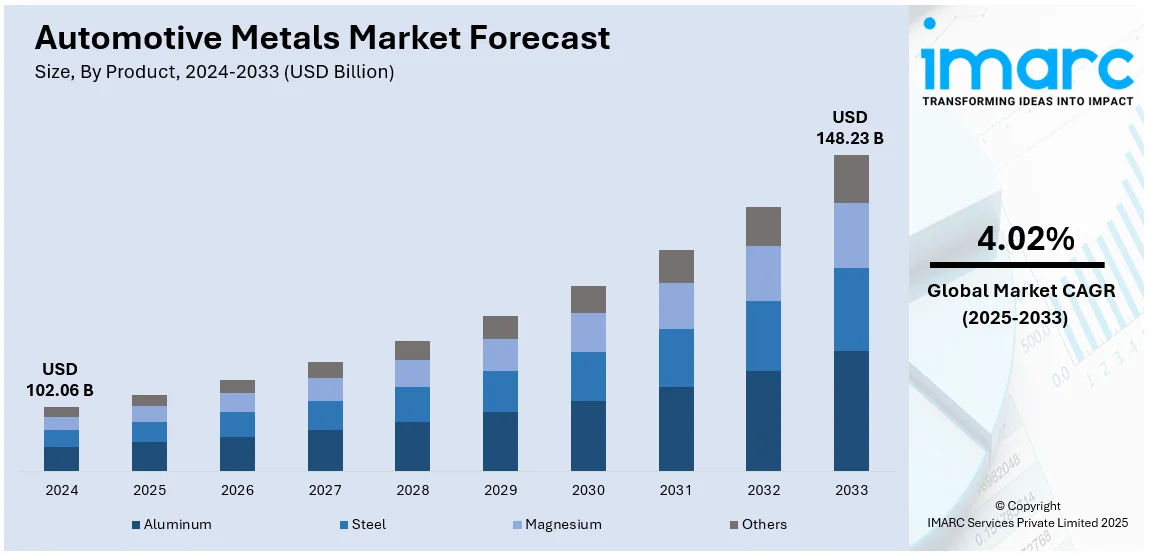

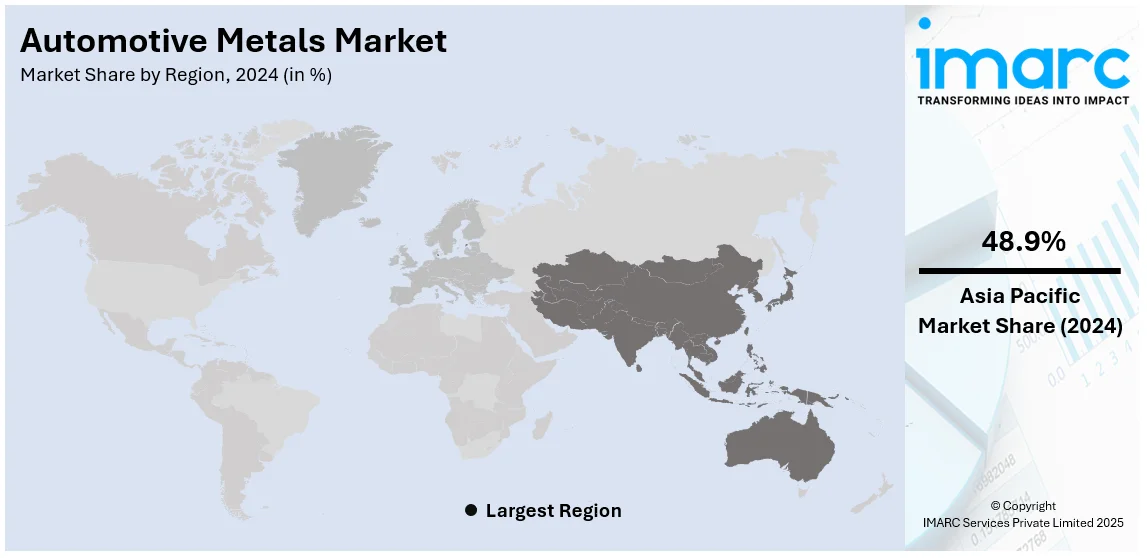

The global automotive metals market size was valued at USD 102.06 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 148.23 Billion by 2033, exhibiting a CAGR of 4.02% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 48.9% in 2024. The expanding vehicle production, preference for lightweight materials, progress in electric vehicle innovations, stricter emission standards, increased adoption of advanced alloys, and regional development through urbanization and infrastructure enhancements aligned with sustainability goals are positively impacting the automotive metals market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 102.06 Billion |

|

Market Forecast in 2033

|

USD 148.23 Billion |

| Market Growth Rate (2025-2033) | 4.02% |

The market is majorly influenced by rapid urbanization and improving global economic conditions that fuel vehicle production, thereby increasing metal consumption. Moreover, continual technological advancements in metallurgy, such as high-strength steel and aluminum alloys, expand applications in automotive design, which is providing an impetus to the automotive metal market growth . For example, Amsted Automotive multi-functional shift technology, designed for electric and hybrid vehicle drivetrain systems, along with advanced powder metal and net-formed manufacturing technologies, was showcased on July 4-5, 2024. These innovations aim to enhance performance, increase range, and reduce costs in electrified powertrains. In addition to this, stringent environmental regulations encourage the adoption of recyclable and eco-friendly metals. Moreover, increased automotive manufacturing activities further contribute to the growth of the market on a global scale.

The United States is a significant region in the market, driven by the shift toward sustainable and lightweight materials to comply with federal fuel efficiency standards. Robust investments in electric vehicle (EV) production intensifies the need for advanced metals like aluminum and high-strength steel, which is expanding the automotive metal market size. The presence of a mature automotive industry and strategic partnerships between automakers and metal suppliers strengthen supply chain efficiency. For instance, on January 5, 2025, A Canadian lithium developer, Patriot Battery Metals, and the Volkswagen Group formed a strategic alliance, investing approximately USD 69 Million to acquire a 9.9% stake in the company. The partnership aims to secure a long-term supply of lithium for Volkswagen's electric vehicle production in Europe and North America. Apart from this, supportive government incentives for EV adoption and infrastructure development significantly stimulate demand for automotive metals in the United States.

Automotive Metals Market Trends:

Shift Toward Lightweight Materials

The paradigm shift towards lighter-weight materials in the resultant endeavor to adhere to stringent fuel efficiency and emission norms is one of the significant automotive metals market trends globally. Governments across the globe are cutting down on carbon emissions to an alarming limit and have made automobile makers, including vehicle lighting, as a solution to such problems. Graphene, aluminum, magnesium, and advanced high-strength steel are being slowly replaced for the usage of traditional steel in automobiles. Graphene has specific properties that make it ideal for technical applications, such as advanced battery housing structures in lightweight construction and heat-dissipation systems in electric vehicles. Aluminum usage in EVs is especially valued for its strength-to-weight ratio and corrosion resistance in body panels, engine components, and chassis applications. The partnerships between material producers further enhance this development; these relationships spur new ideas and expansion in the market. For instance, HEG said that on January 11, 2025, it entered a Memorandum of Understanding between TACC Limited and Ceylon Graphene Technologies (CGT) with an intent to enter jointly a graphene manufacturing collaboration. The collaboration will combine TACC's manufacturing know-how for synthetic graphite and CGT's high-end vein graphite for manufacturing graphene and its derivatives.

Rising Adoption of Electric Vehicles (EVs)

The growing adoption of electric vehicles among the masses is increasing the automotive metals market demand as the need for specific materials is being fueled. According to an industry report on January 14, 2025, nearly 64% of consumers are inclined to select an electric vehicle (EV) for their next purchase. The survey, encompassing over 1,300 respondents from various countries, revealed that 60% perceive charging infrastructure as a significant challenge, while 56% are willing to invest up to USD 40,000 in an EV. Additionally, 90% of manufacturers emphasized that advancements in battery technology are essential for improving EV range and charging speed. EVs require lighter, high-performance materials to optimize battery efficiency and vehicle range. This has led to a surge in the use of aluminum and magnesium alloys, as well as composites, for structural and thermal applications. The growth of EV-specific designs and maximization of performance and sustainability shape material innovation and global supply chains.

Growing focus on Reducing Carbon Footprints

The increase in concerns regarding carbon footprint reduction across the production and supply chain are creating a favorable automotive metals market outlook, as automotive companies and metal producers utilize low-carbon technologies to be in line with stringent environmental norms and sustainability initiatives. As per industry reports, total CO2 emissions for 2024 are expected to be 41.6 Billion Tons against last year's 40.6 Billion Tons. The producers of aluminum are also utilizing renewable energy to reduce emissions while smelting with hydropower. Life cycle assessments (LCA) are fast becoming the normal approach, weighing up all dimensions of the environmental impact of the material at each step of extraction and end-of-life recycling. The light weight of the metals, especially aluminum and magnesium, reduces emissions by increasing the fuel-efficient cars. These factors are supported by carbon pricing mechanisms, consumer demand for greener products, and corporate net-zero goals that make carbon footprint reduction a central focus in the automotive metals industry.

Automotive Metals Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global automotive metals market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, application, and end use.

Analysis by Product:

- Aluminum

- Steel

- Magnesium

- Others

Steel leads the market with around 70.0% of the market share in 2024 due to the high versatility, tensile strength, and cost-effectiveness. In addition to this, several vehicle manufacturers use it since it makes up an important proportion of the overall automobile weight. Due to its durability and tensile strength, the material is utilized for most crucial parts, such as chassis, body structures, and suspension systems. Advanced high-strength steel (AHSS) variants have further developed their role in providing superior performance while reducing weight, which supports the fuel efficiency and emissions reduction goals. Its recyclability aligns with sustainability efforts, making it an important part of eco-friendly vehicle production. Moreover, the adaptability of steel to forming and welding processes enables manufacturers to create complex designs with precision.

Analysis by Application:

- Body Structure

- Power Train

- Suspension

- Others

Body structure leads the market with around 38.8% of the market share in 2024. As the backbone of the vehicle for safety, durability, and performance, the body structure forms the primary frame and panels of the machine. Materials such as advanced high-strength steel, aluminum, and magnesium are increasingly used for body structures because they can combine strength with lightweight properties. The design and material options of body structures have a significant bearing on the merits of crashworthiness, aerodynamics, and fuel efficiency. With stringent regulations on emissions and safety, automakers are prioritizing lightweight yet robust solutions, which brings up new opportunities for material technologies..

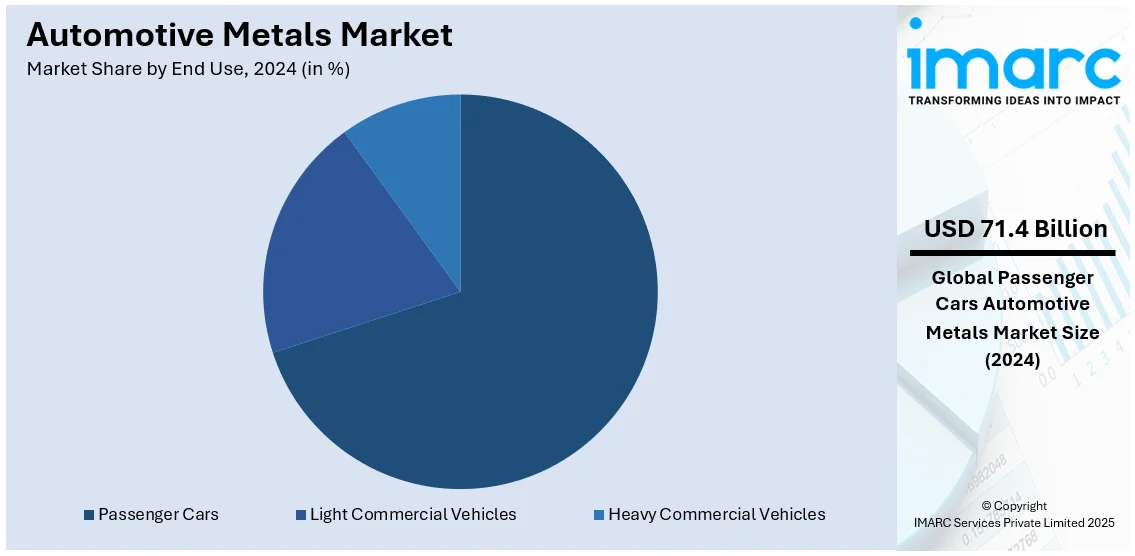

Analysis by End Use:

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

Passenger cars lead the market with around 70.0% of the market share in 2024, primarily driving demand for materials that help improve performance, safety, and efficiency. Building passenger vehicles involves a combination of these metals: steel, aluminum, and magnesium. Advanced high-strength steel is widely used in structural components that provide crash resistance and rigidity. In contrast, aluminum is used for lightweight properties that are helpful in saving fuel and lowering emissions. The increasing adoption of electric vehicles results in the need for lightweight metals more necessary to balance the weight of batteries. Passenger car designs also require materials to enable complex shapes, high recyclability, and cost efficiency.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 48.9% with a healthy production volume of vehicles, huge consumers, and an expanding industrial sector. Large proportions of the total world automobile production of China, India, Japan, and South Korea lie in this region. Growing middle-class populations and disposable income in the economies raise the demands for passenger vehicles as well as commercial vehicles, thereby propelling the demand for automotive metals. Asia Pacific is also an important steel and aluminum-producing region, thus bringing in the cost and supply chain advantages in vehicle production. In addition to this, the region is seeing a rapid deployment of electric vehicles, which enhances the demand for lightweight technologies such as aluminum and magnesium.

Key Regional Takeaways:

United States Automotive Metals Market Analysis

The United States holds a substantial share of the North American automotive metals market at 84.70% due to the progress occurring in automobile production. Manufacturers are rapidly adopting high-technology materials in their products in accordance with growing needs for more efficiency, reduced weight, and superior performance. With EVs and lightweight components, manufacturers are adding new metal alloys and composites that provide strength, durability, and reduced weight, which lead to better fuel economies and sustainability. For instance, auto manufacturers have announced investments of over USD 75 Billion in the U.S. since the beginning of 2021. New technologies and manufacturing methods are fueling the demand for specialized automotive metals, especially in the areas of powertrains and battery casings. Regulatory pressures toward reducing carbon emissions and enhancing vehicle safety have also encouraged further utilization of these materials, thereby underpinning their essential role in modern car production. The greater push toward sustainability, performance, and efficiency will continue to influence the adoption of automotive metals in the automotive industry.

Asia Pacific Automotive Metals Market Analysis

The demand for automotive metals is rising as a result of large investments in the Asia-Pacific automobile sector. According to the India Brand Equity Foundation, cumulative equity FDI inflow into the automobile sector has reached approximately USD 35.65 Billion between April 2000 and December 2023. With substantial capital going into production facilities, technological advancements, and research into material sciences, the automotive industry is increasingly turning towards specialized metals to meet performance and regulatory standards. Also, the need for electric vehicles (EVs) is growing remarkably. Therefore, EV manufacturers seek lightweight, durable, and energy-efficient materials. This is prompting metal suppliers to innovate metals that meet battery casings, powertrains, and vehicle frames. Additionally, the implementation of supportive government policies that encourage the manufacture of automobiles and their export increases the usage of advanced metals so that manufacturers are equipped to face global competition. The expansion of production capacities and adoption of advanced materials supports the rising demand for automotive metals in the region.

Europe Automotive Metals Market Analysis

In Europe, the increasing vehicle ownership is significantly influencing the demand for automotive metals. The International Council on Clean Transportation estimates that in 2023, there were 10.6 million new automobile registrations in the 27 Member States, which is 14% more than in 2022. As the number of cars on the roads continues to rise, there is a growing need for high-quality metals to meet the requirements of production, maintenance, and repair. The shift towards electric mobility is also driving this trend, as manufacturers require specialized metals for the construction of lightweight yet durable EV components, including chassis, body panels, and batteries. Moreover, metals like aluminum, magnesium, and high-strength steel are becoming increasingly important in car design due to the increased emphasis on lowering vehicle emissions and increasing fuel efficiency. The growing demand for vehicles in urban and rural areas alike is further driving the adoption of automotive metals to meet the needs of vehicle longevity, repair, and recyclability. The combination of regulatory mandates and market demand for sustainable, high-performance vehicles is expected to continue propelling the use of automotive metals throughout the continent.

Latin America Automotive Metals Market Analysis

In Latin America, increasing disposable income is driving the demand for passenger cars, which is leading to a higher need for automotive metals. For example, over the years 2021–2040, Latin America's total disposable income is expected to increase by almost 60% in real terms. Several people in the region are acquiring financial means, and the need for personal transportation is on the rise, which further fuels vehicle purchases. This increased number of vehicles owned has made the demand for lighter, cheaper materials that enhance fuel efficiency and performance even more crucial. The demand for cheaper yet high-performance metals is very evident as consumers look for vehicles that offer reliability, durability, and value for money. As automobile manufacturers target this increasing demand, the automobile industries increasingly use specialized automotive metals to serve the evolving requirements of consumers and regulatory demand for environmental sustainability. Regional growth toward new-generation, environment-friendly automobiles also lends support to the adoption of advanced metal alloys that improve fuel efficiency.

Middle East and Africa Automotive Metals Market Analysis

The increased demand for Light Commercial Vehicles (LCV) in the Middle East and African region contributes to the growth of the market in the region. For example, the logistics industry makes up 6% of the Kingdom of Saudi Arabia's GDP and is expected to increase to 10% by 2030, or over USD 5.36 billion. These vehicles, which are essential for transportation and delivery services, require metals that offer a balance of strength, durability, and weight efficiency. As the region invests in infrastructure development and urbanization, the need for reliable logistics solutions continues to grow, spurring the demand for LCVs. Automotive metals, particularly lightweight alloys and high-strength steels are crucial for building vehicles that can handle heavy loads while maintaining fuel efficiency. E-commerce, retail distribution, and regional trade activities are becoming increasingly important, further accelerating the demand for these types of vehicles. As logistics companies expand and modernize their fleets to meet growing consumer demands, the adoption of automotive metals remains a key factor in ensuring that LCVs are optimized for performance and cost-effectiveness.

Competitive Landscape:

The global market is highly competitive, with intense competition among manufacturers to meet the changing needs of the automotive industry. Key players in the market are developing lightweight, durable, and high-strength metals that enhance vehicle performance, fuel efficiency, and safety. Technological advancements, such as advanced alloys and innovative production methods, play a crucial role in maintaining a competitive edge. Moreover, investment increases in research and development (R&D) activities fuel innovations to support rising demand for EVs and sustainability in materials. Regional manufacturers take advantage of the available raw materials and low-cost production capabilities, which further intensifies competition in the market. Business strategies are further being aligned towards global sustainability parameters, focusing more on recycling and cutting carbon footprints to adhere strictly to the string of environmental policies.

The report provides a comprehensive analysis of the competitive landscape in the automotive metals market with detailed profiles of all major companies, including:

- Allegheny Technologies Incorporated

- ArcelorMittal S.A.

- JSW Steel Ltd

- Nippon Steel Corporation

- Novelis Inc. (Hindalco Industries Limited)

- Nucor Corporation

- POSCO

- Tata Steel Ltd

- Thyssenkrupp AG

- United States Steel Corporation

- Voestalpine AG

Latest News and Developments:

- January 2025: In New Delhi, Gestamp displayed its most recent automotive technologies at the Bharat Mobility Global Expo. The business, which is well-known for creating and manufacturing sophisticated metal parts, showcased innovative solutions for the automobile industry. The performance and efficiency of vehicles are intended to be enhanced by these technologies. With its proficiency in automotive technology and metals, Gestamp is at the forefront.

- January 2025: As part of a USD 1 Billion investment, ArcelorMittal Nippon Steel India (AM/NS India) plans to start two auto steel production lines at its Gujarat facility. Advanced automotive steel products will be the emphasis of the lines, which include a continuous galvanizing line and a continuous galvanizing and annealing line. This project is a component of a larger capital investment of USD 7.4 Billion to increase the upstream capacity of the Hazira plant to 15 million tons. By 2025, full operations are anticipated.

- November 2024: JSW Steel and POSCO bolstered their positions in the Indian steel market by committing USD 7.73 Billion to build a steel mill in Odisha, India. Operations are anticipated to start next year, and the project will create an integrated complex capable of producing five million tons annually. The plant's expansion will be aided by Odisha's plentiful iron ore reserves, which would eventually result in an annual production of 18 Million tons. To accommodate growing demand, the investment will produce galvanized, cold-rolled, and hot-rolled steel.

- November 2024: The installation of a Schuler coil-fed Laser Blanking Line at Kloeckner Metals' Queretaro, Mexico operation is scheduled to start production in the middle of 2026. The company's automotive metals capabilities are improved by this cutting-edge technology, which gives clients more flexibility, efficiency, and cost savings. Kloeckner's leadership in configured metal blanking solutions will be strengthened by the new line, which will be housed in a 93,700 square foot extension.

- August 2024: Hydro and Porsche AG launched a new business model aimed at providing low-carbon aluminum for the automotive industry, promoting sustainability and transparency in the supply chain. This collaboration focuses on decarbonizing supply chains and supports Porsche's climate targets. Hydro's CEO, Eivind Kallevik, expressed excitement for the partnership's potential impact, encouraging others to adopt similar approaches.

Automotive Metals Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Aluminum, Steel, Magnesium, and Others |

| Applications Covered | Body Structure, Power Train, Suspension, and Others |

| End Uses Covered | Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Allegheny Technologies Incorporated, ArcelorMittal S.A., JSW Steel Ltd, Nippon Steel Corporation, Novelis Inc. (Hindalco Industries Limited), Nucor Corporation, POSCO, Tata Steel Ltd, Thyssenkrupp AG, United States Steel Corporation and Voestalpine AG., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the automotive metals market from 2019-2033.

- The automotive metals market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the automotive metals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The automotive metals market was valued at USD 102.06 Billion in 2024.

The automotive metals market is projected to exhibit a CAGR of 4.02% during 2025-2033, reaching a value of USD 148.23 Billion by 2033.

The automotive metals market is primarily driven by the rise in vehicle production, increasing demand for lightweight and fuel-efficient vehicles, advancements in electric vehicle (EV) technologies, and stringent government regulations on emissions. The adoption of high-strength and lightweight materials, such as aluminum and advanced steels, further accelerates growth.

Asia Pacific currently dominates the automotive metals market, accounting for a share of 48.9% in 2024. The dominance is fueled by expanding EV manufacturing, rapid urbanization, and growing investments in automotive infrastructure across countries like China, India, and Japan.

Some of the major players in the automotive metals market include Allegheny Technologies Incorporated, ArcelorMittal S.A., JSW Steel Ltd, Nippon Steel Corporation, Novelis Inc. (Hindalco Industries Limited), Nucor Corporation, POSCO, Tata Steel Ltd, Thyssenkrupp AG, United States Steel Corporation, and Voestalpine AG., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)